Stop Loss Definition

A stop loss is one of the key tools traders and investors use to manage risk and protect capital in financial markets. It provides a way to automatically sell or buy an asset when it reaches a pre-determined price.

Understanding stop loss orders is essential to reducing unexpected losses and guarding against emotional decision-making.

Stop loss orders are widely used in stocks, forex, commodities, and cryptocurrency trading. This article will explain what stop loss means, the different types, how it works, the benefits, limitations, and best practices to help both beginners and experienced traders.

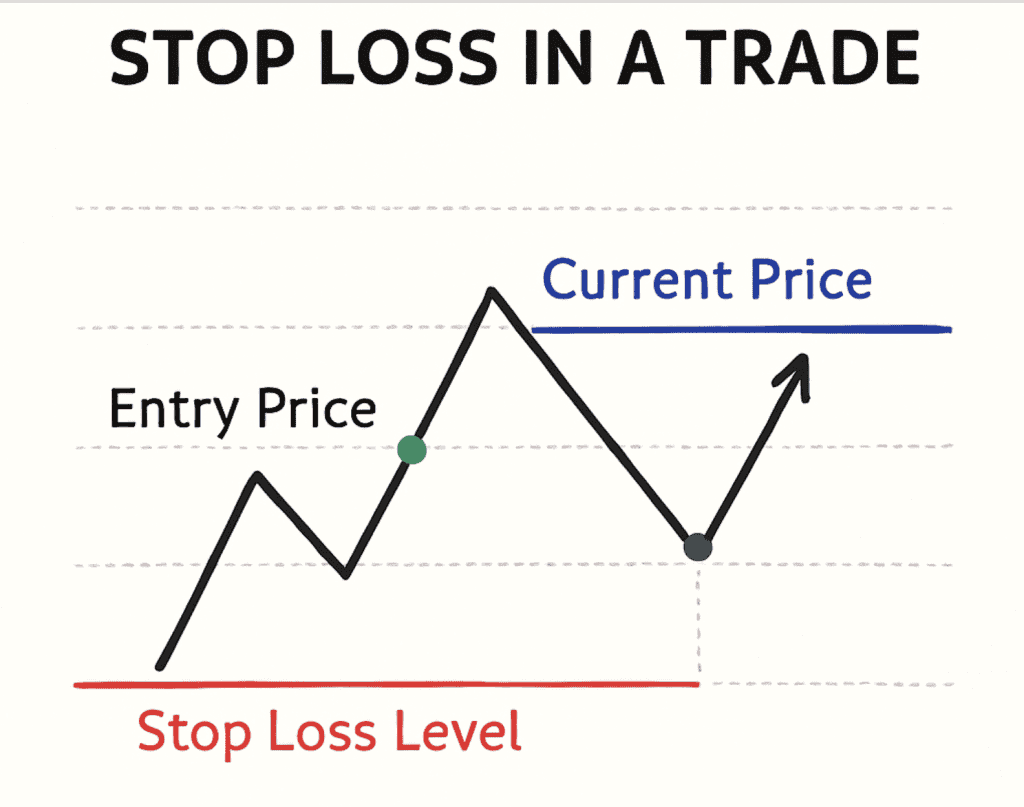

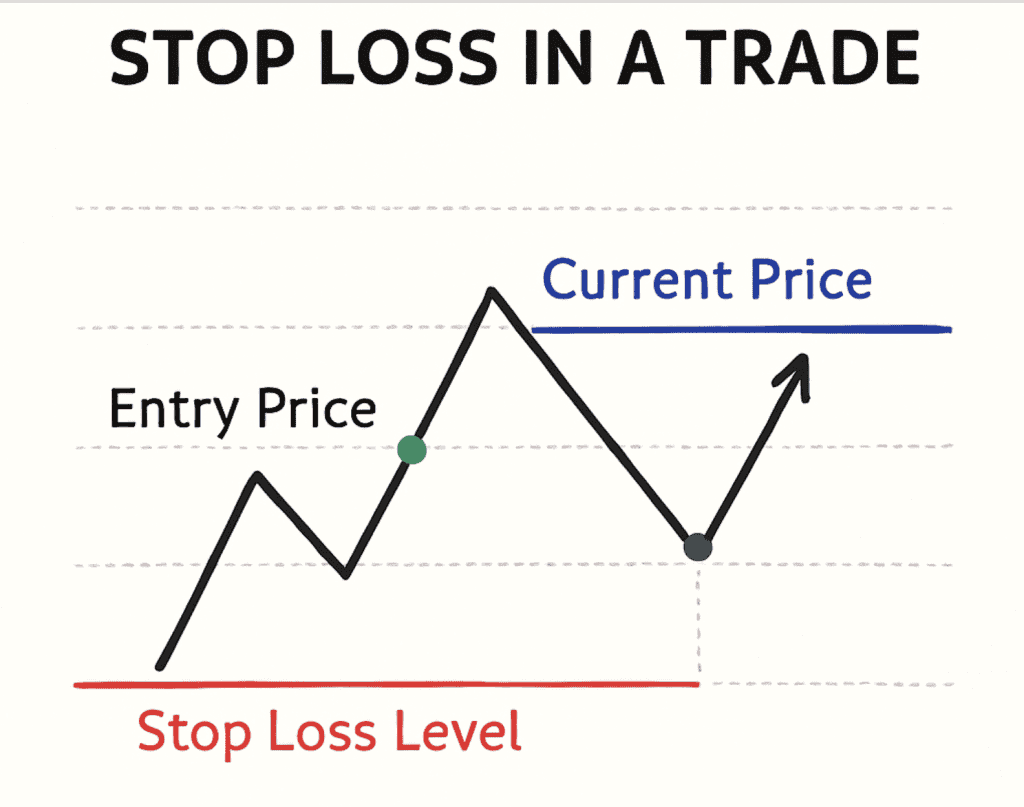

The Mechanics Of A Stop Loss

A stop loss order is an instruction placed with a broker to buy or sell a security once its price reaches a specific level. If the price moves unfavourably, the order triggers and closes the position at the next available market price. The primary aim is to prevent further loss beyond a level that a trader is unwilling to accept.

