The best oil and gas ETF 2026 is no longer a single “energy sector” decision. It is the ETF structure that aligns with how energy tends to move in late-cycle markets: oil prices can swing on geopolitics and OPEC+ policy, while energy equities can re-rate on buybacks, dividends, and capital discipline. The right pick depends on whether the goal is crude oil beta, energy stock dividends, or midstream cash-flow stability.

Energy exposure enters 2026 with a mixed but still compelling setup. Performance has varied by subsector, but shareholder distributions, capital discipline, and cash generation remain key drivers to watch.

Top 10 Best Gas and Oil ETF For 2026

| Rank |

Ticker |

Fund |

Exposure type |

AUM |

Expense ratio |

Annual distribution yield |

| 1 |

XLE |

Energy Select Sector SPDR (S&P 500 energy sector) |

US energy equities |

$31.30B |

0.08% |

2.55% |

| 2 |

VDE |

Vanguard Energy ETF |

Broad US energy equities |

$7.94B |

0.09% |

2.77% |

| 3 |

IXC |

iShares Global Energy ETF |

Global integrated energy equities |

$2.10B |

0.40% |

3.30% |

| 4 |

MLPX |

Global X MLP & Energy Infrastructure |

Midstream infrastructure (MLP + C-corp mix) |

$2.79B |

0.45% |

4.54% |

| 5 |

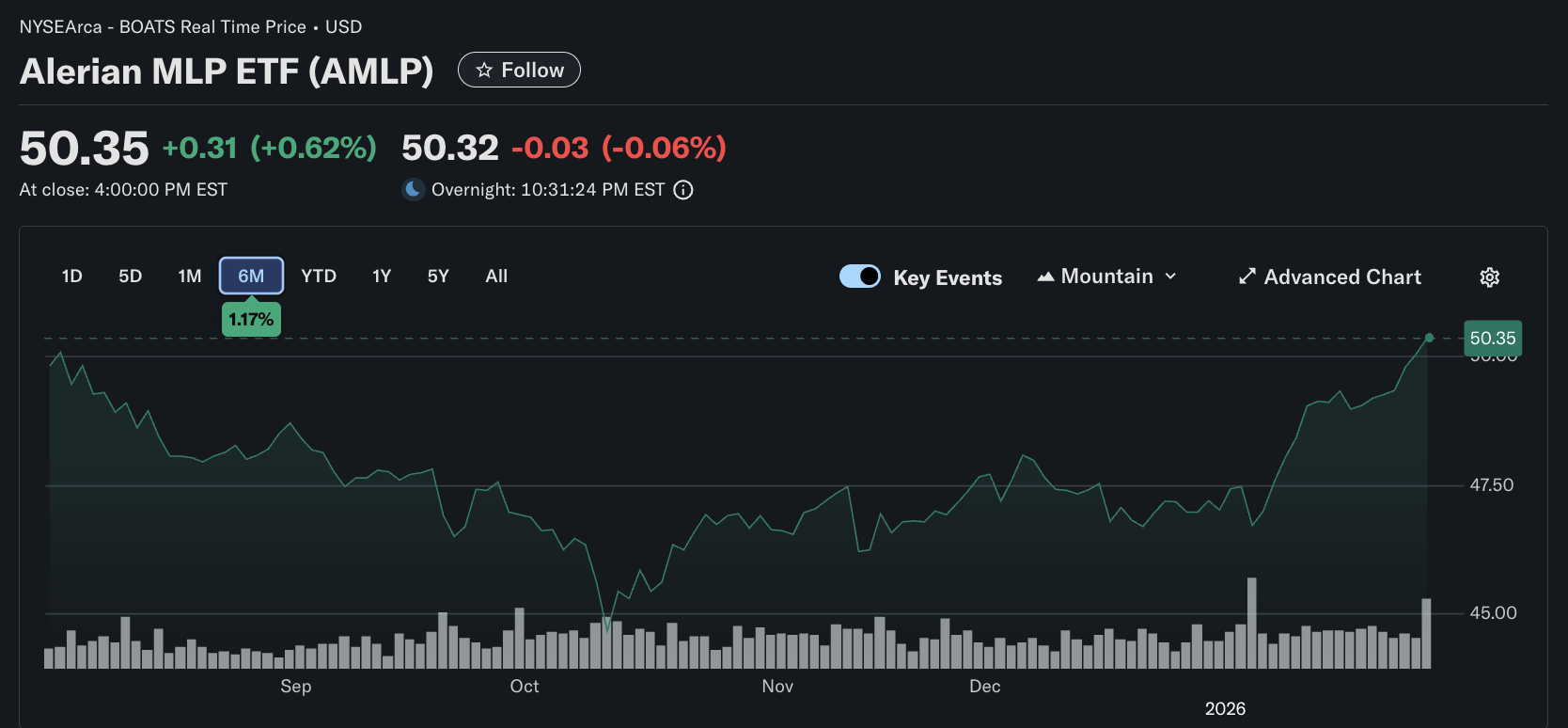

AMLP |

Alerian MLP ETF |

US midstream MLPs |

$11.14B |

0.85% |

7.85% |

| 6 |

XOP |

SPDR S&P Oil & Gas E&P ETF |

US exploration and production equities |

$2.00B |

0.35% |

2.41% |

| 7 |

USO |

United States Oil Fund |

WTI near-month futures (crude oil beta) |

$1.73B |

0.60% |

n/a |

| 8 |

BNO |

United States Brent Oil Fund |

Brent near-month futures (global crude beta) |

$178.7M |

1.00% |

n/a |

| 9 |

USL |

United States 12 Month Oil Fund |

WTI futures ladder (12-month blend) |

