Accrued interest is the amount of interest that builds up each day on a bond, loan, or other interest-bearing asset even when no payment has been made yet. It represents the interest earned by a lender or owed by a borrower during the time between scheduled payments.

It matters for traders because it changes the total value of a bond or position. When you buy or sell a bond, part of the price reflects the interest that has already built up but has not been paid.

Definition

In trading, accrued interest is the interest built up since the last coupon payment on a bond or since the last settlement period on a loan or margin product. When traders buy a bond in the middle of a coupon cycle, they must pay the seller the interest the seller has earned so far.

This keeps the system fair, since the buyer will receive the full coupon at the next payment date.

Accrued interest appears on trade tickets, bond quotes, and clearing statements. Bond traders, fixed-income desks, and anyone trading interest-sensitive products monitor it closely. It affects the cash needed for settlement and can change the true cost of entering or exiting a position.

Basic Formula

Most markets use the simple interest formula:

The exact “day count” method (30/360, Actual/365, Actual/Actual) depends on the bond type and country.

What Changes Accrued Interest Day To Day

Drivers that increase or decrease accrued interest

Days passed since the last payment. When more days pass, accrued interest rises. After a coupon is paid, it resets to zero.

Coupon rate. Higher coupon rates lead to faster interest growth.

Day count convention. Different markets use different day count rules, which slightly change the calculation.

Settlement date. The closer you are to the next coupon payment, the higher the accrued interest portion in the bond’s price.

Interest rate shifts. Market rates do not change accrued interest directly, but they change the bond’s clean price. The accrued portion still grows each day at the coupon rate.

How Accrued Interest Affects Your Trades

The impact on entries, exits, and overall cost

Accrued interest changes the actual amount of cash that moves when you buy or sell. Bond prices are often quoted as clean prices, which exclude accrued interest. The amount you pay at settlement is the dirty price, which includes accrued interest.

This can surprise new traders who see a price on the screen but receive a higher settlement total.

For exits, accrued interest can raise the proceeds you receive when selling a bond before the coupon date. You earn interest for every day you held the position. This helps offset changes in market price.

Accrued interest also affects risk planning. If you trade with limited capital, you need to know how much the accrued portion adds to your trade size so you do not take on more exposure than intended.

Good situation:

You know the coupon date and how much interest has built up.

The difference between clean and dirty prices is clear.

Your platform displays the day count method.

Bad situation:

You buy or sell without checking accrued interest.

You misread the true cash amount needed for settlement.

You confuse price moves caused by market rates with changes caused by accrued interest.

