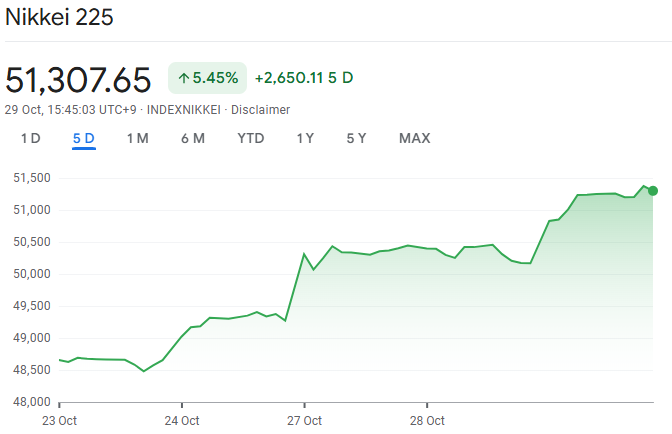

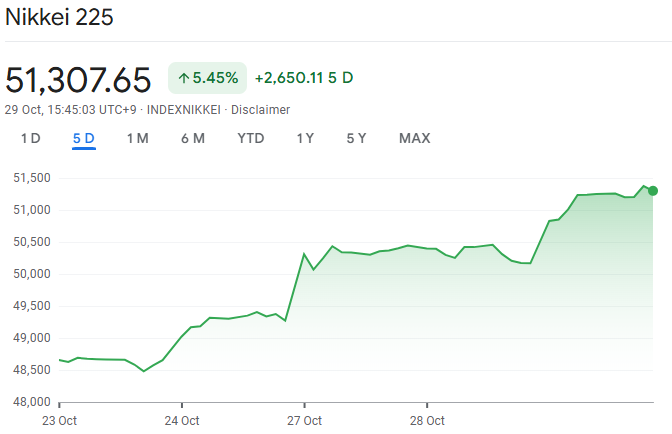

The Nikkei 225 surged past 51,000 points for the first time in history on Wednesday, October 29, reaching an intraday high of 51,412.97 before settling at 51,307.65. The breakthrough came just two trading days after the index first broke through the 50,000 level on Monday, October 27, when it closed at 50,512.32.

Four primary factors drove the historic rally: Prime Minister Sanae Takaichi's economic stimulus package totalling over $90 billion, a rare earths cooperation framework signed between President Trump and PM Takaichi on Tuesday that strengthens US-Japan supply chain security, artificial intelligence sector optimism that lifted technology stocks, and expectations for continued Federal Reserve interest rate cuts.

Seven Days That Pushed Nikkei to 51K

| Date |

Close Price |

Daily Change |

Key Event |

Market Impact |

| Oct 21 |

49,316.06 |

+0.27% |

Momentum builds on Takaichi policy speculation |

Foreign buying accelerates ahead of political transition |

| Oct 22 |

49,307.79 |

-0.02% |

Takaichi confirmed as PM, signals stimulus plans |

Market digests fiscal expansion expectations |

| Oct 24 |

49,299.65 |

-0.02% |

US-China trade deal rumors surface |

Export sector optimism begins lifting sentiment |

| Oct 27 |

50,512.32 |

+2.46% |

Breaks 50,000 barrier (intraday high: 50,549.60) |

Psychological milestone cleared on stimulus euphoria |

| Oct 28 |

50,219.18 |

-0.58% |

Trump-Takaichi sign rare earths deal, $490B investments |

Brief consolidation despite major bilateral agreements |

| Oct 29 |

51,307.65 |

+2.17% |

Breaks 51,000 barrier (intraday high: 51,412.97) |

AI sector optimism drives tech rally (Advantest +20%) |

The breakthrough marks a remarkable recovery from the 1989 crash, when the Nikkei collapsed from its bubble-era high of 38,957.44 and spent more than three decades attempting to reclaim those levels.

Japanese equities only surpassed the 1989 peak in February 2024, and have now extended gains by an additional 29%.

