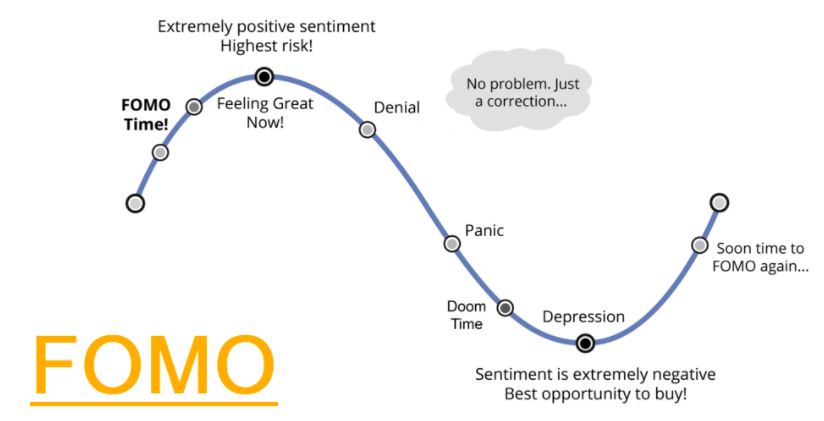

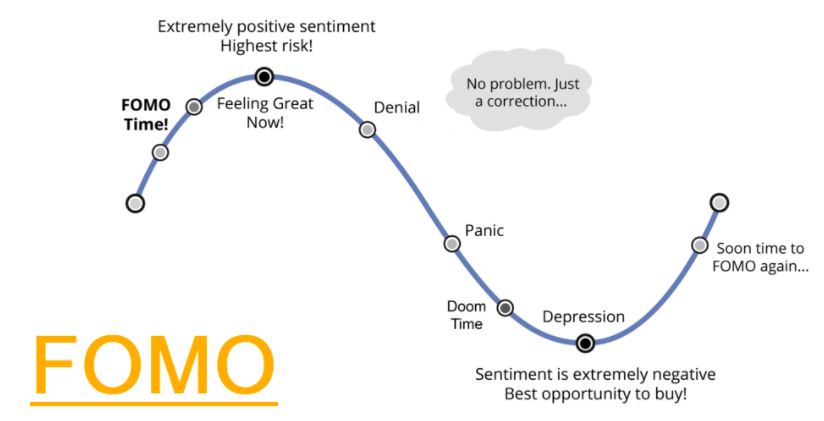

In the fast-paced world of trading, emotions can make or break your success. One of the most powerful and common emotions that affect traders is FOMO—the Fear of Missing Out. Whether you're watching a stock skyrocket or hearing buzz about a new hype "going to the moon," the urge to jump in without a plan can be overwhelming.

FOMO in trading refers to the emotional reaction that traders buy or sell impulsively due to the fear of missing an opportunity. While it's natural to feel excitement during strong market moves, acting on these feelings without strategy often leads to losses.

In this comprehensive guide, we'll explore what FOMO is, how traders feel affected, real-world examples, and strategies to overcome it — so you can trade with confidence, not panic.

What Is FOMO in Trading?

FOMO stands for Fear of Missing Out, and in trading, it refers to the anxious feeling that you're missing a profitable opportunity that others are profiting from. It often arises when:

A stock or asset is rapidly increasing in price

Everyone on social media is talking about a trade

News headlines hype up a market move

Traders affected by FOMO often rush into trades without analysis, ignore risk management, and end up buying high or selling low.

Why FOMO Happens: Psychological Triggers

FOMO is rooted in psychology. Here are the main reasons why traders experience it:

1. Herd Mentality

Even if the move isn't backed by fundamentals, when everyone is buying an asset, it creates pressure to follow the crowd.

2. Social Media Influence

Platforms like twitter, Reddit, or Discord create constant noise and hype around hot stocks.

3. Recency Bias

Recent price moves heavily influence decisions. If an asset rallies 20%, traders presume it will continue.