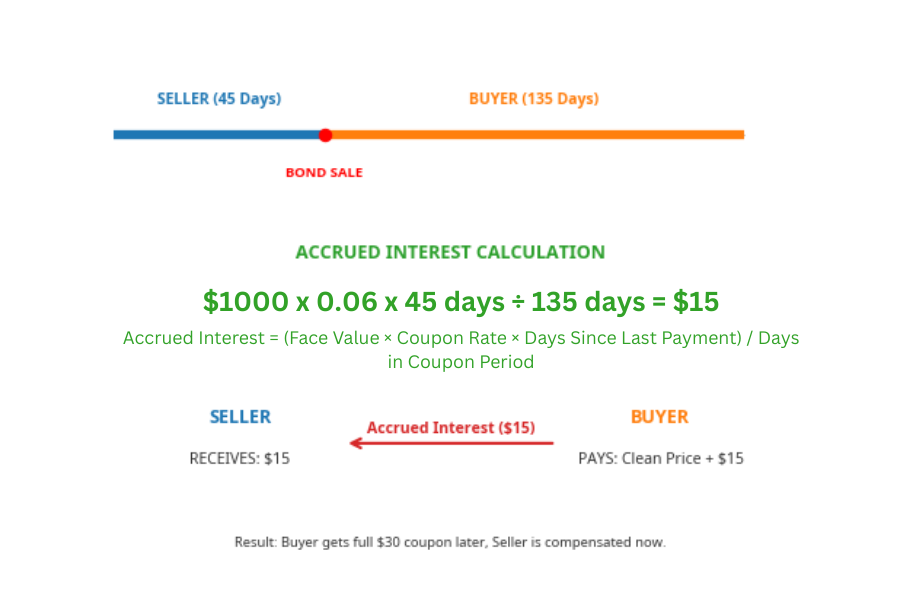

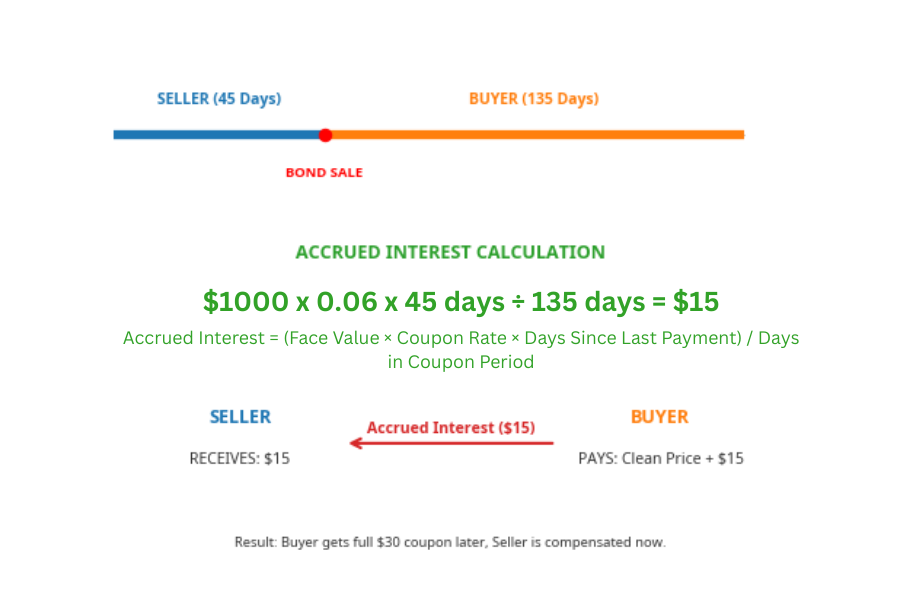

Quick Example

Imagine a bond with a face value of 1,000 and a 6 percent annual coupon. It pays interest twice a year, so each coupon is 30. If 45 days have passed since the last payment and the coupon period has 180 days, the accrued interest is:

If you buy the bond today, you pay the clean price plus 15. That 15 goes to the seller because they earned it by holding the bond for 45 days.

At the next coupon payment, you receive the full 30, even though you only held the bond for part of the period. This ensures fairness between buyer and seller.

How To Check Accrued Interest Before You Trade

Steps traders follow

Look at the bond’s coupon rate and the next coupon date.

Check the “accrued interest” field on your trading platform or settlement preview.

Confirm which day count method is being used.

Review whether the quote on screen is clean or dirty.

Compare the settlement amount to your available capital.

Recheck accrued interest whenever you hold bonds over several weeks.

Common Mistakes That Traders Make

Ignoring the clean vs. dirty price difference. This leads to wrong assumptions about cost.

Not knowing the day count method. This creates small but important calculation errors.

Buying right before a coupon without planning. The cash needed may be higher than expected.

Selling just after a coupon without checking resets. Accrued interest returns to zero, which changes proceeds.

Confusing coupon rate with market yield. Only the coupon rate sets accrued interest.

Related Terms

Coupon rate: The fixed interest rate that determines how fast interest accrues.

Clean price: The market price of a bond without accrued interest.

Dirty price: The total settlement price, including accrued interest.

Yield: The return a bond offers based on market price, different from the coupon rate.

Frequently Asked Questions (FAQ)

1. What is accrued interest in simple terms, and why does it matter to traders?

Accrued interest is the interest that builds each day on a bond or loan before the next payment. It belongs to whoever holds the asset during that time. Traders must factor it into the settlement price, which can change how much cash a trade requires.

2. How do you calculate accrued interest, and which method is most common?

Accrued interest is the face value times the coupon rate times the fraction of the period that has passed. Markets use different day count rules, such as 30/360 or Actual/Actual, which change the number of days in the calculation. Traders check their platform or contract to confirm the correct method.

3. How does accrued interest affect the price you pay when buying or selling a bond?

Bond quotes show the clean price, but you settle using the dirty price, which adds accrued interest. When buying, you repay the seller for the interest they earned. When selling, you receive both the market price and your earned interest since the last payment.

Summary

Accrued interest is the daily interest that builds between payment dates. Traders must track it because it changes the total cost or proceeds of every bond trade. When used correctly, it helps you understand the real value of a position.

When ignored, it leads to poor planning and surprise settlement amounts.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.