Drawdown Definition

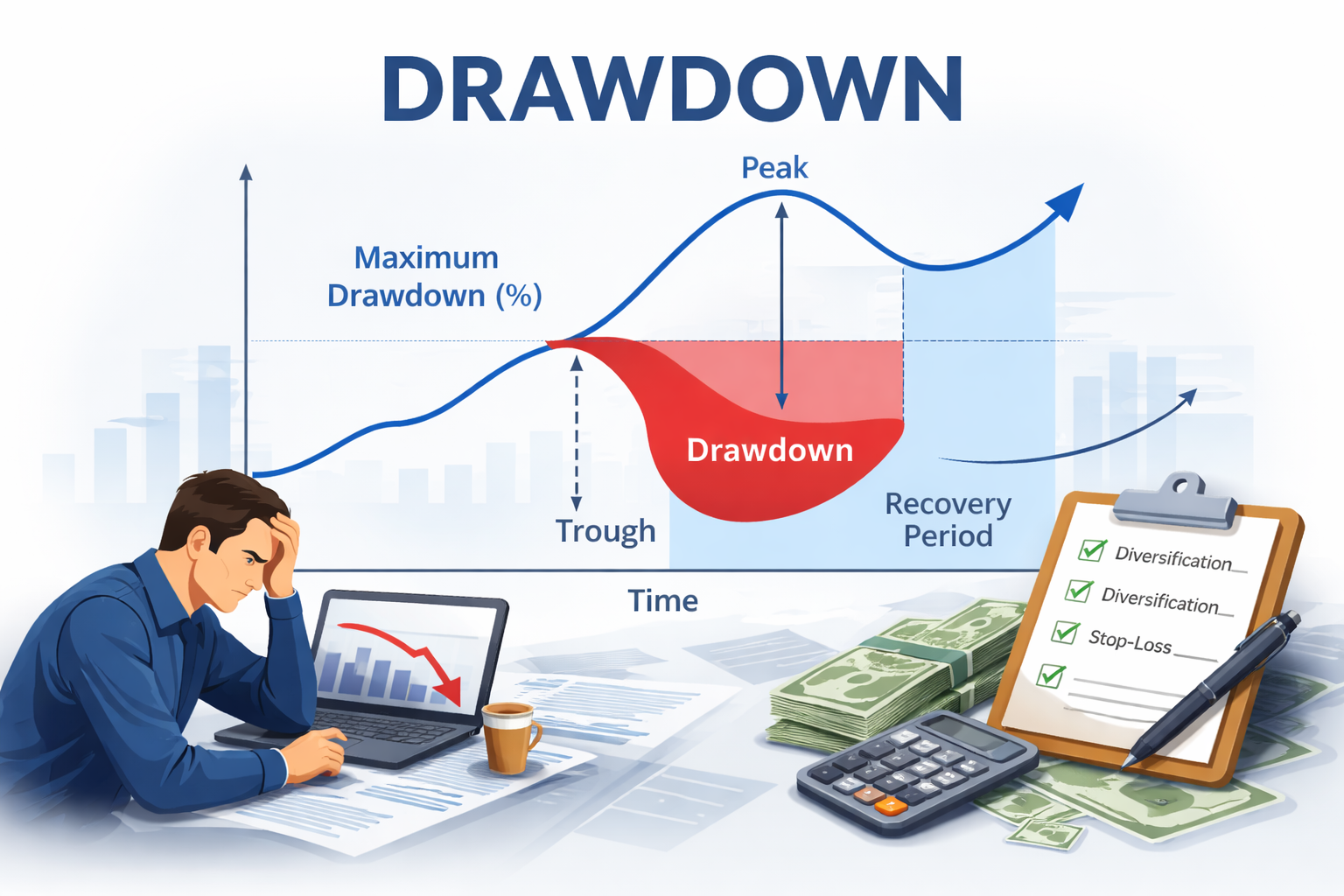

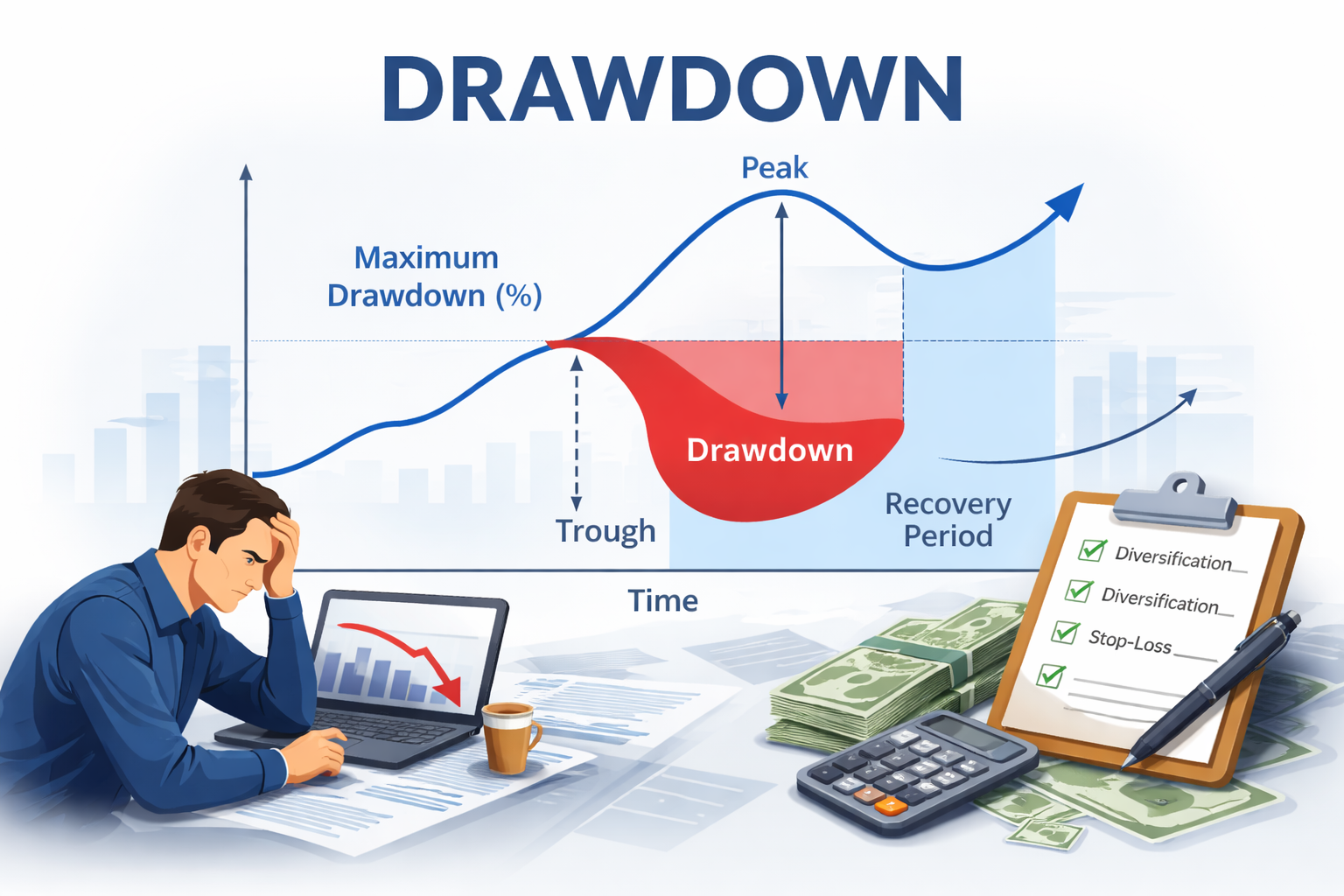

In investing and risk management, drawdown is a critical concept that measures how much an investment or portfolio has declined from a historical peak. Whether you're a seasoned trader or a beginner investor, understanding drawdown helps you assess risk, set expectations, and build resilience into your strategies.

