A high yield alone doesn't make a REIT ETF the best for dividends. Real stability comes from diversification, strong underlying balance sheets, and clear, low fees that protect your income.

With higher rates, consistent dividends matter more than recent payouts.

REIT payouts compete with yields from cash and bonds. In January 2026, the U.S. 10-year Treasury approached 4 per cent, raising required returns and making stable dividends more valuable than slightly higher, riskier yields.

7 Best REIT ETFs for Dividends Now

Yields and assets are noted as of now because REIT distributions depend on property fundamentals, special dividends, and index rebalances.

| ETF (Ticker) |

Portfolio style |

AUM / Net assets (as of) |

Expense ratio |

Holdings |

Distribution frequency |

Yield measures shown |

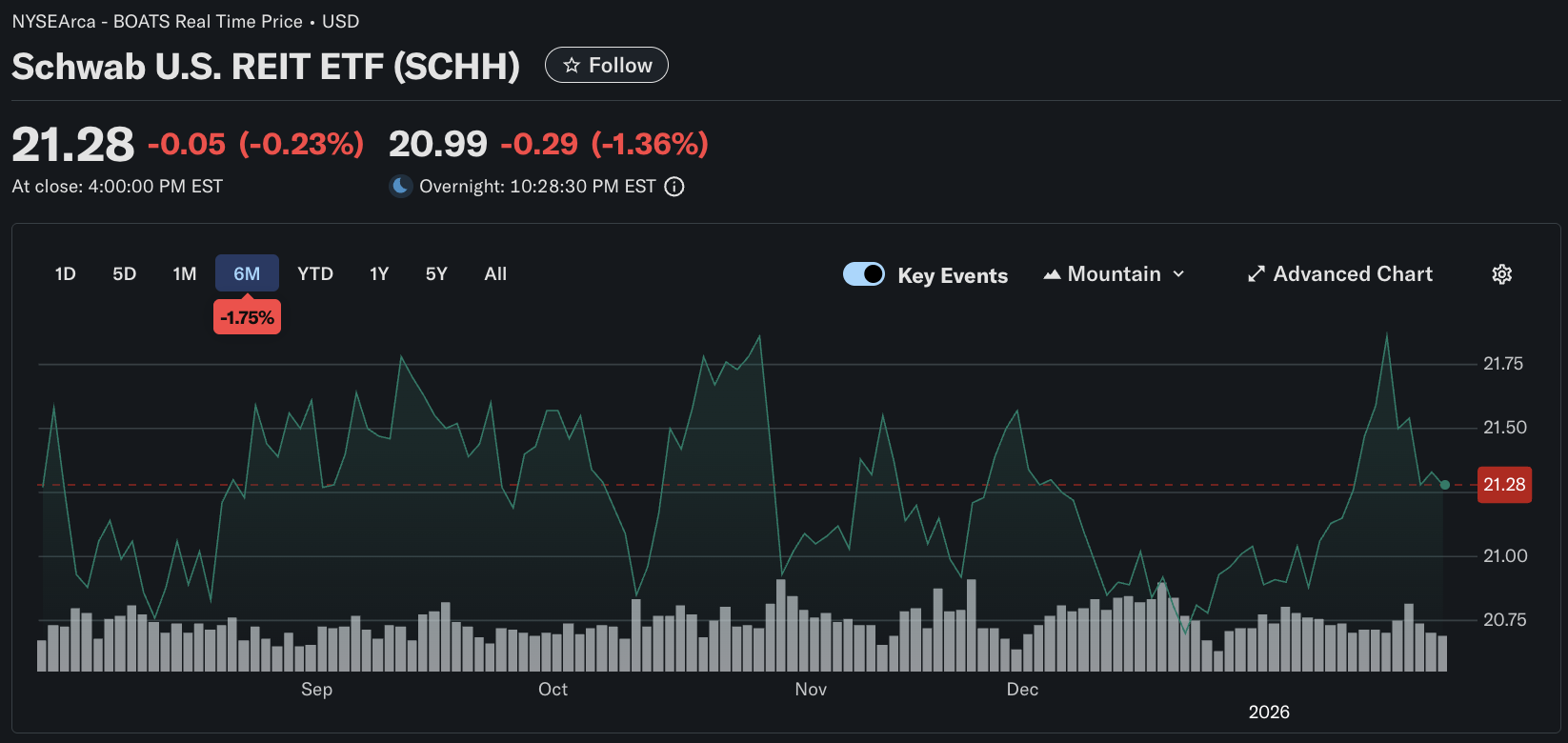

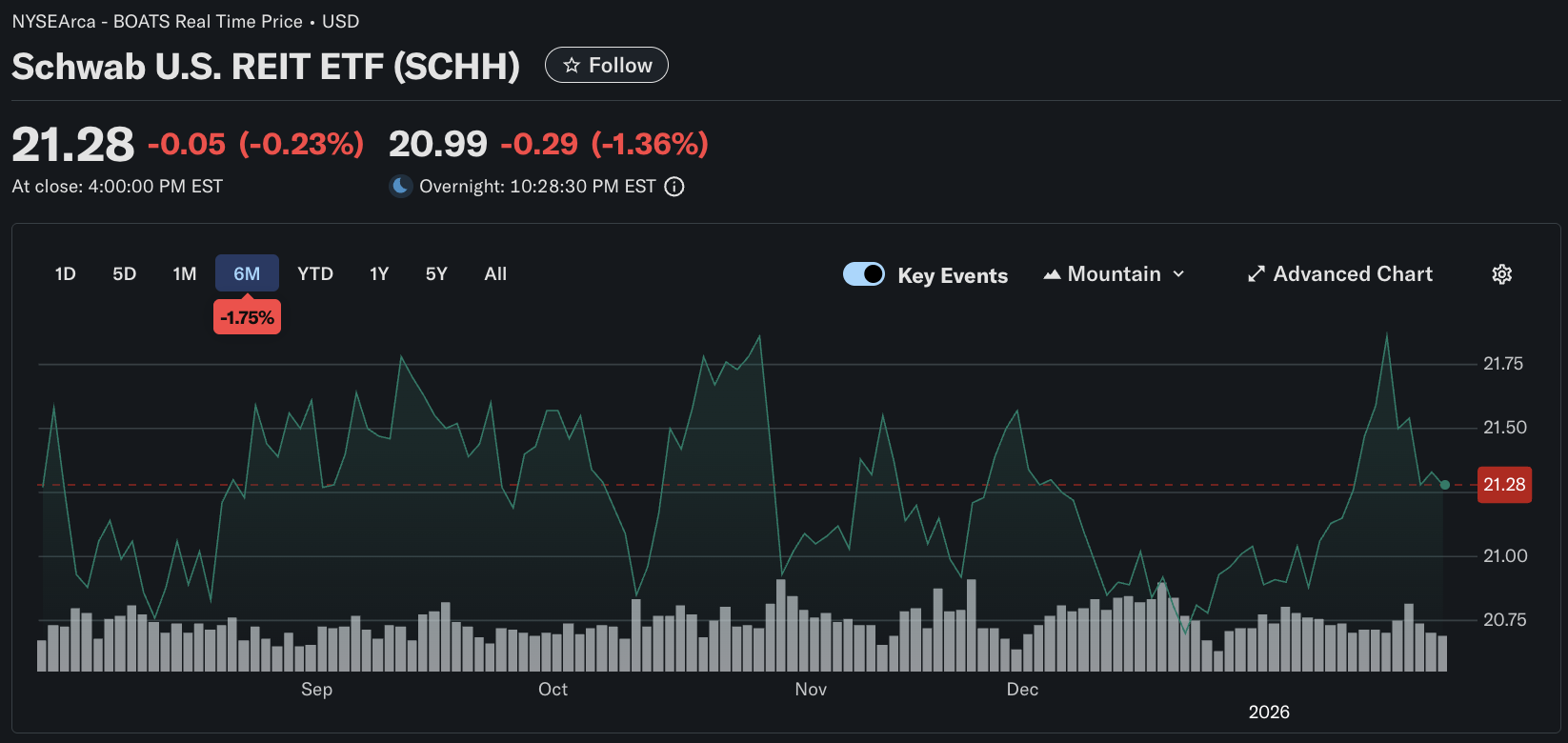

| Schwab U.S. REIT ETF (SCHH) |

Broad U.S. equity REITs, low fee |

$9.03B |

0.07% |

123 |

Quarterly |

SEC yield 3.54% (01/23/2026); TTM distribution yield 3.04% (12/31/2025) |

| Vanguard Real Estate ETF (VNQ) |

Broad real estate equities |

$34.68B |

0.13% |

165 |

Quarterly |

Dividend yield 3.84% (TTM shown on overview) |

| iShares Core U.S. REIT ETF (USRT) |

REIT-pure core index |

$3.30B |

0.08% |

131 |

Quarterly |

SEC yield 3.26% (12/31/2025); 12m trailing yield 3.07% (12/31/2025) |

| Fidelity MSCI Real Estate Index ETF (FREL) |

Broad U.S. real estate index |

~$1.10B |

0.08%–0.084% |

142 |

Quarterly |

30-day SEC yield 3.25% (12/31/2025); yield ~3.56% (snapshot) |

| SPDR Dow Jones REIT ETF (RWR) |

Broad REIT exposure, higher fee |

$1.70B |

0.25% |

- |

-

|

