Crypto's October 2025 crash resulted from a combination of event-driven liquidations, ETF outflows, rising real yields/dollar moves, and headline risk.

For context, the crypto market plunged in October 2025, erasing over $370 billion in value within hours. Bitcoin tumbled to $ 104,000, Ethereum dropped below $4,000, and altcoins crashed by 50–90%.

During the worst sessions, traders liquidated over $19 billion, and spot crypto ETFs drained hundreds of millions in outflows as investors de-risked. Listed below are the reasons why crypto fell so sharply, the factors behind the sell-off, expert recovery forecasts, and what investors should expect next.

Crypto Market Crash October 2025: Quick Summary

| Asset |

Current Price |

October 10 Low |

Peak 2025 (YTD) |

Change from Peak |

| Bitcoin (BTC) |

~$110,796 |

$104,782 |

$126,198 (Oct 2024) |

-12.2% |

| Ethereum (ETH) |

~$4,039 |

$3,878 |

$4,625 (Sept 2025) |

-12.7% |

| Solana (SOL) |

~$168 |

$142 |

$238 |

-29.4% |

| Cardano (ADA) |

~$1.89 |

$1.45 |

$2.60 |

-27.3% |

| Total Market Cap |

~$3.7 trillion |

$3.33 trillion |

$4.1 trillion |

-9.5% |

What Happened to Crypto in October 2025?

Early October 2025:

Bitcoin reached fresh all-time highs above $126,000 (intraday highs in early Oct).

October 10–13, 2025:

Sharp reversal and one of the largest 24-hour selloffs in history, with estimates putting aggregate liquidations in the $19–20 billion range across spot and derivatives markets during the worst sessions. [1]

That triggered a series of margin calls and compelled selling.

Mid-October 2025:

U.S.-listed Bitcoin and Ether ETFs recorded hundreds of millions of dollars in outflows (roughly $755 million in combined outflows during key sessions). ETF flows shifted from being a major structural bid to a near-term source of volatility.

Oct 20–21, 2025:

Partial recovery as large buyers and some ETF inflows re-entered, and Bitcoin traded back above $110k in response to calming headlines and macro data. But volatility remained elevated and liquidity thin in some venues. [2]

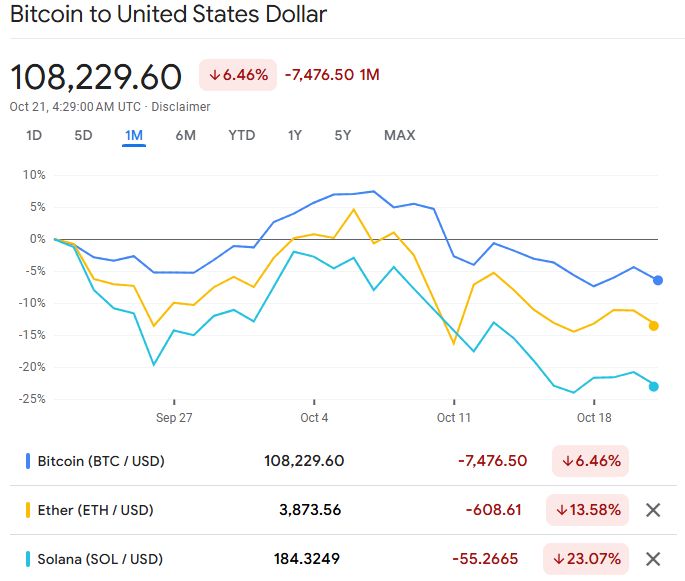

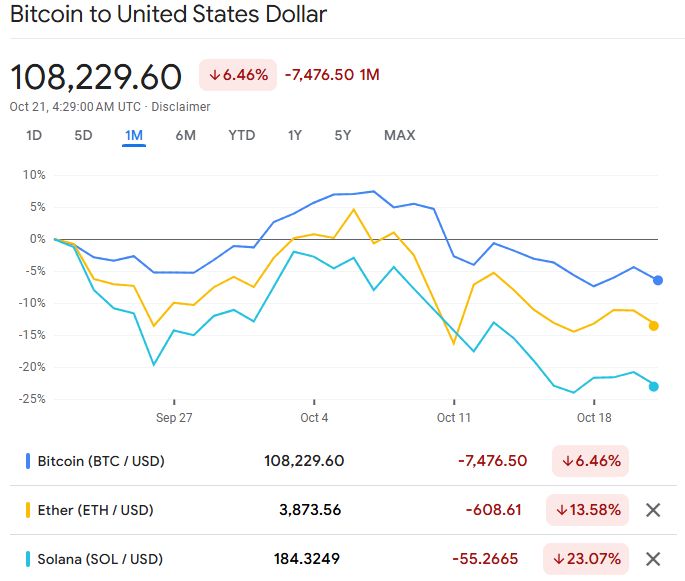

The Scale of the Crypto Collapse

Bitcoin (BTC): Dropped over 14%, from $123,000 to about $107,000, bottoming near $104,782 before rebounding slightly.

