Gold and silver are not creeping higher. They are breaking records in a way that forces every portfolio manager to make a decision.

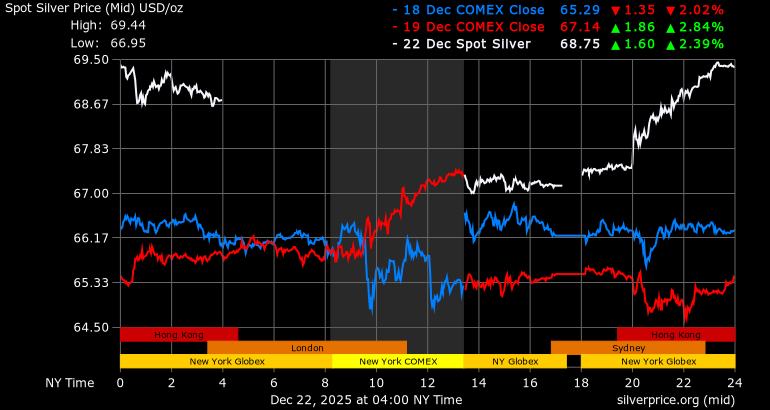

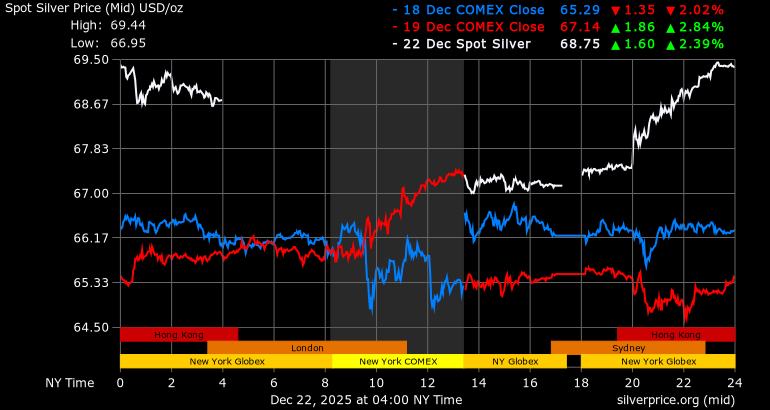

Today, spot gold is priced at a new high of $4,420, while spot silver surged to a peak of $69.44, driven by expectations of further rate cuts, a weaker dollar, and a fresh wave of safe-haven demand linked to geopolitical and trade tensions.

This move is not just a momentum headline. It is the market repricing of three forces simultaneously

A renewed safe-haven bid,

A clearer path to easier U.S. policy in 2026

A tighter physical backdrop for silver that is amplifying every macro impulse.

What Happened to Gold and Silver Prices Today?

Key Market Prints (Dec 22, 2025):

Gold (spot): hit a record $4,420, then traded around $4,410.

Silver (spot): hit an all-time high near $69.44.

Performance context: gold is up about 67% this year, while silver is up about 138% this year.

The Immediate Catalysts

Safe-haven positioning strengthened as geopolitical and trade tensions stayed elevated.

Rate-cut expectations for 2026 firmed, which matters because lower policy rates reduce the opportunity cost of holding non-yielding metals.

The dollar softened, making metals more affordable for non-U.S. holders and supporting momentum flows.

Why the Safe-Haven Demand Looks Different This Time?

Safe-haven rallies often fade when the macro story becomes single-threaded. Today's surge has more depth because financial conditions and structural demand are reinforcing it.

1) Risk Hedging Is Back in Fashion

When news becomes erratic, investors usually prioritise liquidity and portability, with precious metals ranking the highest.

Thus, today's gold and silver breakouts are explicitly linked to heightened safe-haven demand alongside geopolitical and trade tensions.

Some coverage also pointed to specific geopolitical flashpoints that raised near-term uncertainty. Even if those headlines cool, the market has already shown that dips are being treated as restocking opportunities rather than exits.

2) The Market Is Pricing an Easier Policy, Not Just "Lower Inflation"

The more important shift is that traders are no longer debating whether rates are restrictive. They are questioning how quickly policy will become less exclusive in 2026, as markets were expecting two rate cuts in 2026, which is consistent with a metals-friendly macro backdrop.

A practical way to see why that matters is to look at where yields have been sitting. The U.S. 10-year yield was recently around 4.1% based on the latest available market-day readings, which keeps the rates channel highly relevant to daily metals pricing.

