Global stock markets appear to regain footing following last week's wild

swing, but shifts in broad landscape are drawing attention. The years started

with Wall Street profit-taking from popular tech names.

Small caps go back to the radar, which are poised to benefit from an upswing

in economic growth and falling interest rates. The Russell 2000 has gained 6.4%

this year, while the Nasdaq 100 stayed in the red.

More exposed to local market, shareholders of those companies closely watch

hiring gauges. US job growth significantly picked up in January, supported by

fewer layoffs in some seasonal industries.

Economists said the Trump administration's trade and immigration policies

have chilled the labour market, though tax cuts are seen to boost hiring this

year. That may lead to acceleration of prices.

SMEs typically carry higher debt loads and hence more sensitive to interest

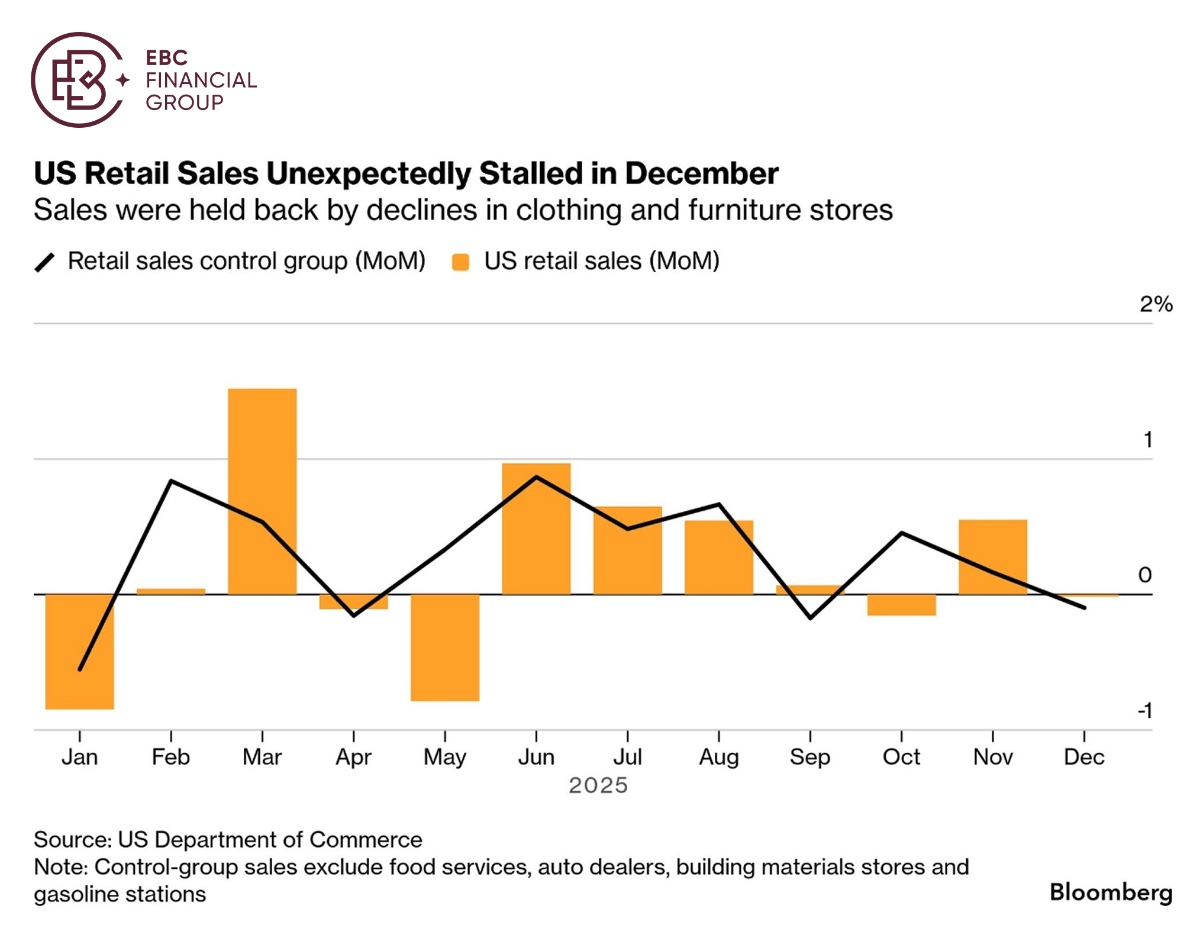

rates. On Tuesday unexpectedly stagnant retails sales in December has bolstered

the case for more monetary easing.

