Buying the best semiconductor ETF has shifted from a simple “buy the chip cycle” trade into a more nuanced allocation decision. In 2026, semiconductors sit at the intersection of AI compute, data centre capex, automotive electrification, industrial automation, and geopolitical reshoring.

That mix can reward the right exposure and punish concentrated or leveraged positioning when volatility returns.

The following ranked list presents the most relevant semiconductor and chip ETFs for investors and traders as of January 2026. The selection considers liquidity, cost, portfolio construction, and intended use, ranging from long-only core holdings to tactical leveraged products.

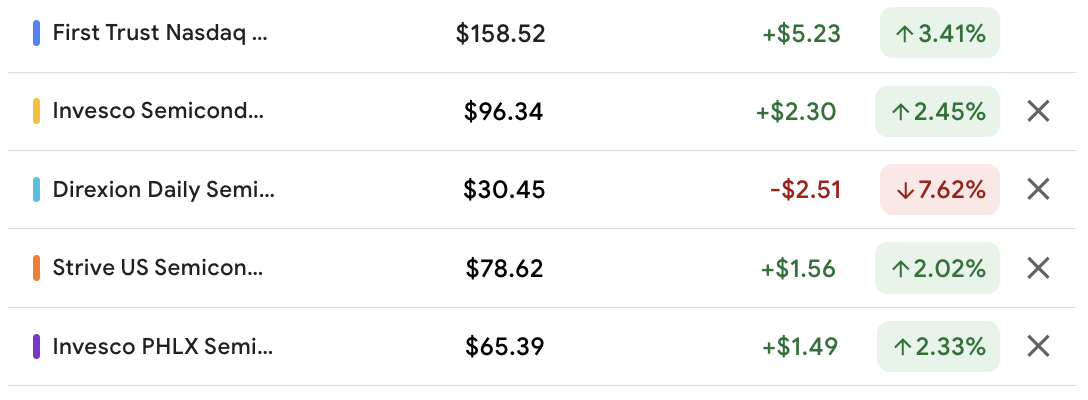

Top 10 Semiconductor ETFs (With AUM, Fees, and Recent Performance) 2026

| Rank |

ETF (Ticker) |

Type |

Best for |

Fund size (US$ bn) |

Expense ratio |

1M |

3M |

6M |

| 1 |

VanEck Semiconductor ETF (SMH) |

Long-only |

Liquid core exposure, large-cap tilt |

44.96 |

0.35% |

2.5% |

10.7% |

29.5% |

| 2 |

iShares Semiconductor ETF (SOXX) |

Long-only |

Broad, highly traded core holding |

21.79 |

0.35% |

1.6% |

11.2% |

26.6% |

| 3 |

Direxion Daily Semiconductor Bull 3X Shares (SOXL) |

Leveraged long (3x) |

High-octane tactical bull trades |

12.42 |

0.75% |

1.9% |

20.6% |

67.4% |

| 4 |

ProShares Ultra Semiconductors (USD) |

Leveraged long (2x) |

2x tactical upside with less leverage than SOXL |

1.78 |

0.95% |

0.0% |

6.2% |

42.2% |

| 5 |

SPDR S&P Semiconductor ETF (XSD) |

Long-only (equal-weight) |

Equal-weight diversification |

1.74 |

0.35% |

0.1% |

0.8% |

25.5% |

| 6 |

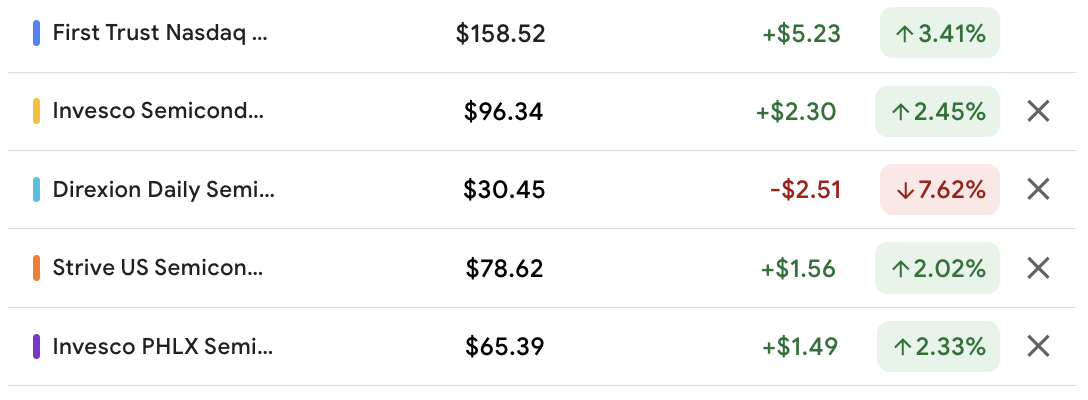

First Trust Nasdaq Semiconductor ETF (FTXL) |

Long-only (rules-based) |

Rules-based exposure with strong momentum sensitivity |

1.53 |

0.60% |

3.3% |

15.9% |

35.2% |

| 7 |

Invesco Dynamic Semiconductors ETF (PSI) |

Long-only (factor-driven) |

Factor-driven, “smart selection” approach |

1.17 |

0.56% |

2.4% |

12.1% |

31.6% |

| 8 |

Direxion Daily Semiconductor Bear 3X Shares (SOXS) |

Leveraged inverse (-3x) |

Short-term hedging or bearish trades |

1.08 |

0.97% |

-7.5% |

-38.6% |

-59.4% |

| 9 |