3) The Dollar Is No Longer Fighting the Move

Gold and silver can increase in value alongside a strong dollar, but maintaining that momentum is more difficult. Today, the dollar has not been providing that headwind.

The U.S. Dollar Index (DXY) was around 98.59 on Dec 22, 2025, marginally lower than its highs.

A softer dollar does two things simultaneously:

It improves affordability for non-U.S. demand.

It promotes trend-following investments in commodities, as the currency exchange no longer hinders the trade.

4) Central Banks and Investors Remain Active

The World Gold Council reported that central bank net purchases totalled 53 tonnes in October, which was a strong month-on-month increase.

Additionally, the World Gold Council emphasised significant investment interest in 2025, featuring ETF inflows of +222 tonnes in Q3 2025, along with consistent demand for bar and coins.

Silver's Own Story: Supply Tightness + Industrial Demand

Silver is behaving like a high-beta version of gold, which is normal in late-stage precious-metals rallies. The difference in 2025 is that silver has had a supportive physical narrative underneath the momentum.

It is the perfect storm, including strong investment demand, speculative momentum, and continued supply deficits, with industrial demand tied to sectors such as AI data centres, solar, and electric vehicles.

Furthermore, the addition of silver to the U.S. critical minerals list supported its price strength and can shape the longer-term perception of strategic supply.

What Investors Are Actually Pricing Now

The simplest way to frame today's breakout is to separate the trade into two layers.

Layer 1: Macro Repricing

Rate cuts expected in 2026 support non-yielding assets.

A softer dollar removes a common headwind.

Geopolitical and trade tensions add an insurance premium.

Layer 2: Market Microstructure

Gold is in price discovery above a major psychological level ($4,400), which attracts trend systems and forces late hedging.

Silver is reacting more violently because it is already stretched, and volatility is part of the product.

Gold and Silver Technical Analysis

| Metric (Daily) |

Gold |

Silver |

What it implies |

| RSI (14) |

77.975 (Overbought) |

67.38 (Buy) |

Gold is extended; silver is strong but less stretched. |

| MACD (12,26) |

20.23 (Buy) |

0.769 (Buy) |

Momentum remains positive in both markets. |

| ADX (14) |

58.134 (Buy) |

57.884 (Buy) |

Trend strength is high, which often keeps dips shallow. |

| Stoch (9,6) |

78.158 (Buy) |

81.473 (Overbought) |

Both are elevated; silver is nearer short-term exhaustion. |

| Technical summary |

Strong Buy |

Strong Buy |

The bias stays upward until price breaks structure. |

The technical picture is bullish across both metals, although gold is showing overbought readings on several indicators.

Key Levels to Watch (Spot-Focused)

Because gold is making new highs, there is limited historical resistance overhead. Traders typically switch to psychological levels and pullback zones.

Gold (XAUUSD)

Resistance: $4,400 (record area), then $4,430 (near-term futures reference).

Support zones: $4,350–$4,360 (near-term pivot), then $4,300 (prior swing area referenced by recent pricing).

Silver (XAGUSD)

Resistance: $69.44 (record), then $70 (psychological).

Support zones: $66–$67 (previous record region last week), then $65 (round-number support).

What to Watch Next: The Drivers That Can Flip the Story

Fed communication and the 2026 cut path

The U.S. dollar trend

Geopolitics and trade policy headlines

Silver supply tightness

Frequently Asked Questions (FAQ)

1) Did Gold Hit an All-Time High Today?

Yes. Spot gold briefly traded at a new record of around $4,420 on Dec 22, 2025.

2) Did Silver Also Hit an All-Time High?

Yes. Spot silver reached an all-time high of around $69.44/oz today.

3) Why Is Silver Outperforming Gold in 2025?

Silver is supported by investment demand and a tighter physical backdrop, and it is also more sensitive to momentum flows because the market is smaller and less liquid.

4) Could We See Profit-Taking After Record Highs?

Yes. The risk of profit-taking, especially as year-end trading volumes thin, persists. That does not end the trend by itself, but it can create sharp pullbacks.

Conclusion

In conclusion, gold clearing $4,420 and silver reaching $69.44 reflects a market that is paying for insurance again, while also leaning into a more favourable rates environment for 2026.

From here, the most important question is not whether records can extend. The question is whether pullbacks are met with real buying. If gold holds above the breakout zone and the dollar remains soft, the uptrend can continue to grind higher.

If liquidity-driven profit-taking cracks key support levels, the longer-term setup may still be bullish, but late, leveraged entries are likely to get hit first.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.