In simple terms, a drawdown shows the maximum loss an investment has suffered during a specific period before recovering to a new high. It tells you not just that losses occur, but how deep they go.

Drawdown: The Basics

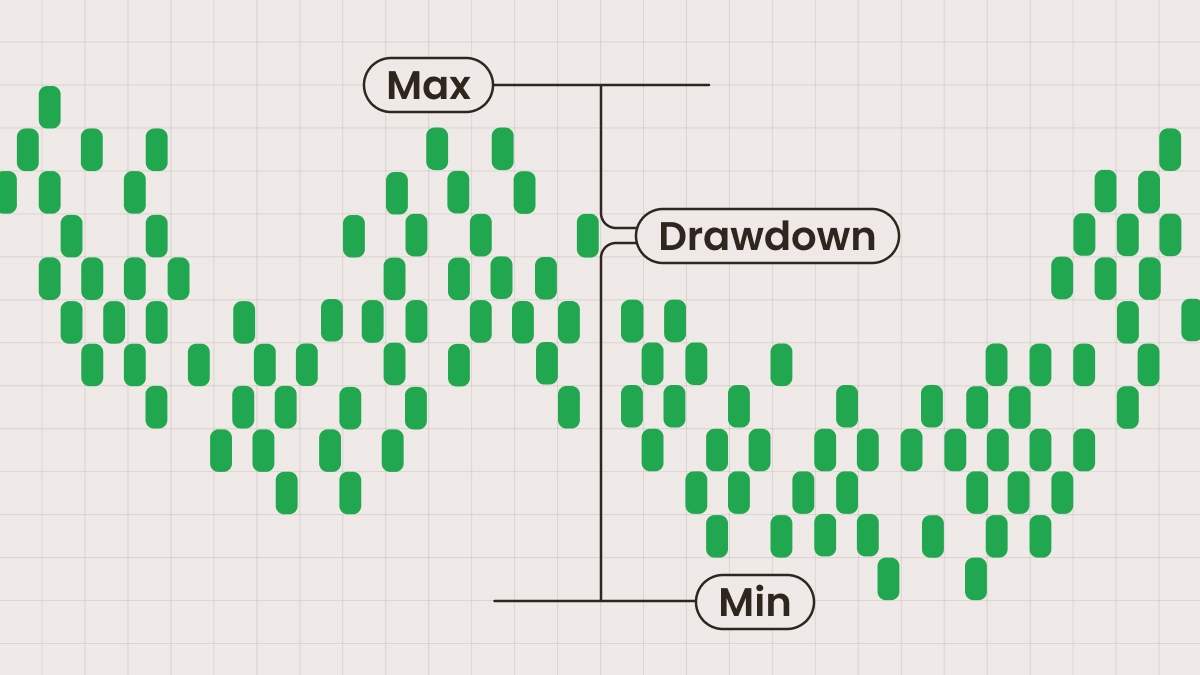

A drawdown is typically expressed as a percentage and reflects the decline from a peak value to a subsequent trough (lowest point) over a given period.

Formula:

A simplified and clearer way to present the formula is:

Drawdown (%) = (Trough Value ÷ Peak Value − 1) × 100

Or, in plain words:

Drawdown (%) = Percentage drop from the peak to the lowest point

A negative drawdown represents a decrease, but for simplicity, we often show drawdowns as positive percentages indicating loss magnitude.

Why Drawdowns Matter

Understanding drawdowns helps investors in several ways:

Risk Assessment: It shows how much capital could be at risk in adverse conditions.

Performance Evaluation: Two funds may have similar returns, but the one with smaller drawdowns likely has more stable performance.

Investor Psychology: Large drawdowns can trigger emotional selling, harming long-term returns.

Past performance doesn’t predict future results, but drawdown history provides insight into how volatile an investment can be.