Invesco PHLX Semiconductor ETF (SOXQ) |

Long-only (low-fee) |

Low-fee benchmark exposure |

0.97 |

0.19% |

0.9% |

11.4% |

28.1% |

| 10 |

Strive U.S. Semiconductor ETF (SHOC) |

Long-only (newer) |

Newer alternative with competitive recent returns |

0.15 |

0.40% |

0.8% |

9.9% |

29.3% |

* 1M/3M/6M returns (market price total return, as of 12/31/2025)

1) VanEck Semiconductor ETF (SMH)

SMH is frequently regarded as the default chip ETF for those seeking highly liquid, large-cap semiconductor exposure, currently dominated by names such as NVIDIA, TSMC, Broadcom, Micron, and ASML. It brings together chip designers and manufacturers with key supply-chain enablers such as lithography, wafer-fab equipment, and EDA software (e.g., ASML, Lam, KLA, Synopsys, Cadence).

SMH typically mirrors the areas where industry profit pools are most concentrated during periods of AI-driven expansion.

Why it ranks: scale, liquidity, and clean sector beta.

Main trade-off: concentration risk when a handful of names dominate index weights.

2) iShares Semiconductor ETF (SOXX)

SOXX is a core candidate for “best semiconductor ETF” lists because it combines deep liquidity with broad industry coverage. It is widely used as a benchmark for holding US-listed semiconductor exposure.

SOXX holds a broader basket of U.S.-listed semiconductor equities, spanning memory, logic, analogue, and manufacturing tools, with top weights including Micron, AMD, NVIDIA, Applied Materials, and Broadcom.

Why it ranks: balanced core exposure with strong tradability.

Main trade-off: still cap-weighted, so single-stock risk can rise during momentum surges.

3) Direxion Daily Semiconductor Bull 3X Shares (SOXL)

SOXL is designed for aggressive, short-term bullish positioning. It magnifies both upside and drawdowns, making it popular among traders during high-momentum chip rallies. SOXL is not a long-only stock portfolio; it targets a +300% DAILY move of the NYSE Semiconductor Index, primarily through derivatives and financing instruments rather than simply buying chip stocks outright.

Why it ranks: unmatched torque for tactical trades.

Main trade-off: unsuitable for most investors as a long-term holding due to leverage mechanics and volatility drag.

