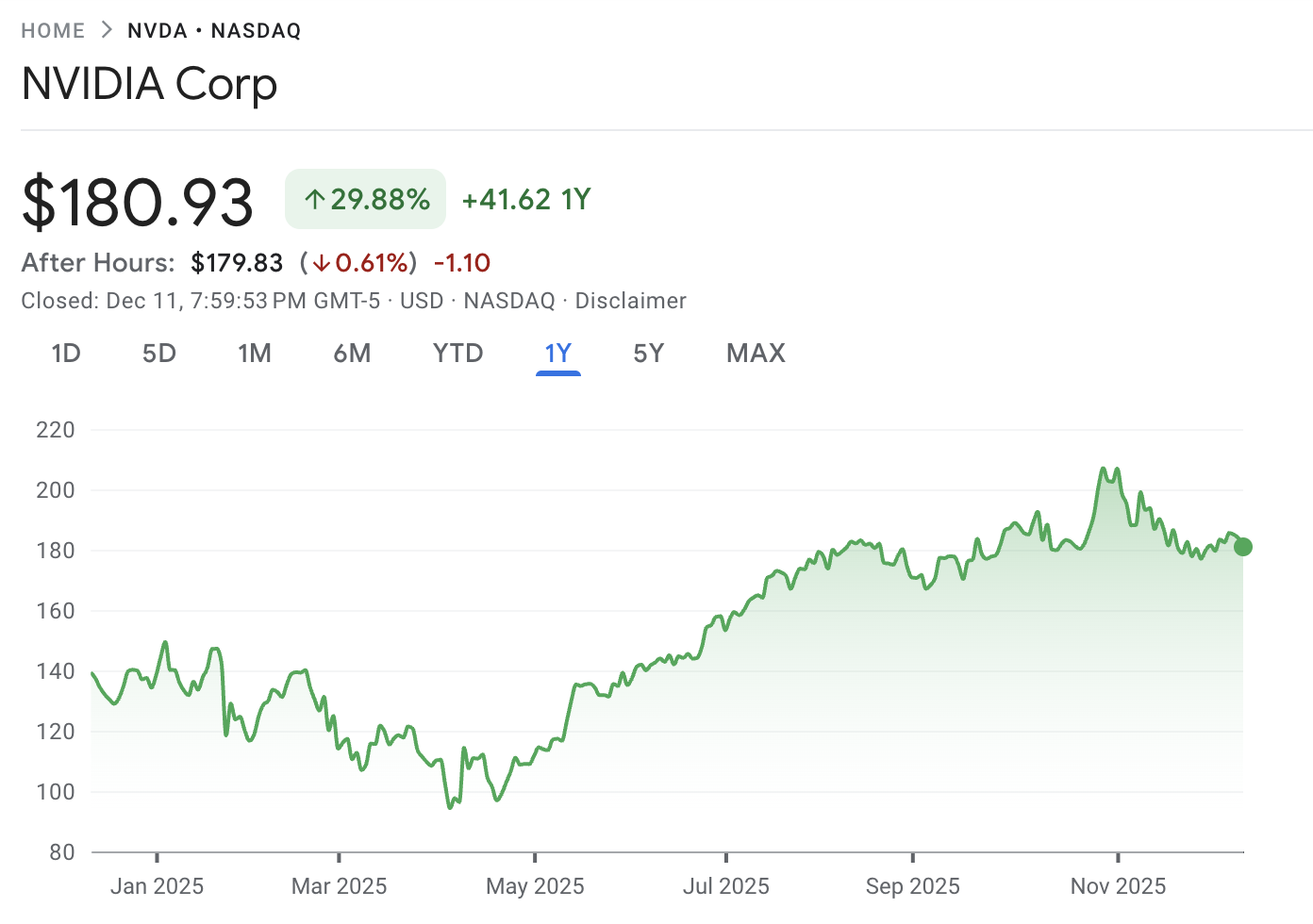

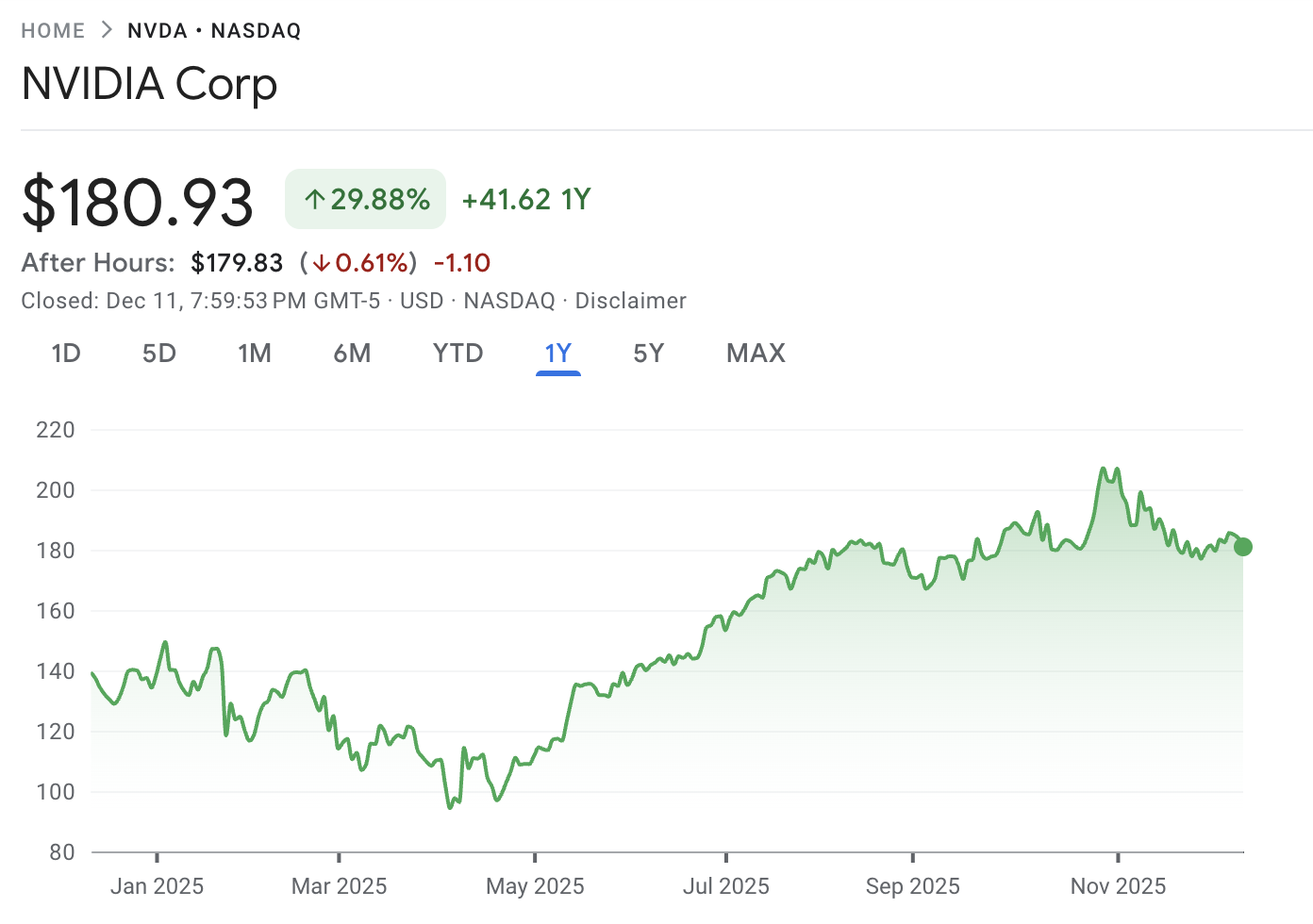

NVIDIA (NVDA) is one of those rare stocks where the story is simple and the execution is not. The story is about the demand for computing power. The execution is knowing exactly what you are buying, how you are buying it, and what happens after you click “confirm” on an overseas order.

If you are searching how to buy NVIDIA stock in India, the smart approach in 2026 is to decide upfront whether you want long-term ownership or short-term exposure, then follow a path that matches that goal with clean execution.

Get that structure right and the rest becomes straightforward. Get it wrong and you spend your time fixing avoidable mistakes instead of building a position.

NVIDIA Stock isn’t listed on Indian exchanges, investors must use a regulated international investment platform/broker to purchase NVDA shares.

This article explains exactly how Indian investors can buy NVIDIA stock using EBC Financial Group, covering regulatory requirements, account creation, funding, order execution, taxation, and a complete technical analysis to support informed decision-making.

