Wendy’s (WEN) shares recently traded near $7.27, near a 52-week low and approaching levels last seen in early 2020. The company is scheduled to release its fourth-quarter and full-year 2025 results before the US market opens on Friday, February 13, 2026.

The near-term stock move is unlikely to be decided by a single-quarter earnings-per-share (EPS) print. Investor focus is more likely to be on US (United States) traffic stabilisation and whether Project Fresh can improve unit economics enough to rebuild confidence in 2026 guidance.

The evidence so far has been unfavourable. Wendy’s posted three straight quarters of negative US same-restaurant sales in 2025, with sequential weakening through Q3. At the same time, management has signalled that underperforming restaurants are dragging down system results, prompting closures, operational simplification, and a sharper capital-allocation stance.

Wendy’s (WEN) Stock Q4 Forecast

Wendy’s will report Q4 and full-year 2025 results before the market opens on Friday, February 13, 2026. The Company will host a conference call at 8:30 a.m. ET (Eastern Time), with a simultaneous webcast on its investor relations website.

| Metric |

Q1 2025 |

Q2 2025 |

Q3 2025 |

| Total revenue ($m) |

523.5 |

560.9 |

549.5 |

| Adjusted EBITDA ($m) |

124.5 |

146.6 |

138.0 |

| Adjusted EPS ($) |

0.20 |

0.29 |

0.24 |

| Global same-restaurant sales |

-2.1% |

-2.9% |

-3.7% |

| US same-restaurant sales |

-2.8% |

-3.6% |

-4.7% |

The headline numbers will matter less than directionality in comps, margins, and the tone of 2026 guidance. A simple way to frame the debate is to compare 2025’s trend lines with management’s comments on Q4 momentum and the 2026 outlook.

Q1 to Q3 actuals are from company releases. For Q4, consensus estimates vary across data providers, so it is safer to treat any single number as directional and update it close to publication.

Guidance credibility is the key sensitivity. In August 2025, Wendy’s updated its full-year outlook to global systemwide sales down 3% to 5%, adjusted EPS $0.82 to $0.89, and adjusted EBITDA $505 million to $525 million. Investors will listen for whether Q4 commentary suggests stabilisation, or another step down.

Wendy’s (WEN) Recent Performance (1W, 1M, 6M)

| Timeframe |

Performance |

| 1W (5 trading days) |

-9.58% |

| 1M |

-14.47% |

| 6M |

-28.09% |

Key Overview: WEN’s recent price action reflects pronounced risk-averse sentiment. The stock has been under persistent selling pressure across short and medium timeframes ahead of the Q4 report.

The six-month trend matters because it suggests the market has been steadily marking down expectations, not just reacting to a single headline. For the Q4 report, that raises sensitivity to any change in the US comp trajectory and to the credibility of the 2026 outlook.

Why Wendy’s Stock Is Sliding Into Earnings

Wendy’s approaches its fourth-quarter results with market expectations already reflecting a challenging outlook.

The recent decline in share price is less due to a sudden loss of confidence in the brand and more to an earnings model reliant on comparable sales, which is now facing weaker US traffic, diminished operating leverage, and uncertainty about the timing of business stabilisation.

1) The US business is shrinking while profitability is becoming more fragile.