Types of Drawdowns

There are several ways investors categorise drawdowns:

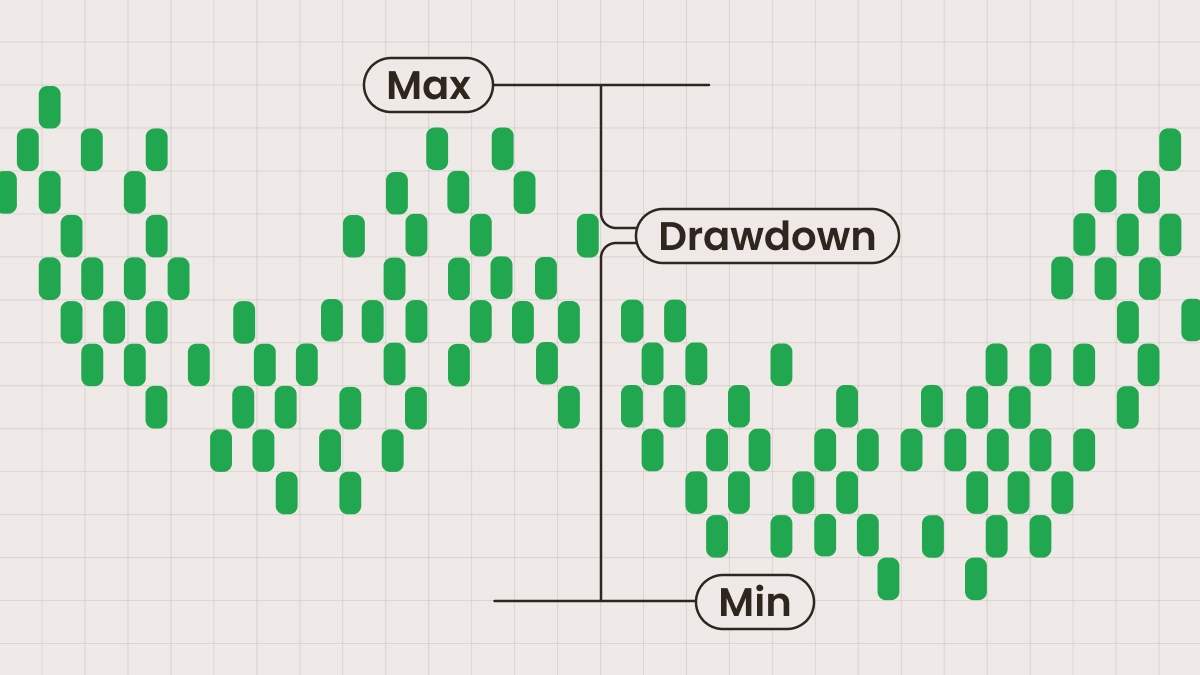

a. Peak-to-Trough Drawdown

This is the most common measure; it tracks the decline from the highest value to the lowest value before a recovery.

b. Maximum Drawdown (Max DD)

The maximum observed drawdown over the entire life of an investment or strategy. This is widely used in performance reporting.

c. Relative vs Absolute Drawdown

Absolute Drawdown measures the drop from the initial investment value.

Relative Drawdown measures the drop from the highest value reached.

d. Drawdown Duration

This captures the length of time it takes from peak to recovery. A short drawdown might recover quickly, while a long one could take years.

Example: Calculating Drawdown

Let’s say you invest in a fund:

| Date |

Portfolio Value |

| Jan 1 |

$100,000 |

| Mar 1 |

$120,000 |

| Jun 1 |

$90,000 |

| Sep 1 |

$95,000 |

| Dec 31 |

$125,000 |

Step 1 — Peak to Trough:

Peak: $120,000 (Mar 1)

Trough: $90,000 (Jun 1)

Drawdown = (90,000 ÷ 120,000 − 1) × 100 = −25%

This means the portfolio experienced a 25% drawdown before recovery.

5. Drawdown vs. Other Risk Metrics

It’s helpful to compare drawdowns with other risk measures:

| Risk Measure |

What It Shows |

| Drawdown |

% loss from peak to bottom |

| Volatility (Std Dev) |

How much returns fluctuate |

| Value at Risk (VaR) |

Estimated loss over a timeframe with confidence level |

| Beta |

Sensitivity to market movements |

Unlike volatility, which measures dispersion of returns, drawdown reflects actual losses experienced, which is arguably more intuitive for many investors.