The Easiest Way for Indians Investors to Invest in NVIDIA Stock

If you want direct exposure to the world’s fastest-growing AI chipmaker, EBC Financial Group offers a seamless and compliant way to buy NVIDIA shares from India. As global markets accelerate toward AI-powered systems, NVIDIA’s GPUs have become essential infrastructure for enterprises, research labs, governments, and cloud hyperscalers.

This growing demand has made NVDA one of the most sought-after global stocks among Indian investors looking to diversify internationally while participating in the AI revolution.

Why NVIDIA Is a High-Demand Stock for Indian Investors

Before making any investment, understanding NVIDIA’s business fundamentals can help you better appreciate why demand remains consistently strong globally.

Key reasons investors pursue NVIDIA stock:

Key reasons investors pursue NVIDIA stock:

NVIDIA dominates the AI GPU market with an 80-90% share, powering large-language models, robotics, autonomous driving, simulation, gaming, and cloud AI systems.

Its flagship processors, H100, GH200, and the next-generation Blackwell architecture, run the highest-performance AI data centers worldwide.

NVIDIA continues expanding into networking, autonomous vehicles, robotics software, AI-accelerated analytics, and edge computing.

Global AI spending is forecast to exceed USD 1 trillion in the coming decade, placing NVIDIA at the core of this transformation.

Its market capitalization recently surpassed USD 2 trillion, reflecting unparalleled institutional confidence.

For Indian investors, NVIDIA offers exposure to one of the most powerful growth narratives shaping the future of global technology.

Why Indian Investors Are Increasingly Buying U.S. Tech Stocks

Indian investors are showing a growing appetite for U.S. technology stocks, and this trend is accelerating for several important reasons.

Global tech giants such as NVIDIA, Apple, Microsoft, and Amazon are driving some of the world’s most significant innovations, from artificial intelligence and robotics to cloud computing and semiconductor development.

As a result, long-term wealth creation opportunities in U.S. tech markets often exceed what is available in traditional domestic sectors.

Another key factor is global diversification. Many Indian investors want to balance their portfolios with international assets to reduce country-specific risk. By gaining exposure to U.S. tech leaders, investors can participate in industries that are not yet fully developed or publicly listed in India.

Thanks to platforms like EBC Financial Group, investing in U.S. markets has become more accessible than ever. Indian traders can now open an account, invest internationally under RBI’s LRS framework, and own shares of companies shaping the digital and AI-driven future of the global economy.

For many, buying stocks like NVIDIA represents not just an investment, but a strategic move toward long-term global wealth building.

Can You Buy NVIDIA Stock Directly from India?

Yes, Indian residents can legally purchase foreign equities such as NVIDIA through platforms like EBC Financial Group. The process is fully compliant but must follow:

RBI’s Liberalised Remittance Scheme (LRS)

Under LRS, Indian individuals can remit up to USD 250,000 per financial year for permissible transactions, including investing in foreign stocks.

How Buying NVIDIA Works for Indian Residents

NVIDIA is a U.S.-listed security, meaning Indian investors must follow:

1. RBI’s Liberalised Remittance Scheme (LRS)

Under LRS, resident individuals may remit USD 250,000 per financial year overseas for permitted capital and current account transactions, including buying foreign stocks.

EBC Financial Group allows you to create an account, verify identity, and access global equities in compliance with applicable remittance rules.

2. International Brokerage Execution

EBC Financial Group provides access to global markets where you can place buy/sell orders for NVDA like any U.S.-based investor.

3. Currency Conversion

Your INR is converted to USD before executing any NVDA purchase.