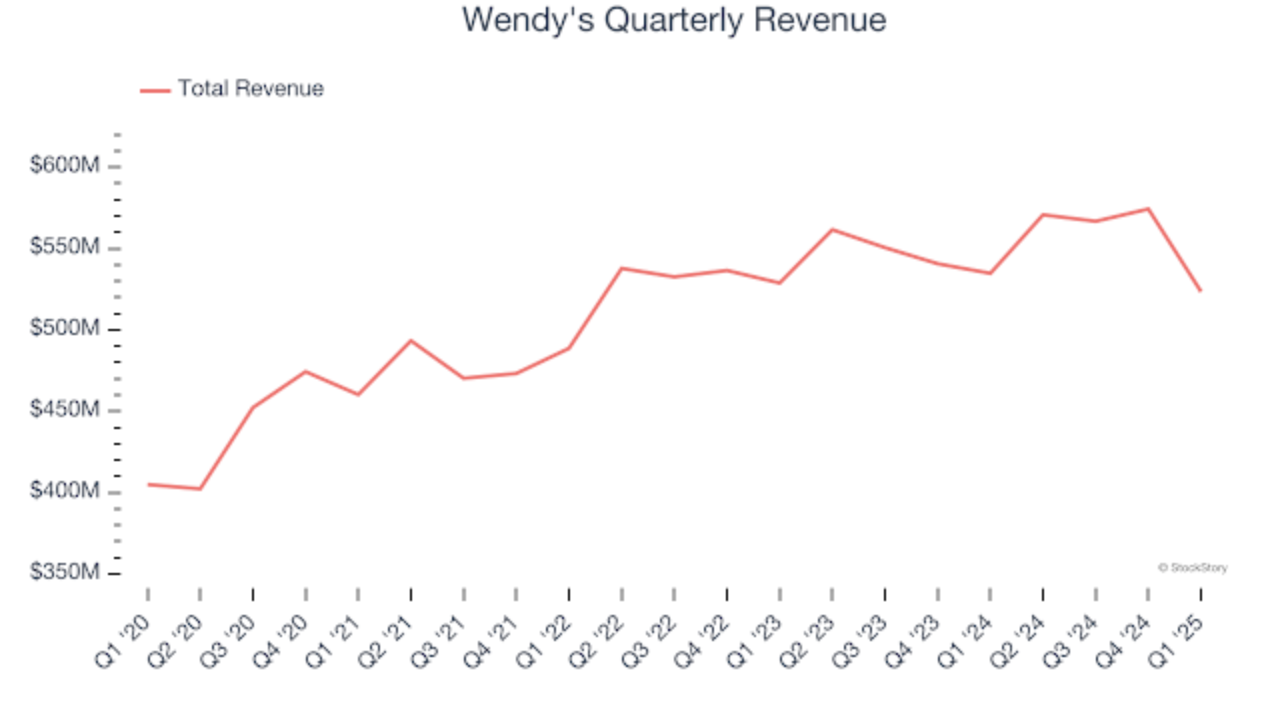

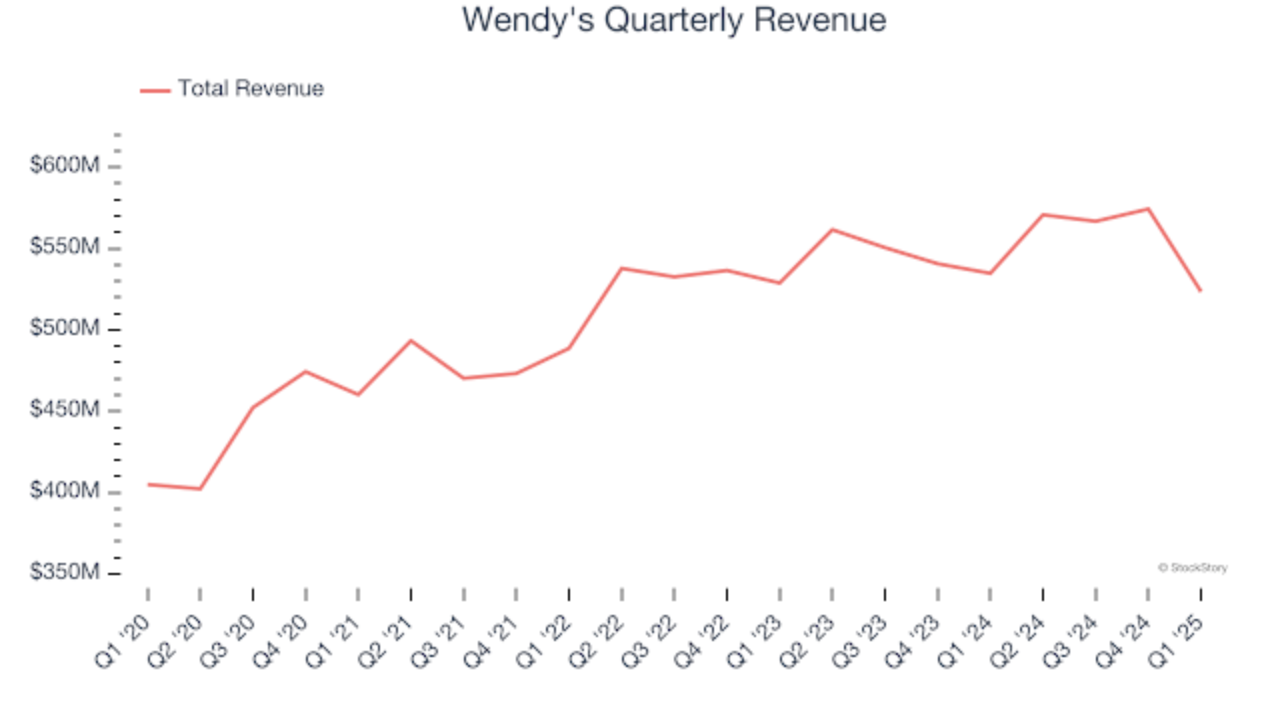

In Q3 2025, total revenue fell 3.0% year on year to $549.5 million, US same-restaurant sales declined 4.7%, and adjusted EPS eased to $0.24. The deeper issue is that negative comps are not isolated to a weak promo window. They reflect broad demand softness that is pressuring both franchisee sales and company-operated store results.

When sales decline, the system loses its capacity to offset increases in labor, occupancy, and ingredient costs. This dynamic renders the earnings base more sensitive to minor fluctuations in customer traffic and average transaction value.

2) Margins are weakening faster than earnings.

US company-operated restaurant margins compressed to 13.1%, a more concerning signal than the EPS move, as it points to deteriorating store-level economics. EPS can be buffered in the short term by buybacks, timing, or non-operating items. Restaurant margin cannot.

A decline in margins typically indicates a loss of fixed-cost leverage, as fewer transactions are distributed across unchanged staffing, rent, and utility expenses. This trend also suggests that increased promotional activity may not be generating profitable traffic, a common risk in the late stages of the fast-food business cycle, when consumers reduce spending but remain selective.

3) The deterioration has been consistent across 2025.

Q1 revenue declined to $523.5 million with US same-restaurant sales down 2.8%. Q2 revenue declined to $560.9 million with US same-restaurant sales down 3.6%, while global same-restaurant sales fell 2.9%.

The progression of results is significant: the market may overlook a single quarter of negative comparable sales if management demonstrates sequential improvement.

However, multiple consecutive quarters of deteriorating US comparable sales indicate that the brand is losing momentum at a time when investors seek evidence of restored pricing power and customer traffic relevance.

4) Negative comps hit Wendy’s harder than many peers.

A meaningful share of Wendy’s economics comes from royalties and franchise fees, which depend on system sales and franchisee profitability, so that traffic pressure can cascade into weaker system health. When franchisees see unit-level pressure, they pull back on reinvestment, remodel cadence, and incremental development.

This dynamic can undermine the brand revitalisation narrative and prolong the timeline for increasing average unit volumes. Weak comparable sales not only reduce current-period earnings but can also impede the operational momentum necessary for future growth and modernization.

