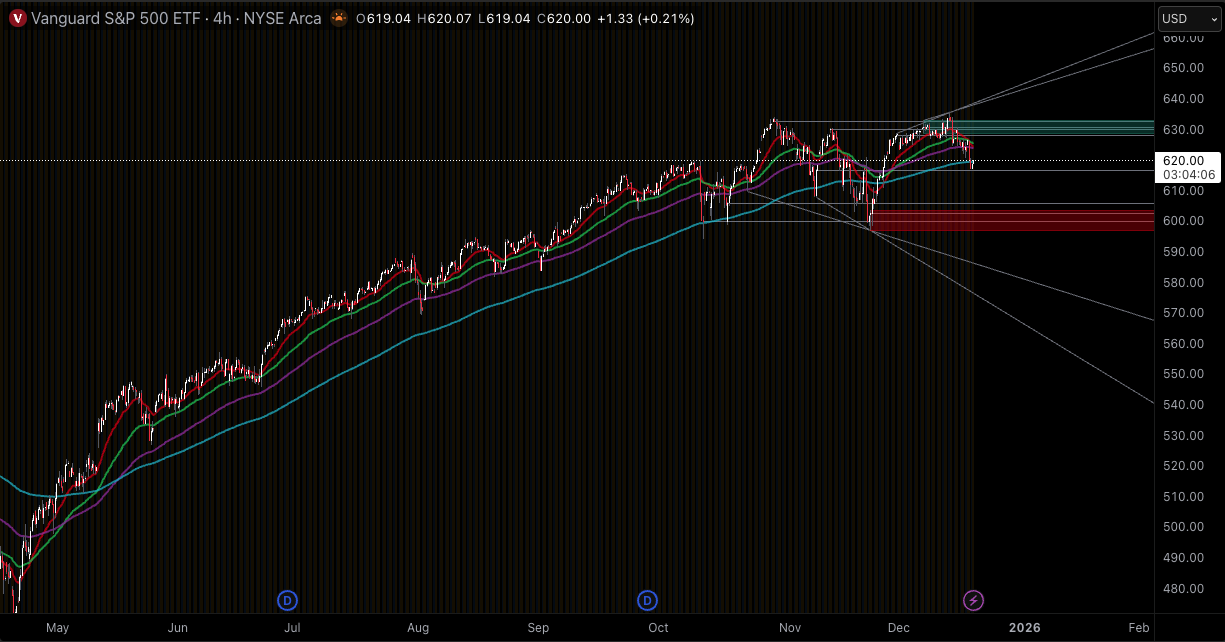

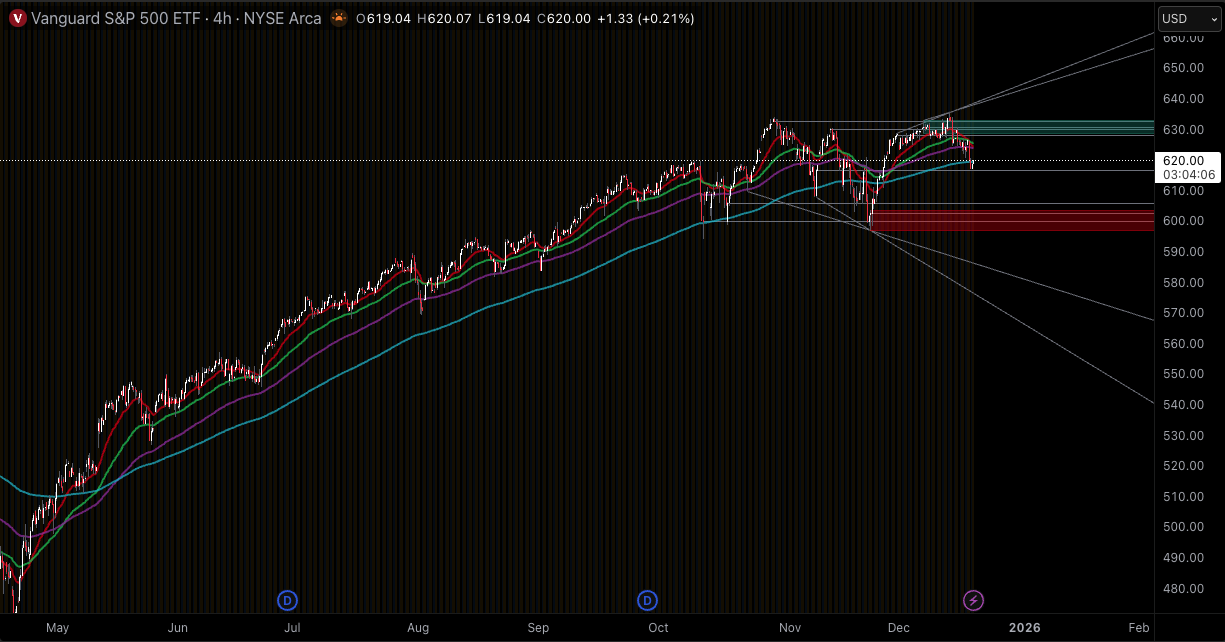

VOO ETF is coming into year-end with a clean “risk check” setup: the broader large-cap tape is still structurally supported on higher timeframes, but the short-term momentum has flipped hard enough to force discipline.

The latest cash close sits at $617.35, while the market’s broader risk tone remains relatively controlled with volatility around the high teens and the 10-year yield holding near the low-4% area.

The technical tension into 2026 is straightforward. If buyers can defend the $614 to $612 support pocket and reclaim the first overhead supply band, the move likely resolves as a late-year shakeout inside an ongoing uptrend.

If that floor gives way on a closing basis, the chart opens into a deeper retracement zone where dip-buying becomes more selective and trend-followers start thinking “reset,” not “buy the first red candle.”

| Level |

Price Zone |

Why It Matters |

| Resistance 2 |

$628.53 |

Second overhead sell zone; reclaim shifts bias back to trend continuation. |

| Resistance 1 |

$622.94 |

First “line in the sand” for bulls; reclaim often forces short covering. |

| Pivot |

$618.65 |

Near-term balance point; repeated acceptance above usually stabilizes intraday structure. |

| Support 1 |

$614.46 |

First defense area; a hold keeps the pullback contained. |

| Support 2 |

$611.57 |

Breakdown trigger area; below here, downside can accelerate quickly. |

| Support 3 |

$605.98 |

Next downside magnet if the $611s fail; often where reflex bounces attempt to form. |