Ethereum (ETH): Fell around 12% to a low near $3,878, with subsequent partial recovery to the $4,000 zone.

Altcoins: Over 97% of the top 100 cryptocurrencies traded lower, with many, such as Solana, Cardano, and Avalanche, losing 30–70% overnight.

The sudden crash wiped about $370 billion off total crypto market capitalisation and reset aggregate open interest by $65 billion, returning it to early-2025 levels.

Why Is Crypto Crashing? 4 Key Drivers Explained

1. Massive Liquidations and Leverage Unwind

When BTC reversed from its early-October high, leveraged longs faced margin calls. In a market with concentrated derivatives positioning, small price moves can trigger large forced sales.

Multiple outlets and on-chain liquidation trackers reported record single-day wipeouts that cascaded through futures and perpetual markets. It is classic deleveraging behaviour: liquidations push price down, which triggers more liquidations.

2. ETF Outflows (Structural Flows Turned Two-Way)

Spot Bitcoin and Ether ETFs had been a structural buyer of BTC throughout 2025, but in the crash, they became sellers as institutions redeemed or rebalanced.

Major ETF trackers reported hundreds of millions in outflows after the plunge, turning a central bid into a source of pressure. ETF flows are now a core price driver in crypto, so this reversal amplifies volatility. [3]

3. Macro Backdrop: Real Yields & Dollar Dynamics

Crypto prices are sensitive to real (inflation-adjusted) yields and dollar moves. As of mid-October 2025, the U.S. 10-year real yield stood at 2.32%, its highest since mid-2024, while the DXY hovered near 107.8, both exerting downside pressure on risk assets.

Markets in October were parsing U.S. data and Fed messaging; any surprise that pushed real yields higher or the dollar stronger raised the opportunity cost of holding non-yielding risk assets, pressuring BTC and large-cap altcoins.

The interplay between Fed expectations, TIPS yields, and dollar strength was a major amplifier.

4. Geopolitical and Headline Shocks (Trigger Events)

Geopolitical headlines such as trade policy flareups, tariffs, or other shocks can tip an already-crowded trade into a selloff by changing risk appetite.

In October 2025, several geopolitical and macro headlines coincided with the liquidation window, accelerating the selloff. Markets now move faster and news holds more sway, especially when positioning is crowded.

Together, these drivers create a feedback loop: headlines and macro moves trigger ETF redemptions and margin calls; forced sales hit order books, causing more liquidations.

Is Crypto's Pain Worse This Time?

The October 2025 crash is now considered nine times larger (in liquidation value) than the February 2025 correction, making it the biggest single-day crypto wipeout ever recorded.

Analysts describe this event as "a necessary deleveraging" rather than a full systemic failure. Unlike earlier crypto winters, this crash occurred after record highs; Bitcoin's all-time high of $126,198 (October 2024) gave the market a longer runway before correction.

Overheating factors preceding the crash:

Record open interest near $100B across perpetual futures

Unchecked meme-coin speculation

Excessive yield farming exposure on low-liquidity DeFi protocols

How Bad Can Crypto Fall? Scenario Analysis (3 Plausible Paths)

1) Base Case: Range & Repair (50% Probability)

Assumptions: ETF inflows stabilise at lower yet positive levels; real yields hold near current levels; no major regulatory shock.

Price path: BTC trades between $95k–$135k over the next 2–3 months, with episodic volatility. Market heals as forced positions are closed and spot ETFs resume steady purchases.

2) Bull Case: Fast Rebound (25% Probability)

Assumptions: ETF inflows resume strongly, macro risk-off eases (dollar softens, real yields fall), and retail returns on dip.

Price path: BTC reclaims $126k and moves toward $150k–$200k into Q4 if momentum and flows align. This requires convincing evidence that ETF demand is durable.

3) Bear Case: Deeper Correction (25% Probability)

Assumptions: Continued ETF outflows, sustained rise in real yields/dollar, or a regulatory clampdown (major enforcement action or policy shock).

Price path: BTC falls back toward $60k–$85k, a material correction driven by reduced liquidity and structural redemptions. This path is painful but historically plausible in fast deleveraging.