4. Greed

The desire to make quick profits can override logical thinking and lead to impulsive trades.

5. Regret Aversion

Traders fear the regret they'll feel if they don't act, and the market surges without them.

How FOMO Manifests in Trading Markets: Examples

1) FOMO in Forex Trading

In the foreign exchange (forex) market, FOMO often strikes during:

Major economic news releases (e.g., Non-Farm Payrolls, interest rate decisions)

Sudden currency pair breakouts (e.g., EUR/USD breaking resistance)

Examples of FOMO behaviour:

Entering trades immediately after a massive candle forms, fearing you'll miss the trend.

Overleveraging during a volatile news event without a stop-loss.

Switching pairs frequently to catch whatever is "moving."

Risk: The forex market is highly leveraged and fast-moving — FOMO can result in margin calls or stop-outs very quickly.

2) FOMO in Stock Trading

In the stock market, FOMO is common during:

Examples of FOMO behaviour:

Buying a stock after it's already up 30% in a day, based on hype.

Following social media tips without checking fundamentals or technicals.

Holding a stock too long, expecting more upside.

Risk: Stocks can gap down sharply, and FOMO buying often occurs at tops when institutional investors begin taking profits.

3) FOMO in Commodities Trading

In commodities markets (gold, oil, silver, etc.), FOMO typically arises from:

Geopolitical events (e.g., war, sanctions)

Supply-demand shocks (e.g., OPEC announcements, droughts, harvest failures)

Inflation or macroeconomic fears

Examples of FOMO behaviour:

Chasing gold during a crisis without waiting for a pullback.

Entering crude oil long trades after a sudden 10% price spike.

Ignoring the cyclical nature of commodities.

Risk: Commodities are volatile and news-sensitive — FOMO can lead to buying tops and suffering from sharp reversals.

4) FOMO in indices trading

In indices trading (S&P 500, Nasdaq, DAX, etc.), FOMO shows up during:

Bull market rallies (e.g., after Fed stimulus or tech stock booms)

Strong economic data lifting the entire index

When indices hit all-time highs

Examples of FOMO behaviour:

Buying index CFDs or futures late into a long rally with no risk control.

Jumping in after seeing positive sentiment everywhere (media, social platforms).

Holding losing trades in the hope of catching "just one more leg up."

Risk: Indices tend to trend longer, but FOMO trades without technical setups or stop-losses can be dangerous during pullbacks or corrections.

Recent Real-World Examples

Example 1: Bitcoin Bull Run (2020–2021)

As Bitcoin soared past $20,000, $40,000, and eventually $60,000, many retail traders jumped in late due to fear of missing out. When the price corrected, many of them faced huge losses.

Example 2: GameStop (GME) Short Squeeze (2021)

Triggered by Reddit's WallStreetBets, GME increased from $20 to $400 and more. FOMO led thousands of new traders to buy near the top, only to watch it crash within days.

Example 3: Meme Coins (Dogecoin, Shiba Inu)

Social media hype caused explosive rallies. Many traders bought in late during the peak, only to lose money as prices sharply corrected.

Signs You're Trading with FOMO

You may be experiencing FOMO if you:

