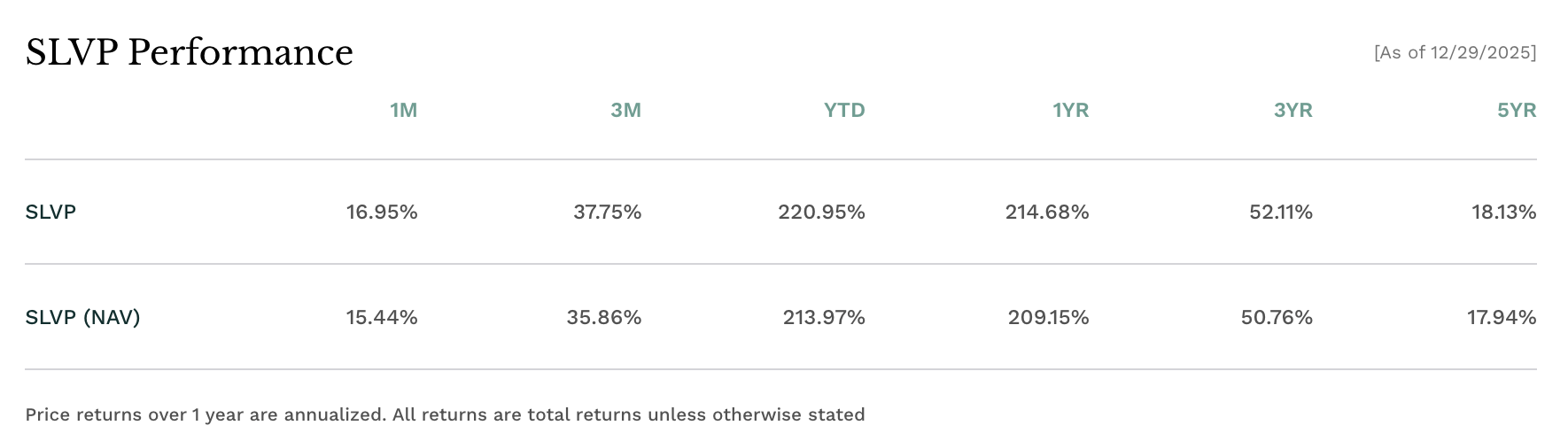

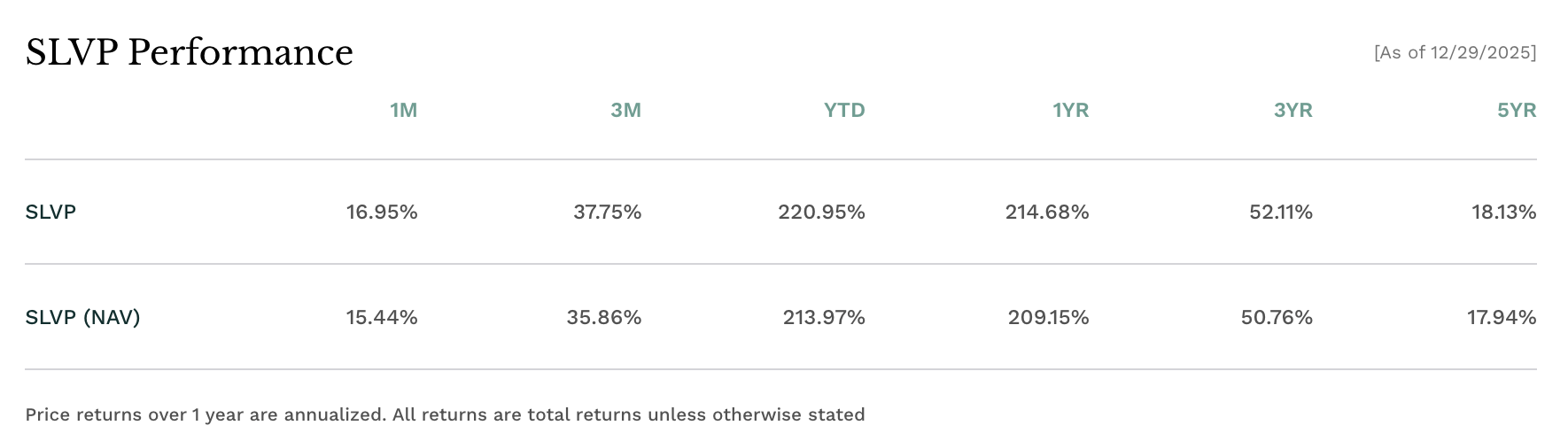

SLVP is the highest-returning non-leveraged equity ETF in 2025, with year-to-date gains approaching +180%. [1] That level of performance is rare among unleveraged ETFs, particularly in a market where many top performers rely on derivatives, leverage, or concentrated country exposure. SLVP’s advance has been driven entirely by the equity performance of its underlying holdings.

SLVP’s gains reflect a re-rating of silver mining stocks, where rising silver prices drove revenue and margin growth faster than the metal itself. That earnings leverage flowed directly into ETF price appreciation due to SLVP’s concentrated exposure.

Physical silver ETFs track price alone, while broad equity funds dilute silver exposure. The higher earnings leverage of silver miners is the key reason SLVP has outperformed other non-leveraged ETFs in 2025.

Key Summary

SLVP was the top-performing non-leveraged ETF in 2025, with gains approaching +180%, achieved without derivatives or structural leverage.

Its silver-focused index design provided direct exposure to mining companies whose revenues rise sharply when silver prices increase.

Mining equity earnings grew faster than spot silver, as higher prices flowed through largely fixed cost structures, expanding margins and cash flow.

Silver demand was supported by multiple sources, including industrial use, investment flows, and safe-haven allocation, creating a more durable price trend.

Investor rotation into precious metals during periods of equity market stress further reinforced gains in silver mining equities.

SLVP’s concentration in established producers allowed it to capture upside with lower volatility than silver ETFs focused on smaller, early-stage miners.

6 Reasons Why SLVP Is The Best Performing ETF In 2025

1. Exceptional YTD Returns Without Leverage

The iShares MSCI Global Silver and Metals Miners ETF has generated returns in the ~180–210% range in 2025, ranking it at or near the top of non-leveraged ETF performance lists across all asset classes.