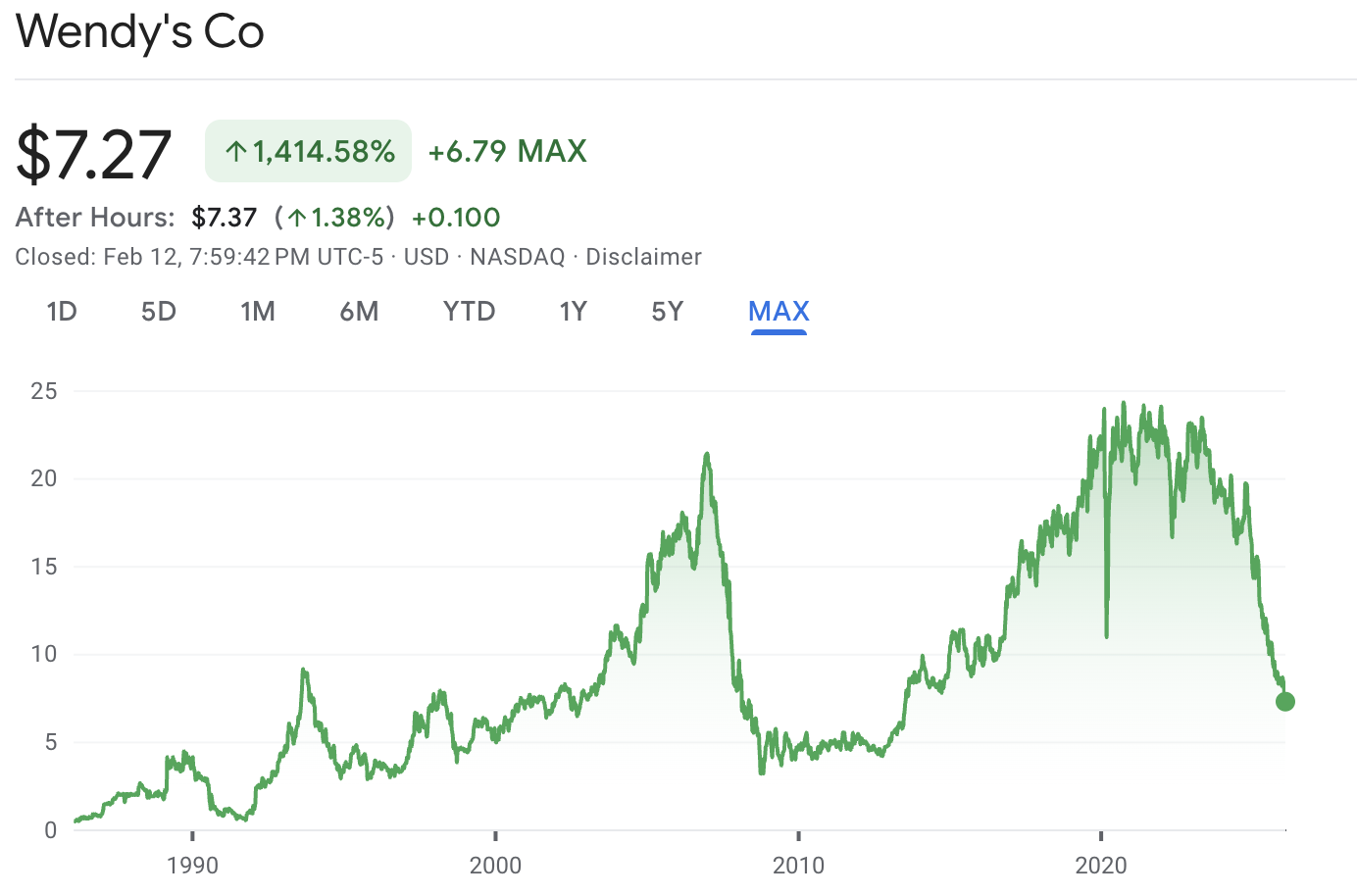

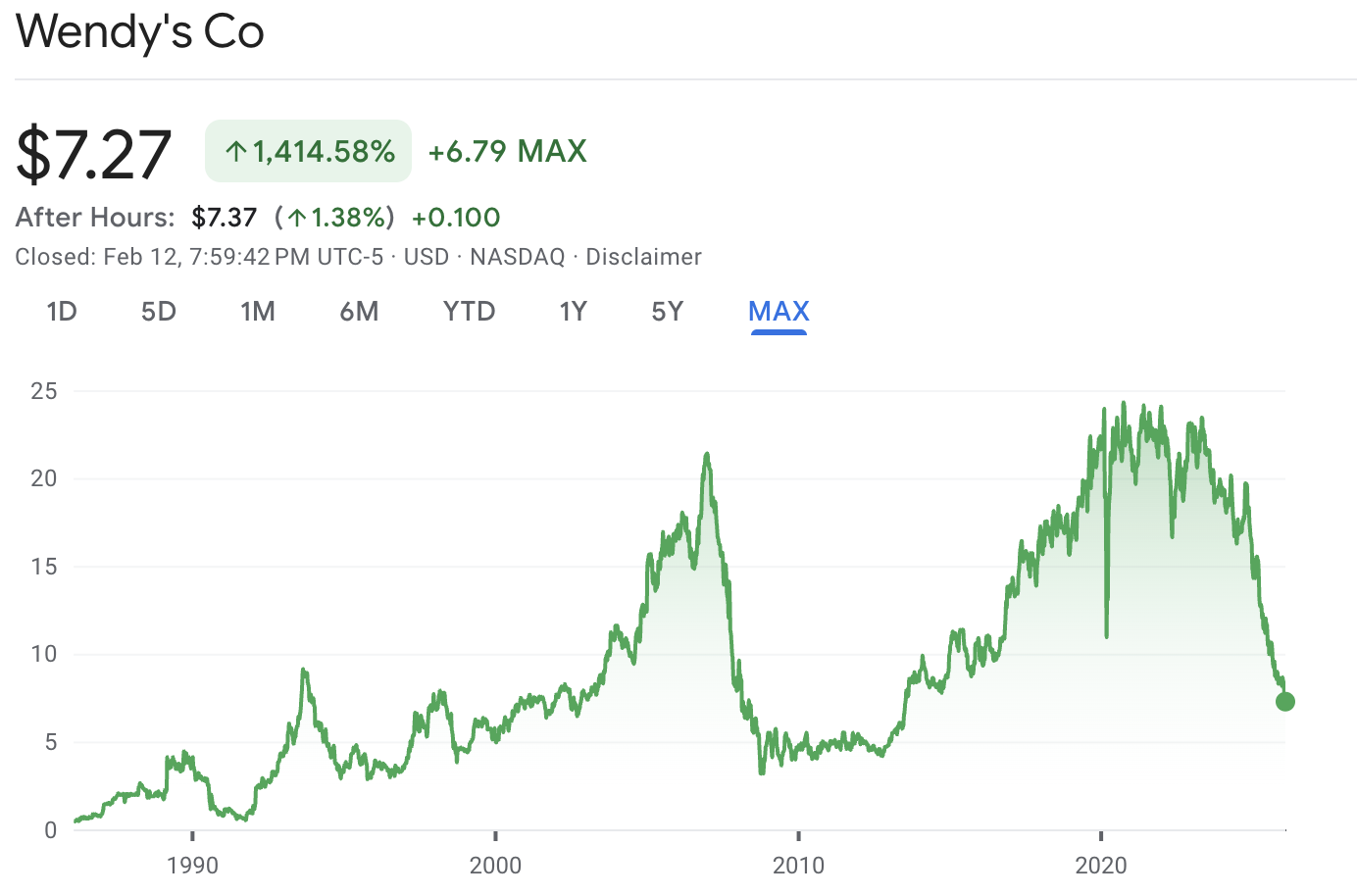

5) The chart is signaling “stress-level” expectations.

Wendy’s shares reached a low of $6.82 in March 2020. With WEN currently trading near this level, the market is interpreting the present challenges in traffic, value perception, and operational execution as comparable in severity to those experienced during the pandemic.

From a technical perspective, this situation establishes a high-risk environment, as investors view these historic lows as a critical threshold before a potential further downward revaluation.

Project Fresh: What Has to Work, and What Can Go Wrong

Project Fresh is intended to streamline operations across the system. Management has structured the initiative around four pillars: brand revitalization, operational excellence, system optimization, and capital allocation.

Closures are the most immediate, and most sensitive lever. Wendy’s has said it expects to close a mid-single-digit percentage of its US restaurants starting in Q4 2025, and it closed 240 restaurants in 2024.

