XAG is the international code for silver, similar to how XAU refers to gold. Traders use XAG when pricing silver in spot or futures markets and when quoting silver against major currencies like USD.

It matters because silver is both a precious metal and an industrial metal. This mix makes its price move on economic trends, safe haven flows, and supply changes. For traders, XAG provides chances to trade both momentum and short term volatility.

Definition

In trading, XAG is the code for silver, and it is commonly treated like a “currency-style” symbol even though it is a metal. The key point is the unit: 1 XAG = 1 troy ounce of silver, and a troy ounce is 31.1034768 grams.

The price moves all day in global markets, and most brokers offer XAG as a spot instrument or CFD based on international pricing. The value is driven by supply, demand, and expectations in futures markets.

You will see XAG on trading platforms alongside gold, oil, and currency pairs. Commodity, macro, and intraday traders watch silver because it often reacts faster than gold during sharp moves. XAG attracts traders seeking both trend opportunities and quick reactions around news.

Think about buying apples at a store. You do not buy “one apple” if every apple is a different size. You buy by weight, like 1 kilogram. Silver trading works in a similar way. XAG is like the label that tells you, “This price is for a standard weight.”

In silver’s case, that standard weight is the troy ounce, which is used for precious metals. When you understand the “weight label,” you stop making basic mistakes like trading 10 times bigger than you planned.

What Changes The Value Of XAG Daily

Several forces push silver prices higher or lower.

1. Economic Outlook

If the global economy strengthens, industrial demand for silver grows. When demand for electronics or solar production rises, XAG often trends higher.

2. The US dollar Moves

Silver is priced in dollars worldwide. A weaker dollar usually supports higher XAG/USD. A stronger dollar often pressures the metal lower.

3. Investor Sentiment

During uncertainty, some investors buy silver as a safe haven. When fear rises, demand increases. When confidence returns, safe haven buying slows.

4. Supply Changes

Mining output, refining capacity, and inventory levels impact long term trends. Tight supply can lift prices while strong production can ease pressure.

These factors combine to create daily volatility, especially during active trading sessions.

How XAG Affects Your Trades: Why Silver Affects Timing And Risks

XAG influences trading decisions because it moves quickly and responds sharply to news. When volatility rises, spreads and slippage can increase.

This affects entry timing and costs. Traders also pay attention to strong levels like round numbers and recent highs, because silver often reacts at these points.

For exits, silver’s speed can help trends continue once they start. However, it can reverse fast when the dollar shifts or when risk mood changes. This means traders need clear stops and targets before entering.

Helpful conditions:

Risky conditions:

Sharp intraday spikes during major US data.

Flat, range bound markets where price whipsaws frequently.

How The XAG Is Traded

| Method |

What It Is |

Who Uses It |

Key Features |

| Spot XAG/USD |

The live market price of silver quoted per troy ounce in USD. |

Retail and professional traders. |

Fast pricing, no expiry, follows global liquidity. |

| CFDs on XAG |

Contracts that track the price of silver without owning the metal. |

Retail traders and active short term traders. |

Ability to trade long or short, flexible trade sizes, access to stops and limits. |