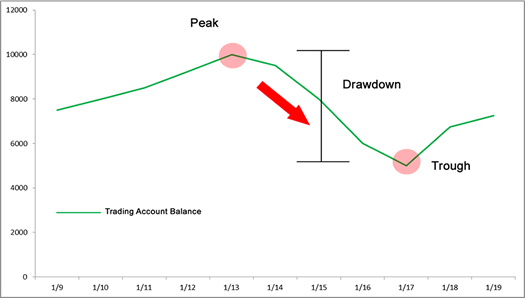

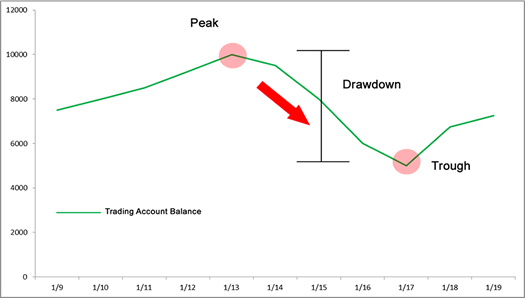

Drawdown Chart (Example)

A typical drawdown chart shows portfolio value and decline periods:

In this chart, the dip between 13 January and 16 January shows the drawdown period.

Drawdown Duration Table

| Period |

Peak Date |

Trough Date |

Recovery Date |

Drawdown % |

Duration (Months) |

| 2023 Cycle |

Jan 2023 |

Apr 2023 |

Aug 2023 |

18% |

7 |

| 2024 Cycle |

Feb 2024 |

May 2024 |

Nov 2024 |

22% |

9 |

Typical Drawdown Patterns by Asset Class

Different investments show differing drawdown behavior:

| Asset Class |

Typical Drawdown Range |

Notes |

| Cash / Money Market |

~0–2% |

Very low risk |

| Government Bonds |

~1–10% |

Stable, low drawdowns |

| Equities (Stocks) |

~10–50% |

Can be volatile |

| Crypto Assets |

~30–90% |

High risk/high return |

| Hedge Funds |

~5–30% |

Varies by strategy |

These are general ranges — actual drawdowns can differ based on market conditions.

How to Manage Drawdowns

Managing drawdowns is a fundamental element of risk management:

a. Diversification

Spreading capital across uncorrelated assets tends to smooth out drawdowns.

b. Stop-Loss Orders

Automated exit triggers can limit losses, though they might also increase trading costs.

c. Position Sizing

Limiting exposure to any one asset reduces individual drawdown impact.

d. Risk Controls

Using risk budgets and monitoring metrics can prevent excessive drawdown exposure.

e. Systematic Rebalancing

Regularly adjusting the portfolio back to target weights helps lock in gains and manage risk.

Drawdown and Compounding: Why Losses Hurt More Than Gains Help

One of the most overlooked aspects of drawdown is its asymmetric impact on returns. Losses require disproportionately larger gains to recover, which directly affects long-term compounding.

For example:

| Drawdown (%) |

Gain Needed to Break Even |

| 10% |

11.1% |

| 20% |

25% |

| 30% |

42.9% |

| 40% |

66.7% |

| 50% |

100% |

A portfolio that experiences a 50% drawdown must double just to return to its previous peak. This mathematical reality explains why controlling drawdowns is often more important than chasing high returns.

From a compounding perspective, smaller drawdowns allow capital to stay productive, enabling steady growth over time rather than repeated recovery cycles.

Drawdown in Trading vs Long-Term Investing

Drawdown is interpreted differently depending on the strategy horizon:

a. Short-Term Trading

Traders expect frequent but controlled drawdowns

Emphasis is placed on maximum drawdown limits

A strategy may be paused or stopped once a predefined drawdown threshold is reached

In trading systems, drawdown often determines capital allocation and whether a strategy remains viable.

b. Long-Term Investing

Drawdowns are typically less frequent but deeper

Long-term investors focus on the drawdown recovery time

Market cycles and macroeconomic conditions play a larger role

For long-term investors, drawdowns are often accepted as part of market participation, provided the underlying fundamentals remain intact.

