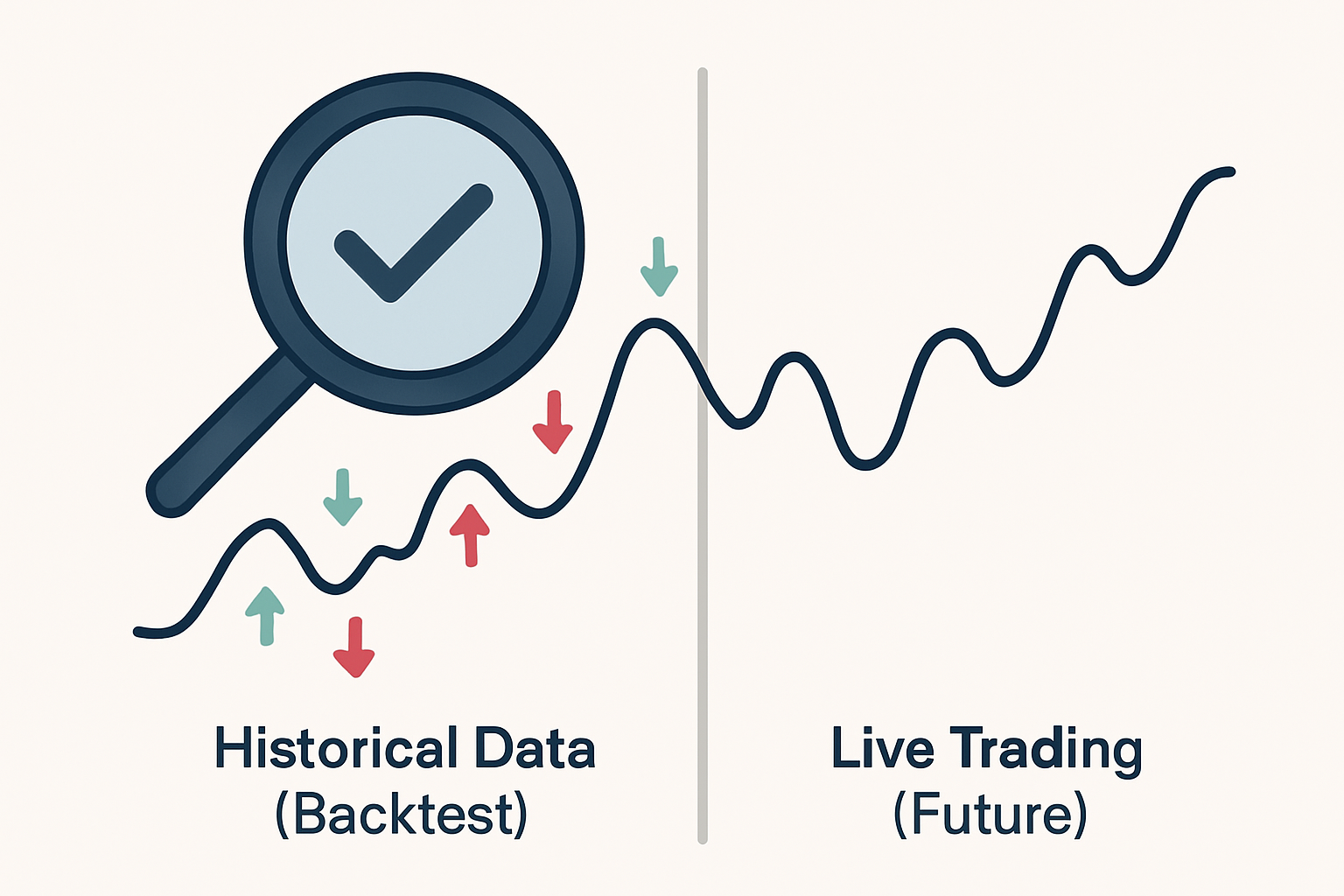

A backtest is a simple process that checks how a trading strategy would have performed using past market data. It shows whether the rules of the strategy worked well, failed often, or behaved inconsistently across different conditions.

Backtesting matters because it helps traders avoid blind guesses. Instead of trusting a new idea based on feeling, a backtest offers real evidence of how the idea held up in markets that already happened.

