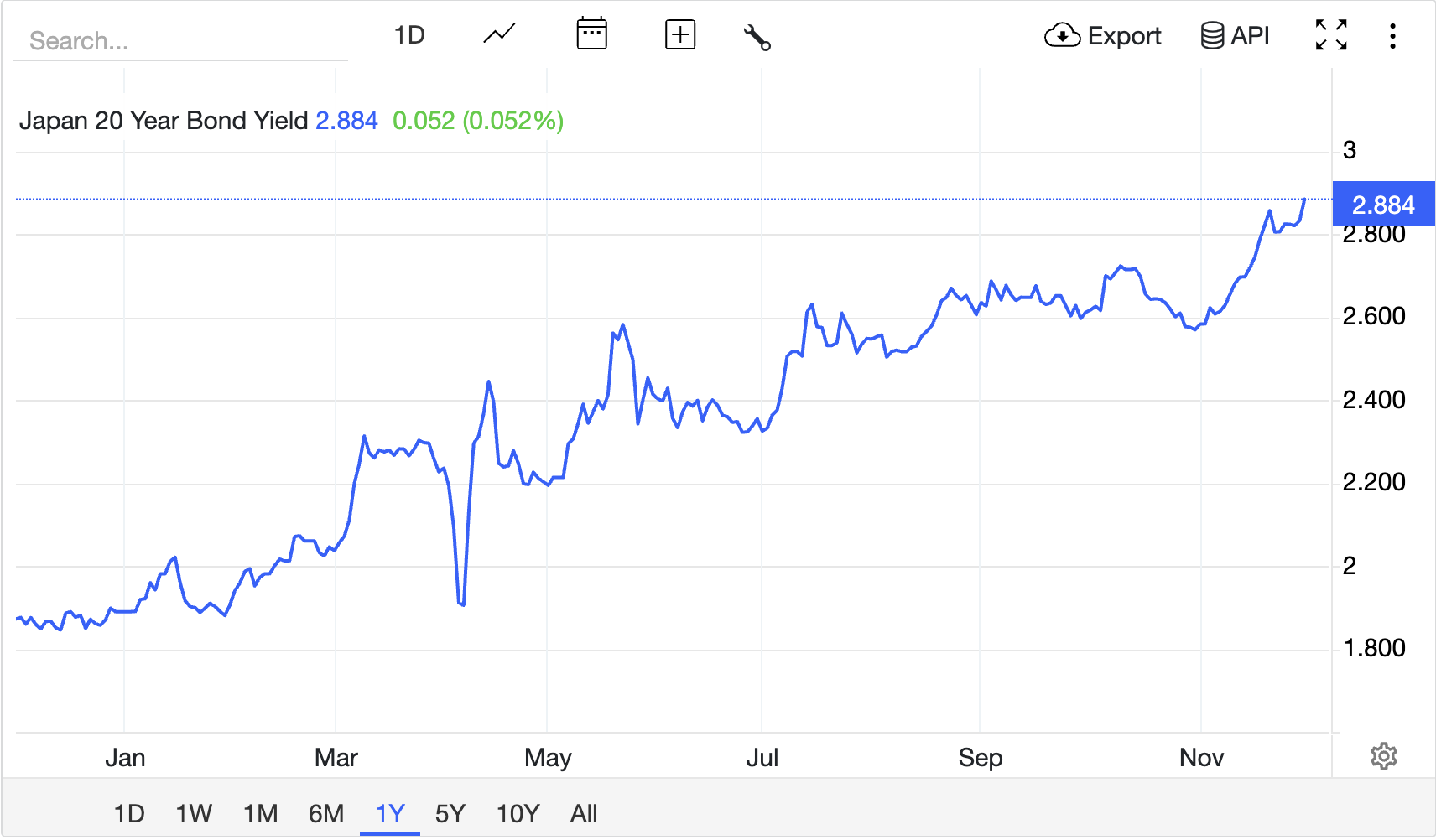

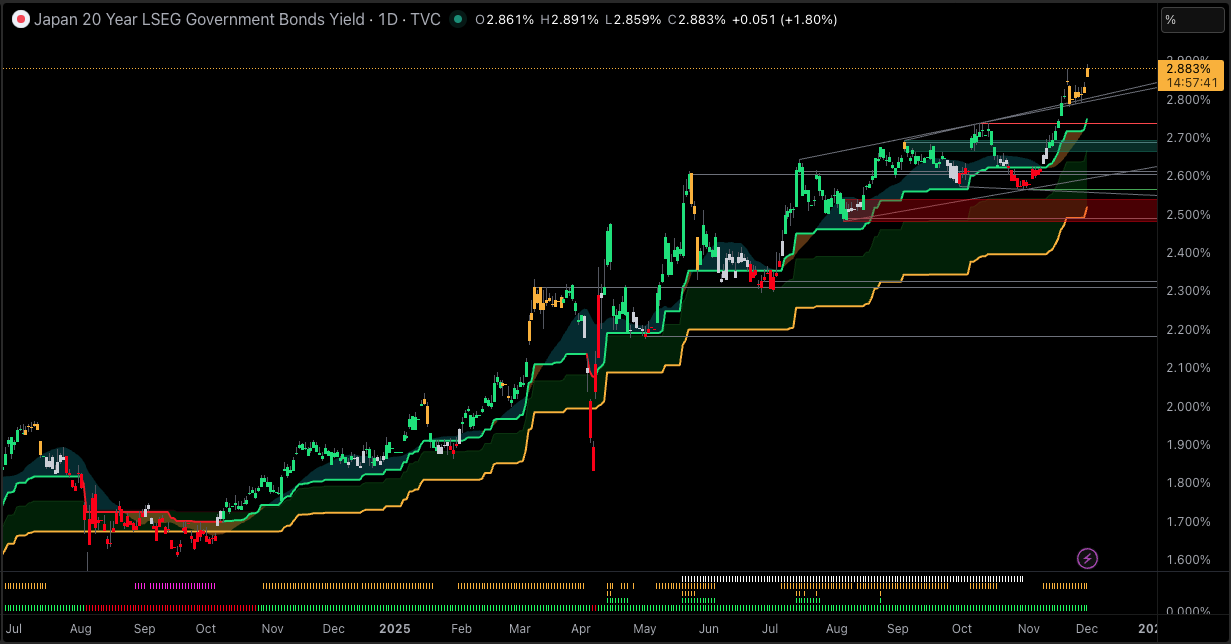

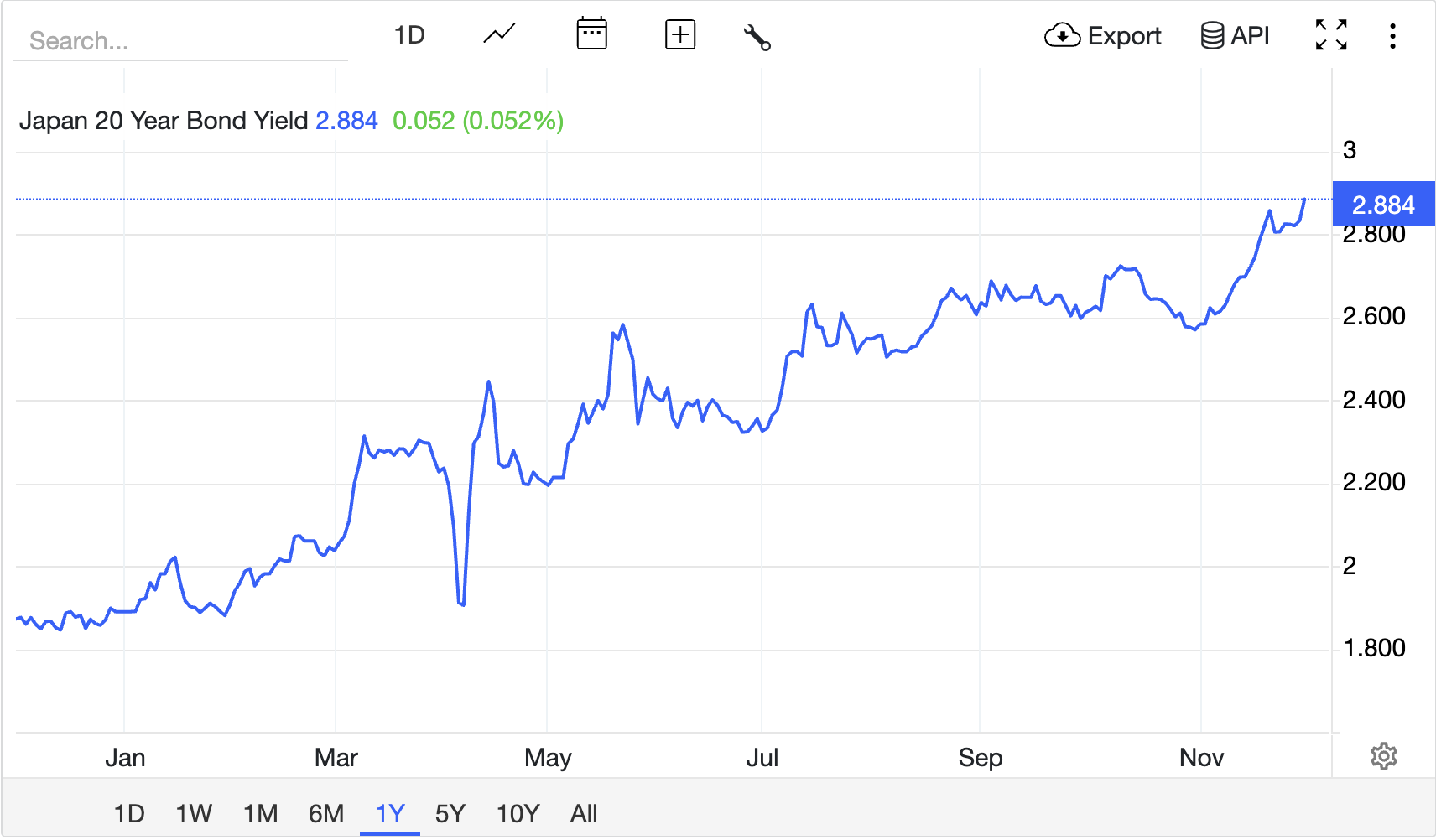

Japan's bond market has finally woken up. The yield on Japan's 20-year government bond has climbed to around 2.85–2.88%, the highest level since 1999, after years spent near zero. For a