The Russell 2000 could see strong gains in early 2026, Goldman Sachs analyst

Ben Snider said in December, noting that the index's return dispersion is more

than twice that of the S&P 500.

But with a forward 12-month PE ratio of 23.25 as of 6 February, according to

Birinyi Associates, it is already valued significantly higher than the S&P

500's21.8x, and close to the Nasdaq 100's 24.7x.

AI disruption

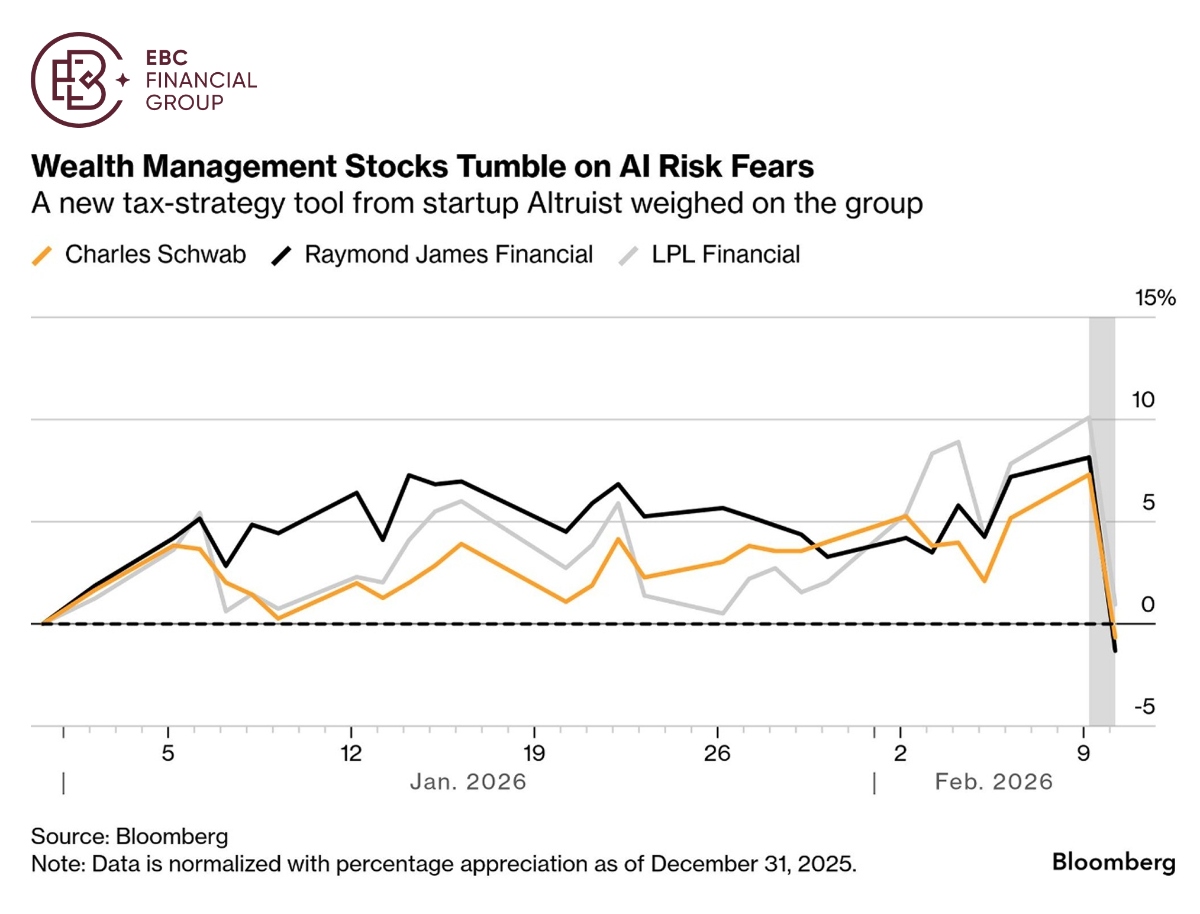

Fresh concerns are growing about how the hyperscalers will generate profits

on their new capital spending plans, along with the extent of the damage these

investments will wreak on legacy businesses AI might displace.