Constantly check charts or news, fearing you'll miss something

Feel anxious or pressured when others talk about their profits

Abandon your Trading plan to "get in" before it's too late

Enter trades without proper risk analysis or a stop-loss

Experience regret after most of your trades

Dangers of FOMO

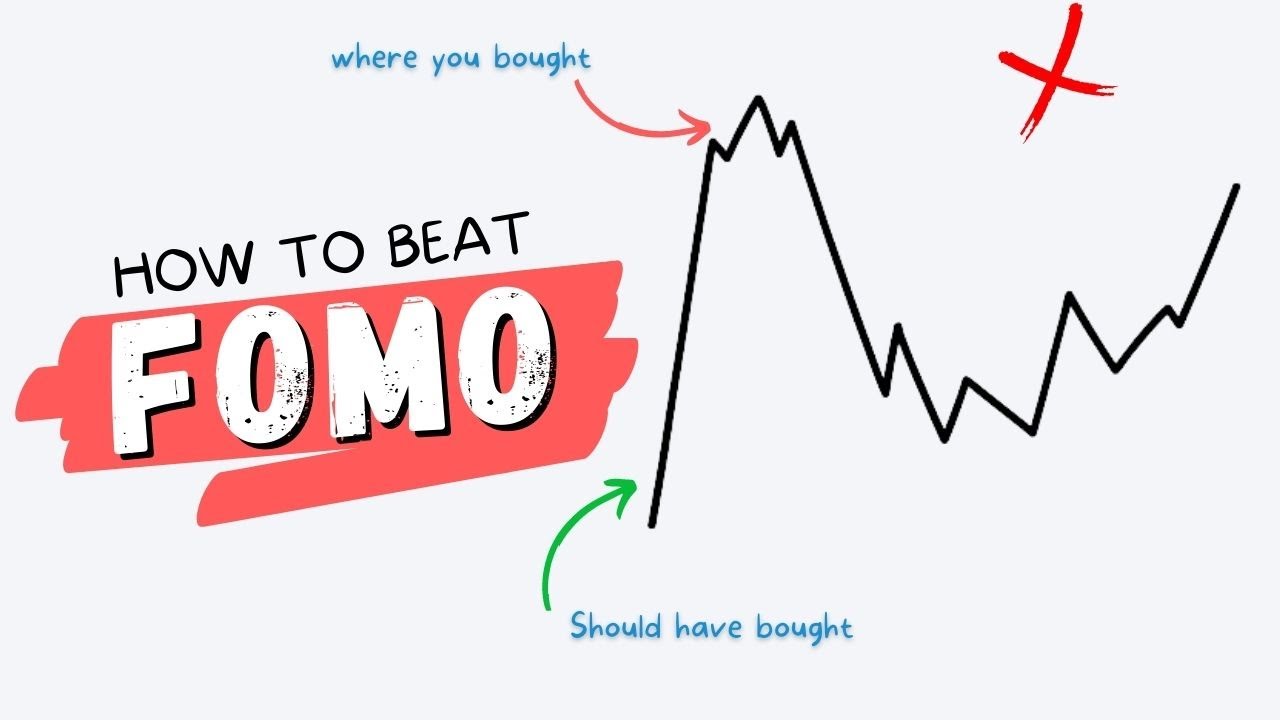

1. Poor Entry Points

Jumping in during a rally often leads to buying at overextended prices — just before a reversal.

2. Emotional Decision-Making

FOMO causes traders to ignore charts, analysis, or trading plans.

3. Increased Risk Exposure

Traders driven by FOMO may take larger positions than usual, increasing losses.

4. Short-Term Thinking

Focus shifts from long-term strategy to chasing quick profits.

5. Erosion of Confidence

Repeated losses due to FOMO hurt a trader's confidence and can lead to revenge trading or burnout.

