Qualcomm shares jumped 11% on Monday after the company unveiled two new artificial intelligence chips designed to compete directly with Nvidia and AMD.

The announcement marks Qualcomm's most ambitious push yet into data-centre computing, a market long dominated by its rivals.

Investors reacted positively to the move, sending the stock to a 15-month high as expectations grew that the company could expand beyond its mobile roots.

The article below examines Qualcomm's latest AI strategy, the market reaction, how its technology compares with leading competitors, and the potential risks and opportunities that lie ahead.

What Qualcomm Announced

Product names and timing: AI200 (2026) and AI250 (2027).

Design emphasis: rack-scale accelerators optimised for inference workloads, supporting large memory footprints and liquid cooling for thermal efficiency.

Strategic partnerships:

Qualcomm disclosed an early customer and deployment programme with HUMAIN in Saudi Arabia, which is targeting a large-scale deployment of Qualcomm rack solutions starting in 2026. This provides an early commercial anchor. [1]

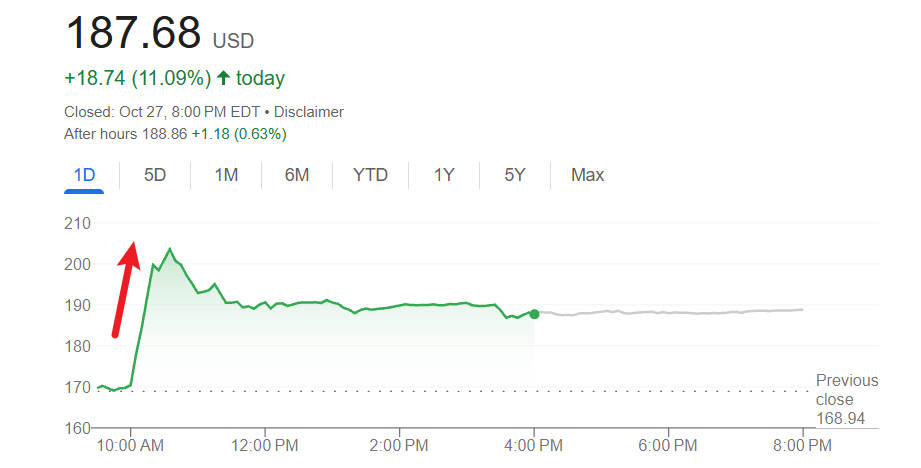

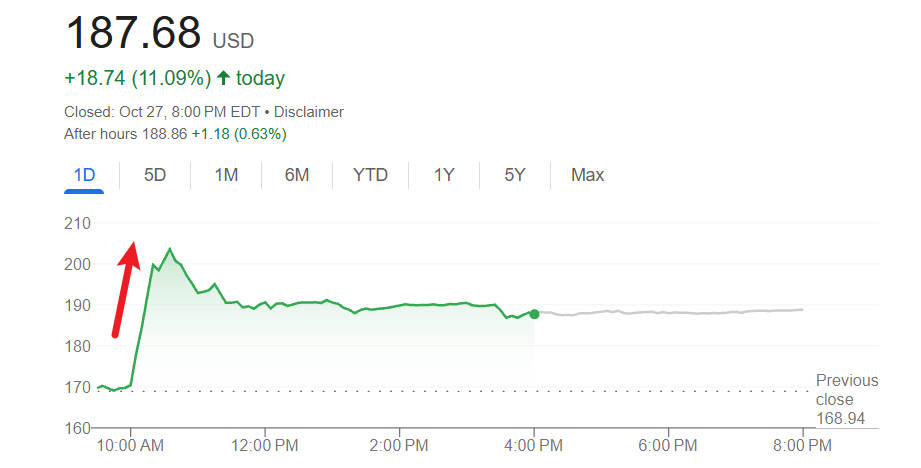

Investor Response: Qualcomm's 11% Surge Reflects Renewed Confidence

Investors responded enthusiastically:

Qualcomm shares rose sharply on the day of the announcement, at one point gaining double-digit percentages and finishing the session with a roughly 11 percent advance as markets digested the implications. The move came amid broader technology strength on the day, with major indexes also rallying. [2]

| Stock snapshot |

Data (closing / day of announcement) |

| Intraday peak gain |

> 20% (briefly reported) |

| Closing gain |

≈ +11% |

| Share price context |

Highest level in about 15 months |

Slight variation in intraday numbers depending on exchanges and reporting times, but all agree on a substantial one-day re-rating.

Why Qualcomm is Doing This

Qualcomm is seeking to transpose decades of experience in efficient neural processing and system integration from mobile devices into the data-centre inference market. The strategic rationale rests on three pillars:

Market diversification: reduce dependence on handset and modem revenue and capture AI infrastructure upside.

Efficiency advantage: leverage Qualcomm's NPU expertise to offer inference solutions that prioritise throughput per watt and lower total cost of ownership for service providers.

Platform play: deliver hardware plus system integration and a release cadence that mirrors how hyperscalers evaluate long-term suppliers.