This result is notable because SLVP does not employ leverage, derivatives, or daily reset mechanics. The gains reflect pure equity performance from its underlying holdings rather than structural amplification. In a year when many high-return products relied on leverage or narrow thematic exposure, SLVP’s advance has been driven by fundamentals.

2. Index Structure That Favors Silver Miners

SLVP tracks the MSCI ACWI Select Silver Miners Investable Market Index, [2] which focuses on companies deriving a substantial share of revenue from silver production. The index includes both primary silver miners and diversified mining firms with meaningful silver output.

This structure allows changes in silver prices and mining profitability to flow directly into constituent earnings. As silver prices rose in 2025, the index design enabled SLVP to capture those gains more efficiently than broad materials or diversified mining ETFs.

3. Direct Exposure To Silver Mining Profitability

Silver mining equities respond differently to metal price changes than physical silver instruments. While spot silver reflects price movement alone, miners convert price increases into revenue and profit growth.

For SLVP holdings, higher realized silver prices in 2025 drove operating margin expansion because many mining costs remain fixed or semi-fixed in the short term. Labor contracts, infrastructure spending, and energy inputs adjust more slowly than metal prices, allowing revenue gains to flow directly into earnings.

4. Commodity Price Momentum Supported By Multiple Channels

Silver’s advance in 2025 has been supported by several reinforcing forces rather than a single speculative driver. [3] These include:

Sustained industrial demand from electronics, solar energy, and electrification supply chains

Increased investor demand for hard assets amid macroeconomic uncertainty

A weaker U.S. dollar environment, which historically supports dollar-denominated commodity prices

Together, these factors created a durable price trend rather than a short-lived spike. Mining equities responded accordingly, with valuation multiples expanding alongside earnings expectations.

