Nvidia stock surged by nearly 5% to $201.03 after the company announced a $1 billion investment in Finland's Nokia, marking one of its most strategically significant moves beyond the semiconductor space.

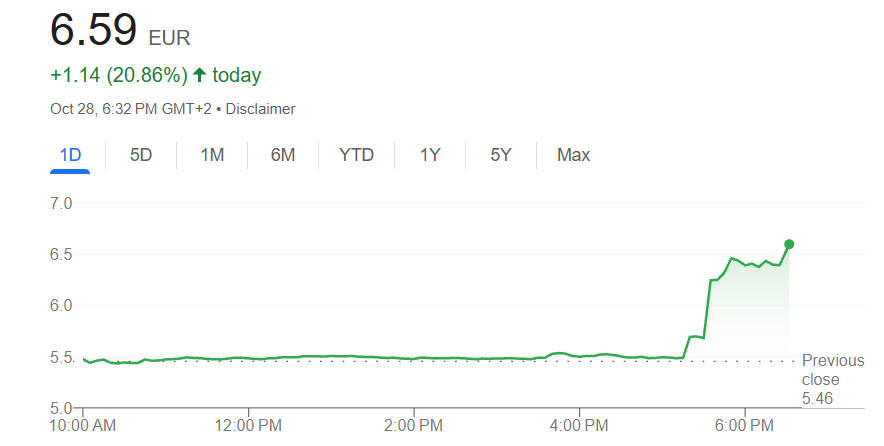

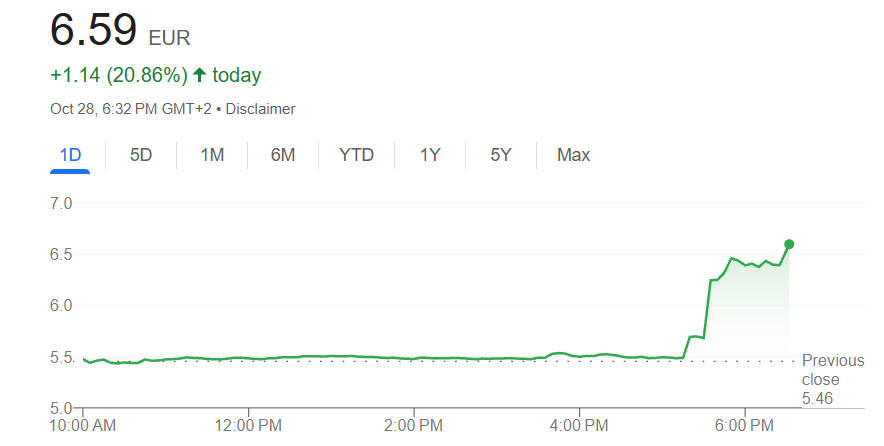

Meanwhile, Nokia shares jumped approximately 20.9 % to €6.59 in the wake of the announcement, reaching their highest level in nearly a decade.

The deal sparked optimism across both the technology and telecom sectors, as investors interpreted it as a step toward the convergence of AI computing and next-generation networks.

Inside the Nvidia–Nokia Deal

Nvidia confirmed the purchase of USD 1.0 billion worth of new Nokia shares at USD 6.01 per share, giving Nvidia an estimated 2.9 % stake in the Finnish telecom giant.[1] The agreement includes a technology collaboration to integrate Nvidia's AI computing platforms with Nokia's networking and 5G/6G infrastructure.

The partnership's stated goal is to develop "AI-native network architectures", where machine learning optimises traffic routing, energy efficiency, and network reliability.

For Nokia, the investment injects fresh capital into its AI-driven transformation programme; for Nvidia, it secures a strategic foothold in telecom infrastructure, extending its reach from data-centres to global network edges.

Key Parameters in the Nvidia–Nokia Partnership

| Parameter |

Details |

| Investment Value |

USD 1 billion |

| Stake Acquired |

Approx. 2.9 % of Nokia following issuance |

| Share Purchase Price |

USD 6.01 per newly issued Nokia share |

| Objective |

AI-native network development and infrastructure integration |

| Strategic Impact |

Extends Nvidia's AI infrastructure reach into telecom/edge networks |

Why the Nokia Bet Matters for Nvidia Stock Valuation

Analysts have noted that this partnership holds both symbolic and financial importance. Symbolically, it signals Nvidia's intent to own the full stack of AI delivery,—from chips and cloud systems to data-transmission networks.