Fund distribution yield 3.70% (365-day measure) |

| Real Estate Select Sector SPDR (XLRE) |

S&P 500 real estate sector slice |

$7.11B |

0.08% |

31 |

Quarterly |

30-day SEC yield 3.44% (01/23/2026) |

| Invesco KBW Premium Yield Equity REIT ETF (KBWY) |

Yield-weighted small/mid REITs |

$265.2M |

0.35% |

32 |

Monthly |

Dividend yield 9.44% (TTM shown on overview) |

1) SCHH: Schwab U.S. REIT ETF

Yield: Approximately 2.9% to 3.04%.

SCHH is notable for its combination of scale, a very low expense ratio, and broad equity-REIT exposure. The fund’s 0.07 per cent fee supports greater cash flow compounding, and its 3.54 per cent SEC yield remains competitive without reliance on concentrated or financially stressed holdings.

This approach is compelling for those who want stable REIT income.

2) USRT: iShares Core U.S. REIT ETF

Yield: Approximately 3.07%

USRT tracks a REIT-focused benchmark and includes 131 holdings, providing a diversification profile that helps smooth dividend distributions across property types.

The fund’s 3.26 per cent SEC yield and 3.07 per cent trailing yield offer meaningful income without requiring excessive credit or small-cap risk.

3) VNQ: Vanguard Real Estate ETF

Yield: Approximately 3.83% to 3.92%

VNQ is among the most widely held real estate ETFs, with $34.68 billion in assets and 165 holdings. Its 3.84 per cent dividend yield is attractive for a broadly diversified product, and its scale typically results in tight trading spreads and efficient index tracking.

If you want liquidity and broad coverage, VNQ is a complete solution.

4) FREL: Fidelity MSCI Real Estate Index ETF

Yield: Approximately 3.5% to 3.6%