Big Tech have to choose between stemming capital returns to shareholders,

raiding their cash reserves or tapping the bond and equity markets more than

previously planned, analysts say.

BNPP said that free cash flows at Oracle, Alphabet, Amazon and Meta were

starting to "plummet toward negative territory", with only Microsoft appearing

"more resilient, at least for now".

Gigantic cash pile is largely what makes Big Tech safe-havens. Russ Mould,

investment director at broker AJ Bell, noted the transition from "an asset-light

business model to a more capital-intensive one."

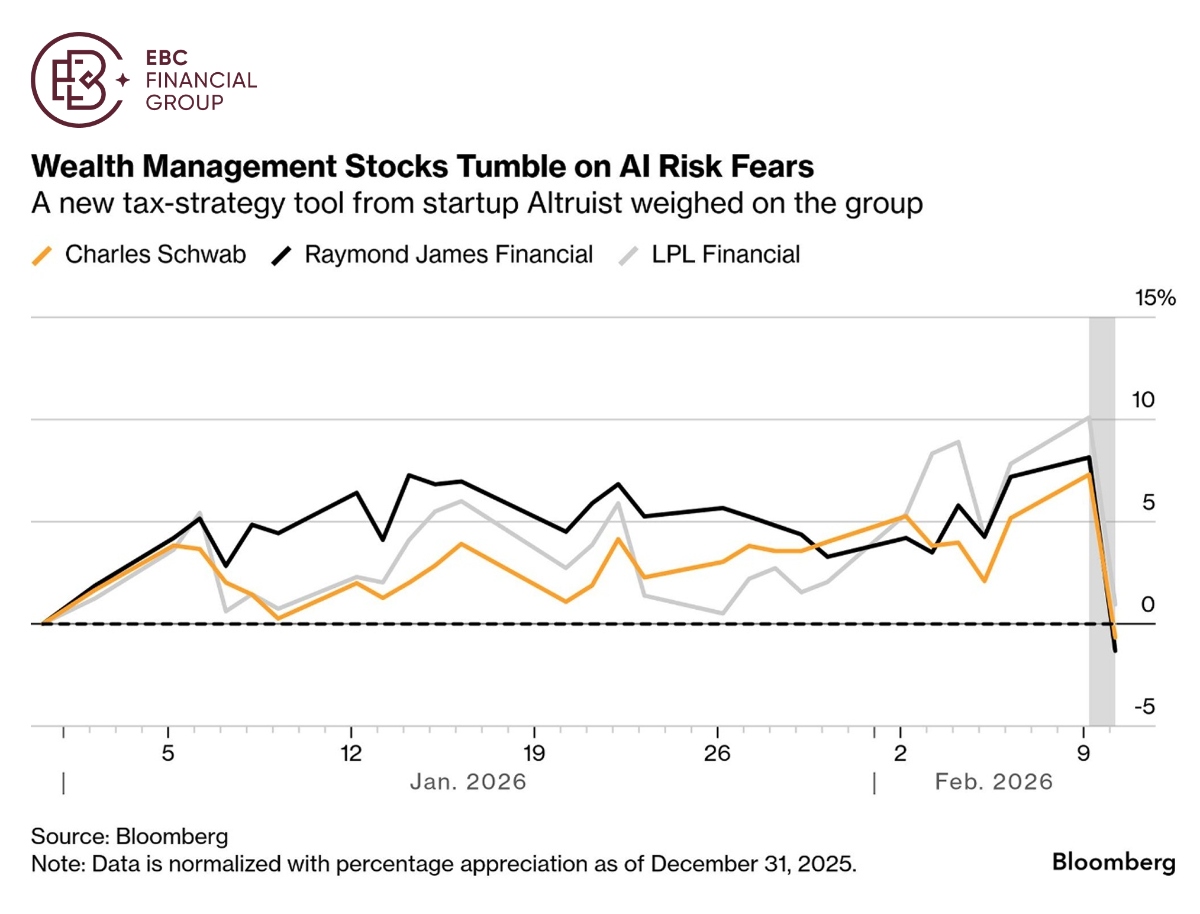

Investors are also weighing the losers in the wave of disruptive innovation.