How Takaichi's $90 Billion Stimulus Drove Nikkei Higher

Prime Minister Sanae Takaichi's economic policy stance has emerged as the dominant driver behind the Nikkei's surge. Since taking office on October 22, Takaichi has signalled a clear commitment to expansionary fiscal policy and continued monetary accommodation.

Stimulus package overview:

Total package size: Over $90 billion (approximately ¥13.9 trillion)

Timeline: Implementation across fiscal years 2026-2028 [1]

Focus areas: Infrastructure investment, household cost-of-living support, regional development, and corporate tax incentives

Political signal: Clear preference for accommodative monetary policy alongside fiscal expansion

Takaichi's approach differs markedly from her predecessor's more cautious stance. Her long-standing advocacy for increased government spending and easy monetary policy has reassured equity investors concerned about potential fiscal tightening.

The stimulus announcement has particularly benefited construction, infrastructure, and domestic consumption stocks, with major gainers on Monday including Tokyo Electric Power, Mitsubishi Heavy Industries, and East Japan Railway.

Market analysts at Nomura Securities noted that the stimulus package addresses Japan's twin challenges of persistent inflation and sluggish wage growth.

By directing funds toward households whilst maintaining corporate investment incentives, the policy mix aims to sustain consumption without triggering excessive inflation.

Trump-Takaichi Rare Earths Cooperation Framework

President Trump and Prime Minister Takaichi signed a rare earths cooperation agreement in Tokyo on Tuesday, October 28, during Trump's Asia tour. The framework commits both nations to securing critical mineral supplies through coordinated mining, processing, recycling, and stockpiling efforts, reducing dependence on China's dominant market position.

The agreement addresses supply chains for neodymium, dysprosium, and other elements essential for electric vehicle motors, defence systems, and advanced electronics. Both governments pledged to jointly identify projects addressing supply gaps for rare earths and derivative products, including permanent magnets, batteries, catalysts, and optical materials.

The deal came alongside Japanese corporate commitments of $400-490 billion in US investments spanning energy, artificial intelligence, shipbuilding, and critical minerals. Trump praised Takaichi's "very strong handshake" and the two leaders declared a "new golden age" of the US-Japan alliance.

Market beneficiaries: Toyota and Honda gain supply security for EV components, Sony and Panasonic benefit from diversified sourcing, and materials companies see reduced geopolitical risk.

US-China Trade Dialogue Progress

Renewed hopes for US-China trade progress provided additional momentum. Reports of movement toward a partial agreement lifted Asian markets broadly, with South Korea's Kospi breaking 4,000 on the same day the Nikkei cleared 50,000.

Lower tariffs would benefit Japanese manufacturers in the automotive and electronics sectors, while reduced tensions ease cross-border planning. Improved China growth outlook supports demand for Japanese capital goods and machinery. Major exporters, including Toyota, Sony, and Panasonic, rallied on combined optimism from both the bilateral rare earths framework and broader regional trade developments.

Why Fed Rate Cuts Are Boosting Japanese Stocks

Expectations for continued Federal Reserve monetary easing have provided tailwinds for global equity markets, including Japan. Markets currently price in two additional 25 basis point rate cuts before year-end, bringing the Fed funds rate to 3.50%-3.75%.

How Fed policy supports Japanese stocks:

Yield differential narrowing: Lower US rates reduce the gap with Japan's 0.5% policy rate, supporting moderate yen stability that aids import costs without crushing exporters

Global liquidity expansion: Easier Fed policy increases global risk appetite and capital flows into developed market equities outside the US

Valuation support mechanism: Lower discount rates improve present value calculations for long-duration assets like equities, particularly growth stocks

Sector rotation benefits: Japanese tech and growth stocks receive dual support from both lower rates and export competitiveness

The Bank of Japan's continued ultra-loose monetary policy stance compounds the Fed effect. With the BOJ holding rates at just 0.5% whilst inflation runs near 3%, real interest rates remain deeply negative, encouraging equity investment over bonds. Currency markets have responded favourably, with USD/JPY trading around the 152-153 range—weak enough to support exporters but not so weak as to trigger intervention concerns.

