Convergence means two prices, or two values, moving closer over time. In trading this often describes the cash price of an asset and its futures price drifting toward the same level as the futures contract gets closer to expiry.

The gap between them becomes smaller until it disappears at the end of the contract. This matters because traders build many strategies around how fast or slow this closing gap happens. It guides decisions on entries, exits, and risk control.

Definition

In trading, convergence describes the natural pull between the futures price and the spot price of the same asset. Spot price means the price for immediate delivery. Futures price is the price for delivery at a later date.

As time runs down, the futures price usually shifts toward the spot price because there is less time for storage costs, interest, or supply changes to create a difference.

Traders see convergence on price charts, futures expiry calendars, and spread quotes. Spread traders, arbitrage traders, and hedgers watch this closely because their profit often depends on the gap between futures and spot moving in a predictable way.

When the gap does not behave as expected, it signals stress in the market or changing expectations.

What Changes Convergence Day To Day

Why price gaps widen or shrink

Several forces affect how quickly futures and spot prices come together.

When interest rates change, convergence changes. Futures prices often include a small interest adjustment. When interest rates rise, futures can sit slightly above spot for longer.

When rates fall, the gap often closes faster.

When storage or holding costs change, convergence shifts. For assets like oil, metals, or grains, storage costs matter. Higher storage costs can keep futures prices above spot for longer. Lower costs can pull prices together sooner.

When market expectations change, the pace of convergence moves. If traders expect strong demand later, futures may stay above spot until new data comes out. If expectations weaken, futures can quickly drop toward the spot. The speed reflects changing beliefs about the future.

How Convergence Affects Your Trades

Convergence shapes the quality of entry and exit prices. When a futures contract trades far from its spot price, traders may wait for a more normal relationship before entering. When prices are close and moving steadily together, entries can feel cleaner because the relationship is stable.

Convergence also affects exit timing. If the contract is nearing expiry and prices have almost met, the room for further profit shrinks. Traders may choose to close sooner to avoid noise or sharp moves in the last days of the contract.

Costs and risk are tied to convergence as well. When the gap behaves normally, spreads remain calm. When the gap behaves oddly, slippage and wider spreads can appear because the market is unsure about value.

Good situation:

Futures and spot prices move in a steady, predictable path toward each other.

The gap is narrow and follows normal patterns for that asset.

Bad situation:

The gap widens unexpectedly.

Convergence reverses or becomes unstable near expiry.

Price action feels jumpy and inconsistent with history.

