Dividend investing is no longer a passive exercise in yield collection. As markets move deeper into a regime defined by tighter liquidity, structurally higher interest rates, and uneven economic growth, investors are being forced to re-learn an old lesson: income only matters if it endures.

The best dividend stocks for 2026 will not be those offering the loudest yields, but those combining cash-flow resilience, balance-sheet discipline, and dividend growth capacity. In an era where capital is no longer free, dividends have become a credibility signal, proof that a company’s earnings are real, recurring, and prudently allocated.

This article presents a fully reasoned, analyst-grade framework for dividend investing in 2026, followed by a ranked, deeply elaborated list of the top 10 dividend stocks, sorted from highest to lowest yield and evaluated for sustainability, risk, and portfolio role.

Why Dividend Stocks Matter More in 2026

Three structural forces are reshaping income investing:

Higher-for-longer interest rates penalize weak balance sheets and reward companies that self-fund dividends.

Earnings volatility increases the value of predictable shareholder returns.

Demographic demand for income continues to rise globally.

Historically, dividends have contributed roughly 40% of long-term equity returns. In lower-growth, higher-volatility environments, the share often increases. Dividends are no longer just income; they are risk management.

Best Dividend Stocks To Invest In 2026

Below is a list of the best dividend stocks to invest in 2026:

| Company |

Sector |

Yield Range |

Dividend Strength |

Portfolio Role |

| Realty Income |

REIT |

5.0–5.75% |

Very high |

Core income |

| AbbVie |

Healthcare |

3.0–4.2% |

High |

Yield enhancer |

| Exxon Mobil |

Energy |

3.5–4.0% |

High |

Inflation hedge |

| Chevron |

Energy |

3.5–4.49% |

Conservative |

Stable energy |

| Johnson & Johnson |

Healthcare |

~3.0% |

Ultra-stable |

Anchor holding |

| Coca-Cola |

Consumer Staples |

~3.0% |

Extremely reliable |

Volatility dampener |

| Unilever |

Consumer Staples (Global) |

3.5–4.0% |

Very strong |

Global defensive income |

| Procter & Gamble |

Consumer Staples |

~2.4% |

Elite consistency |

Stability |

| Broadcom |

Technology |

~2.0% |

Rapid growth |

Income acceleration |

| Microsoft |

Technology |

~0.7% |

Exceptional growth |

Long-term compounding |

1. Realty Income (O)

Dividend Yield: ~5.0-5.75%

Realty Income is purpose-built for income reliability. Its portfolio of long-duration, net-lease commercial properties produces contractually predictable cash flow, supported by investment-grade tenants and built-in rent escalators. Monthly dividends add an additional layer of practical appeal for income-dependent investors.

2026 thesis: Conservative leverage and inflation-linked leases position Realty Income as one of the safest high-yield equities in public markets.

2. AbbVie (ABBV)

Dividend Yield: ~3.0-4.2%

AbbVie offers one of the highest sustainable yields in large-cap healthcare. While its Humira patent cliff raised concerns, management has executed a credible transition toward a diversified drug portfolio, maintaining dividend coverage in the process.

2026 thesis: Elevated yield compensates for execution risk. Best used as a complementary holding rather than a portfolio anchor.

3. Exxon Mobil (XOM)

Dividend Yield: ~3.5-4.0%

Exxon Mobil has emerged from the last energy downturn structurally leaner and far more disciplined. Its dividend is now supported by lower break-even oil prices, strong free cash flow, and a renewed commitment to shareholder returns via dividends and buybacks.

2026 thesis: Global energy demand remains durable. Exxon provides yield with real asset backing and inflation protection.

4. Chevron (CVX)

Dividend Yield: ~3.5-4.49%

Chevron differentiates itself through balance-sheet strength and restrained capital spending. That discipline lowers downside risk relative to peers and supports dividend sustainability through commodity cycles.

2026 thesis: Lower leverage and project selectivity make Chevron a higher-quality energy income option.