Financially, it opens a new total addressable market worth an estimated USD 150 billion+ by 2030. driven by telecom AI automation, intelligent routing, and cloud-edge integration.[2]

According to industry commentary, the Nokia partnership may enhance Nvidia's network-related revenues by up to 7 % annually starting in FY2027 if operating smoothly. Such growth potential supports Nvidia's premium valuation multiples despite broader market volatility.

Moreover, the collaboration allows Nvidia to further export its CUDA and Spectrum-X technologies into a new class of network hardware. That, in turn, strengthens its recurring software and service income streams—a key driver of margin expansion.

From Silicon to Signal: How Nvidia Stock Gains from Telecom Integration

The Nokia partnership marks Nvidia's next major ecosystem expansion, following deals with CoreWeave and OpenAI. The difference here is that the move brings Nvidia closer to telecom carriers, a traditionally hardware-driven industry now turning towards AI-enabled automation.

By embedding AI inference capabilities directly within network layers, Nvidia could enable telecoms to reduce latency, optimise traffic, and monetise premium data services. In practice, that means its chips and software could become integral not just to AI-training clusters but to every intelligent base station and mobile core network.

For investors, this development indicates that Nvidia Stock is no longer tied solely to the performance of the semiconductor cycle but to the broader digital-infrastructure economy.

Can Nvidia Stock Sustain Its Momentum? Key Catalysts and Risks Ahead

While the market applauded Nvidia's bold expansion, analysts caution that several execution and regulatory risks remain. Cross-border investments in telecom infrastructure often invite regulatory scrutiny, especially when involving strategic national assets such as 5G.

In addition, integrating AI into large-scale network environments poses technical and commercial challenges, including data-privacy compliance, cost of deployment, and interoperability across vendors.

Key Catalysts and Risks Affecting Nvidia Stock

| Category |

Positive Catalyst |

Potential Risk |

| Strategic |

New AI-native network market with Nokia |

Regulatory barriers in telecom sectors |

| Financial |

Additional revenue streams and software margins |

Execution delays and integration costs |

| Market |

Strengthened AI ecosystem credibility |

Volatility in global tech valuations |

Even with these risks, investor sentiment remains firmly optimistic. Analysts expect the next key trigger to be Nvidia's Q4 earnings guidance, where investors will look for early signs of synergy and updated cap-ex projections from both companies.

Investor Take-Away: Nvidia Stock at the Crossroads of AI and Connectivity

The Nokia alliance reflects Nvidia's long-term ambition to dominate every layer of the AI economy. By bridging the gap between computing and communication, the company positions itself not just as a chipmaker but as an AI infrastructure enabler.

For investors, the partnership reinforces the thesis that Nvidia's growth is moving into its next structural phase—where the value lies not only in chips but in how those chips power intelligent systems across industries.

Frequently Asked Questions

1. Why did Nvidia Stock rise after the Nokia partnership announcement?

Nvidia Stock climbed as investors saw the USD 1 billion investment in Nokia as a move to expand the company's reach into AI-powered telecom networks. The deal suggests potential long-term revenue growth and deeper ecosystem integration.

2. How did the Nokia stock rise affect investor view of Nvidia Stock?

Nokia's shares rose roughly 20.9 % following the announcement, underlining market confidence in the partnership. This surge in Nokia stock helps validate the strategic logic behind Nvidia Stock's uplisting.[3]

3. How will the Nokia partnership impact Nvidia Stock's valuation?

Analysts believe the partnership could lift Nvidia Stock valuation by increasing its exposure to the global AI-infrastructure market, projected to exceed USD 150 billion by 2030.

4. Is Nvidia Stock expected to remain strong after the deal?

While Nvidia Stock is likely to remain supported by strong earnings and sector momentum, investors should be mindful of integration risks and high valuation levels.

5. What risks could affect Nvidia Stock following the Nokia investment?

Key risks include regulatory hurdles in telecom sectors, execution delays in AI-network integration, and global market volatility impacting tech valuations.

6. Should investors buy Nvidia Stock after the Nokia deal?

Investors who believe in Nvidia's long-term dominance in AI infrastructure may view this partnership as a growth catalyst, but it remains essential to balance optimism with valuation caution.

Sources:

[1]https://www.nokia.com/newsroom/inside-information-nvidia-to-make-usd-1-billion-equity-investment-in-nokia-in-addition-to-new-strategic-partnership-nokias-board-resolved-on-directed-share-issuance-to-nvidia/

[2]https://www.ft.com/content/075c6d4e-7319-45c7-9de8-49da908aa594

[3]https://www.reuters.com/world/europe/nvidia-make-1-billion-investment-finlands-nokia-2025-10-28/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.