$23.6M |

0.85% |

n/a |

| 10 |

PXE |

Invesco Energy Exploration & Production |

US E&P equities (rules-based selection) |

$73.8M |

0.61% |

2.81% |

1) XLE: Energy Select Sector SPDR Fund

Why choose it: XLE is the institutional “core” energy sector ETF, offering diversified exposure to large US energy firms within the S&P 500 Energy Sector. It combines scale with low fees and liquidity, which matters in a volatile tape.

Expense ratio / growth: 0.08% fee, $31.30B AUM, 2.55% yield.

2026 angle: Best for investors who want broad energy beta with dividends and buybacks, not oil futures mechanics.

2) VDE: Vanguard Energy ETF

Why choose it: VDE is a broad US energy equity portfolio that typically reaches deeper into the sector than mega-cap-heavy funds, offering more mid-cap exposure.

Expense ratio / growth: 0.09% fee, $7.94B AUM, 2.77% yield.

2026 angle: Best for investors who want broad US energy coverage with a low-cost profile.

3) IXC: iShares Global Energy ETF

Why choose it: IXC adds non-US majors and global energy exposure, reducing single-country risk when geopolitics, taxation, or regulatory shifts drive dispersion.

Expense ratio / growth: 0.40% fee, $2.10B AUM, 3.30% yield.

2026 angle: Best for a “global energy” sleeve tied to Brent-linked companies and international demand.

4) MLPX: Global X MLP & Energy Infrastructure ETF

Why choose it: MLPX targets the infrastructure layer of the oil and gas industry, including transportation, storage, and processing. That profile can be steadier than upstream cyclicality.

Expense ratio / growth: 0.45% fee, $2.79B AUM, 4.54% yield.

2026 angle: Best for investors who want midstream exposure without concentrating solely in MLP partnership structures.