How to Buy NVIDIA Stock in India Through EBC Financial Group

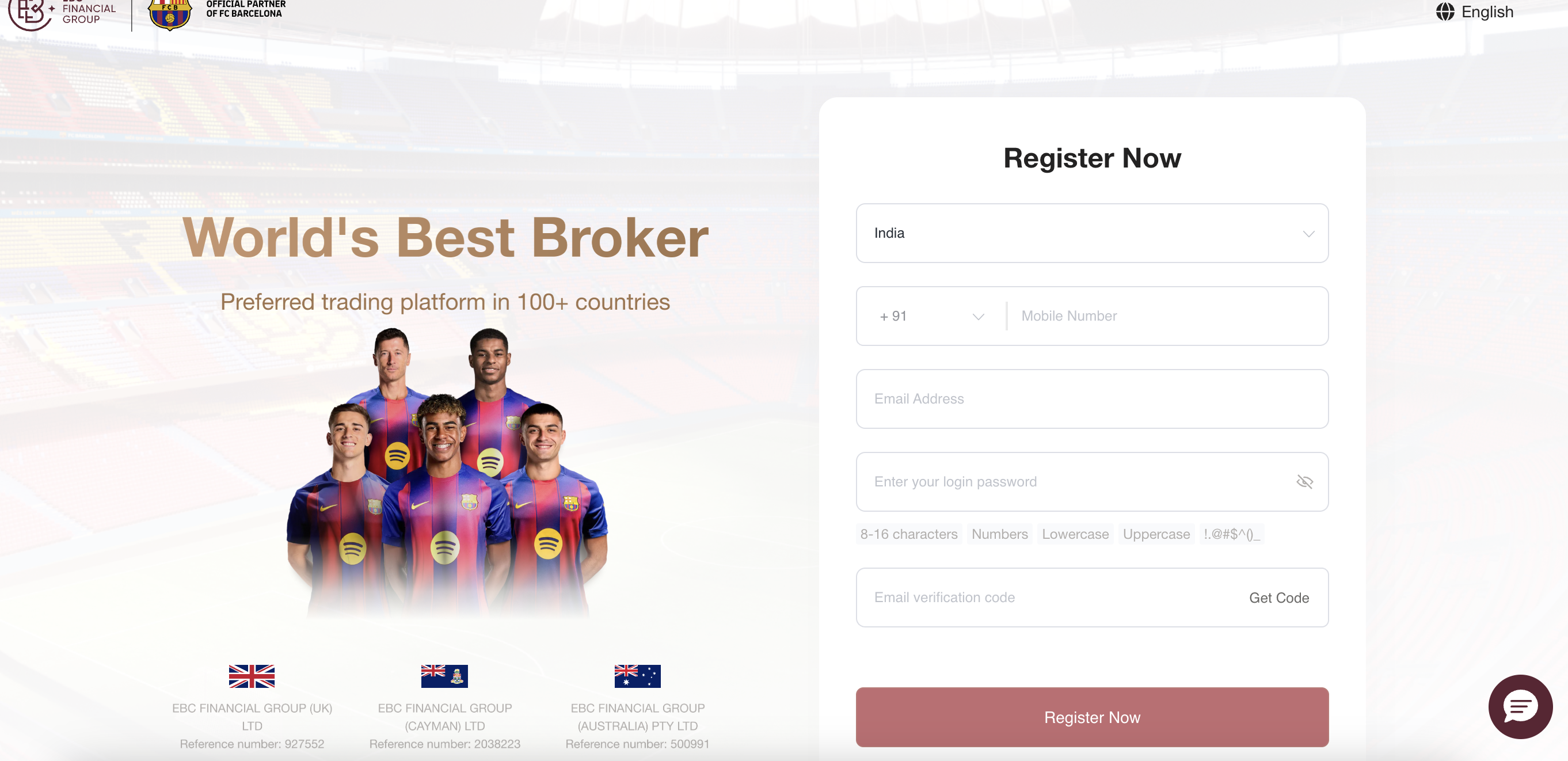

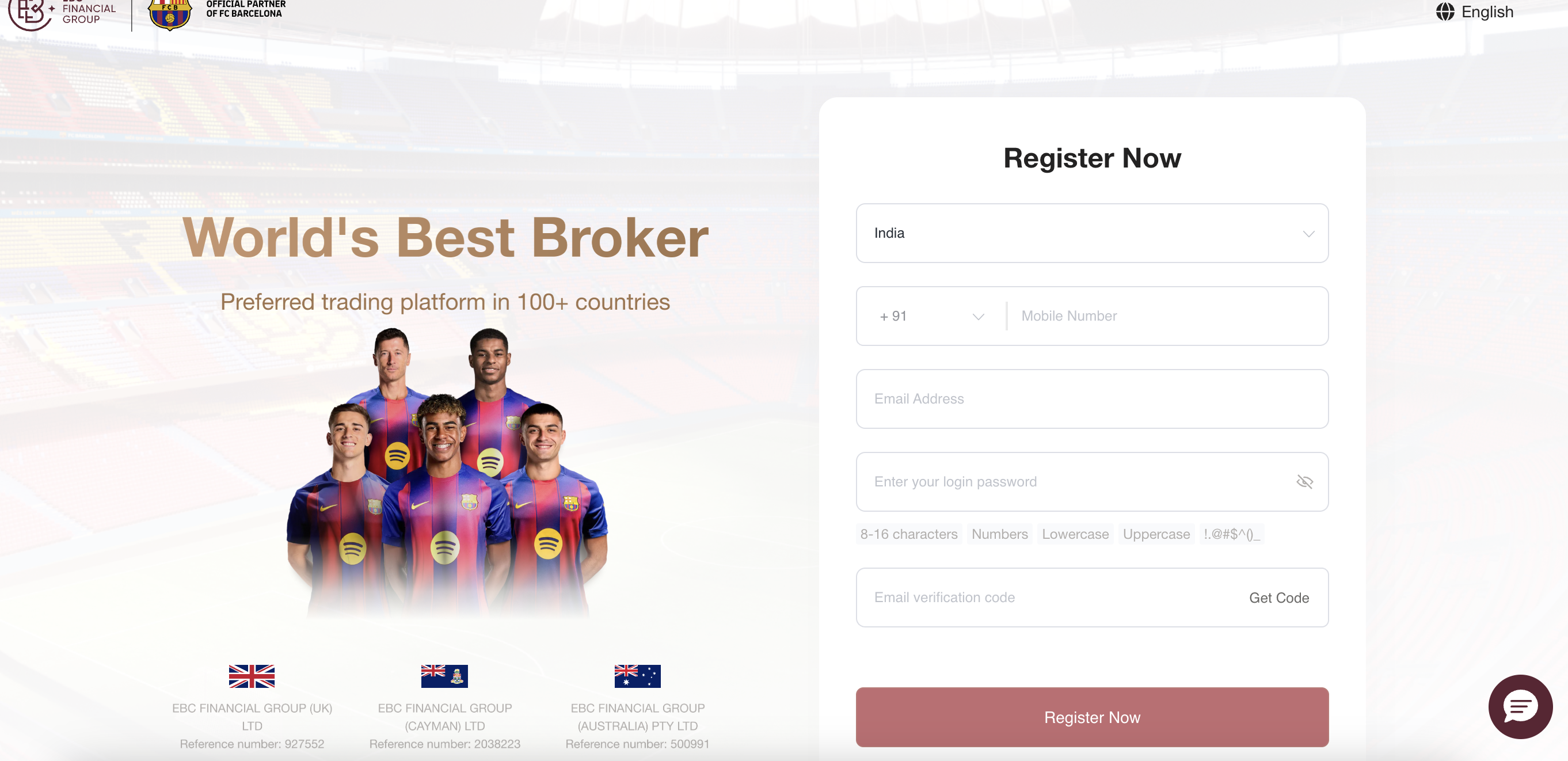

Step 1: Create an Account with EBC Financial Group

Visit EBC’s platform to begin registration. EBC performs digital KYC checks to verify your identity and ensure compliance with international investment regulations.

Step 2: Complete Regulatory Requirements (LRS Compliance)

Before sending money abroad, you must ensure:

Your bank details match your EBC account identity.

The purpose of transfer is clearly designated as investment abroad.

You understand LRS limits and disclosures.

EBC guides you through this process so you can remit funds smoothly.

Step 3: Fund Your Account (Convert INR to USD)

Once your account is approved, you can:

Log in to your EBC dashboard.

Choose the funding option.

Enter the amount you want to transfer.

Approve INR-to-USD conversion.

Confirm the LRS purpose code for investment.

Once the transfer clears, your USD balance becomes available for trading.

Tip: Consider exchange rate movements. A stronger INR may lower your effective cost of buying NVDA shares.