Definition

A backtest checks a defined set of trading rules on historical prices. The rules must be clear. For example: buy when price breaks above a moving average, exit when RSI crosses below 50, and use a fixed stop.

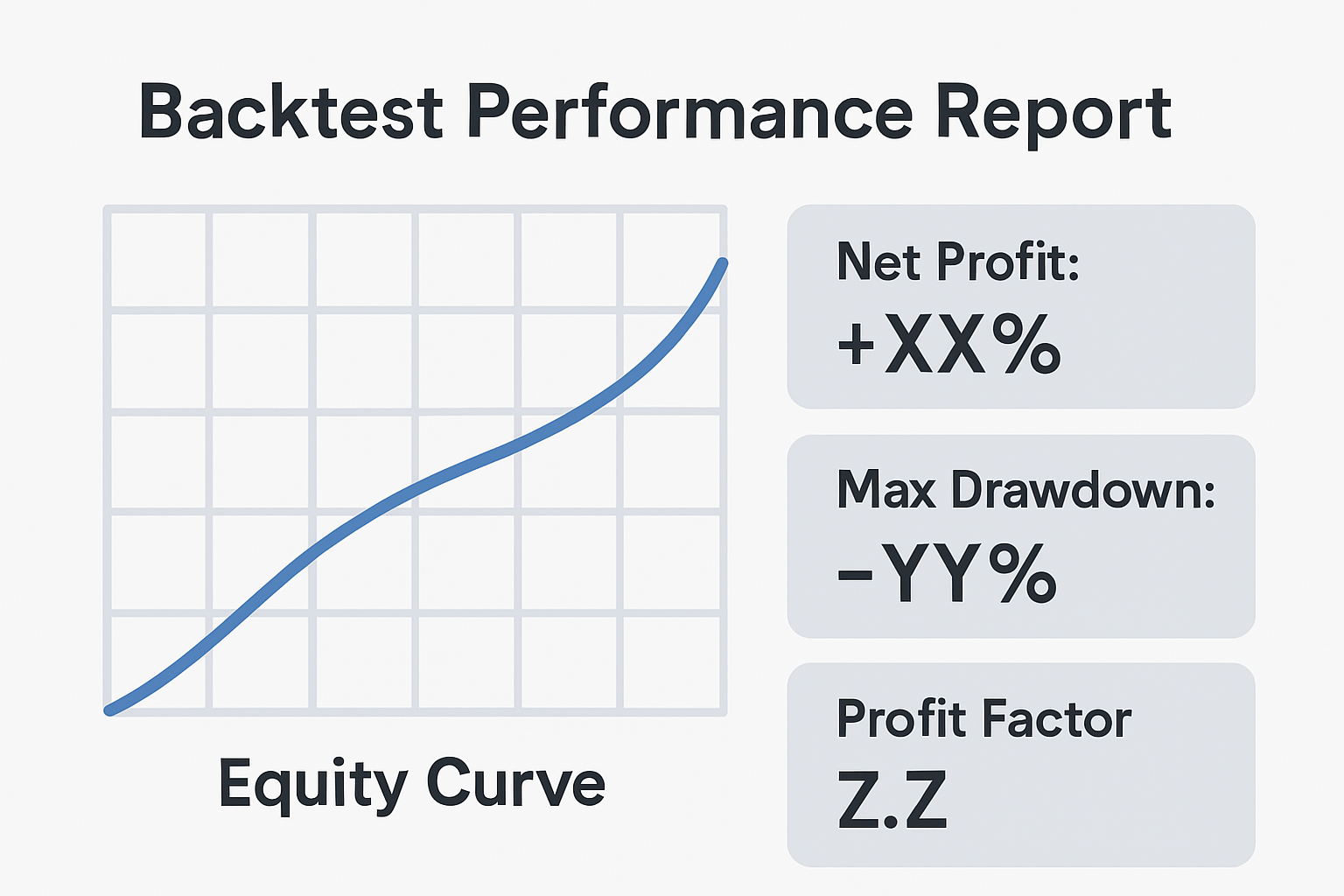

The backtest shows the profits, losses, drawdowns, and number of trades that would have followed.

