Accumulation means steady buying over time. A trader or large player adds to a position in small steps instead of one large order. This slow build often happens before a trend begins because it helps avoid moving the price too quickly.

It matters because spotting accumulation can give traders an early clue that demand is rising, even if the chart still looks flat.

Definition

In trading, accumulation is the quiet phase when buyers build long positions while keeping price movements minimal. They may buy on dips or during tight ranges where the market looks calm. This is different from breakout buying, which happens fast and is easy to see.

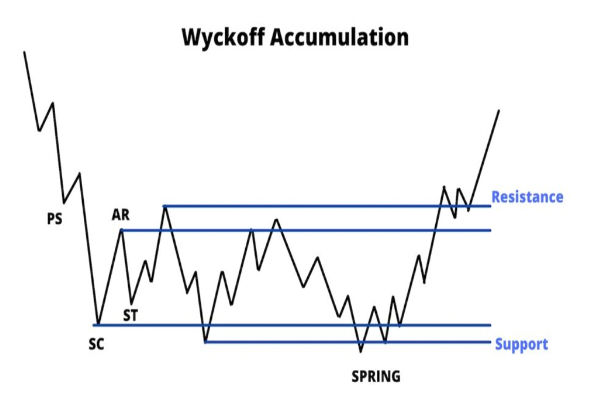

Accumulation is much more subtle. It shows up as higher lows, rising volume on up moves, or steady buying interest at certain levels.

Traders notice accumulation in price charts, order books, and volume reports. It is common in forex, stocks, commodities, and crypto. Short-term traders may watch it on lower timeframes.

Longer-term traders look for it on daily or weekly charts to spot early trend changes. Many professionals track how price reacts at key support levels to decide whether accumulation is taking place.

What Changes Accumulation Day To Day

The forces that strengthen or weaken accumulation

Several conditions can make accumulation grow or shrink.

When market sentiment turns positive, accumulation tends to rise. Buyers feel safer taking positions before a larger move.

When price reaches a strong support level, some traders step in to buy, which adds to accumulation.

When economic data improves, accumulation may climb because investors expect higher prices ahead.

When volatility spikes, accumulation often slows. Buyers may avoid building positions when price is unstable.

When liquidity drops, accumulation becomes harder because each order moves the market more than usual.

These simple cause and effect patterns help traders understand when accumulation is likely to appear and when it may fade.

How Accumulation Affects Your Trades

The role it plays in entries, exits, and risk

Accumulation can shape your entry timing. When you see steady buying near support, it can signal that the downside is limited. This helps traders plan entries with clear stops.

For exits, accumulation can warn that a downtrend is weakening. If you hold a short position and new buyers appear, it may be time to reduce risk.

Trading costs can also shift during accumulation. Spreads may stay stable because the market is calm. Slippage is often small because the price is not jumping around. This helps traders place orders with better control.

However, once accumulation ends and a breakout begins, spreads and slippage can widen quickly.

A good situation:

A bad situation:

Price dips below support with no buyers stepping in.

Volume dries up.

Large sell orders appear, blocking upward movement.

Quick Example

Imagine a currency pair trading around 1.2000. Over several hours, buyers quietly collect long positions. Each time the price falls to 1.1990, buying appears and pushes it back up. Volume on the small rallies is slightly higher than volume on small dips.

This steady pattern signals accumulation.

Now suppose a trader enters a long at 1.2000 with a stop at 1.1975. If accumulation continues, price may drift up to 1.2030. The trader gains because early buying created a base. If accumulation had been weak, price could have dropped through 1.1990 and hit the stop.

The key lesson is that strong accumulation increases the chance that the trend will turn upward.

How To Check Accumulation Before You Trade

Look at the chart for higher lows near a stable support area.

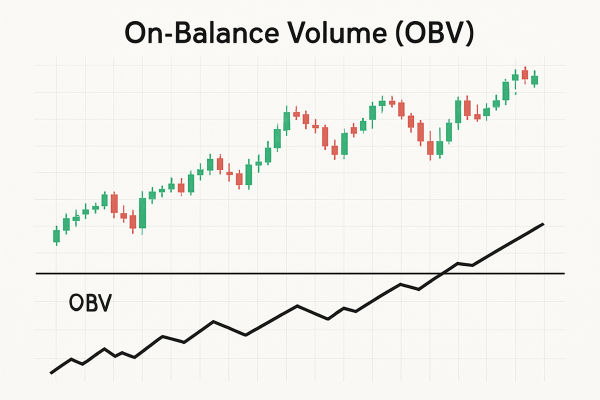

Compare volume on upward and downward moves. Rising volume on small rallies is a sign of accumulation.

Check the order book if available. See whether buy orders cluster near the same level.

Watch time of day. Accumulation is often clearer during slower sessions when noise is lower.

Review recent news. If data supports a bullish case, accumulation may be stronger.

A simple rule is to check these signals every time you plan a trade, especially if you want to buy near support.

Common Mistakes

Forcing the signal. Traders sometimes see accumulation where none exists, which leads to early entries.

Ignoring volume. Price alone is not enough. Without supportive volume, the pattern may be weak.

Entering too late. If the breakout already occurred, the accumulation phase is over and risk rises.

Setting stops too tight. Accumulation zones can be choppy. Stops placed too close often trigger early.

Not watching the higher timeframe. What looks like accumulation on a 5-minute chart may be noise within a larger downtrend.

Related Terms

Breakout: A move where price leaves a range after buyers or sellers gain control.

Trend reversal: A shift from one dominant direction to another when pressure changes.

Market sentiment: The overall mood of traders, which guides how much demand or supply appears.

Liquidity: How easily orders fill without moving the price, which affects how accumulation forms.

Volatility: How much price moves in a period, which can either hide or reveal accumulation patterns.

Frequently Asked Questions (FAQ)

1. What is accumulation in simple terms?

Accumulation is steady buying that builds over time without pushing the price sharply higher. Traders or investors add to positions in small steps so the market does not notice a sudden jump in demand. This slow build often forms a base under the price. When enough buying gathers, the market becomes harder to push lower, which can set the stage for an upward move.

2. How do I confirm that accumulation is real?

To confirm accumulation, check whether buyers keep stepping in at the same support area. Prices should show higher lows, which means sellers are losing control. Volume often rises on small upward moves and falls on small dips, which signals stronger demand. If your platform shows an order book, look for buy orders that refill quickly at key levels.

3. Can accumulation fail even when signals look strong?

Yes. Accumulation is only a sign of interest, not a guarantee. Sudden news, weak economic data, or large sell orders can break the pattern at any time. Price may fall through support even after long periods of steady buying. Accumulation improves the odds of an upward move, but it does not remove the possibility of loss.

Summary

Accumulation is the slow build-up of buying interest before a larger move. It often appears near support and shows up through higher lows and rising volume. When understood well, it can help traders spot early signs of strength and plan better entries.

The main risk is misreading the pattern or entering too late. Careful chart reading and volume checks make accumulation a useful guide for timing trades.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.