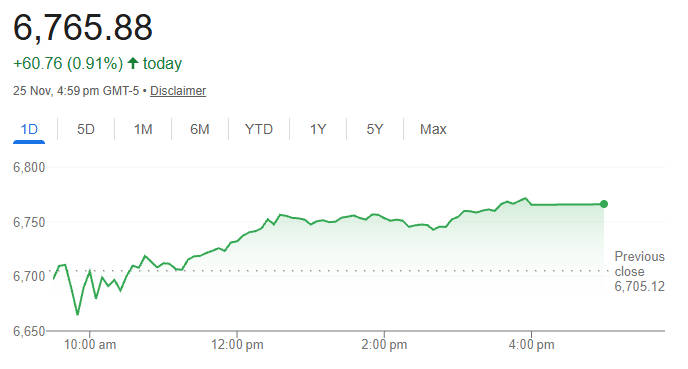

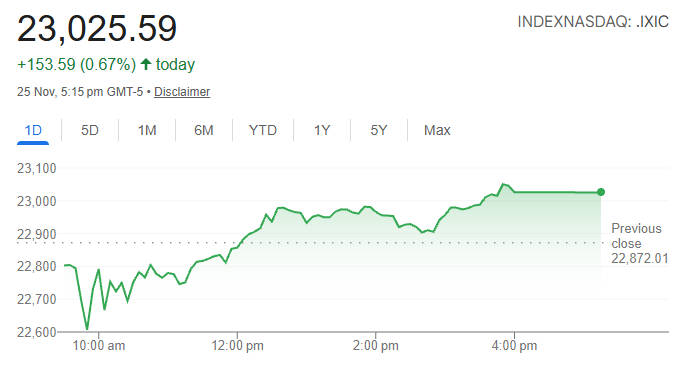

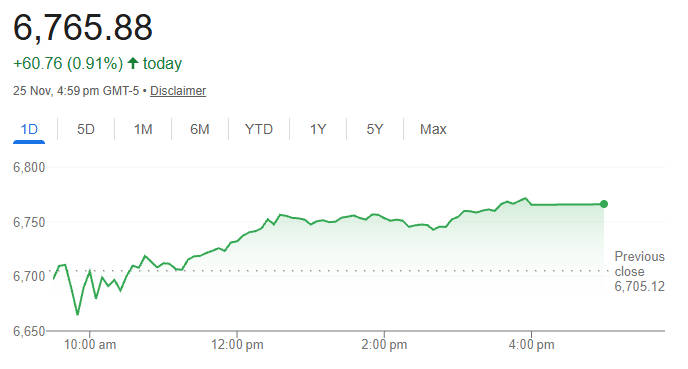

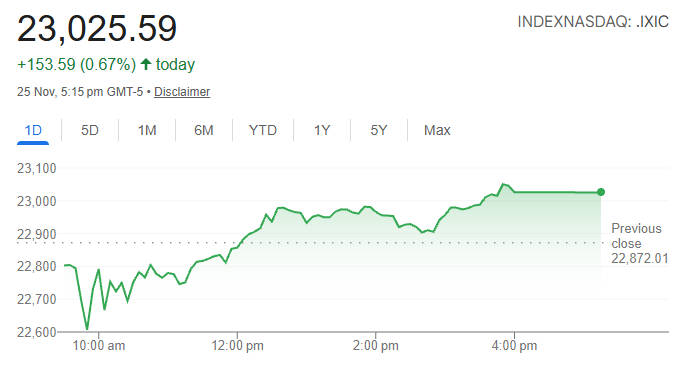

Major US Index Performance Today

US stock futures opened the holiday week with a generally constructive tone after another session of gains in the cash market.

The uplift in the S&P 500. Nasdaq Composite and the Dow reflected a combination of stronger earnings snippets, hopes for easier policy and a modest retreat in longer-term yields.

Markets are also operating in thinner pre-Thanksgiving liquidity, which amplifies headline moves and intra-day swings.

Key macro markers driving the futures environment include:

Market pricing that has rapidly shifted to favour a December Fed rate cut.

Ten-year Treasury yields near the 4.00% level.

A VIX that has come down from recent spikes but remains above historically calm levels.

Latest Performance In US Stock Futures: Index And Sector Snapshots

Pre-open and overnight futures behaviour mirrored the broad cash gains. S&P-linked futures showed modest upward bias, Dow futures outperformed on a momentum lift from several blue-chips, while Nasdaq futures were firmer but more sensitive to semiconductor and AI-related headlines.

Sector-wise:

Technology remains the marginal driver of near-term market direction thanks to concentration in mega-caps.

Financial names benefitted from the recent small pullback in short-term yields and positioning for easing policy.

Consumer discretionary was buoyed by early signs of robust seasonal spending in certain retail categories.