5. Investment Demand And Safe-Haven Allocation

Investment demand has also played a role in supporting silver prices. Ongoing geopolitical tensions and periods of equity market stress have reinforced safe-haven allocation to precious metals as portfolio diversifiers.

In early 2025, concerns around stretched valuations in certain growth and technology segments, including AI-related equities, coincided with renewed flows into metals-linked assets. Silver benefited alongside gold, but with the added support of industrial demand, allowing mining equities to sustain gains rather than relying solely on defensive positioning.

6. Revenue Sensitivity: Miners Versus Spot Silver

Silver miners typically exhibit 2× to 4× earnings sensitivity relative to changes in spot silver prices. This occurs because revenue rises immediately with higher metal prices, while cost structures adjust slowly.

For example, a 20% increase in silver prices can result in a much larger percentage increase in operating cash flow for a miner whose production costs remain largely unchanged.

| ETF Type |

Exposure Type |

Earnings Sensitivity to Silver |

Uses Leverage |

Typical Volatility |

| SLVP (Silver Miners ETF) |

Silver mining equities |

High (2×–4× vs spot silver) |

No |

High |

| Physical Silver ETFs |

Spot silver price |

Low (price only) |

No |

Moderate |

| Broad Materials ETFs |

Multi-metal & industrial |

Low to moderate |

No |

Moderate |

| Leveraged Metals ETFs |

Price derivatives |

Very high (short-term) |

Yes |

Very high |

Equity markets tend to capitalize on these cash flow improvements aggressively during sustained commodity cycles.

This relationship explains why SLVP has outpaced both:

Physical silver ETFs, which track the price only

Broad materials ETFs, which dilute silver exposure with other metals and industrial inputs

SLVP’s concentration allows it to fully express the equity leverage inherent in silver mining economics.

Why The 2025 Silver Rally Is Structurally Different

1. Industrial Demand Has Become More Reliable

Past silver rallies were often driven by speculation or short-term macro shocks and tended to fade quickly once momentum slowed.

In 2025, industrial demand contributed more consistently to silver consumption, supported by energy infrastructure, electronics, and electrification supply chains. This steadier demand base helped reduce reliance on short-term speculative buying.

2. Mining Companies Showed Better Cost Discipline

SLVP’s holdings generally favored balance sheet strength and cash flow over rapid production expansion as silver prices increased.

This limited supply growth and supported higher realized prices. For investors, that translated into more sustainable earnings and less downside pressure during pullbacks.

3. Macro Conditions Favored Hard Assets

Silver demand in 2025 benefited from both industrial use and steady investment buying. That combination helped prices hold gains more consistently than metals tied to a single demand source.

Mining equities benefited most from this environment because they offered direct exposure to silver prices along with earnings growth, positioning SLVP to capture those allocation shifts effectively.

Comparative Edge Among Non-Leveraged ETFs

Many of the year’s top performers were tied to narrow equity themes or specific regions, benefiting from localized or short-term factors. SLVP’s gains, by contrast, were driven by a global silver cycle that supported mining earnings across multiple markets.

| ETF Type |

2025 YTD Return |

Earnings Leverage to Silver |

Volatility Profile |

| SLVP (Silver Miners ETF) |

~+180% |

High (≈2×–4×) |

High but controlled |

| Physical Silver ETFs |

~+40%–50% |

Low (price only) |

Moderate |

| Broad Materials ETFs |

~+20%–30% |

Low–Moderate |

Low–Moderate |

| Junior-Miner Silver ETFs |

~+200%+ (peaks) |

Very High |

Extremely High |

Risk Considerations Investors Should Understand

SLVP’s strong performance comes with risks that investors should weigh carefully.

Silver mining equities are cyclical. If silver prices decline, miner margins can compress quickly, leading to sharp pullbacks in share prices. Even without leverage, SLVP can be more volatile than broad equity ETFs.