| Futures Contracts |

Standardized silver contracts traded on major exchanges. |

Institutions, funds, and advanced traders. |

High liquidity, expiry dates, often used to set global benchmark prices. |

| Physical Silver |

Buying silver bars, coins, or bullion. |

Long term investors and collectors. |

No market execution risk, but includes storage and handling costs. |

| ETFs linked to silver |

Funds that track silver prices. |

Investors and portfolio managers. |

Easy access through stock markets, useful for long term exposure. |

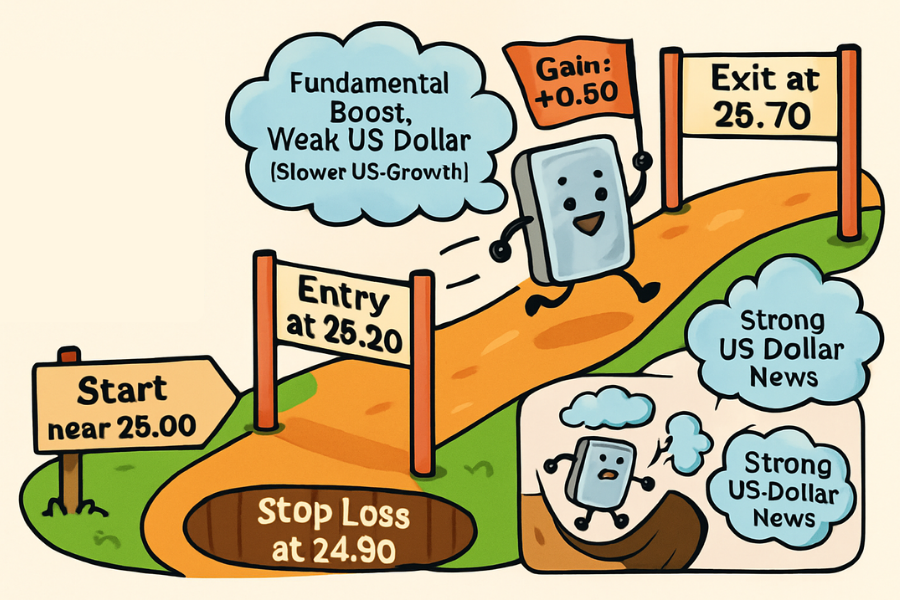

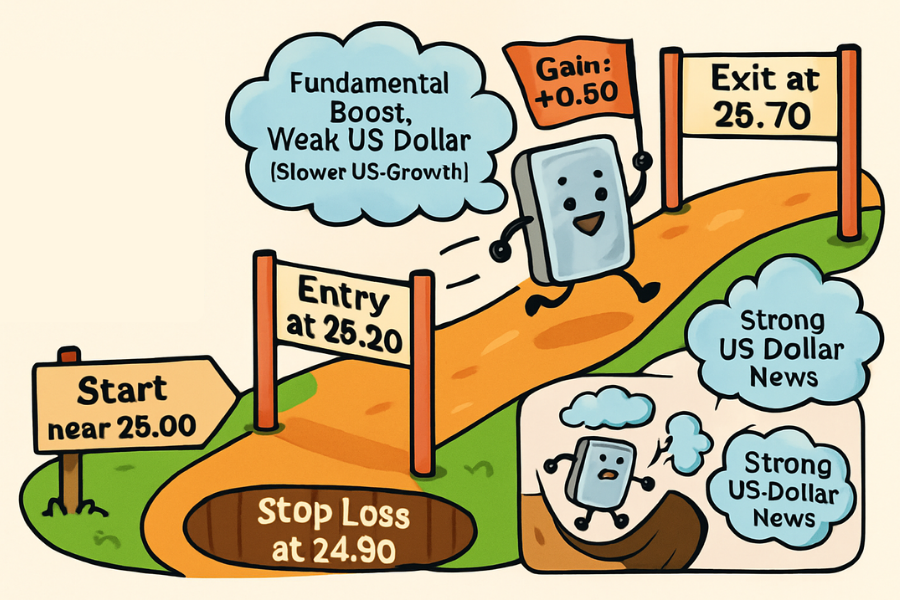

Quick Example

Suppose XAG/USD trades at 25.00. A trader buys when price breaks above 25.20 with a stop at 24.90. US data later shows slower growth, which weakens the dollar.

XAG climbs to 25.70 because both safe haven demand and industrial demand expectations improve. The trader exits at 25.70 for a 0.50 gain.

However, if the dollar had strengthened instead, XAG might have dropped back under 25.00 and hit the stop. This example shows how the dollar moves and market mood shapes silver results.

How To Check XAG Before You Click Buy Or Sell

A simple routine keeps XAG decisions clear.

Check the US dollar index because dollar direction often drives XAG/USD.

Look at volatility. Silver becomes unstable during major US data, Fed events, and risk shocks.

Mark key support and resistance levels on the daily and intraday chart.

Confirm whether industrial demand news or sentiment shifts are in play.

Adjust your position size if volatility increases.

Review XAG conditions a few times per day during London and US sessions.

Common Mistakes When Trading XAG

Ignoring the dollar. Silver often moves opposite the USD, so skipping this step weakens timing.

Using wide stops in quiet markets. This reduces reward and makes exits unclear.

Chasing sharp breakouts. Silver snaps back quickly, which traps late entries.

Not preparing for news. Spread changes around US data can surprise new traders.

Assuming silver behaves like gold. XAG reacts more to industry demand and can be more volatile.

Related Terms

XAU: The code for gold, another major precious metal used for comparison with silver.

USD Index (DXY): A measure of dollar strength that often affects XAG/USD direction.

Volatility: The speed of price changes, which tends to be high in silver.

Futures markets: Where large institutions trade silver contracts that influence spot prices.

Safe haven flows: Investors shift into metals during uncertainty, which often lifts XAG.

Frequently Asked Questions (FAQ)

1. Is XAG more volatile than gold?

Yes, silver usually moves faster because it depends on both investment demand and industrial demand. This dual role creates bigger daily swings. Traders often manage risk more tightly with XAG for this reason.

2. Why does the dollar impact XAG so strongly?

Silver is priced in dollars worldwide, so a stronger dollar makes silver more expensive for global buyers. This reduces demand and can push XAG/USD down. When the dollar weakens, buying pressure often returns.

3. Is XAG suitable for beginners?

It can be, but beginners need to understand how quickly silver moves. Clear stops, modest position sizes, and attention to news help reduce risk. Many new traders start with longer timeframes to avoid noise.

4. Does EBC provide XAG trades?

Yes. EBC offers access to XAG trading through spot silver and silver-based CFDs. Traders can open long or short positions, monitor real time pricing, and use common risk tools while trading XAG/USD under regulated conditions.

Summary

XAG is the global code for silver and reflects both safe haven and industrial demand. It reacts to dollar moves, economic trends, and sentiment shifts, which makes it active and sometimes volatile.

When traded with clear rules and awareness of key drivers, XAG can offer strong opportunities while avoiding common mistakes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.