market defined by ultra-low rates, this is a regime change, not a blip.

Super-long JGBs are now trading in yield territory many global investors have never seen in their careers. That shift matters for everything from yen carry trades and Japanese bank stocks to global bond valuations and EM debt flows.

In this article, we will break down what's driving the move, how the chart looks, and what this new yield landscape really means for investors.

What Happened to the Japan 20 Year Bond Yield?

1. The Move in Numbers

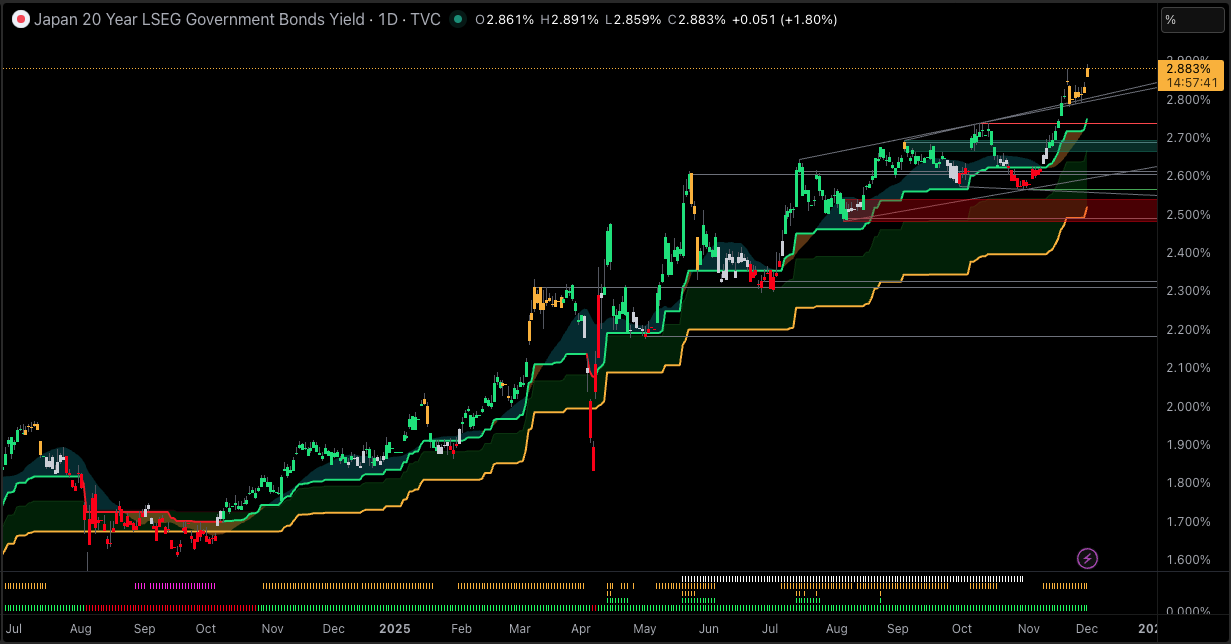

As of 1 December 2025, Japan's 20-year JGB yield is about 2.88%.

