The world's stock markets have rallied once again, smashing all-time highs in late October 2025. If you're wondering why stocks are soaring despite macroeconomic worries, inflation, or global headlines, you're not alone.

In truth, today's rally is not a single-note story; it's the result of several positive beats lining up at once: a softer-than-expected U.S. inflation print that revived near-term Fed rate-cut expectations; renewed optimism in U.S.–China trade relations; strong earnings and AI momentum in big tech; and supportive portfolio flows into risk assets.

As a result, these themes propelled the S&P 500, Nasdaq, and Dow Jones to new or near-record highs, while lifting futures ahead of the next wave of megacap earnings announcements.

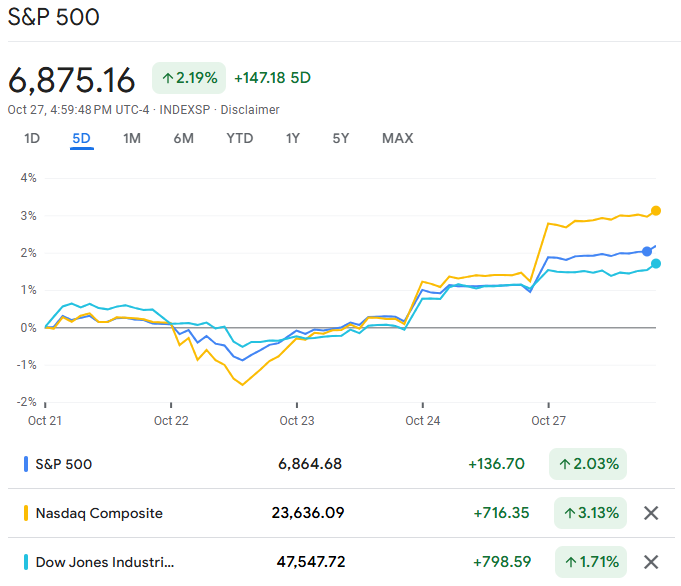

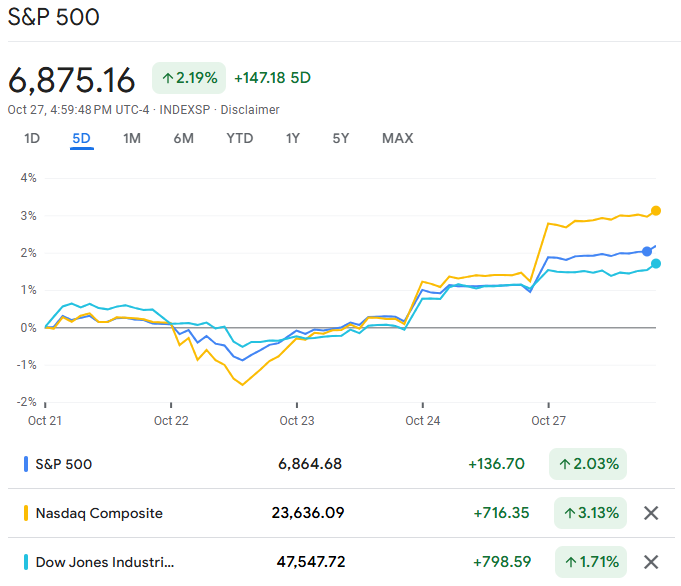

Market Snapshot: What Moved and by How Much

In the most recent sessions, markets showed broad gains, with the S&P 500 and Nasdaq posting new records, while the Dow also closed notably higher.

October alone has seen the indices up by between 3% and 7%, with small caps and Asian markets outperforming large caps globally.

Following the latest U.S. CPI release and a wave of upbeat corporate results, the Dow added several hundred points in one session, with the S&P and Nasdaq rising roughly 0.8–1.2%. [1]

Futures extended gains into the next trading day as investors priced in higher odds of Federal Reserve rate cuts and digested strong tech earnings. Volumes and breadth were constructive: advancing issues outnumbered decliners by meaningful margins on both the NYSE and Nasdaq.

Why Is Stock Market Up Today? Explaining the 6 Catalysts

| # |

Catalyst |

Key Driver / Summary |

| 1 |

Cooler Inflation & Fed Rate-Cut Bets |

Softer U.S. CPI (core at 3%) boosted expectations of near-term Fed cuts, easing yields and lifting equities. |

| 2 |

U.S.–China Trade Optimism |

Positive signals from trade talks and mini-deals reduced geopolitical risk and improved earnings visibility. |

| 3 |

Tech & AI Earnings Momentum |

Strong Q3 results from major tech firms confirmed durable AI-driven growth. |

| 4 |

ETF & Fund Inflows |

Surge in equity ETF inflows post-CPI and trade news created upward pressure on indices. |

| 5 |

Macro Tailwinds: Real Yields & Dollar |

Falling real yields and a softer dollar increased the appeal of risk assets. |

| 6 |

Market Breadth & Technicals |

More stocks hitting new highs confirmed broad participation and bullish momentum. |

1. Cooler Inflation and the Fed Rate-Cut Story

A softer U.S. Consumer Price Index report for September showed core inflation at 3.0%, below expectations and down from the prior month. Markets quickly priced in a quarter-point rate cut, raising the probability of the Fed easing at the October 29 FOMC meeting.

That shift lowered real yields and boosted valuations for growth sectors. Around 96% of futures traders now expect the Fed to cut rates to 3.75–4.00%.

Why This Matters: Lower inflation boosts risk appetite by increasing the likelihood of easier monetary policy and reducing pressure on household/consumer spending.