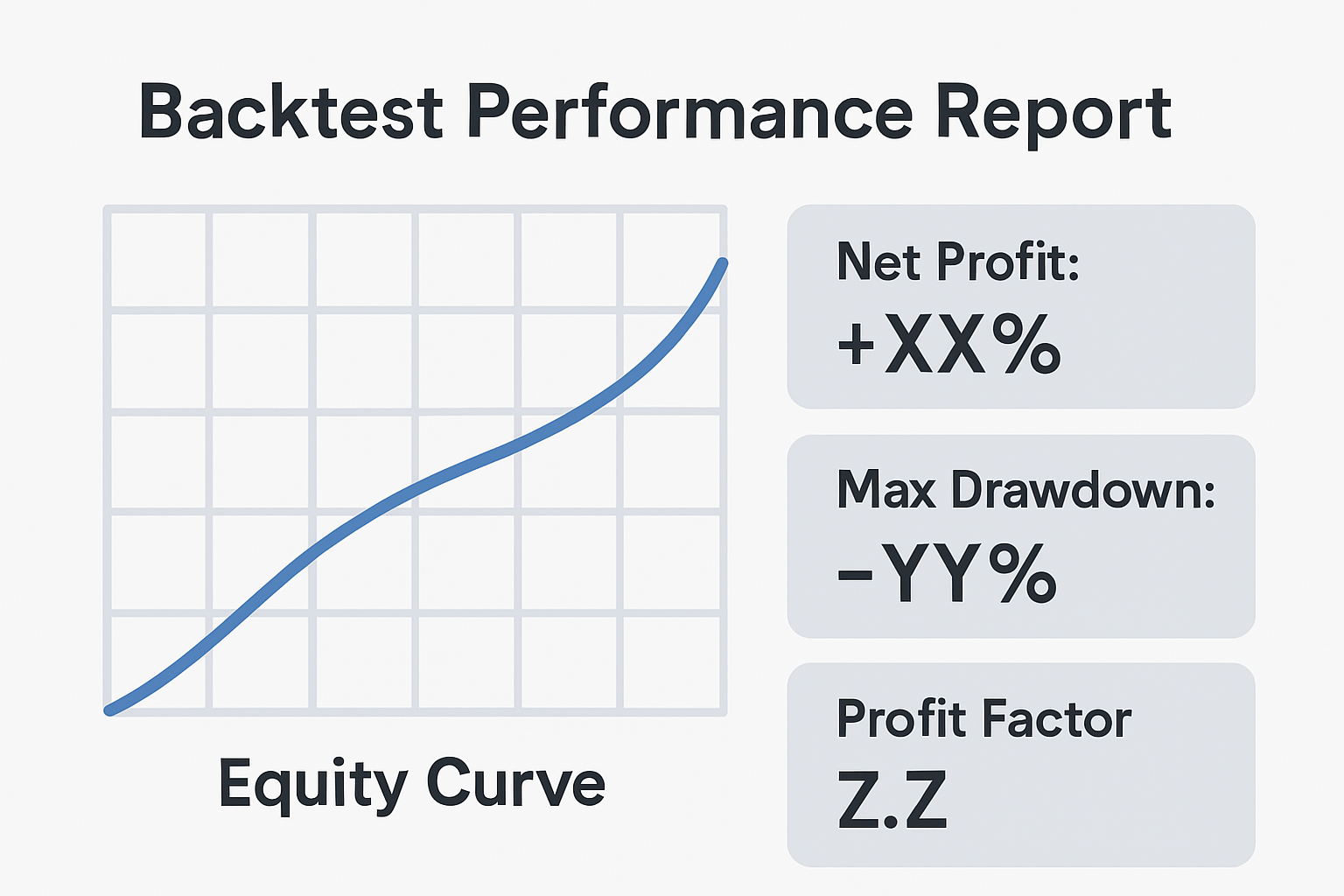

Traders see backtesting tools in most platforms. Some show results with charts, equity curves, and tables. Both beginners and advanced traders use backtests.

Beginners use them to understand how a strategy behaves. Experienced traders use them to refine rules or compare systems before putting money at risk.