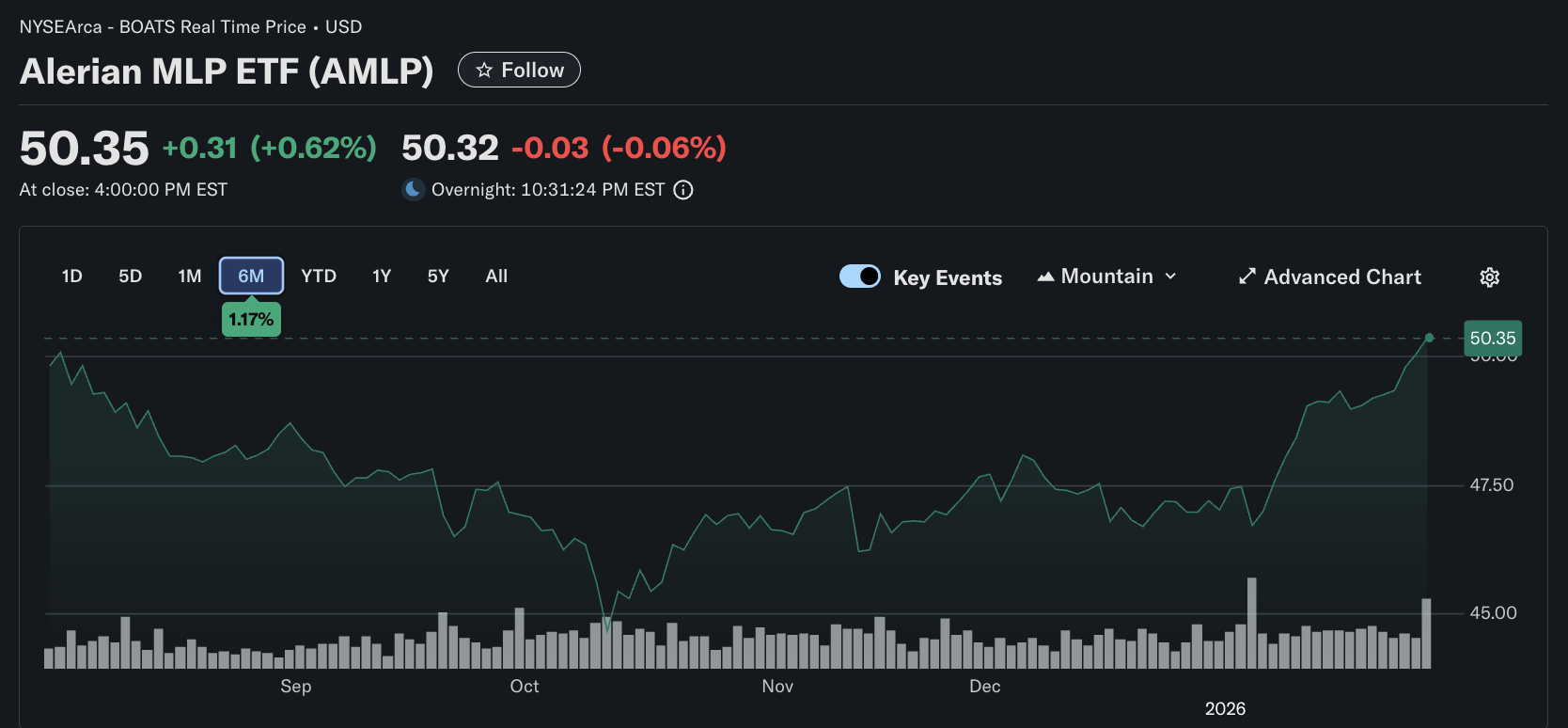

5) AMLP: Alerian MLP ETFWhy choose it: AMLP is designed for US midstream MLP exposure and has historically appealed to income-oriented allocators who want energy-linked cash distributions.

Expense ratio / growth: 0.85% fee, $11.14B AUM, 7.85% yield.

2026 angle: Best for yield seekers, with the trade-off that MLP fund structures and tax characteristics require careful review.

6) XOP: SPDR S&P Oil & Gas Exploration & Production ETF

Why choose it: XOP focuses on exploration and production companies and is a higher-beta play on upstream profitability. It can outperform sharply in oil upcycles and underperform in drawdowns.

Expense ratio / growth: 0.35% fee, $2.00B AUM, 2.41% yield.

2026 angle: Best as a satellite position when oil’s upside convexity is the goal.

7) USO: United States Oil Fund

Why choose it: USO targets daily WTI-linked moves through near-month futures exposure. It is a futures-based ETP (commonly structured as a commodity pool), so returns can differ from spot oil depending on roll dynamics.

Expense ratio / AUM: 0.60% fee, $1.73B AUM.

2026 angle: Best for tactical crude oil exposure, with the structural reminder that futures roll dynamics can change outcomes versus spot oil.

8) BNO: United States Brent Oil Fund

Why choose it: BNO tracks the global oil benchmark, Brent, which can price fundamentals differently from WTI when seaborne trade flows and regional shocks matter.

Expense ratio / AUM: 1.00% fee, $178.7M AUM.

2026 angle: Best when the thesis is “global crude tightness” rather than purely US-centric supply dynamics.

9) USL: United States 12 Month Oil Fund

Why choose it: USL spreads exposure across a 12-month strip of WTI futures, seeking a smoother path than a single front-month focus.