| Indicator |

Reading |

What It Suggests |

| Price |

$617.35 (last close) |

The market is testing the lower end of the current support ladder. |

| RSI (14) |

28.6 |

Oversold conditions on a common daily model; bounce risk rises, but the near-term trend remains down. |

| MACD (12,26) |

-2.45 |

Bearish momentum remains active; rallies may fade until momentum starts turning up. |

| ADX (14) |

53.9 |

Strong directional phase, indicating the selloff has had real force. |

| ATR (14) |

~$6.85 (≈1.11%) |

Daily movement is meaningful; levels can be breached intraday without true breakdown confirmation. |

| Williams %R |

-97.9 |

Deeply oversold, often associated with late-stage liquidation or capitulation attempts. |

| CCI (14) |

-152.0 |

Downside momentum is stretched; mean reversion becomes more likely if support holds. |

| MA200 |

~571.5 |

Long-term trend proxy remains bullish as long as price holds well above this region. |

Momentum And Structure

The most important read into 2026 is timeframe alignment. The short-term posture is clearly pressured: price is sitting below key near-term moving averages (5-day, 20-day, and 50-day measures are overhead), which typically means rallies are “sellable” until proven otherwise.

At the same time, the longer-term trend is not broken. The 200-day trend proxy remains far below spot, and the year-to-date profile still reflects an uptrend regime rather than a distribution top. That combination is classic for late-year stress: short-term traders feel the downside, longer-term investors still see a pullback inside an uptrend.