On 17 November 2025, it traded around 2.75%, widely reported as the highest since 1999.

Earlier in August 2025, the yield hit roughly 2.655%, already flagged as the highest level since 1999.

For context:

The 10-year JGB now yields about 1.85%, also at multi-year highs.

The 30-year and 40-year yields have pushed above 3.2–3.6%, underscoring a bear steepening in the long end.

In simple terms, Japan's yield curve is no longer pinned down by the central bank. It's trading like a normal developed bond market again, and it's repricing fast.

2. Why The Headline "Highest Since 1999" Matters?

The 20Y yield last traded in this region when:

Back then, 2–3% yields were the start of easing. Today, similar levels are the result of tightening, as the BoJ backs away from decades of ultra-easy policy. That inversion of context is crucial for investors.

What Are the Macro Drivers Behind Japan's 20Y Yield Spike?

1. BoJ: From Yield Control to Gradual Tightening

The recent yield surge sits on a clear policy shift:

In March 2024, the BoJ terminated yield curve control (YCC) on 10-year JGBs and eliminated negative rates, adjusting the overnight policy rate to approximately 0–0.1%.

By early 2025, a series of hikes had taken the short-term policy rate to about 0.5%, according to the IMF's Article IV report.

In October 2025, the BoJ held at 0.5% but the decision was split, with two board members pushing for a hike to 0.75% and Governor Ueda signalling that conditions for further tightening were improving.

By late November and early December 2025, Ueda was publicly discussing the possibility of a December rate increase, causing the yen and JGB yields to rise.

Key takeaways:

The BoJ is no longer suppressing long yields with heavy buying.

Markets now expect more rate hikes if inflation stabilises near 2%, which lifts yields across the curve.

2. Fiscal Policy and "Bond Vigilantes"

The other massive driver is fiscal:

New Prime Minister Sanae Takaichi has pushed a large stimulus package and extra budget, with estimates around ¥21 trillion or more in headline size, funded mainly by fresh JGB issuance.

Market commentary repeatedly links the 20Y's 2025 highs to fears of fiscal expansion and concerns about Japan's already massive public debt load.

Put bluntly, investors are starting to demand a higher term premium to hold super-long JGBs, especially now that the BoJ is not automatically mopping up supply.

3. Inflation, Yen and Global Spillovers

After years of undershooting, Japanese inflation has run above 2% at times, with the BoJ arguing that underlying, demand-driven inflation is only now closing in on target.

A weaker yen has lifted import prices and kept inflation pressure alive. Recent hints of further BoJ hikes have helped the yen bounce, but volatility remains high.

Higher domestic yields make JGBs more attractive relative to U.S. Treasuries and European bonds, encouraging Japanese institutions to repatriate capital at the margin. That can weigh on foreign bond markets, especially when global yields are already elevated.

For investors, the message is simple: Japan is no longer a pure "low-yield anchor" in the global bond complex. It's now an active source of rate risk.

Technical View: Mapping the Japan 20Y Bond Yield

Even with bonds, technicals matter. Here's a simplified technical map of the Japan 20-year yield.

| Timeframe |

Yield area |

Role |

Why it matters |

Investor read |

| Daily / Weekly |

2.90–2.95% |

Immediate resistance |

Near the current 52-week high around 2.89% on live data. Thin trading history above here since 1999. |

Hard zone for new shorts; if broken cleanly, signals another leg of bear steepening. |

| Daily |

2.75–2.80% |

First key support |

November spike high (~2.75%) that marked the first clear “1999 high” headline. |

A retest that holds would confirm this band as the new floor for the regime shift. |

| Daily |

2.55–2.65% |

Deeper support |

August peak at 2.655%, first time markets shouted “highest since 1999”. |

If yields fall back here, it suggests some BoJ/fiscal reassurance or global risk-off bid. |

| Weekly |

2.30–2.40% |

Medium-term pivot |

Zone of consolidation during mid-2025 as BoJ normalisation priced in. |

A move back below here would imply the market is scaling back BoJ hike expectations. |

| Weekly / Monthly |

~1.80–2.00% |

Long-term support |

Rough area of early-2025 highs and the lower end of the current 52-week range (1.82%). |

Only likely if growth slumps or BoJ signals a clear pause; would be a big relief rally for JGB holders. |

Trend and Momentum

Based on current yield levels and the shape of the curve:

Trend:

Momentum:

The speed of the rise from around 2% to near 2.9% within a year suggests overbought momentum on daily charts, even if the longer-term trend is still maturing.