Expense ratio / AUM: 0.85% fee, $23.6M AUM.

2026 angle: Best for investors trying to reduce front-month roll impact, acknowledging that “less roll risk” does not mean “no roll risk.”

10) PXE: Invesco Energy Exploration & Production ETF

Why choose it: PXE targets E&P equities using a rules-based approach tied to its index methodology, providing a differentiated upstream basket versus broader E&P funds.

Expense ratio / AUM / annual dividend yield: 0.61% fee, $73.8M AUM, 2.81% yield.

2026 angle: Best as a secondary E&P allocation when factor selection and rebalancing rules are preferred over pure sector-weight exposure.

How To Choose An Oil and Gas ETF in 2026

Two questions drive most outcomes.

1) First: do you want oil-price exposure or corporate cash-flow exposure? If the intent is to track crude oil’s daily moves, WTI and Brent futures ETFs are the most direct route. If the intent is to participate in dividends, buybacks, and balance-sheet strength, energy equity ETFs tend to be the cleaner instrument.

2) Second: where do you want your volatility? Upstream E&P funds tend to amplify oil moves. Midstream infrastructure tends to dampen them and lean more into income. Integrated majors often sit in the middle, with refining and trading operations that can buffer pure upstream swings.

2026 Positioning: Three Energy ETF “Buckets” That Map to Real Portfolios

1) Bucket 1: Core energy equities (XLE, VDE, IXC).

These tend to work when the market rewards free cash flow, capital returns, and balance-sheet strength. They also integrate better into traditional equity allocations because they are stocks rather than futures.

2) Bucket 2: Income and infrastructure (MLPX, AMLP).

These are often used as a “carry” sleeve within energy, where cash distributions and contracted infrastructure economics can matter as much as oil direction.

3) Bucket 3: Direct crude exposure (USO, BNO, USL).

These are most appropriate for tactical views on WTI and Brent crude, as well as short-term price catalysts. They demand more attention to roll yield, volatility, and holding-period discipline.

A practical risk-management cue: when energy is moving fast, many desks simplify the decision to “spot-driven” versus “equity-driven” exposure and size positions accordingly. The execution language traders often use around breakouts, pullbacks, and risk levels is consistent with common market microstructure playbooks.

Frequently Asked Questions (FAQ)

1) What is the best oil and gas ETF in 2026 for broad, long-only exposure?

Broad energy equity ETFs such as XLE and VDE typically offer the cleanest, most diversified exposure to oil and gas companies, with dividends and liquidity that fit long-only portfolios. They are less sensitive to futures roll effects than crude oil funds.

2) Are crude oil ETFs like USO good long-term investments?

Crude oil futures ETFs are usually better treated as tactical instruments. Over long holding periods, contract rolls and curve shape can cause returns to diverge materially from spot oil. They are designed to express price views, not replace ownership of energy equities.

3) What is the difference between WTI and Brent oil ETFs?

WTI-focused ETFs, such as USO, track US-linked crude, while other focused ETFs, such as BNO, reflect the global seaborne benchmark. The two can diverge when regional supply constraints, refinery dynamics, or geopolitical disruptions shift the balance from local to global.

4) Can I access energy-themed ETF CFDs with EBC Financial Group?

EBC Financial Group offers ETF CFD trading across a selection of global ETFs, enabling long or short positions with leverage, depending on jurisdiction and account terms. Review the relevant product documentation and risk disclosures before trading, since leverage can magnify losses.

5) Do midstream ETFs behave like oil prices?

Not perfectly. Midstream funds often respond more to volumes, contracts, financing conditions, and distribution policy than to day-to-day crude swings. They can still correlate with oil during stress events, but their cash flow profile is typically less spot-sensitive than that of upstream producers.

Conclusion

Selecting the best oil and gas ETF in 2026 is an exercise in choosing the right transmission mechanism. Energy equity ETFs such as XLE, VDE, and IXC translate oil and gas fundamentals into dividends, buybacks, and earnings power. Midstream ETFs such as MLPX and AMLP lean into infrastructure cash flows and income.

Futures-based funds such as USO, BNO, and USL provide more direct crude exposure but require respect for roll dynamics. The strongest outcomes usually come from aligning the ETF structure with the intended holding period, risk budget, and the specific energy thesis being expressed.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.