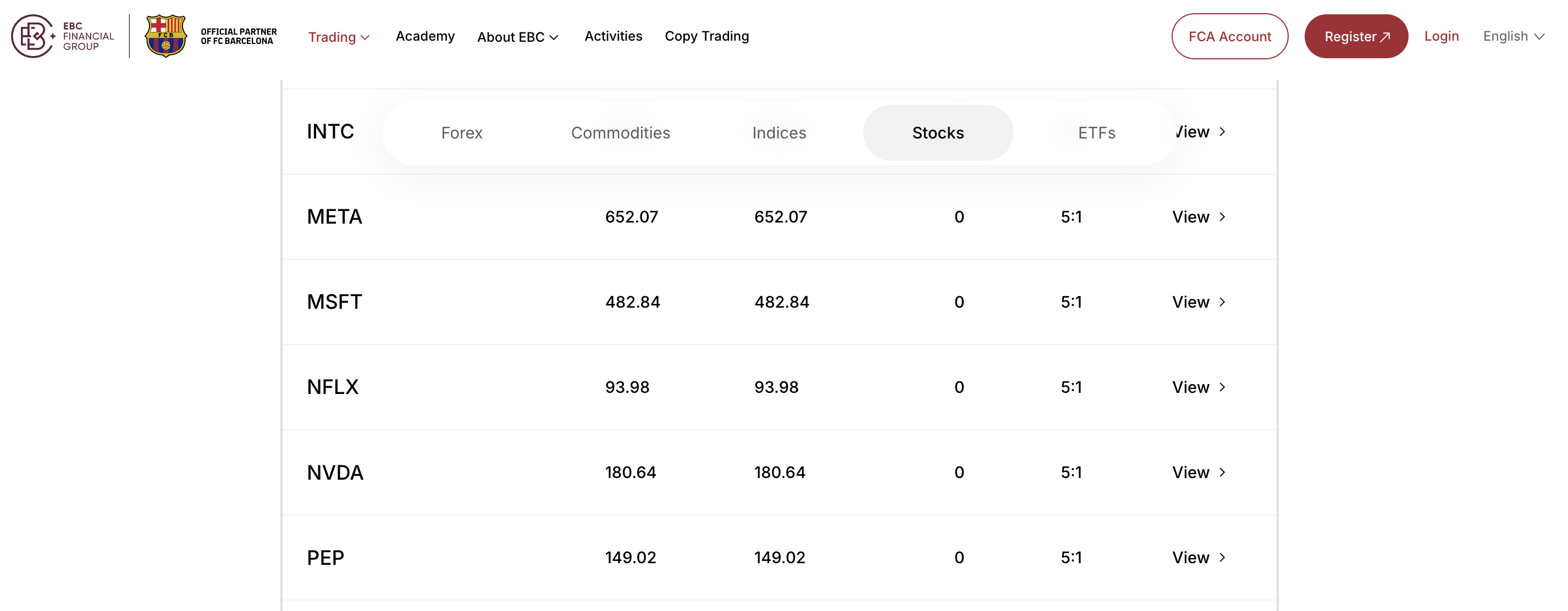

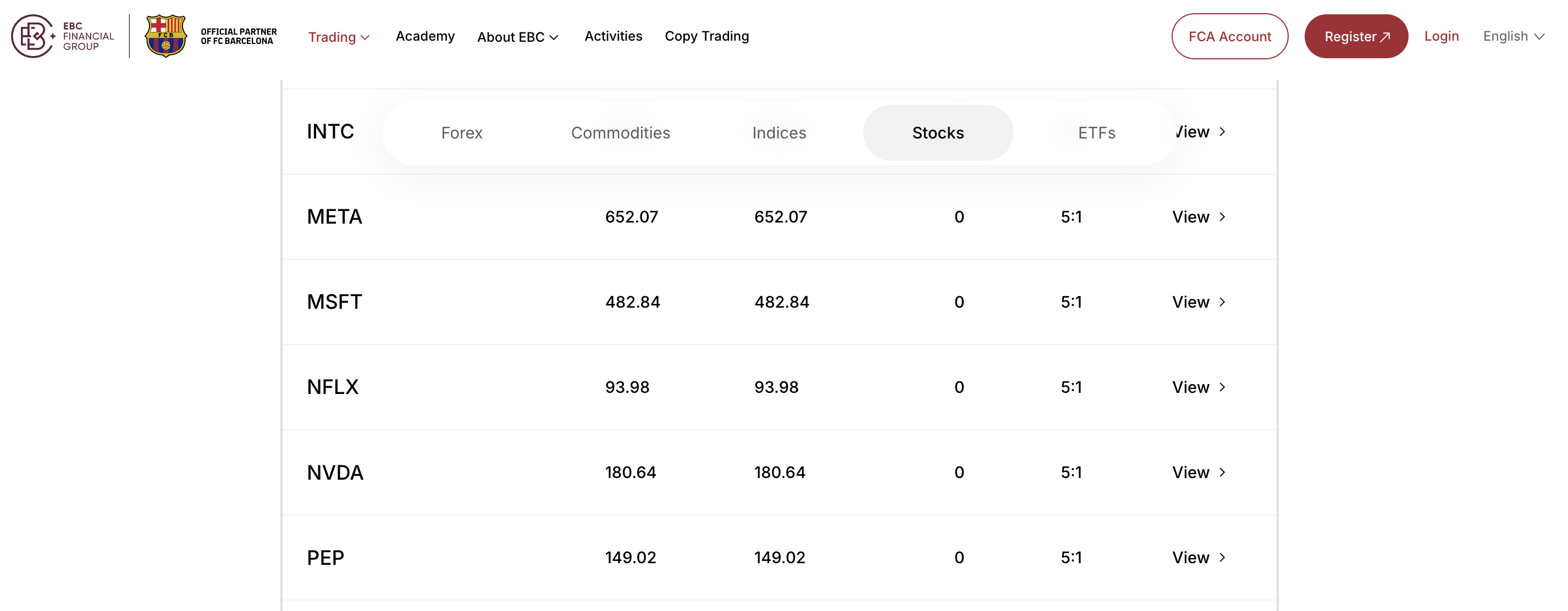

Step 4: Search for NVIDIA Stock on EBC

Type NVDA in the search bar.

Open NVIDIA’s detailed asset profile.

Review real-time charts, quotes, fundamentals, and market sentiment tools.

Depending on your account type, fractional share purchasing may be enabled, allowing you to invest even if a single full share is expensive.

Step 5: Place a Buy Order

You can choose from different order types. After selecting the order type:

Enter quantity or investment amount

Review charges and order details

Confirm your trade

Your NVIDIA shares will now appear in your EBC portfolio.

Step 6: Monitor Your Position and Manage Risk

Once you own NVDA:

Track price performance

Review earnings dates

Use EBC’s alerts for volatility or news events

Consider stop-loss or trailing-stop mechanisms

Periodically reassess long-term positioning

Active management helps protect gains and minimize downside risk.

Why Buy NVIDIA Stock Through EBC Financial Group?

EBC Financial Group provides:

Quick Comparison: Investment Routes

Before choosing a platform to trade NVIDIA stock in India, it’s important to understand the different pathways available to investors. Each method offers unique advantages depending on your goals, risk tolerance, and investment budget.

The comparison below outlines the key differences between direct and indirect routes, helping you decide whether you prefer full ownership of NVIDIA shares, simplified access via Indian brokers, or diversified exposure through ETFs and mutual funds.

| Investment Method |

Direct Ownership |

Min. Investment |

Requires LRS |

Notes |

| US Stocks via Intl Platform |

✔️ |

Yes (any via fractional) |

✔️ |

Best for direct NVDA ownership |

| Indian Broker with US Access |

✔️ |

Depends |

✔️ |

May have different fee structure |

| ETFs/Mutual Funds |

Indirect |

Varies |

No direct LRS |

Easier entry, diversified exposure |

Frequently Asked Questions (FAQ)

1. Can I buy NVIDIA stock directly in India through EBC Financial Group?