Expert Insights: Is It Just a Correction or the Start of a Bear Market?

| Source |

Forecast Summary |

Bitcoin Target |

| Bloomberg & Reuters Joint Analysts |

Market expected to stabilise by Q1 2026 amid Fed easing. |

$125K |

| Economic Times / Yahoo Finance |

Cautious tone through end-2025; macro easing seen as critical. |

$115K–$120K |

| Glover Wave Analysis |

Predicts ongoing bear market possibly lasting until late 2026. |

$70K floor |

| CoinDesk / ChainUp |

Expects year-on-year recovery as leverage resets and ETF inflows resume. |

$130K–$140K |

| Changelly / Bitpinas (ETH focus) |

Projects Ethereum could regain $4.8K–$5.2K before mid-2026. |

— |

Short-term: Negative Momentum Likely to Persist

Technical Outlook: Bitcoin faces resistance near $114K–$117K, while strong support sits at $100K. A decisive breakdown under $100K could trigger a deeper bear leg toward $85K–$88K, analysts warn.

Derivatives Reset: Reduction in open interest suggests fewer speculative traders, potentially limiting imminent volatility but reducing near-term upside.

Institutional Sentiment: ETF outflows and risk-off signals may cap gains through Q4 unless monetary conditions ease.

Mid-Term: Path Toward Stabilisation

Recovery signs are already appearing. By October 20, Bitcoin gained 0.4% to $110,796, while Ethereum inched above $4,000. These rebounds suggest early structural support forming after leverage exhaustion.

Historically, such deleveraging phases last 6–10 weeks before equilibrium returns.

A crypto winter is therefore unlikely, as analysts prefer the term "macro reset."

Why Markets May Recover in Late 2025

1. Strong Blockchain Fundamentals

Despite lower prices, on-chain volumes remain robust. Bitcoin's daily transaction value still exceeds $28 billion, up 40% year-over-year.

Ethereum's Layer-2 throughput and ETF traction keep its network utilisation above 80% capacity.

2. Funding Conditions Normalising

Funding rates on perpetual swaps, previously overheated, have neutralised. Exchanges report balanced long-short ratios (~51/49), signalling stabilisation in sentiment.

3. Ongoing Institutional Adoption

Spot ETFs for Bitcoin, Ether, and XRP continue to attract net inflows over time, despite temporary drawdowns. Institutional demand likely keeps long-term floors higher than past cycles.

4. Macro Factors Support Recovery

By late Q4 2025, forecasts suggest gradual Fed policy easing, possibly reducing real yields and softening the dollar index (DXY), conditions historically bullish for crypto assets.

5 Indicators That Will Tell You if Crypto Recovery Is Likely

1) ETF Net Flows (Weekly):

Positive, sustained flows = structural bid; continued net outflows = danger. ETF flow trackers showed large outflows mid-Oct.

2) Derivatives Funding & Open Interest:

Falling long funding or collapsing OI indicates de-leveraging is nearly complete; rising OI with positive funding suggests renewed risk appetite.

3) Real U.S. Yields & DXY:

Watch TIPS spreads and the dollar index, as falling real yields and a weaker dollar historically help BTC.

4) Exchange Reserve Flows & On-Chain Exchange Inflows:

Large exchange inflows often precede selling pressure; exchanges drained or balanced = healthier price action.

5) Macro/Regulatory Headlines:

Any coordinated regulatory action (SEC/CFTC enforcement, major exchange outage or hack) can quickly reignite selling. The SEC has continued to tighten its enforcement attention in 2025.

Frequently Asked Questions

Q1: Did Spot ETFs Cause the Crash?

ETFs didn’t cause the crash single-handedly, but ETF outflows amplified the selloff by turning a structural bid into a temporary seller during the liquidation window.

Q2: Is Crypto Dead After This Crash?

No. Crypto has recovered from the worst shocks historically. The asset class is volatile and will see cycles.

Q3: Should I Buy the Dip Now?

If you're long-term, buying on disciplined dips with position sizing and cold storage is reasonable; if you're trading short-term, wait for confirming signals.

Q4: How Much Worse Could It Get?

A deeper correction to the $60k–$85k range is possible under continued outflows and rising real yields.

Conclusion

In conclusion, Crypto's crash in October 2025 is a reminder of two truths: crypto is still a high-volatility, high-conviction market; and modern crypto markets are tightly coupled to macro flows and institutional products.

If you're an investor, define why you own crypto (insurance, diversification, speculation) and size accordingly. If you're a trader, be ruthless about risk and manage leverage.

Finally, watch the three pivot variables: ETF flows, real yields/dollar direction, and regulatory headlines. They will likely tell you more about where prices head next than any single technical indicator.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.reuters.com/world/asia-pacific/after-record-crypto-crash-rush-hedge-against-another-freefall-2025-10-13/

[2] https://economictimes.indiatimes.com/markets/cryptocurrency/crypto-news/bitcoin-trades-at-110k-ethereum-at-4000-crypto-market-recovers-from-recent-crash/articleshow/124700617.cms

[3] https://finance.yahoo.com/news/digital-asset-etps-post-513-123701812.html