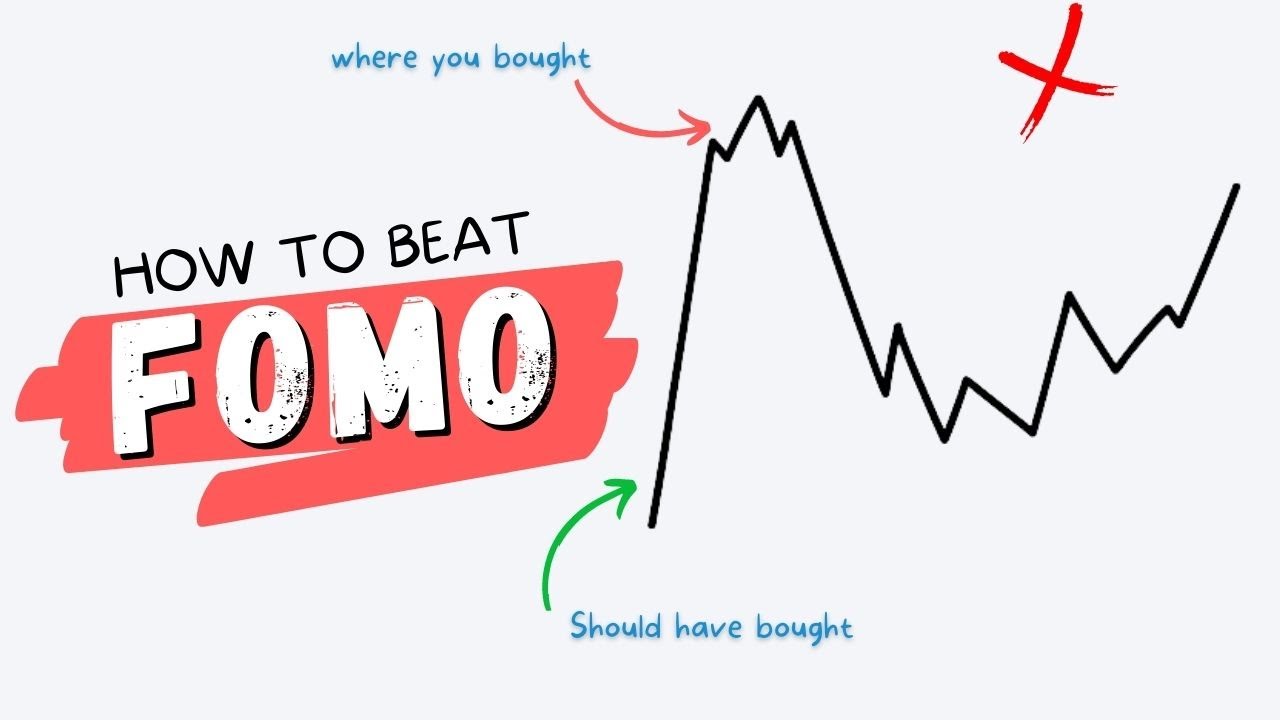

How to Overcome Fear of Missing Out in Trading

Here are proven strategies to manage and beat FOMO:

1. Follow a Trading Plan

A well-defined plan has entries, exits, and risk management. It keeps your actions objective, not emotional.

2. Use Risk Management

Limit risk to 1-2% per trade. This ensures a single FOMO decision won't wipe out your account.

3. Set Entry Alerts Instead of Watching the Chart

Use alerts or pending orders at key price levels instead of reacting in real time.

4. Use Higher Time Frames

1D or 4H charts reduce the noise and hype found in 1-minute charts. They also align better with consistent strategies.

5. Avoid Trading on News or Social Hype

Don't chase after tweets, Reddit trends, or viral "signals." Wait for setups that match your analysis.

6. Journal Your Trades

Record every trade and the reason behind it. This helps identify patterns and emotional decisions tied to fear.

7. Accept That You Will Miss Some Moves

You can't catch every winning trade. And that's okay. Opportunities are endless in the market

Strategies to Replace FOMO with Discipline

| Discipline Tactic |

How It Helps |

| Have predefined entry rules |

Avoids random entries during hype |

| Stick to daily or weekly goals |

Keeps your focus on process, not profits |

| Limit screen time |

Reduces overtrading and market anxiety |

| Practice mindfulness or meditation |

Builds emotional control |

| Use demo or paper trading |

Helps test without emotional risk |

Conclusion

In conclusion, fear of missing out is one of the most common psychological traps in trading — and it affects traders at every level. From new traders jumping on meme stocks to seasoned pros caught in market euphoria, no one is immune.

The key is not to eliminate emotion but to manage it. With a solid trading plan, strong risk management, and awareness of FOMO triggers, you can avoid costly mistakes and trade with discipline and confidence.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.