Stop loss is not a guarantee of execution at the exact price specified. In fast-moving markets, the actual execution price may differ from the stop price. This difference is known as slippage. While stop loss orders are powerful risk management tools, traders must understand how price gaps and volatility can affect outcomes.

Stop loss orders are common in all markets. For example, if you buy a share at $100 and set a stop loss at $90, the stop loss order will trigger a sale if the share falls to $90 or lower. This means you exit the trade before larger losses accumulate.

Different Forms Of Stop Loss

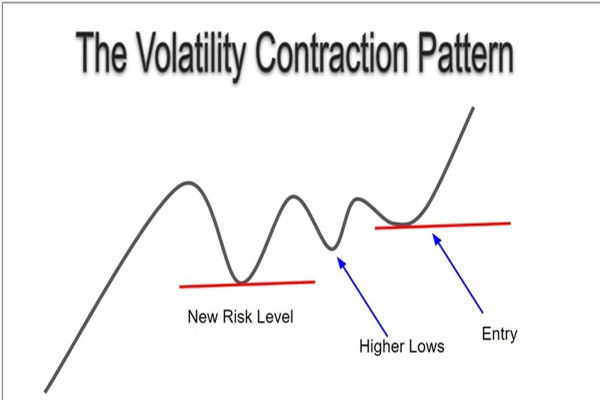

Stop loss orders come in different forms. The most basic type is a standard stop loss. Traders may also use trailing stop loss orders, which adjust dynamically as the price moves in their favour. Trailing stops offer flexibility because they allow profit protection while still providing downside protection.

In forex trading, stop loss orders are vital because the market can move rapidly in response to economic news. Without a stop loss, a small unfavourable movement can escalate into significant losses. For leveraged positions, the risk is even higher because leverage amplifies both gains and losses.