Volume behavior adds a key clue. The latest downswing has come with heavier participation, which can mean either distribution or capitulation. If the next few sessions show stabilization (smaller real bodies, improved closes, and failed downside follow-through below $611 to $614), it favors the “shakeout then recover” script.

If volume stays elevated while closes keep printing below support, that usually marks a regime shift into a deeper retracement.

What Lower Timeframe Charts Are Saying

Intraday signals are still pointing lower. The market’s multi-timeframe technical summary shows Strong Sell on 30-minute, hourly, and 5-hour reads, while weekly and monthly remain in Strong Buy territory.

That split matters: it often creates sharp, tradable swings around support, but it also punishes premature bottom-calling before the first reclaim level is recovered.

Practically, the tape is asking for one of two confirmations.

Either (1) defend $614 to $612 and reclaim $618.65 to $622.94, which would signal absorption and open the path back into the $628 to $631 band, or (2) lose $611.57 on a closing basis, which tends to invite the next air pocket toward $606 and potentially lower retracement zones if macro pressure intensifies.

Scenarios

| Scenario |

Trigger |

Invalidation |

Targets |

| Base Case (Range Rebuild) |

Holds $614.46 and reclaims $618.65

|

Daily closes below $611.57

|

$622.94, then $628.53, then $631.42

|

| Bull Case (Trend Resumes) |

Acceptance above $628.53 and a push through $631.42

|

Rejection back below $622.94

|

$634 (prior high zone), then extension into the mid-$640s if breadth improves |

| Bear Case (Deeper Reset Into 2026) |

Daily close below $611.57

|

Reclaim $622.94and hold |

$605.98 first, then a larger retracement zone near ~$589 (23.6% of the 52-week swing) |

Risk Notes

With ATR around $6 to $7 per day, VOO can whip through nearby levels intraday and still “look fine” on the daily close. That makes closing basis confirmation particularly important around $611 to $614.

Macro catalysts can override clean chart setups. The current backdrop of mid-teens volatility and yields around the low-4% area is not panic pricing, but any surprise re-pricing in rates, growth expectations, or earnings risk can quickly turn a normal pullback into a larger retracement.

Frequently Asked Questions (FAQ)

1. From a technical analysis perspective, is VOO bullish or bearish right now?

Short-term is bearish (momentum and moving average positioning), while higher timeframes still lean bullish. This is a pullback environment, not a confirmed long-term trend break.

2. What are the most important support levels into early 2026?

The key zone is $614.46 to $611.57. If that fails on a closing basis, $605.98 becomes the next high-probability magnet.

3. What level would signal the selloff is losing control?

A sustained reclaim of $622.94 is the first sign of stabilization, with stronger confirmation above $628.53 to $631.42.

4. Does “oversold” RSI mean price must bounce?

No. Oversold increases bounce probability, but strong downtrends can stay oversold. A bounce becomes more tradable when price also reclaims structure levels like the pivot and first resistance band.

5. Why do different sites show different RSI or moving average values?

Indicator values can vary by data cut-off time, whether prices are adjusted, and the exact calculation settings. The tradable takeaway is the same: momentum is weak, and confirmation levels matter more than a single indicator print.

6. How should risk be framed around these levels?

Instruments with ~1% daily ATR can breach levels intraday and reverse. Using closing confirmation and allowing for volatility around support reduces the chance of getting chopped in the noise.

Conclusion

VOO heads into 2026 with a clear decision point: $614 to $612 is the battleground that determines whether this move is just a late-year pressure release or the start of a deeper reset.

The short-term chart is still bearish, but the longer-term structure remains constructive, which is exactly the mix that produces sharp swings and fast reversals around well-defined levels.

As long as support holds and price can reclaim $622.94, the base case favors stabilization and a push back toward $628 to $631. A clean break and close below $611.57 shifts the 2026 conversation toward deeper retracement zones, where buyers typically demand stronger confirmation before stepping in size.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.