Company-level risks also matter. Mining operations face cost pressures, regulatory changes, and geopolitical exposure. While SLVP is diversified across multiple firms, sector-wide downturns can still affect the entire portfolio.

Remember, strong performance can attract crowded positioning. If silver demand weakens or macro conditions shift, the same factors that supported SLVP’s gains could reverse, leading to faster downside moves.

SLVP ETF 2026 Outlook

Bull Case: Silver Holds Firm, Earnings Stay Elevated

Bull Case: Silver Holds Firm, Earnings Stay Elevated

In the bullish scenario, silver prices remain firm or trend modestly higher in 2026, supported by steady industrial demand and continued investment interest. Mining costs remain controlled, allowing margins and free cash flow to stay elevated.

Under this outcome, silver mining equities continue to generate strong earnings, even without further multiple expansion. SLVP ETF benefits from sustained profitability rather than renewed speculation, supporting further upside, albeit at a slower pace than 2025.

Key drivers

Stable-to-higher silver prices

Continued capital discipline by miners

Ongoing industrial demand from energy and electronics

Base Case: Consolidation With Earnings Support

The base case assumes silver prices consolidate after the sharp 2025 move, trading in a range rather than trending aggressively higher. In this environment, miner revenues normalize, but margins remain healthy due to cost structures adjusting slowly.

SLVP performance in this scenario is driven by earnings durability, dividends, and selective stock-level gains rather than broad re-rating. Returns are more moderate, but the ETF remains supported by fundamentals rather than momentum alone.

Key drivers

Range-bound silver prices

Stable cash flow and dividends

Reduced but still positive investor interest

After an exceptional 2025, SLVP’s 2026 outlook is less about momentum and more about silver price stability and investor discipline. Upside remains possible, but outcomes are likely to be more differentiated and volatile, with returns increasingly tied to earnings quality rather than broad revaluation.

Frequently Asked Questions (FAQ)

1. What is the SLVP ETF?

SLVP is a non-leveraged equity ETF that invests in global silver mining companies. It focuses on firms with substantial revenue exposure to silver production rather than holding physical metal.

2. Why is SLVP up so much in 2025?

SLVP rose sharply in 2025 because higher silver prices translated into outsized earnings growth for silver miners, amplified by fixed cost structures and supported by industrial demand and investment flows.

3. Is SLVP a leveraged ETF?

No. SLVP does not use leverage or derivatives. Its gains reflect equity performance driven by mining profitability rather than structural leverage.

4. How does SLVP compare with physical silver ETFs?

SLVP often outperforms physical silver ETFs during strong price cycles because mining profits can grow faster than metal prices due to fixed cost structures.

5. What are the main risks of holding SLVP?

Key risks include commodity price volatility, operational risks within mining companies, and sensitivity to global economic conditions.

6. Is SLVP suitable for long-term investors?

Yes, it can be suitable for investors with a long-term bullish view on silver, but volatility may make it more suitable as a tactical allocation.

7. Does SLVP pay dividends?

Yes. SLVP distributes dividends, though yields are generally modest and fluctuate with mining profitability.

Conclusion

SLVP’s position as one of the best-performing non-leveraged ETFs in 2025 reflects a convergence of favorable commodity dynamics, disciplined mining operations, and structural equity leverage embedded in its holdings. Its ability to translate silver price momentum into outsized equity returns has set it apart from both physical metal funds and broader equity strategies.

The ETF’s performance also underscores a broader lesson for investors: sector-specific, non-leveraged ETFs can deliver exceptional returns when structural drivers align. In 2025, SLVP has become a clear case study in how targeted exposure to mining equities can outperform in a metals-driven market cycle.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://www.blackrock.com/us/individual/products/239656/ishares-msci-global-silver-miners-etf

[2] https://www.msci.com/indexes/index/701930

[3] https://iea.blob.core.windows.net/assets/81a931a2-1d2f-4957-896a-7287d2d909ee/EnergyEfficiency2025.pdf