Key Forces That Affect Backtest

Several factors decide how strong or weak a backtest looks.

Market Conditions

Trends, ranges, and high volatility periods all change how rules behave. A trend strategy performs better during directional moves. It may lose during sideways markets.

Quality Of Data

The backtest depends on accurate historical data. Gaps or incorrect prices can distort the results and mislead traders.

Rule Clarity

Vague or flexible rules cause inconsistent results. Clear conditions create consistent trades and help avoid accidental curve fitting.

A backtest does not predict the future. It highlights how the idea handled past conditions.

How Does Backtest Affect Your Trades?

A backtest provides proof that a strategy has strengths and weaknesses. It guides entries by showing when rules historically worked well. It guides exits by showing which stop or target method created better outcomes.

It also highlights risk, showing how deep the worst losing streak was. Traders use this information to set realistic expectations.

It also highlights risk, showing how deep the worst losing streak was. Traders use this information to set realistic expectations.

Backtests also prevent overconfidence. When results show mixed performance, a trader can reduce size or skip the system. When results show stable outcomes across many years, confidence becomes stronger and decisions more disciplined.

Useful signs:

Warning signs:

Quick Example

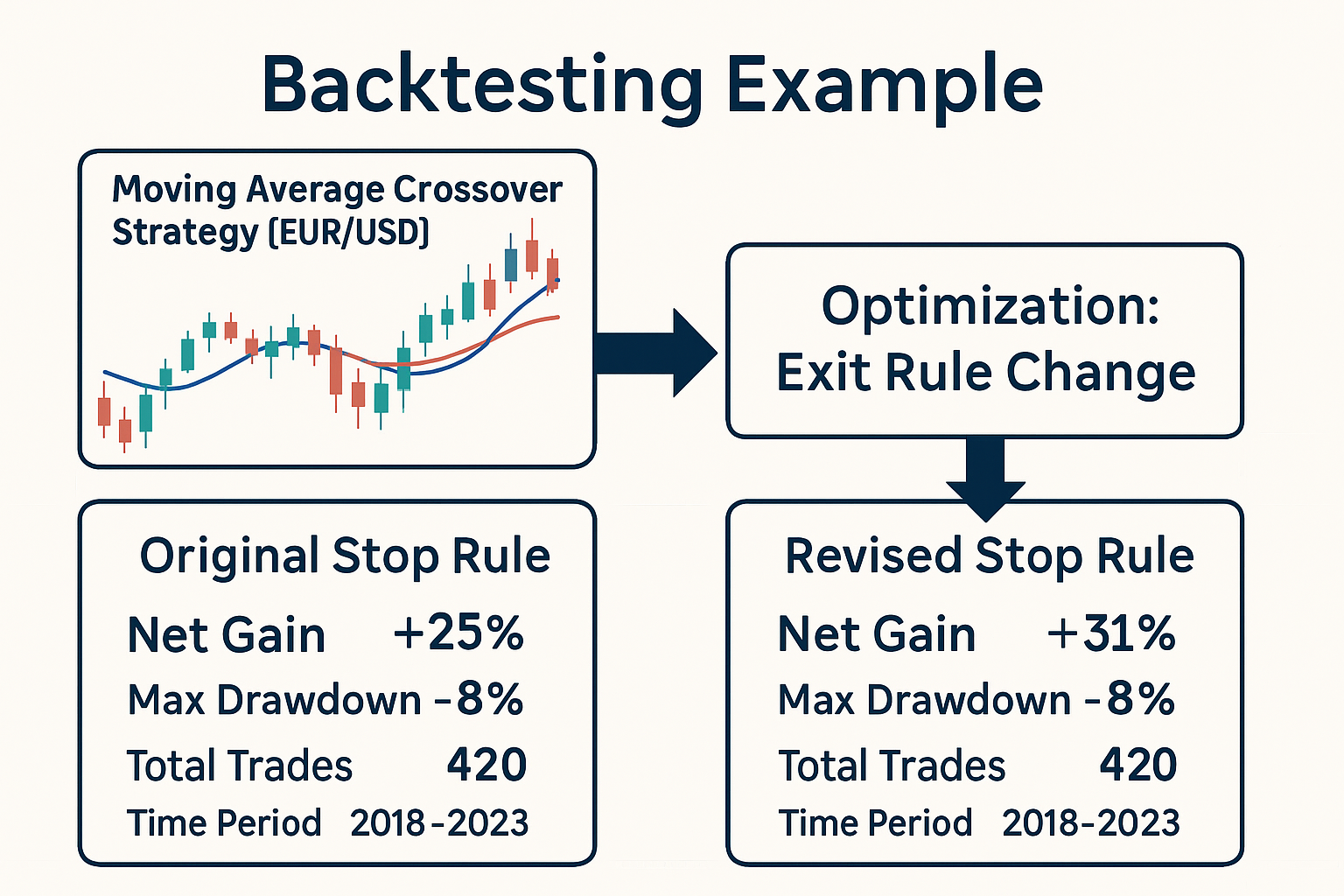

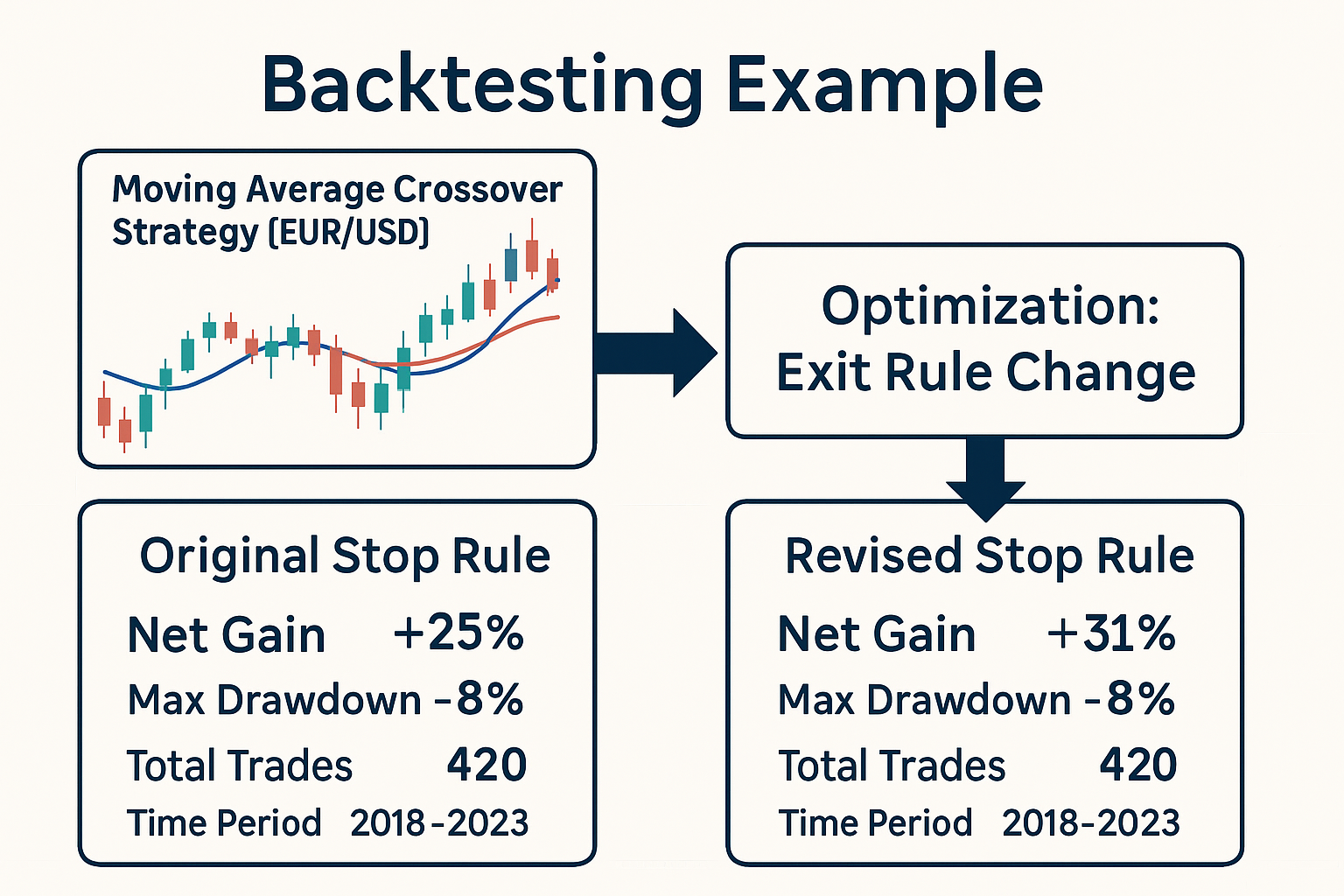

A trader tests a moving average crossover system on EUR/USD. In the backtest from 2018 to 2023, the strategy produced 420 trades. It gained 25 percent over the full period with a maximum drawdown of 8 percent.

Most gains came during trending months. The trader changes the stop rule and retests. Now the gain improves to 31 percent with the same drawdown.

This helps the trader understand that the exit rule had a big effect. The example shows how clear rules and steady checking lead to better strategy design.

This helps the trader understand that the exit rule had a big effect. The example shows how clear rules and steady checking lead to better strategy design.

How To Check Backtest Before Trading

A short routine helps make backtesting more reliable.

Confirm the historical data is clean and covers different market conditions.

Write clear entry, exit, and stop rules with no guesswork.

Run the backtest and record profit, drawdown, average win, and average loss.

Compare results across multiple time periods to check stability.

Look at the equity curve. Smooth lines often mean steadier performance.

Run a small demo test in real time to confirm the behaviour matches the backtest.

Checking the backtest every time you modify a rule helps avoid surprise outcomes.

Common Mistakes With Backtest

Fitting rules to past data. Adjusting rules until results look perfect hides real weaknesses.

Using too little data. Short samples miss different market conditions.

Ignoring drawdowns. A profitable backtest with deep losses may be too stressful to trade.

Overusing indicators. Too many conditions reduce the chance of repeating results.

Not testing exits carefully. Many strategy problems come from poor exit rules.

Forgetting real order costs. Spread and slippage can change results sharply.

Related Terms

Forward testing: Checks the same strategy on new data to confirm the backtest’s behaviour.

Paper trading: Tests strategy execution in live markets without real money.

Walk forward analysis: Rotates test periods to see if rules stay stable over time.

Risk management: Helps shape sizes using drawdown data from the backtest.

Systematic trading: Relies on rules, which makes backtesting essential.

Equity curve analysis: Helps understand whether gains and losses in a backtest are smooth or unstable.

Frequently Asked Questions (FAQ)