Quick Example

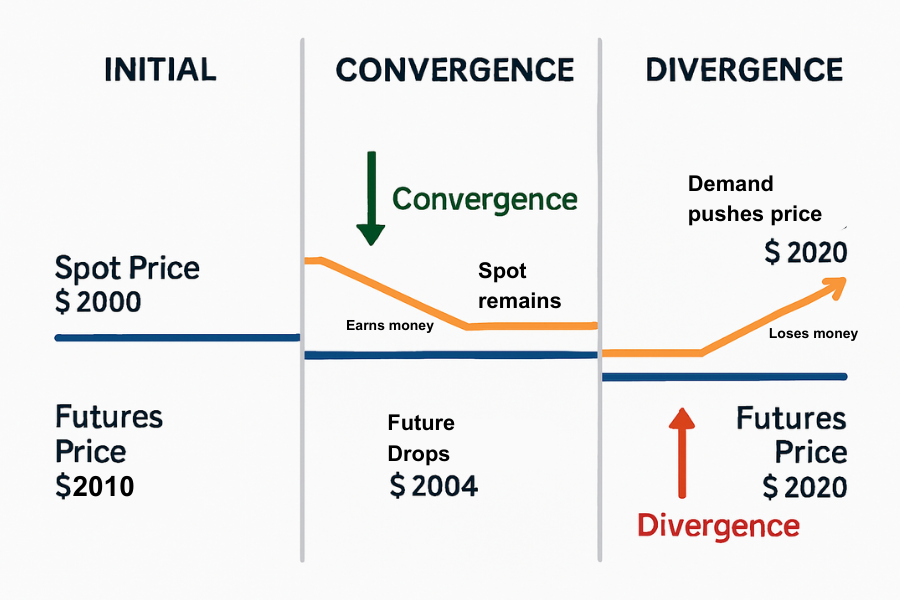

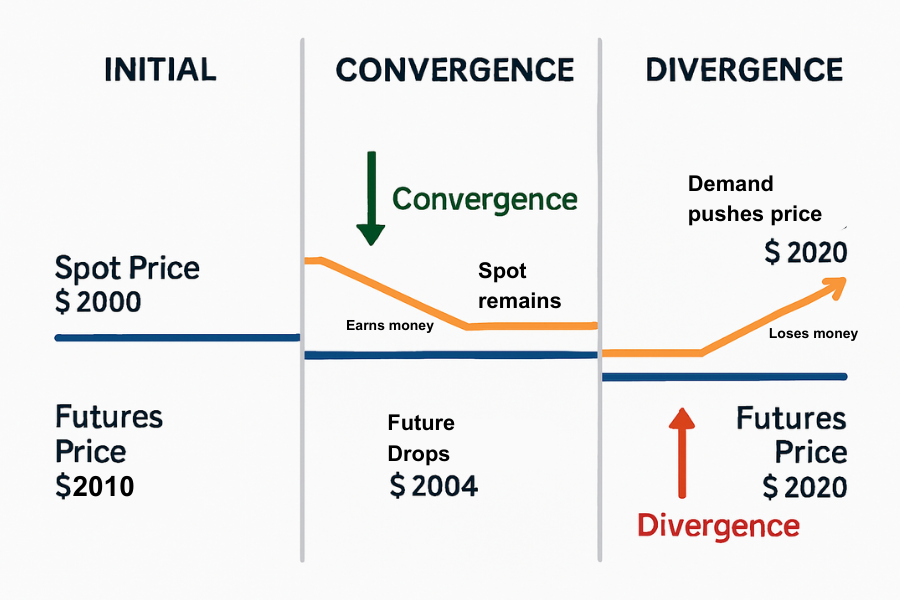

Imagine the spot price of gold is 2,000 dollars. A one-month futures contract trades at 2,010 dollars because of small interest and storage costs. A trader expects normal convergence, meaning the futures price should move toward 2,000 dollars as the month passes.

If, after two weeks, spot stays at 2,000 dollars but futures fall to 2,004 dollars, the convergence is working. A trader who sold the futures at 2,010 dollars and bought spot at 2,000 dollars would gain six dollars from the shrinking gap.

But if new demand data pushes futures to 2,020 dollars instead, the gap widens. The convergence trade loses money because the spread moved the wrong way. This example shows how the direction of convergence affects results even when the spot price does not move.

How To Check Convergence Before You Trade

Before taking a trade, look at:

The current spread between spot and the futures contract.

Past spread levels at the same time in the contract cycle.

Whether interest rates, storage costs, or news events are shifting expectations.

The contract’s expiry date, which affects how fast convergence should happen.

The depth of the market to see if spread quotes look normal.

Check these factors each time you plan to trade the same contract cycle. Conditions can change quickly, so review them at least once per session.

Common Mistakes

Ignoring expiry timing. The pace of convergence changes as expiry gets close, and this affects outcomes.

Assuming convergence is always smooth. Market shocks can distort normal patterns.

Not watching interest rate changes. Even small changes can shift futures pricing.

Trading only from past patterns. History helps but does not guarantee the same future path.

Overlooking liquidity. Thin markets can create false spread signals.

Related Topics

Spot price: The current market price for immediate delivery of an asset.

Futures price: The agreed price today for delivery or settlement at a future date.

Basis: The gap between a futures price and its related spot price.

Contango: A market state where the futures price is higher than the spot price.

Backwardation: A market state where the futures price is lower than the spot price.

Arbitrage: A trade that aims to profit from price differences between related markets.

-

Slippage: The difference between the expected trade price and the actual fill price due to market changes.

Frequently Asked Questions (FAQ)

1. What is convergence in trading?

Convergence is the process where a futures price moves toward the spot price as the contract nears expiry. This happens because fewer future costs or uncertainties remain, so both prices settle around the same value.

2. Why do futures and spot prices meet at expiry?

Settlement rules and market mechanics require futures to reflect the real price of the underlying asset at expiration. If the two prices were far apart, traders would step in to buy the cheaper one and sell the more expensive one until the gap closes.

3. Can convergence behave differently across markets?

Yes. Markets like commodities depend on storage costs, interest rates, and supply conditions. Financial futures may converge more smoothly because they do not rely on physical storage. Each market has its own rhythm.

4. Does convergence always follow a straight path?

No. Prices can move in waves as new information appears. The long-term direction is toward the spot price, but the journey can be uneven due to news, liquidity changes, or short-term imbalances.

5. Why does convergence matter for traders?

It shapes expected profit and risk for spread and futures strategies. When traders understand how the gap normally behaves, they can judge whether current pricing looks stable, stretched, or potentially risky.

Summary

Convergence is the steady move of futures and spot prices toward each other as expiry approaches. It helps traders judge entries, exits, and risk because the gap often follows familiar patterns.

When used with care, convergence gives traders clearer expectations. When ignored, it can hide risks inside the spread.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.