2. U.S.–China Trade Optimism: Policy Beating Headlines

Another big engine behind the move was renewed optimism around U.S.–China trade negotiations.

For context, a meeting between U.S. President Donald Trump and China's President Xi Jinping is scheduled this week in South Korea. Over the past few days, reports indicate that the two sides have agreed on a preliminary trade framework, reducing the risk of another trade war escalation. This eased a major geopolitical overhang for global supply chains and corporate margins. [2]

Additional mini-trade deals with Malaysia, Vietnam, and Thailand further lifted sentiment across Asia.

Why this matters: Large-cap U.S. companies have deep exposure to China. Even a modest improvement in trade flows improves earnings visibility and investor confidence.

3. Tech & AI Earnings Momentum (The Megacap Effect)

Big tech and chip names remain the primary market movers in 2025. It's a crucial week for earnings, with over 170 S&P 500 companies (including the "Magnificent 7" tech giants) reporting Q3 results:

When earnings confirm that AI spending is real and durable, it amplifies optimism across semiconductors, cloud, software and adjacent parts of the market, producing outsized index returns because these companies carry heavy weights in major benchmarks. [3]

In summary, it demonstrates that AI is evolving into a source of repeatable revenue, which enhances the entire risk landscape.

Why this matters: When megacaps outperform, ETF and index-fund flows automatically channel more capital into those names, magnifying index gains.

4. Flows: ETFs, Funds and Positioning

Data from fund trackers and intraday flow feeds showed net inflows into equity ETFs after the CPI print and around the trade-talk headlines. In 2025, passive investment flows and ETFs continue to be a major influence in the market.

When investors allocate funds to broad equity ETFs, they are not selecting individual stocks; instead, they are essentially buying the entire market. This approach creates immediate upward pressure on market indices.

Positive news headlines and reduced concerns about policy rates often lead to brief periods of strong buying activity. During these times, ETFs, active funds adjusting their risk budgets, and proprietary trading desks re-leveraging their positions can amplify upward price movements.

Why this matters: When retail and institutional flows align, even gradual fundamental changes can generate strong market rallies.

5. Macro Backdrop: Real Yields, Dollar and Liquidity

Beyond headlines, the mechanical macro drivers are real yields and the U.S. dollar. A softer CPI print tends to lower expected nominal and real rates; a weaker dollar often follows or accompanies that shift. Lower real yields and a softer greenback are both positive for dollar-priced assets (U.S. equities included) and for emerging-market risk.

Traders watching TIPS spreads, 2s–10s moves, and the DXY will note that these variables have shifted in ways that favour risk assets during the recent sessions.

Why this matters: Reduced real yields raise the present value of future corporate cash flows, especially for growth stocks.

6. Market Breadth and Technical Confirmation

More stocks are now making 52-week highs than lows, signalling healthy participation. Technical breakouts have attracted momentum and quant flows, producing occasional short squeezes.

Additionally, fear of missing out (FOMO) among both retail and institutional investors has fueled follow-through buying.

Why this matters: Breadth confirms that the move isn't just a handful of megacaps dragging indices higher; it suggests participation is broader and more sustainable in the short term.

Are We in a New Bull Phase?

The strength observed today might mark the beginning of a more sustainable rebound, but it could also simply be a significant transient relief rally. For a sustainable bull market, you generally want:

Durable earnings growth

Easing and predictable monetary policy,

Stable or improving geopolitical conditions

Healthy breadth and flows.

Presently, we have pieces of that puzzle, but every piece is subject to change. Therefore, observe if flows remain positive and whether the Fed's measures align with market expectations in the upcoming months.

What Traders Should Watch Next?

Fed communications & meeting calendar

Earnings from the remaining megacaps

U.S.–China trade headlines

ETF flow reports and fund-level net inflows

Real yields & dollar moves

Frequently Asked Questions

1. Will the Market Keep Going up Because of Softer CPI?

Not necessarily. A softer CPI increases the likelihood of the Fed easing, which is optimistic, but markets quickly adjust future expectations.

2. Is the Rally Only Because of AI and Tech Stocks?

No. While tech is a leader, earnings growth is broad-based in Q3 2025, with industrials, financials, and utilities also hitting new records.

3. Are Other Assets Also Rallying?

Bonds are up as yields fall; gold and some cryptos have slightly lagged due to the risk-on environment.

4. Should I Buy the Dip or Wait for a Pullback?

Long-term investors should DCA, while traders should wait for technical confirmation after pullbacks.

5. Could Trade Talks Reverse Everything?

Yes. Trade headlines can quickly shift risk appetite.

Conclusion

In conclusion, before the CPI release, markets were cautiously optimistic but pricing only modest chances of cuts. The softer CPI pushed Fed-cut odds materially higher within hours, leading to immediate re-allocation from cash and short-duration instruments into equities.

Passive funds and algorithmic managers executed buy schedules into ETFs and index futures, amplifying momentum. Within 24 hours, flows and valuation re-rating turned a tentative bounce into record closes for the S&P and Nasdaq.

That sequence of data → policy expectations → flows → price response defines the modern market cycle. Whether the uptrend continues will depend on the next round of macro data, the Fed's decisions, and how long the favourable earnings and geopolitical tailwinds last.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/china/wall-st-futures-hit-record-highs-us-china-optimism-tech-results-focus-2025-10-27/

[2] https://www.reuters.com/world/china/global-markets-trading-day-graphic-2025-10-27/

[3] https://www.kiplinger.com/investing/stocks/dow-adds-472-points-after-september-cpi-stock-market-today