Foreign Investors Pour $18.5B into Nikkei Stocks

Foreign investors have been net buyers of Japanese equities for eight consecutive weeks through October 25, purchasing approximately ¥2.8 trillion ($18.5 billion) in stocks. This sustained inflow contrasts with earlier 2025 when foreign participation was more sporadic.

Warren Buffett's continued investment in Japanese trading houses has encouraged other international investors to reassess the market. Berkshire Hathaway now holds significant stakes in Mitsubishi Corporation, Mitsui & Co., Itochu, Marubeni, and Sumitomo Corporation, validating the value proposition in Japanese equities. Tokyo Stock Exchange officials noted record trading volumes accompanying Monday's milestone, with both domestic and international investors participating in the rally. [2]

The foreign capital influx has been broad-based across sectors, with particular interest in financial services (benefiting from yield curve steepening), technology (trade deal optimism), and industrials (stimulus spending). Japanese pension funds and retail investors have also increased allocations, supported by government-backed investment schemes.

Which Sectors Led Nikkei 225 to Record High?

Monday's rally showed broad participation across sectors, with cyclical and growth-oriented industries leading the advance.

Top-performing sectors on Monday:

Banks: Strong gains on expectations for a steeper yield curve from BOJ policy normalisation

Construction: Outperformed on anticipated infrastructure spending from the stimulus package

Technology: Advanced on trade deal hopes and Federal Reserve easing expectations

Industrials: Benefited from capital investment incentives and regional development plans

Consumer discretionary: Rose on household support measures announced by the Takaichi administration

Notably absent from leadership were defensive sectors like utilities and real estate investment trusts, which underperformed as investors rotated toward growth and cyclical exposures. This pattern suggests confidence in the economic outlook rather than defensive positioning.

Small and mid-cap stocks outpaced large caps during the rally, with the TOPIX Small Index showing stronger percentage gains compared to the broader TOPIX advance. This breadth expansion typically signals healthy bull market dynamics rather than narrow leadership.

Three Risks That Could Reverse Nikkei 225 Rally

Despite the euphoria surrounding the new high, several factors could challenge the Nikkei's continued ascent.

Valuation and technical concerns:

Stretched valuations: Forward price-to-earnings ratios have expanded above historical averages, raising questions about sustainability

Extended momentum: The rapid advance leaves limited room for error, with the index well above key moving averages

Overbought conditions: Momentum indicators show strong bullish readings that historically precede consolidation periods

Policy and economic uncertainties:

BOJ meeting risk: October 29-30 decision could surprise with a rate hike, strengthening yen and pressuring exporters

Stimulus implementation delays: Government must finalise and execute the spending package; execution risk remains significant

Real wage growth challenges: Despite nominal increases, inflation-adjusted wages continue declining, threatening consumption sustainability

External shock potential:

US-China deal fragility: Trade negotiations remain subject to political shifts; any breakdown would reverse sentiment quickly

Global recession risks: Slowing European and Chinese growth could dampen export demand regardless of tariff reductions

Currency volatility: Significant yen strengthening below 148 per dollar could pressure export earnings and trigger selling

Conclusion

Bulls argue that corporate earnings remain solid with expectations for continued profit growth in fiscal 2026, valuations remain reasonable relative to global peers when adjusted for balance sheet strength, and the policy mix of fiscal stimulus plus monetary accommodation provides ongoing fundamental support. [3]

Bears counter that the rally has priced in substantial positive developments, leaving equities vulnerable to any disappointment on stimulus implementation, trade deals, or economic data. They note that retail investor sentiment indicators show extreme optimism levels historically associated with near-term market tops.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/asia-pacific/japans-new-pm-is-preparing-large-economic-stimulus-tackle-inflation-sources-say-2025-10-22/

[2] https://www.morningstar.com/news/dow-jones/20251026714/nikkei-stock-average-rises-above-50000-for-first-time

[3] https://economictimes.indiatimes.com/markets/stocks/news/japans-nikkei-tops-50000-mark-for-first-time-on-stimulus-euphoria/articleshow/124838017.cms