Analysts note that Qualcomm is emphasising inference rather than training, a segment where efficiency and cost per inference can be decisive for many cloud and edge customers. [3]

Competitive Outlook: Assessing Qualcomm's Challenge to Nvidia and AMD

| Dimension |

Nvidia |

AMD |

Qualcomm (new entrant) |

| Strength |

Leadership in training and inference; vast software ecosystem |

Growing GPU presence; competitive pricing |

NPU expertise; system integration; focus on inference |

| Shipment timing |

Immediate and ongoing |

Immediate and ongoing |

AI200 from 2026; AI250 from 2027 |

| Ecosystem |

CUDA ecosystem, broad ISV support |

ROCm progress; partnerships |

Early stage; will need software ecosystem and partner certification |

Nvidia remains the incumbent with a dominant market share and a deep software ecosystem — a formidable moat. AMD has also scaled its presence with GPU offerings and strategic wins.

Qualcomm's path to material market share requires not only competitive silicon but also a robust software stack, validated performance at scale, and customer certifications. Early commercial partnerships, such as the HUMAIN programme, are therefore strategically important.

Execution Risks: What Could Test Qualcomm's AI Ambition

Investors should temper enthusiasm with realism. Key risks include:

Timing risk:

Commercial shipments are scheduled for 2026 and 2027. so near-term revenue impact is limited.

Ecosystem risk:

Customers require mature software, developer tools, and integrations — areas where incumbents are strong.

Performance risk:

Real-world performance and efficiency metrics must match or exceed expectations to win design-wins at hyperscalers.

Geopolitical and supply-chain risks:

The AI infrastructure race is entwined with policy decisions, trade controls and procurement strategies. Reuters and FT note that macro and policy events were also influencing markets the same day.

How the AI Pivot Could Reshape Qualcomm's Profile

The stock reaction reflects a forward-looking re-rating: markets often reward credible moves into structurally growing markets. However, investors should separate the strategic announcement from the path to profit. Important considerations:

How much of the news is already priced in after the initial rally?

What portion of Qualcomm's guidance or analyst projections will be revised to reflect data-centre opportunities?

Will Qualcomm disclose more performance benchmarks, customer design-wins, and margin assumptions in upcoming quarters?

Analysts will likely await concrete benchmarks, pilot deployments and early revenue recognition before materially upgrading consensus forecasts.

What to watch next: Key Catalysts and Milestones Ahead

Qualcomm technical briefings and benchmark disclosures showing relative performance per watt versus incumbents.

Customer design-wins beyond the HUMAIN programme and public references from hyperscalers.

Quarterly commentary from Qualcomm on bookings, pilot revenue and supply-chain readiness.

Competitive responses from Nvidia, AMD and other accelerator vendors: pricing, new products, or partnership announcements.

Closing assessment

Qualcomm's announcement is a clear statement of intent: to be a credible supplier in AI inference infrastructure.

The market reaction was positive because the strategic move addresses a core question investors have posed for years — what is Qualcomm's next large growth engine beyond mobile.

The ultimate outcome will depend on execution, the pace of ecosystem adoption, and how incumbents respond.

For investors, this is a development worth tracking closely but not yet a substitute for due diligence on financials, benchmarked performance data and the company's pathway to scalable data-centre revenue.

Investor FAQs

Q1: What exactly did Qualcomm announce?

Qualcomm unveiled two rack-scale AI inference accelerators, AI200 (2026) and AI250 (2027), designed for liquid-cooled, high-memory data-centre deployments.

Q2: Why did the stock jump so much?

The market interpreted the move as a credible strategic expansion into a high-growth segment that could materially diversify Qualcomm's revenue mix, prompting a re-rating.

Q3: When will these chips generate revenue for Qualcomm?

Commercial shipments and revenue are expected from 2026 for AI200. with broader contribution and the AI250 following in 2027. Meaningful revenue impact will therefore be phased in over multiple fiscal years.

Q4: Can Qualcomm realistically take meaningful share from Nvidia and AMD?

Possible, but difficult. Qualcomm must prove performance, power efficiency, software ecosystem support, and secure sizeable customer design-wins. Early partnerships help, but incumbents hold structural advantages.

Q5: What are the main risks to the investment thesis?

Execution risk, long lead time to revenue, ecosystem immaturity, and competitive responses that compress pricing and margins are the chief concerns. Investors should watch pilots, published benchmarks and customer wins as evidence of progress.

Sources:

[1]https://www.qualcomm.com/news/releases/2025/10/qualcomm-unveils-ai200-and-ai250-redefining-rack-scale-data-cent

[2]https://www.reuters.com/world/china/wall-st-futures-hit-record-highs-us-china-optimism-tech-results-focus-2025-10-27/

[3]https://www.tomshardware.com/tech-industry/artificial-intelligence/qualcomm-unveils-ai200-and-ai250-ai-inference-accelerators-hexagon-takes-on-amd-and-nvidia-in-the-booming-data-center-realm

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.