Behavioral Finance and Drawdown Risk

Drawdowns are not just financial events — they are psychological stress tests. Common behavioral responses during drawdowns include:

Loss aversion: Investors feel losses more intensely than gains

Panic selling: Exiting positions near market bottoms

Recency bias: Assuming recent losses will continue indefinitely

Overtrading: Attempting to “win back” losses quickly

These behaviors can amplify drawdown impact and turn temporary declines into permanent capital loss.

Successful investors often pre-plan their response to drawdowns, including:

Acceptable loss thresholds

Time horizons for recovery

Rules for rebalancing or staying invested

Regulatory and Professional Use of Drawdown Metrics

In professional finance, drawdown is widely used by:

Fund managers to report risk-adjusted performance

Institutional investors to evaluate mandates

Risk committees to enforce capital preservation rules

Many investment mandates include:

Maximum allowable drawdown limits

Automatic risk reduction triggers

Capital protection mechanisms once drawdowns exceed thresholds

This underscores the drawdown’s role not just as an analytical metric, but as a governance and control tool.

Drawdown vs Recovery: Why Time Matters

Two investments can have identical maximum drawdowns but very different investor experiences.

Example:

Investment A: 25% drawdown, recovers in 4 months

Investment B: 25% drawdown, recovers in 3 years

While the numerical drawdown is the same, Investment A is far more manageable psychologically and financially. This is why sophisticated investors evaluate:

Maximum drawdown

Average drawdown

Drawdown duration

Time to recovery

Together, these metrics provide a fuller picture of downside risk.

Using Drawdown as a Decision-Making Tool

Rather than viewing drawdown purely as a negative outcome, experienced investors use it proactively:

To compare strategies with similar returns

To determine appropriate position sizing

To align investments with personal risk tolerance

To stress-test portfolios under adverse conditions

In this way, drawdown becomes a strategic compass, guiding smarter, more resilient investment decisions.

Pro Tips / Expert Insights

Investors often under-estimate psychological drawdown.

A 20% drawdown doesn’t just represent capital loss — it tests discipline. Many investors sell at the bottom, locking in losses. Systems that include pre-defined recovery plans tend to outperform emotionally driven decisions.

Expert Insight #1:

Maximum drawdown should always be evaluated alongside return. A strategy with 15% returns but a 50% max drawdown may be less attractive than one with 12% returns and a 20% max drawdown.

Expert Insight #2:

Drawdown duration matters. A 20% drop that recovers in 3 months is psychologically easier to manage than the same drawdown over 3 years.

FAQ Section

1. What is the difference between a drawdown and a loss?

A loss can occur over any period, while a drawdown specifically measures the decline from a previous high to a low point before recovery.

2. Is drawdown a good measure of risk?

Yes, because it reflects real losses experienced, not just theoretical volatility.

3. Can you eliminate drawdowns entirely?

No. All risky assets experience drawdowns, but you can manage them through diversification and risk controls.

4. What is a maximum drawdown?

It’s the largest observed drawdown over the life of an investment strategy.

5. How does drawdown affect long-term returns?

Large drawdowns can hurt compounded returns because your capital base must recover losses before growing again.

6. Are drawdowns the same in all markets?

No. Bear markets, volatility spikes, and illiquid assets can produce deeper and longer drawdowns.

The Importance Of Understanding Drawdown

Drawdown is more than a statistic; it’s a lens through which investors gauge risk, resilience, and strategy robustness. While returns attract attention, understanding drawdowns helps you tolerate market swings, make smarter allocation choices, and safeguard your portfolio against emotional and financial stress.

Whether you’re building long-term wealth or managing short-term trades, mastering drawdowns equips you with a powerful framework for risk-aware investing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.