4) ProShares Ultra Semiconductors (USD)

USD targets leveraged exposure with lower gearing than SOXL, which can appeal to traders who want amplified upside but slightly less intensity. USD seeks 2x the DAILY performance of the Dow Jones U.S. Semiconductors Index, meaning exposure is generally implemented through derivatives designed to deliver that daily leverage.

Practically, it is a “moderate leverage” alternative to 3x products, still focused on short-term positioning rather than long-term compounding.

Why it ranks: a “middle” leverage tool for tactical views.

Main trade-off: still not built for long holding periods, especially in choppy markets.

5) SPDR S&P Semiconductor ETF (XSD)

XSD is the diversification alternative. Its structure reduces mega-cap dominance and can provide broader participation when mid-caps and smaller chip names rally.

It is built to be equal-weighted and tilted, so it tends to reduce mega-cap dominance and spread exposure across a broader segment of the semiconductor universe. Top weights are typically clustered around ~3% each (for example, Micron, Power Integrations, MACOM, AMD, ON Semi), which can help when performance leadership broadens beyond a few giants.

Why it ranks: a useful complement to cap-weighted chip ETFs, especially for investors worried about single-name crowding.

6) First Trust Nasdaq Semiconductor ETF (FTXL)

FTXL is a smaller but established choice that can behave like a “higher beta” long-only semiconductor ETF, depending on its rules-based construction and rebalancing.

FTXL is relatively top-heavy and currently emphasises names like Micron, Intel, Lam Research, Broadcom, and NVIDIA, alongside equipment and packaging players such as Applied Materials, KLA, Teradyne, and Amkor.

In practice, it often behaves like a “high-conviction basket” across the semiconductor value chain rather than a fully balanced sector index.

Why it ranks: strong momentum sensitivity in upcycles.

Main trade-off: higher fee and smaller scale than the two largest core funds.

7) Invesco Dynamic Semiconductors ETF (PSI)

PSI applies a more “selection-oriented” approach than plain cap-weighting, which can alter its exposures relative to the standard chip benchmarks.

This ETF uses a rules-based approach and currently spreads weight more evenly across ~30+ holdings, with leaders including Micron, Lam Research, KLA, Intel, and AMD. It also tends to include smaller niche and supply-chain names (for example, Ultra Clean, ACM Research, Photronics) that are less prominent in the biggest cap-weighted ETFs.

Why it ranks: differentiated positioning that can add value when leadership rotates inside the sector.

8) Direxion Daily Semiconductor Bear 3X Shares (SOXS)

SOXS is designed for short-term bearish strategies or hedging when a sharp decline in semiconductor prices is anticipated. While not suitable for long-only exposure, it remains a relevant component within a comprehensive semiconductor ETF toolkit.

Why it ranks: a direct hedging instrument.

Main trade-off: high risk and path dependency; poor fit for multi-month holding.

9) Invesco PHLX Semiconductor ETF (SOXQ)

SOXQ is a long-only semiconductor ETF. It tracks a PHLX Semiconductor benchmark and provides benchmark-style exposure to US-listed semiconductor companies at a relatively low fee. Unlike SOXS, it is not an inverse or leveraged product, so it is generally used as a core holding rather than a short-term hedge.

SOXQ’s biggest advantage is cost. It is one of the cheapest long-only ways to own a benchmark-like semiconductor portfolio, which is particularly important if expected forward returns normalise.

Why it ranks: low fee, clean category exposure.

Main trade-off: smaller fund than SMH/SOXX, though still sizeable enough for most retail and many advisory allocations.

10) Strive U.S. Semiconductor ETF (SHOC)

SHOC is a highly concentrated U.S.-listed semiconductor portfolio, with outsized weights in leaders such as NVIDIA and Broadcom, as well as core supply-chain holdings like Micron, Lam Research, ASML, Applied Materials, and KLA.