Why Fed-Cut Expectations Matter For US Stock Futures Today

The biggest macro theme underpinning futures is the rapid repricing of Federal Reserve policy. Fed funds-futures now put a materially higher probability on a 25bp cut in December, shifting both rates expectations and risk-asset valuations.

That repricing reduces headline expected returns on cash instruments and tends to lift growth-oriented assets, which in turn supports index futures.

However, this is a politically and economically sensitive compression of real yields, and any reversal in the narrative would quickly pressure futures.

Yield And Volatility Backdrop: How Treasuries And VIX Are Steering Futures

Ten-year yields have been trading around the 4.00% mark after a recent dip below that threshold; such moves matter because the long-end influences discount rates used to value equities. A lower long-term yield is typically supportive for the multiple and price levels of growth stocks, and therefore positive for Nasdaq-sensitive futures.

The VIX, a short-term gauge of equity volatility, has eased from recent spikes but remains elevated compared with the market's calm earlier in the year. Elevated but falling VIX often coincides with risk-on futures flows, yet it signals that hedge demand and episodic jumps can materialise quickly.

US Stock Futures Reaction To Recent Economic Releases

Recent data has been mixed: producer-price and certain retail metrics have shown disinflationary tendencies, while consumer confidence has been patchy in places. The combined impression has been enough to lift Fed-cut odds but not to guarantee continued easing. Futures are therefore reacting more to the narrative of easing than to a decisive soft-landing data set — a precarious position that requires close monitoring of incoming prints.

Corporate News And Earnings Influence On US Stock Futures

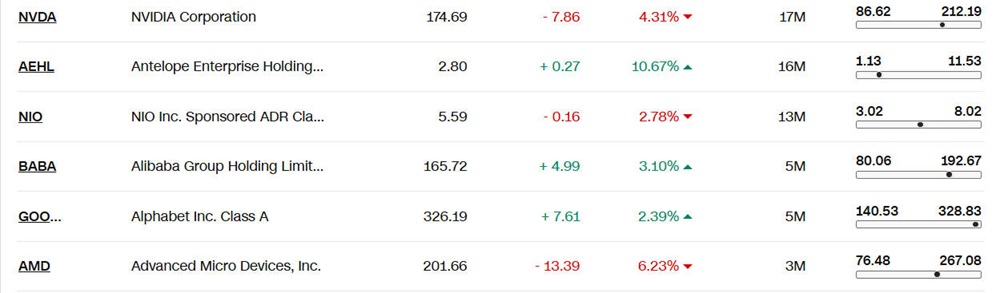

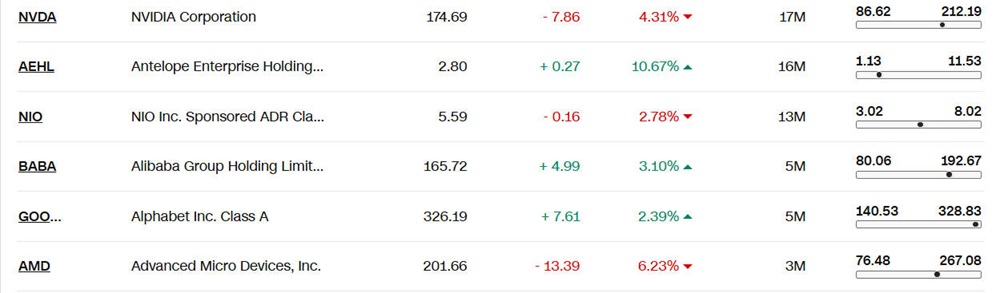

Earnings season continues to supply episodic volatility to futures. Major technology firms, especially those linked to AI services, drove S&P and Nasdaq gains today, while weak guidance or profit-margin commentary from chipmakers occasionally pushed Nasdaq futures lower. Retail and discretionary results will remain key near-term indicators for the holiday trading week.

Technical Levels And Short-Term Signals For US Stock Futures

For traders, the immediate technical map is as important as macro narratives. Key levels to watch today:

S&P 500 futures:

Recent intraday resistance and the 50-day moving average cluster, a clean break above the day's high would reinforce a short-term bullish tilt.

Nasdaq-100 futures:

Pay attention to leadership in mega-caps; failure to sustain gains on big tech would broaden downside risk.

Dow futures:

If price sustains above today's high near the index level you provided, momentum players could add to longs.

Keep an eye on volume and depth: in holiday-thin sessions, technical breakouts are more likely to be false. Use tight risk controls. (Technical levels should be checked on your execution platform for live updates.)

Holiday-Week Liquidity: Strategies To Manage US Stock Futures Risk

Thanksgiving week historically shows lower participation and sharper intraday prints. For futures traders this implies:

Use smaller size or widened stops to reduce the chance of being whipsawed by low-liquidity moves.