5. Johnson & Johnson (JNJ)

Dividend Yield: ~3.0%

Johnson & Johnson remains the global benchmark for dividend reliability. Its diversified healthcare model in pharmaceuticals, medical devices, and consumer health creates earnings stability unmatched by most large-cap peers.

2026 thesis: Defensive demand, conservative payout ratios, and a pristine balance sheet make JNJ foundational for any serious dividend portfolio.

6. Coca-Cola (KO)

Dividend Yield: ~3.0%

Coca-Cola’s strength lies in predictability. Its asset-light bottling model and unparalleled distribution network generate steady cash flow across economic conditions, supporting decades of uninterrupted dividend growth.

2026 thesis: KO excels when growth slows, and volatility rises. It is an income stabilizer, not a growth engine.

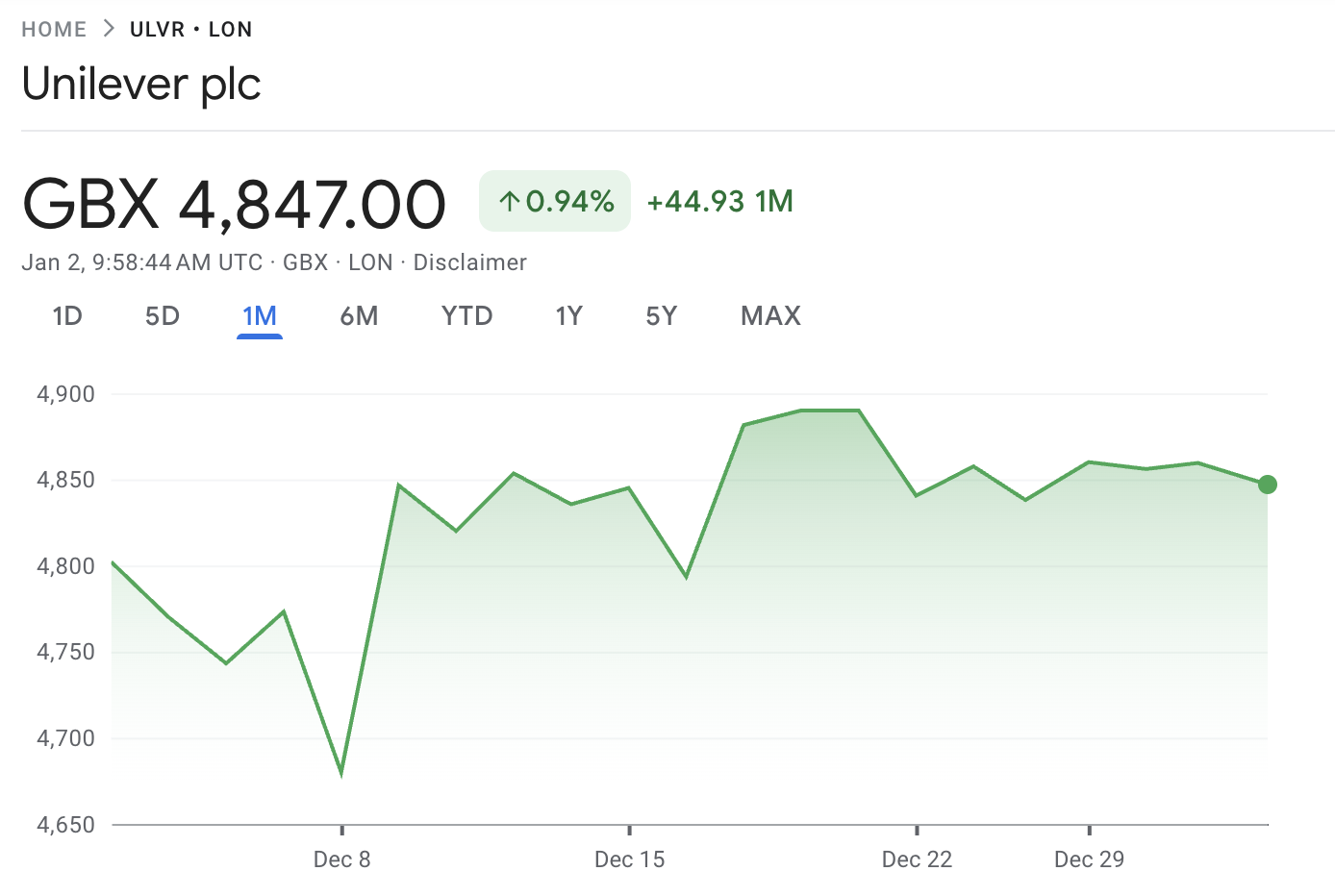

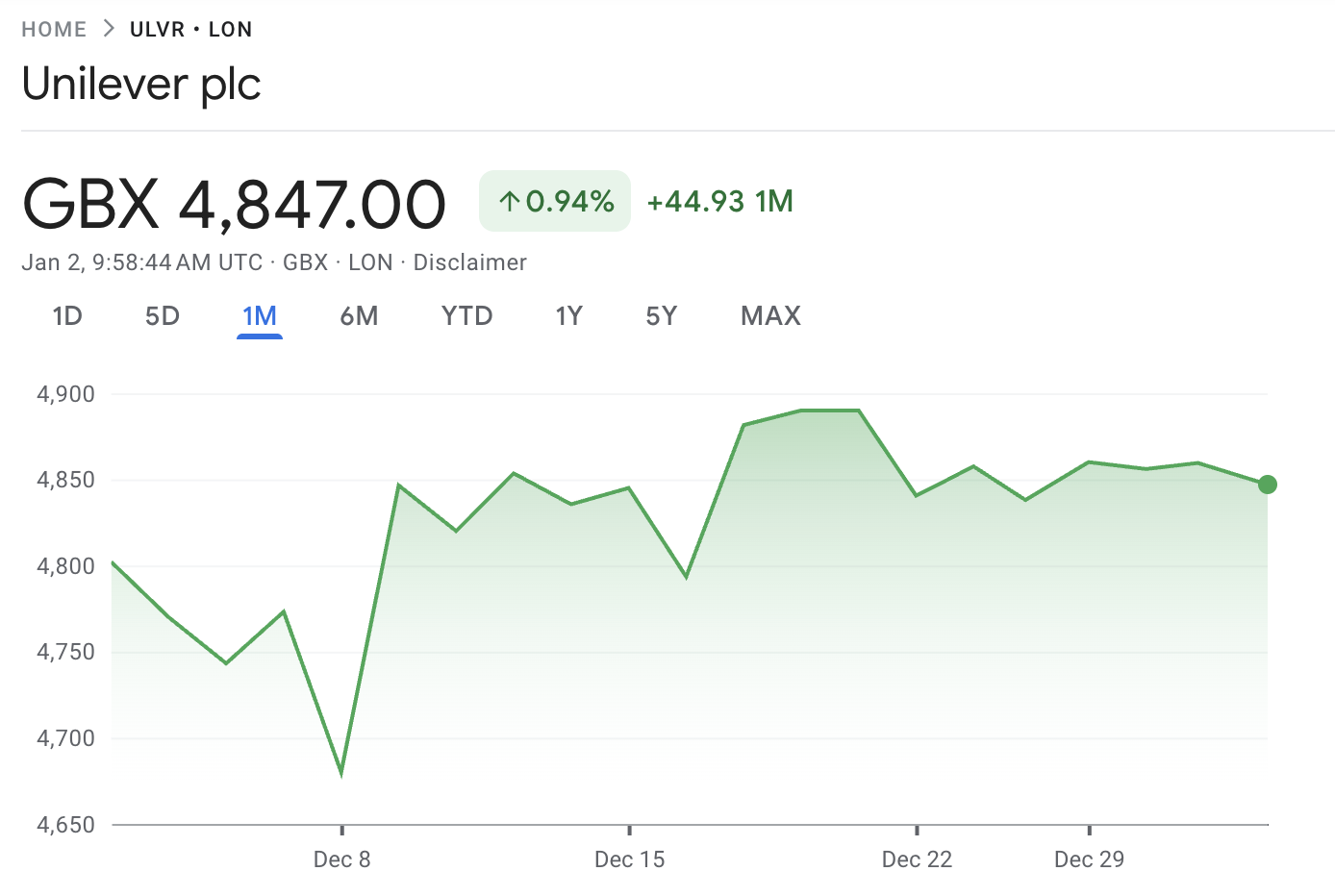

7. Unilever (UL / ULVR)

Dividend Yield: ~3.5-4.0%

Unilever is one of the strongest global inflation pass-through machines in consumer staples. Its exposure to emerging markets, everyday necessities, and premium brands gives it resilience when growth diverges across regions.