System pruning can boost average unit volumes and franchisee profitability, but it can also signal a negative trend if investors interpret it as a demand retreat rather than optimisation. Q4’s disclosure on timing and expected benefits will shape how the market prices the risk.

Operational simplification is a potential catalyst. Management has highlighted the need to improve marketing effectiveness and elevate the customer experience in the US, and a clearer, less complex value message can support that effort.

If a reduction in promotions enhances drive-thru throughput and order accuracy, improvements in both sales and labor productivity may materialize rapidly. Conversely, if simplification diminishes perceived value at an inopportune time, it could further reduce customer traffic.

Capital Returns and Positioning: Why The Reaction Can Be Sharp

Wendy’s currently pays a quarterly dividend of $0.14 per share, equivalent to $0.56 on an annualised basis. However, the dividend was previously reduced from $0.25 to $0.14 per share, reinforcing that capital returns sit behind the turnaround plan and balance sheet priorities.

Share repurchases have helped support EPS despite weak sales performance. Wendy’s repurchased 8.2 million shares for $124.1 million in the first quarter and 4.8 million shares for $61.9 million in the second quarter. Should reinvestment requirements increase under Project Fresh, the pace of buybacks may decline, shifting focus toward operating execution.

Elevated short interest can be a catalyst for volatility. If stabilisation signals become credible, short covering can accelerate upside moves, a dynamic often linked with a short squeeze. Conversely, conservative guidance can reinforce momentum-driven selling.

Technical Levels That Traders Are Watching

If you use technical analysis, focus on a few common daily indicators and verify the latest values on your charting platform, since readings can change quickly and can differ by data provider.

WEN technical analysis table (daily)

| Indicator (daily) |

What to check |

Why it matters |

| Share price (reference) |

Price vs recent support zones |

Helps frame downside risk if support breaks |

| RSI (14) |

RSI below 30 or above 70 |

Often used to flag oversold or overbought conditions |

| MACD (12,26) |

MACD below or above its signal line |

A common momentum gauge |

| SMA 20 / SMA 50 / SMA 200 |

Price above or below key averages |

Often used to judge trend direction across time horizons |

| ATR (14) |

ATR elevated relative to price |

Indicates wider daily swings, which affects position sizing |

Indicator calculations and thresholds can vary by data source. Verify settings (lookback period, session, and adjusted prices) before acting on any signal.

Frequently Asked Questions (FAQ)

1) When will Wendy’s report Q4 earnings?

Wendy’s plans to release fourth-quarter and full-year 2025 results before the US market opens on Friday, February 13, 2026, followed by an 8:30 a.m. ET (Eastern Time) call and webcast.

2) Why is WEN stock near a six-year low?

Investors are reacting to persistent negative US same-restaurant sales, weaker store-level margins, and reduced confidence in guidance. The stock is also approaching an early-2020 price zone, which some traders treat as a major psychological support area.

3) What is Project Fresh by Wendy’s?

Project Fresh is Wendy’s turnaround framework, built around brand revitalisation, operational excellence, system optimisation, and capital allocation, with an emphasis on fixing unit economics and execution.

4) Could short covering fuel a spike higher?

Short interest can amplify volatility around earnings. If 2026 guidance convincingly improves the US comp trajectory, short covering can accelerate rallies, and if guidance disappoints, moves lower can extend quickly.

Conclusion

Wendy’s (WEN) stock currently reflects investor judgement on management’s execution capabilities. While fourth-quarter results are important, the primary determinant of valuation will be whether management can demonstrate stabilisation in US traffic, reduce operational complexity, and improve system economics through the closure plan without diminishing brand presence. If these positive signals are evident, existing bearish positioning could amplify a revaluation. In the absence of such evidence, a break below $7 can keep pressure on the stock as traders test lower support zones.

If these positive signals are evident, existing bearish positions could amplify a positive revaluation. In the absence of such evidence, a decline below $7 may drive the stock toward support levels last seen during the pandemic.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

1) Wendy's Q1 2025

2) Wendy's Q3 2025