Avoid overleveraging ahead of major scheduled announcements or before extended holiday closures.

Consider options-based hedges if directional conviction is required, since options can provide asymmetric protection in thin markets.

These are practical risk controls rather than predictions — they reflect the probability that lower volume will magnify price moves.

Market Risks That Could Quickly Reverse US Stock Futures Gains

Be vigilant about these near-term shocks:

1. Data surprise to the upside on inflation.

A hotter print would materially reduce the odds of a December cut and cause a rapid unwind of long futures positions.

2. Earnings guidance downgrades in tech/AI supply chain.

Given the concentration of equity returns in a few names, a broad guidance pullback would be damaging for Nasdaq-sensitive futures.

3. Geopolitical or fiscal shocks.

Unexpected events disrupting energy or supply chains can raise risk premia and rattle futures.

Bullish Catalysts That Could Sustain US Stock Futures Strength

Conversely, these factors support upside:

Continued dovish communication or evidence that inflation is receding more quickly than feared.

Stronger-than-expected holiday retail data or upbeat corporate guidance from large caps.

A prolonged decline in volatility as VIX falls further and risk appetite broadens.

A Short-Term Prediction For US Stock Futures

Below are scenario-based, cautious short-term forecasts for US stock futures over the next 3–7 trading days. These are probabilistic sketches, not guarantees.

1. Base Case (55% probability):

Markets continue to rally modestly as Fed-cut odds remain elevated and no major inflation upside surprises emerge.

S&P futures trend higher within a defined range, Nasdaq outperforms if tech earnings hold. This scenario is consistent with current futures pricing and recent market moves.

2. Bull Case (20% probability):

A string of benign macro prints and strong retail/tech guidance accelerates the rally. Futures break higher, VIX falls below 18 and momentum players add to longs. This requires the Fed-cut narrative to be reinforced by data and commentary.

3. Bear Case (25% probability):

An upside inflation surprise, unexpected weak guidance from tech leaders, or an external shock causes a rapid de-rating. Futures gap lower with a quick pick-up in VIX and 10-year yields re-steepen.

Given the concentration of gains, downside could be sharp in Nasdaq-sensitive futures.

Trading implication: position sizing and disciplined stop placement are essential; favour scenario hedging rather than aggressive directional leverage in this environment.

Practical Trade Ideas And Risk Management (Short-Term)

Intraday traders:

Use mean-reversion scalps around VWAP in thin markets; keep exposure modest.

Swing traders:

Consider pair trades (long defensive ETF / short tech weight) if you seek to hedge sector concentration.

Long investors:

Use periodic dips to rebalance into high-conviction names rather than chase momentum late in the holiday week.

Hedging:

Short-dated put spreads or collar strategies can protect positions without expensive outright insurance.

Conclusion: How To Read Today's US Stock Futures

Today's market action shows a market willing to price easier policy and reward growth segments, but that willingness sits beside genuine uncertainty: the Fed decision path is fragile, yields are near an important psychological level and thin liquidity could turn small shocks into outsized moves. Treat the current rally as an opportunistic but fragile advance — manage size and use hedges where necessary.

FAQ: US Stock Futures Today

1. Why Are US Stock Futures Moving Ahead Of Thanksgiving Week?

US stock futures are moving due to thinner liquidity, stronger rate-cut expectations and sector rotation into technology and cyclicals. Holiday trading usually magnifies price swings, so futures react more sharply to economic updates and short-term shifts in market confidence.

2. Are US Stock Futures Pointing To A Year-End Rally?

US stock futures suggest cautious optimism for a year-end rally, supported by stronger rate-cut expectations and seasonal spending. However, sustainability depends on upcoming inflation reports, corporate guidance and whether thin liquidity enhances or disrupts positive momentum.

3. What Risks Could Cause US Stock Futures To Pull Back?

Main risks include hotter-than-expected inflation data, a reversal in Fed-cut expectations, negative earnings guidance from major technology firms or geopolitical disruptions. Any of these can trigger rapid unwinding of long positions and push US stock futures sharply lower.

4. How Do Fed Rate-Cut Expectations Impact US Stock Futures?

Rising expectations for a Federal Reserve rate cut typically lift US stock futures because lower borrowing costs support equity valuations. When traders believe monetary easing is imminent, futures on the S&P 500. Nasdaq and Dow often strengthen in anticipation.

5. Why Do Technology Stocks Influence US Stock Futures So Strongly?

Technology stocks heavily influence US stock futures because mega-cap tech firms dominate index weightings. Their earnings, guidance and valuation shifts disproportionately move Nasdaq and S&P 500 futures, driving both bullish momentum and sudden volatility when sentiment changes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.