Stop loss orders can be placed for any asset that is traded through an exchange or broker. These orders remain in effect until they are triggered or until the trader cancels them. Some brokers may allow time limitations, like day orders that expire at the end of the trading session. Others may offer good-until-cancelled orders that stay active indefinitely.

Fundamental Principles of Stop Loss Orders

One of the fundamental principles behind stop loss orders is risk management. Every trade should have a plan, including how much capital to risk and where to place protective orders. Traders often determine stop loss levels based on technical analysis, such as support and resistance levels, chart patterns, or volatility indicators.

Traders who fail to use stop loss orders may find themselves holding losing positions far longer than planned. This can lead to emotional decision-making, where hope rather than strategy drives choices. Implementing a stop loss encourages discipline and helps keep a trading plan intact.

Stop loss orders can also help protect profits. As a trade moves into profit, a trailing stop loss can be adjusted upward, locking in gains while still allowing room for the trade to develop further. This systematic approach reduces the need for constant manual monitoring.

Despite their advantages, stop loss orders have limitations. In highly volatile markets, prices can swing widely, triggering stop losses before reversing in a favourable direction. This is known as being stopped out prematurely. Traders should be mindful of setting stop levels too tightly, which can lead to frequent exits from trades that may have otherwise recovered.

Liquidity conditions can also affect stop-loss execution. Thin markets with low trading volume can cause larger gaps between bid and ask prices. In such cases, the execution price may be significantly different from the stop price. Understanding market conditions is important for the effective use of stop loss orders.

Differences Between Stop Loss Orders And Limit Orders

Stop loss orders are different from limit orders, which are designed to execute trades at a specified price or better. A stop loss order becomes a market order once triggered and executes at the best available price. This means execution is generally fast but not guaranteed at the exact stop price.

Traders must also be aware of how their broker implements stop loss orders. Some brokers may offer guaranteed stop loss orders for an additional fee. These orders promise execution at the exact stop price, even if the market gaps. Such features can be valuable in volatile environments but come at a cost.

Risk management is about more than just placing a stop loss. Traders should assess position sizing, risk-to-reward ratios, and overall portfolio exposure. A stop loss should be part of a broader risk management strategy that considers the trader’s goals, time horizon, and market conditions.

The Rule Of Thumb

New traders sometimes place stop loss orders based on arbitrary percentages. A common rule of thumb is to risk only a small percentage of capital on any single trade. While this can be a helpful starting point, it is better to base stop loss levels on market structure and price behaviour rather than fixed percentages alone.

Professional traders often use charts and technical analysis to find logical stop loss placements. For example, placing a stop loss just below a key support level can protect while allowing the trade room to fluctuate within normal market noise.

Stop loss orders can also be used when selling short. In a short sale, a trader borrows an asset and sells it, hoping to buy it back at a lower price. A stop loss in this context is placed above the entry price to limit losses if the price rises instead of falling.

The Psychological Benefits of Using Stop Loss Orders

There are psychological benefits to using stop loss orders. Knowing that a risk-control mechanism is in place helps reduce anxiety during trading. Traders can focus on analysis and strategy without constant worry about sudden market moves.

In addition to individual traders, institutional participants use stop loss orders. Fund managers, hedge funds, and proprietary trading desks incorporate stop losses within automated trading systems. These systems execute orders based on predefined rules without human intervention.

While stop loss orders are essential, they are not the only risk control tools available. Traders might also use take profit orders, which automatically close a position at a target gain. Combining stop loss and take profit orders helps define the trade’s risk-reward parameters before execution.

Market Rules And Conditions

Stop loss orders are also subject to market rules and conditions. Some markets may have price limits or circuit breakers that temporarily halt trading during extreme volatility. Traders should understand these mechanisms as they affect order execution.

Learning how to set stop loss levels takes practice. Traders often backtest strategies on historical data to find effective stop placements. Paper trading, or simulated trading environments, allows traders to experiment with stop loss orders without risking real capital.