Yes. EBC Financial Group provides international market access that allows Indian investors to purchase NVIDIA shares directly in a legal and compliant manner. You simply complete KYC, fund your account under the LRS guidelines, convert your INR to USD, and place your NVDA order just like an investor in the U.S. market.

2. Do I need a U.S. bank account or U.S. address to invest in NVIDIA?

No. You do not need either a U.S. bank account or a U.S. residential address. Your Indian bank account is sufficient for LRS remittances, and EBC Financial Group handles the conversion and trading infrastructure on your behalf. This makes global investing accessible even if you’ve never previously invested abroad.

3. Can I buy fractional shares of NVIDIA on EBC?

Depending on your account configuration and available product options, fractional shares may be offered. Fractional investing is especially helpful for high-priced stocks like NVIDIA, as it allows you to start with smaller amounts while still gaining exposure to the company’s growth. You can choose to invest based on a fixed dollar value instead of buying a full share.

Summary

Buying NVIDIA stock (NVDA) from India is not only possible but increasingly simple through EBC Financial Group. By completing a quick registration, complying with RBI’s LRS requirements, funding your USD account, and placing a market or limit order, you can acquire ownership in one of the world’s most influential AI companies.

This guide covered the complete process, from regulatory frameworks to step-by-step onboarding, technical analysis, platform selection, and investment routes.

As NVIDIA continues to lead advancements in AI, cloud computing, robotics, and next-generation GPUs, early Indian investors can position themselves to participate in long-term global growth.

With EBC Financial Group’s secure and user-friendly trading ecosystem, accessing global markets becomes simple, transparent, and empowering for investors at all levels.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.