FREL offers diversified real estate index exposure, a low fee, and a yield that does not indicate financial distress. Its 30-day SEC yield of 3.25 per cent suggests that income is generated from ongoing portfolio cash flow rather than from one-time distributions.

The main trade-off is FREL’s smaller size, which matters more for large trades than for long-term investors.

5) XLRE: Real Estate Select Sector SPDR

Yield: Between 3.30% and 4.13%

XLRE represents a sector allocation within the S&P 500 rather than a comprehensive REIT market portfolio. This design increases exposure to the largest and most liquid real estate companies but also raises concentration risk, as evidenced by its 31 holdings and a 3.44 per cent SEC yield.

XLRE works for those seeking blue-chip real estate in an equity portfolio, but it does not offer the most stable dividends.

6) RWR: SPDR Dow Jones REIT ETF

Yield: Around 4.83%

RWR’s 3.70 per cent distribution yield looks compelling, but its 0.25 per cent gross expense ratio is meaningfully higher than today’s low-cost cores. Over long horizons, that fee spread can absorb a material share of the income advantage, especially when REIT total returns are modest.

RWR can work if you want specific tracking, exposure, or easier trading, but it is less cost-efficient.

7) KBWY: Invesco KBW Premium Yield Equity REIT ETF

KBWY’s 9.44 per cent headline yield is paired with 32 holdings and a yield-weighted approach that tends to pull the portfolio toward smaller, higher-yielding REITs. This is the opposite of stability-first design.

KBWY can supplement a portfolio for those willing to accept dividend volatility and price swings for more income. It is rarely the best choice for a core REIT ETF dividend holding.