2026 thesis: Strong pricing power + global diversification + improving operational discipline after restructuring.

8. Procter & Gamble (PG)

Dividend Yield: ~2.3–2.5%

Procter & Gamble monetizes daily necessities. Its global brand portfolio allows it to pass through inflation without sacrificing demand, preserving margins and dividends even in economic downturns.

2026 thesis: PG is not exciting, and that is precisely its value.

9. Broadcom (AVGO)

Dividend Yield: ~1.9–2.1%

Broadcom combines semiconductor scale with recurring software revenue. Management has demonstrated a clear commitment to aggressive dividend growth, often delivering double-digit increases.

2026 thesis: Lower yield today, but among the fastest-growing income streams in the market.

10. Microsoft (MSFT)

Dividend Yield: ~0.6-0.8%

Microsoft’s (MSFT) dividend is small, but its growth is exceptional. Cloud computing, enterprise software, and AI infrastructure generate extraordinary free cash flow, much of which is returned to shareholders.

2026 thesis: Over a full cycle, Microsoft often outperforms higher-yield stocks through dividend growth and capital appreciation combined.

What Actually Makes a “Best” Dividend Stock in 2026

Yield alone is insufficient. The most successful dividend investors focus on:

Free cash flow coverage, not accounting earnings

Balance-sheet flexibility, especially refinancing risk

Dividend growth, which preserves purchasing power

Management discipline, not payout marketing

High yield without durability is not income; it is deferred capital loss.

Frequently Asked Questions (FAQ)

1. What makes a dividend stock “safe” for 2026?

A safe dividend stock is one with strong and recurring free cash flow, a conservative payout ratio, and a balance sheet that does not rely heavily on refinancing. Companies with pricing power, non-cyclical demand, or long-term contracts tend to offer the most dependable dividends.

2. Are high-yield dividend stocks risky in 2026?

High yields are not inherently risky, but they require closer scrutiny. Elevated yields can signal financial stress, declining earnings, or excessive leverage. In 2026, the most reliable high-yield stocks are those whose dividends are covered by cash flow even under conservative economic assumptions.

3. Is dividend growth more important than dividend yield?

Over long periods, dividend growth often matters more than initial yield. Companies that consistently raise dividends help protect investors from inflation and typically deliver stronger total returns than static high-yield stocks with little growth.

4. How do interest rates affect dividend stocks?

Higher interest rates increase borrowing costs and raise competition from fixed-income assets. Dividend stocks with strong balance sheets and low debt are better positioned in this environment, while highly leveraged companies face greater risk to their payouts.

5. Should dividend stocks be part of a growth portfolio?

Yes. Dividend stocks are not mutually exclusive with growth investing. Many high-quality companies offer modest yields today but deliver strong dividend growth and capital appreciation over time, making them valuable components of a long-term growth strategy.

6. How diversified should a dividend portfolio be?

A well-diversified dividend portfolio should span multiple sectors such as healthcare, consumer staples, energy, real estate, and technology. Diversification helps reduce income volatility and protects against sector-specific risks that could disrupt dividend payments.

Conclusion

The best dividend stocks for 2026 are not those advertising the highest yields, but those that treat dividends as a disciplined capital-allocation decision rather than a marketing tool.

These are businesses that generate genuine free cash flow, protect their balance sheets through economic stress, and return capital to shareholders with consistency and intent. In a market environment shaped by higher financing costs and uneven growth, that discipline is what separates durable income from fragile payouts.

In the next market cycle, success will not come from chasing yield, but from owning quality businesses that can sustain and grow their dividends regardless of market conditions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.