Those at risk of being caught off guard suffered sharp sell-off, from small

software makers to big wealth-management firms.

In Europe, French software company Dassault Systemes tumbled 20% on Wednesday

after it reported results that JPMorgan said were "worse than even the most

negative had feared."

AI companies like OpenAI and Anthropic have made solid inroads into software

engineering with products that help developers streamline the process of writing

and debugging code and are moving into other industries.

Portfolio recalibration

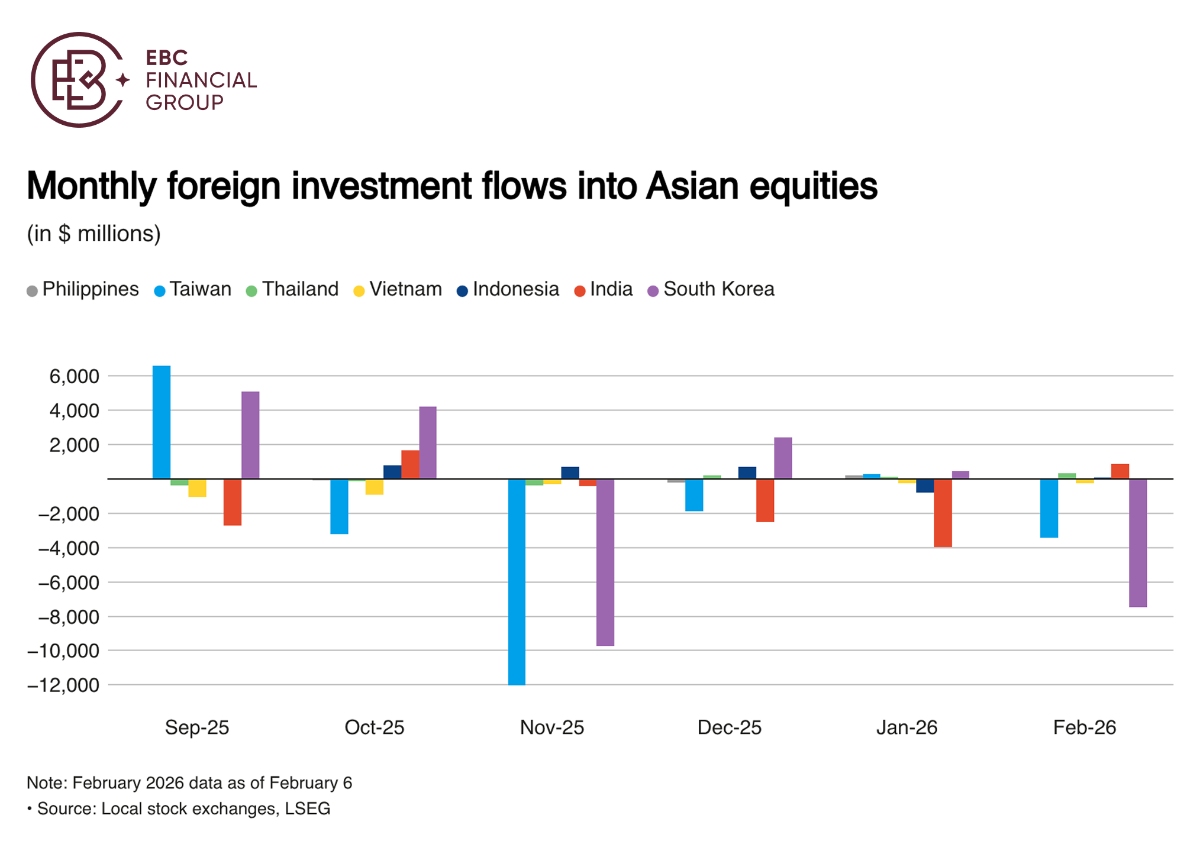

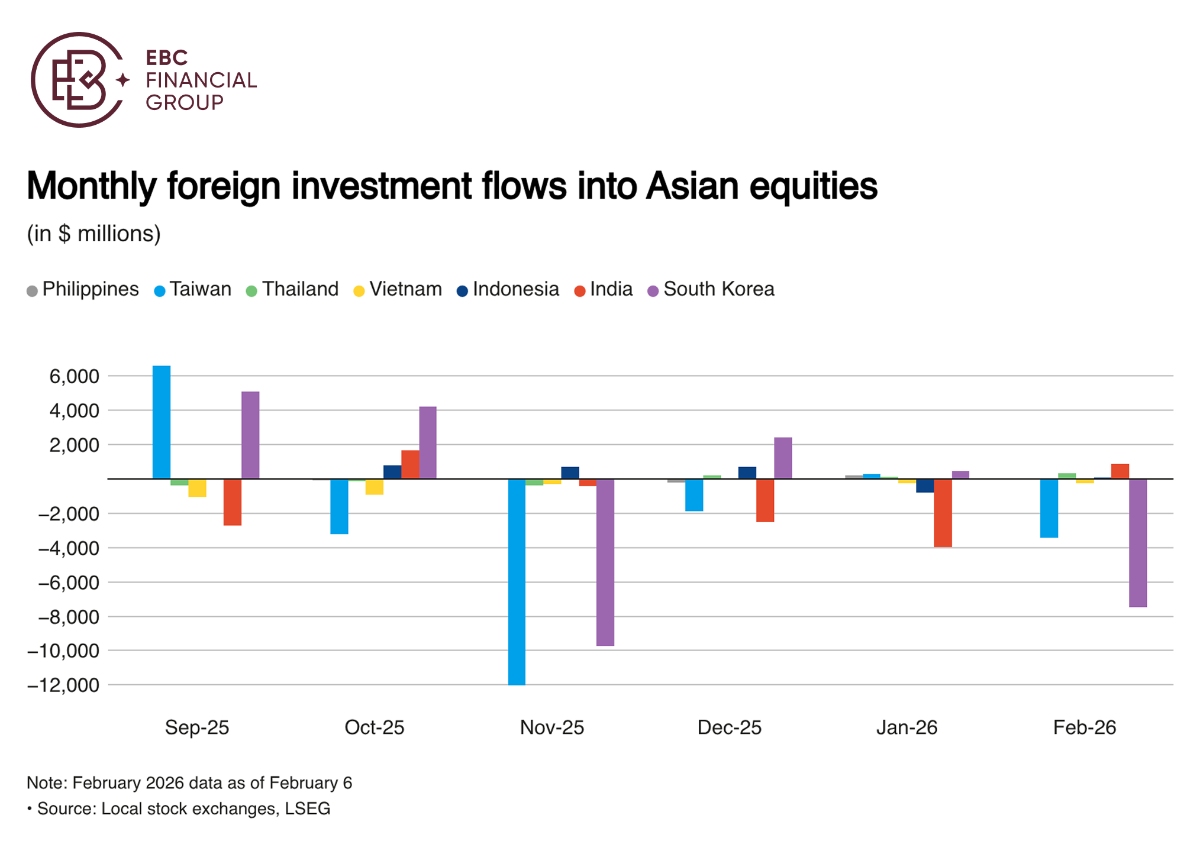

Foreign investors sold a net $9.79 billion worth of Asian stocks in the first

week of February as South Korea came under the most pronounced pressure from the

technology rout.

Meanwhile, they added a net $897 million worth of Indian stocks on optimism

over a trade deal with the US. BNPP sees "the near-term risk/reward balance as

now firmly skewed to the upside."

Most equity benchmarks in the region have risen in 2026, currencies have

shown resilience. The IMF projected that China and India together are expected

to contribute 43.6% of total global growth this year.

Asia supplies much of the hardware underpinning the AI build-out. Any

disappointment in chip demand or pricing power would ripple across the markets

that have been driven higher by fever pitch.

The greenback's persistent decline provides another tailwind by easing

pressure on Asian currencies. It helps increase the return in US dollar terms

and lower the costs to server dollar-denominated corporate debt.

Strategists at State Street say the dollar could slide as much as 10% this

year if the Fed cuts interest rates more sharply than expected. Two rate cuts

have been priced in, according to money market.

iShares MSCI All Country Asia ex Japan ETF offers balanced exposures to tech

powerhouse (China and South Korea) and the fast growing EM economy (India) –

effective supplement to US/European assets.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.