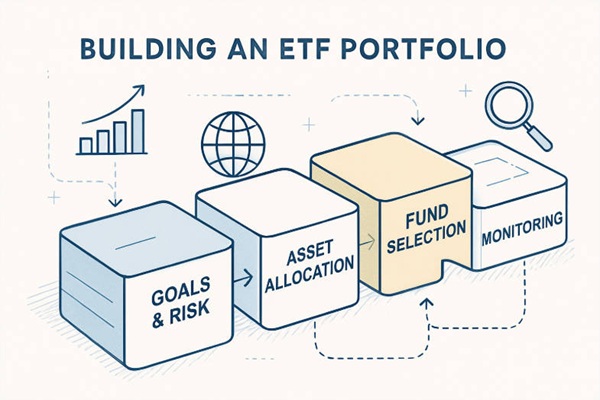

A Practical Way To Balance a Portfolio

A dividend-focused REIT portfolio works best with a core-satellite structure:

Core (70–90 per cent of your REIT allocation): Select one or more broad, low-fee funds like SCHH, USRT, VNQ, or FREL. These serve as the portfolio's foundation, prioritising diversification, lower costs, and consistent dividends to ensure stable REIT income.

Satellite (0–30 per cent): Consider adding a targeted REIT ETF only if you understand the additional risk. For example, XLRE tilts your portfolio to larger companies, while KBWY increases yield and risk by investing in smaller, high-yield REITs.

Rebalancing, not ticker selection, drives stability. REITs can swing sharply with rates. Regularly rebalance to capture this volatility and keep your income allocation from becoming a large interest-rate bet.

Risks That Can Break Dividend Stability In REIT ETFs

Refinancing risk and rate sensitivity: REITs are inherently sensitive to both the level and direction of interest rates, as property values and capital costs are influenced by long-term yields. With the policy rate upper bound at 3.75 per cent in late January 2026, balance-sheet strength remains a critical consideration.

Property-cycle dispersion: The real estate sector encompasses diverse business types. Data centres, apartments, offices, and shopping centres may experience different market cycles simultaneously. Broadly diversified funds mitigate this risk, while narrow or yield-weighted funds may concentrate it.

Dividend optics: REIT dividend streams may be irregular. Special distributions, changes in taxable income, and portfolio adjustments can cause trailing yields to appear more favourable than the forward income run rate. Comparing the SEC yield with the 12-month trailing yield provides a more accurate assessment than relying on a single metric.

Frequently Asked Questions (FAQ)

1) What is the best REIT ETF for dividends if I only want one fund?

A stability-oriented investor chooses a broad, low-cost core like SCHH, USRT, or VNQ. SCHH has a low fee and a competitive SEC yield; VNQ offers large scale and a strong trailing yield. The best choice depends on whether you want pure REIT exposure (USRT) or broader real estate equities (VNQ).

2) Is a higher dividend yield always better in REIT ETFs?

No. A very high yield often means higher leverage, weaker tenants, or concentration in small REITs. KBWY’s high yield comes with bigger drawdowns and less predictable payouts.

3) What is the difference between SEC yield and distribution yield?

Distribution yield summarises income paid over the last 12 months. SEC yield standardises recent net income for easier comparison. These may differ when payouts fluctuate rapidly.

4) Are REIT ETF dividends “safe”?

REIT dividends are not guaranteed. They may fall if rent growth slows, occupancy drops, or refinancing gets expensive. Diversify and avoid distressed REITs for more dividend stability, but you can’t eliminate all risks.

5) How are REIT ETF dividends taxed?

Many REIT distributions are not qualified dividends and often get taxed as ordinary income. They can also include return of capital. Tax treatment depends on your location and account type. Check how REIT ETFs fit your tax situation.

6) Should dividend investors use a sector slice like XLRE instead of a broad REIT ETF?

XLRE suits those wanting large-cap real estate within an S&P 500 approach, but its concentration means less stable dividends. Broad funds generally deliver more reliable dividends across property types.

Conclusion

The best REIT ETF for dividends delivers dependable income, not just a yield spike. With high policy rates and a 4 per cent Treasury yield, stability is driven by diversification, low fees, and clear yield analysis between past and projected income.

For most investors, the stability-focused shortlist is clear: SCHH and USRT are efficient, diversified core options; VNQ remains a liquid flagship with an attractive trailing yield; and FREL offers a credible, low-cost alternative.

Higher-yield options such as KBWY may enhance income, but should be used only as intentionally sized satellite positions where volatility is anticipated.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.