1. Can a backtest guarantee future profits?

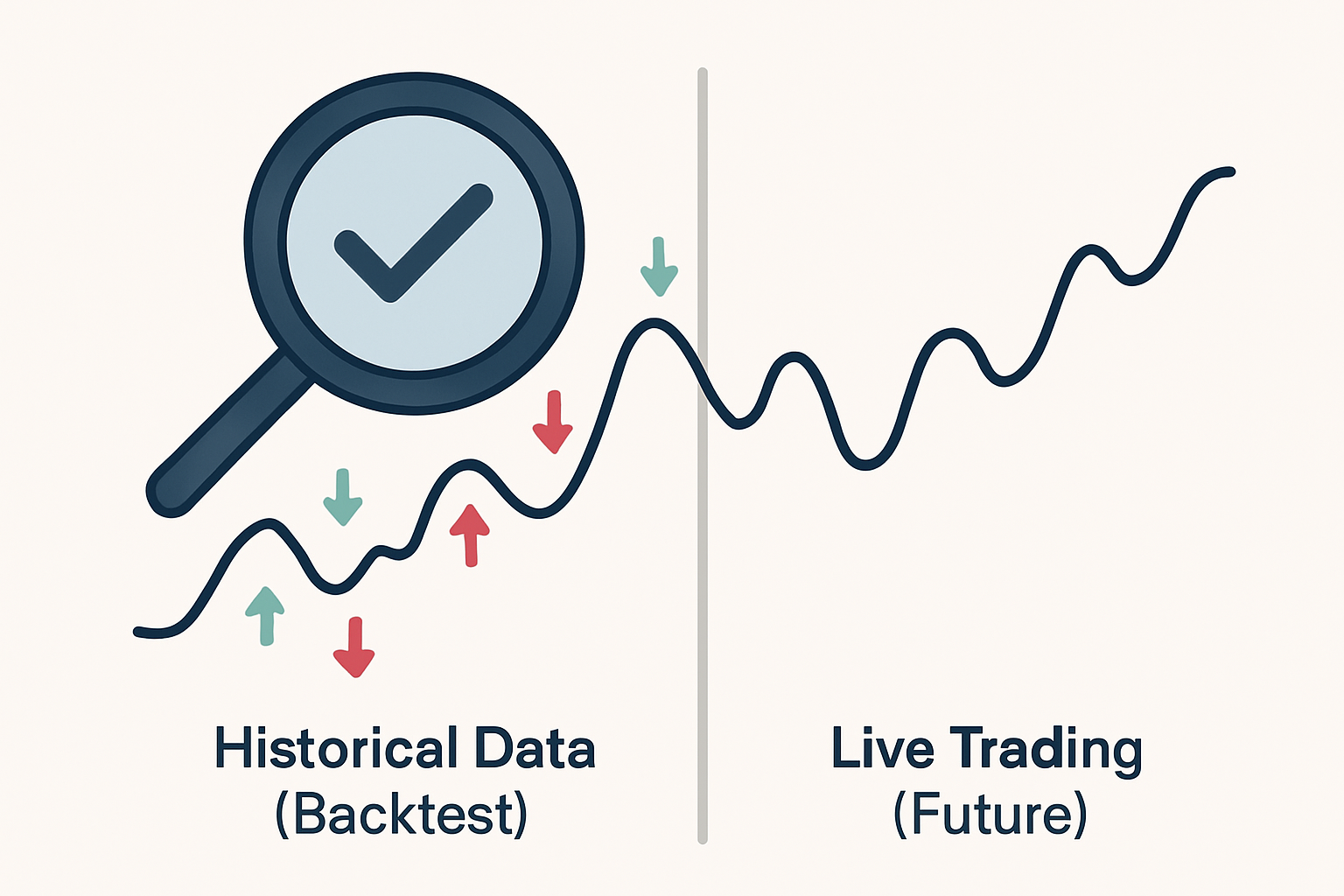

No. A backtest can only show how a strategy performed under past conditions. Markets often change, so any future results may differ. What a backtest does provide is a realistic picture of how the strategy behaves, which helps set expectations and reduce emotional decisions.

2. How much data should I use when backtesting?

It is better to include as many years as possible to capture different market climates. Testing only one type of condition, such as a strong trend period, can create a false sense of safety. A long sample helps show how the strategy reacts during ranges, trends, shocks, and slow markets.

3. Why do backtests often look better than live trading?

Backtests do not always include every real cost, such as spread changes, slippage, and order delays. Platforms often assume perfect execution, which is rare in live markets. This gap explains why many strong backtests perform weaker when traded live.

4. Should I change a strategy each time the backtest improves?

Not necessarily. Frequent adjusting may lead to curve fitting, where the rules match past data too closely. Safe improvements come from simple, logical changes that still make sense in real markets. Checking stability across multiple periods helps avoid unrealistic results.

5. When is a backtest considered strong?

A strong backtest shows consistent profits across various years, a reasonable drawdown, and a smooth equity curve. It should not depend on one lucky period. Results should also remain stable when tested with small rule adjustments.

Summary

A backtest checks a trading strategy on historical data to reveal how the rules behave in real conditions. It guides decisions by showing strengths, weaknesses, and risk levels before money is involved. Used correctly, it makes trading more structured and less emotional.

Traders should avoid curve fitting and always confirm that backtest results stay stable across many years.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

It also highlights risk, showing how deep the worst losing streak was. Traders use this information to set realistic expectations.

It also highlights risk, showing how deep the worst losing streak was. Traders use this information to set realistic expectations. This helps the trader understand that the exit rule had a big effect. The example shows how clear rules and steady checking lead to better strategy design.

This helps the trader understand that the exit rule had a big effect. The example shows how clear rules and steady checking lead to better strategy design.