An effective stop loss strategy considers both the trader’s risk tolerance and the asset’s price behaviour. Highly volatile assets may require wider stop losses to avoid being stopped out by normal price swings. Less volatile assets may allow tighter stops.

Balancing Risks And Opportunity

Technology has made placing and adjusting stop loss orders easier. Most trading platforms allow traders to set stop loss levels at the time of entering a trade. Some platforms also offer visual tools and alerts to help manage orders.

Using stop loss orders aligns with a disciplined trading approach. Rather than reacting emotionally to price fluctuations, traders rely on predetermined parameters. This disciplined approach can improve long-term performance and help manage drawdowns.

Despite their benefits, stop loss orders should not be treated as a guarantee of protection. Unexpected news, economic events, or market disruptions can cause prices to gap beyond stop levels. Traders should always remain vigilant and use stop loss orders as part of comprehensive risk management.

Successful traders learn to balance risk and opportunity. Stop loss orders help define the risk side of the equation. By combining stop loss orders with solid analysis, traders can create a structured approach to trading that supports consistent decision-making.

Pro Tips

Expert traders recommend placing stop loss levels based on technical levels rather than on emotion or guesswork. Use tools such as moving averages, support and resistance, and volatility measures to find logical stop points. Avoid setting stop losses too close to the current price action.

Be mindful of wider market conditions. Economic announcements, earnings reports, and geopolitical events can drive volatility. Adjust stop loss levels or reduce position sizes ahead of major events to protect capital.

Use a stop loss as part of a complete plan. Define your entry, stop loss, and take profit before entering a trade. This removes uncertainty and helps you follow your strategy with discipline.

Related Terms

Take Profit: A take profit order automatically closes a trade once a predetermined profit level is reached. It helps traders lock in gains without needing to monitor the market constantly, balancing risk and reward alongside a stop loss.

Risk–Reward Ratio: This measures how much a trader is willing to risk compared to the potential profit of a trade. For example, risking $100 to make $300 gives a 1:3 ratio, helping traders assess whether a trade is worth taking before placing a stop loss.

Trailing Stop: A trailing stop is a dynamic stop loss that moves in the trader’s favour as the price advances. It allows profits to run while still protecting against sudden market reversals without manually adjusting the stop level.

Support and Resistance: These are price levels where the market historically tends to pause or reverse. Traders often place stop losses just below support or above resistance to avoid being stopped out by normal market fluctuations.

Position Sizing: Position sizing determines how large a trade should be based on account size and risk tolerance. Proper sizing ensures that even if a stop loss is triggered, the loss remains manageable and does not significantly impact the trading account.

FAQ Section

1. What is a stop loss?

A stop loss is an order placed with a broker to sell or buy a security when it reaches a specific price. Its purpose is to limit potential losses by closing the position once the price moves unfavourably.

2. How does a stop loss order work?

A stop loss becomes a market order when the set stop price is reached. It executes at the next available price to close the position and limit further losses.

3. Can stop loss guarantee execution at my price?

No. Regular stop loss orders do not guarantee execution at the stop price. In volatile markets, price slippage may occur, meaning execution happens at the best available price.

4. What is the difference between stop loss and trailing stop loss?

A stop loss is fixed and triggers at a set price. A trailing stop loss adjusts automatically as the price moves in your favour, helping protect gains while still limiting downside.

5. Should beginners use stop loss orders?

Yes. Stop loss orders help manage risk and prevent large losses. They encourage discipline and reduce the emotional impact of trading decisions, especially for new traders.

Summary

Stop loss orders are essential risk management tools for anyone trading financial markets. They help protect capital by automatically closing positions when prices move against expectations. While stop loss orders do not guarantee execution at a specific price, they provide a systematic way to limit loss and reduce emotional decision-making.

Understanding the types of stop loss orders, their benefits, and their limitations allows traders to use them effectively. Whether you are new to trading or experienced, incorporating stop loss orders as part of a wider strategy is key to managing risk and pursuing long-term success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.