It effectively expresses a “U.S.-listed chip champions” thesis, so returns can be driven heavily by a small set of mega-cap names.

Why it ranks: an emerging option for investors who want something outside the “big two” without stepping into leverage.

How To Choose The Best Semiconductor ETF

1) Decide what you are actually buying: AI leaders vs the full chip supply chain.

The term 'semiconductor ETF' encompasses a range of portfolios. Some funds are heavily weighted toward mega-cap designers and AI leaders, while others distribute exposure across analogue, memory, equipment, and smaller fabrication companies and suppliers.

For those focused on AI infrastructure, concentrated exposure may be advantageous. For investors seeking more stable participation in the broader semiconductor cycle, diversification is more important.

2) Treat expense ratio as a filter, not the decision.

While fees are straightforward to compare, the primary consideration should be the ETF's construction. A marginally higher expense ratio may be justified if the fund provides distinct exposure, greater breadth, or superior liquidity for the intended position size.

3) Match the ETF to your holding period.

If you are investing for years, choose liquid long-only funds with sensible concentration risk. If you are trading on a weekly or daily basis, leverage can help, but only with strict risk controls in place.

Common Risks That Investors Underestimate

Single-stock dominance: When a limited number of AI-linked companies outperform, cap-weighted ETFs may become highly correlated with those names, often exceeding investor expectations.

Cyclicality persists: While AI demand may moderate the cycle, semiconductors remain sensitive to inventory adjustments, capital expenditure fluctuations, and end-market slowdowns.

Geopolitics and export controls: Policy changes can rapidly impact supply chains, end-market demand, and valuation multiples.

Leverage decay: Leveraged and inverse semiconductor ETFs may diverge significantly from anticipated multi-month outcomes due to daily resetting mechanisms.

Frequently Asked Questions (FAQ)

1) What is the best semiconductor ETF for long-term investors in 2026?

For most long-term investors, the optimal semiconductor ETF is typically a large, liquid, long-only fund with reasonable fees and diversified holdings. SMH and SOXX meet these criteria, while SOXQ is compelling for those prioritizing a low expense ratio.

2) Is SOXX better than SMH?

Neither fund is universally superior. SMH is typically more concentrated in large-cap leaders, whereas SOXX provides broader sector exposure. The appropriate choice depends on the desired balance between concentration in leading companies and broader industry representation.

3) Are leveraged semiconductor ETFs like SOXL safe to hold long-term?

Leveraged ETFs are generally designed for short-term trading rather than long-term holding. Due to daily resets, compounding effects in volatile markets can lead to outcomes that differ significantly from investor expectations over extended periods.

4) Where can traders access semiconductor ETFs like SMH and SOXX?

SMH and SOXX can be traded through major regulated brokers as listed ETFs. For traders who prefer long/short flexibility and margin-based positioning, EBC Financial Group lists both SMH and SOXX as tradable ETFs on its platform, subject to jurisdiction and account type.

5) What should investors watch when trading semiconductor ETFs with EBC?

Start with product fit. The underlying ETFs suit multi-year allocation, while CFD-style trading introduces leverage, financing costs, and path-dependent risk. Review contract specs, trading hours, margin requirements, spreads, and sector concentration, then size positions conservatively. EBC’s disclosures highlight that CFD losses can exceed deposits.

Conclusion

As of January 2026, MH and SOXX remain the most practical core options for the best semiconductor ETFs, given their scale and liquidity. SOXQ leads in cost efficiency for long-only exposure, while XSD provides diversification benefits when sector leadership extends beyond mega-cap companies.

Through EBC’s ETF offering, eligible clients can trade semiconductor ETFs such as SMH and SOXX, with the ability to take long or short exposure using margin, subject to local restrictions and product availability.

EBC Financial Group operates through regulated entities, including FCA-registered entities in the UK and a Cayman Islands subsidiary licensed by CIMA (with licence references published in its entity disclosures), allowing traders to sign up with a minimum deposit of only $50.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.