Curve:

Bear steepening dominates: long yields rising faster than short yields as markets prioritise fiscal risk and term premiums over imminent rate increases.

In yield terms, you're buying a strong uptrend with stretched momentum. For price-based investors, that means bond prices are in a clear downtrend, and rallies (yield dips) are likely to be sold until the macro story changes.

How Does Japan's 20Y Yield High Affect Different Investor Groups?

1. Japanese Domestic Investors

Winners:

Higher long yields steepen the curve, supporting net interest margins and offering more attractive reinvestment levels

Life insurers, who need long-duration assets to match liabilities, can finally lock in higher returns.

Retail-focused JGB campaigns now have a more compelling yield story than at any time in the last two decades.

Losers and risks:

2. Global Bond Investors

Higher 20Y JGB yields challenge the role of U.S. Treasuries and Bunds as the default "safe yield" destinations.

Japanese funds bringing back money can increase foreign yields, particularly in markets where Japanese investors hold significant stakes (Australia and certain European sovereign bonds).

For global multi-asset portfolios, Japan is no longer just an equity/FX story; it's now a true rates allocation again.

3. FX Traders and Yen Carry

Rising long yields, combined with potential BoJ hikes, make short-yen carry trades less one-way.

If the BoJ hikes again and signals tolerance for tighter financial conditions, yen could find more durable support, especially against low-yielders.

That said, as long as U.S. and European yields stay high, the yen remains a funding currency, just with a thinner cushion.

How Should Investors Think About Risk and Opportunity Now?

1. If You Underweight JGBs

Arguments for starting to add 20Y exposure (or extending duration modestly):

You are finally being paid for duration risk in Japan, which hasn't been true since the late 1990s.

If BoJ hikes stall at around 0.75% and inflation settles near 2%, locking in close to 3% nominal on a high-quality sovereign looks reasonable on a 5–10-year view.

Any global growth scare or BoJ communication that hints at a slower hiking path could trigger a sharp rally in long JGBs.

Risk checks:

Don't assume the 20Y peak is in simply because headlines say "highest since 1999". If fiscal worries keep building and BoJ remains hawkish, yields can overshoot, perhaps flirting with 3.0–3.2%.

2. If You've Already Long Super-Long JGBs

Things to watch:

2.75–2.80% as first support: a break below that zone in yield terms (i.e. rally in price) would ease some pressure.

Headlines around the BoJ December and early-2026 meetings, where a hike or dovish hold could shape the next big move.

Fiscal news from Tokyo and any signs of restraint or credible consolidation could compress term spreads.

Pragmatically, many investors will:

3. If You're Trading Japan via Equities and FX

Banks/insurers: Rising long yields are supportive, especially if credit quality holds.

REITs and high-dividend defensives: Face pressure as local yields become a more viable alternative.

Exporters: If yields rise faster than global peers and the yen strengthens, FX headwinds can offset domestic rate benefits.

For FX, a simple rule of thumb:

More BoJ hikes + rising 20Y yields vs. stable or falling U.S. yields → supportive for yen.

BoJ hikes, but U.S./Europe stay hawkish or reprice higher → yen still struggles to mount a lasting rally.

Frequently Asked Questions

1. Why Is the 20Y Yield Rising Faster Than Shorter Maturities?

Because investors are demanding extra compensation for long-term fiscal risk and uncertainty about the BoJ's end-game for rates and balance-sheet policy.

2. Is This the Start of a "Japanese Bond Crisis"?

No. Yields are rising from very low levels, and the move is still controlled. But the market is clearly testing how far it can push before the BoJ or Ministry of Finance react.

3. Should International Investors Hedge Currency Risk When Buying JGBs?

For most non-Japanese investors, FX risk is now a key swing factor. If you expect BoJ to keep tightening and the yen to strengthen, you might accept some unhedged exposure.

4. Could the BoJ Step Back in and Cap the 20Y Yield Again?

The BoJ has stepped away from explicit YCC and has signalled a desire to let markets play a bigger role. Thus, a formal cap on 20Y yields looks unlikely.

Conclusion

In conclusion, Japan's 20-year government bond is no longer a sleepy corner of the global bond market. With yields near 2.9%, it now reflects that the BoJ is normalising policy, and investors are finally pricing in fiscal risk and proper term premium.

For Japanese investors, this brings both pain and opportunity. For global investors, Japan is suddenly relevant again as a yield story, not just an FX sideshow. And for anyone running multi-asset money, ignoring the 20Y JGB now is a luxury you probably don't have.

The key is not to overreact to a single level but to understand the regime shift: the era of pinned Japanese long yields is over.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.