Gold and silver did not fall because the long-term story suddenly changed. They dropped because the market became too crowded and too stretched, and then it was hit with a cash-and-leverage shock at the worst time of the year for liquidity.

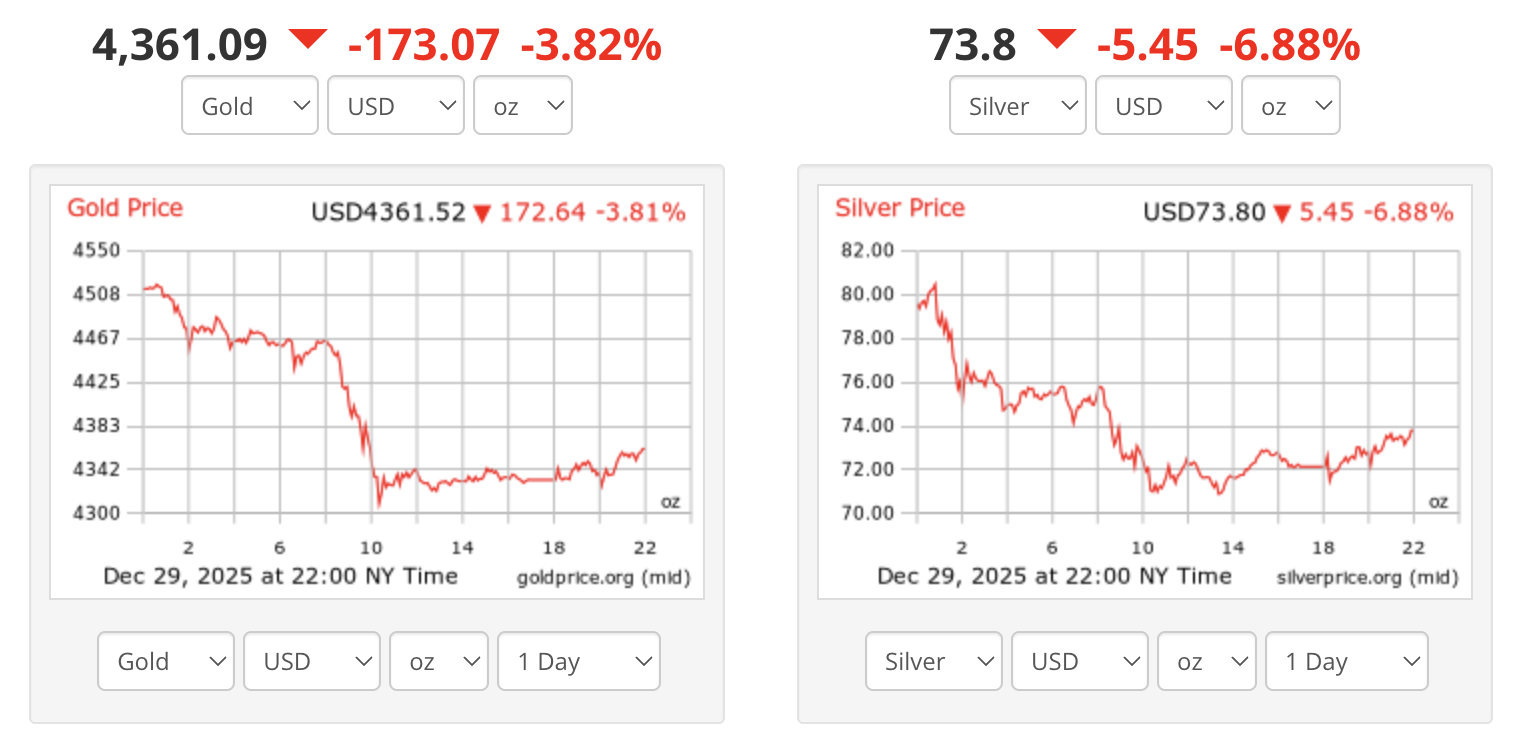

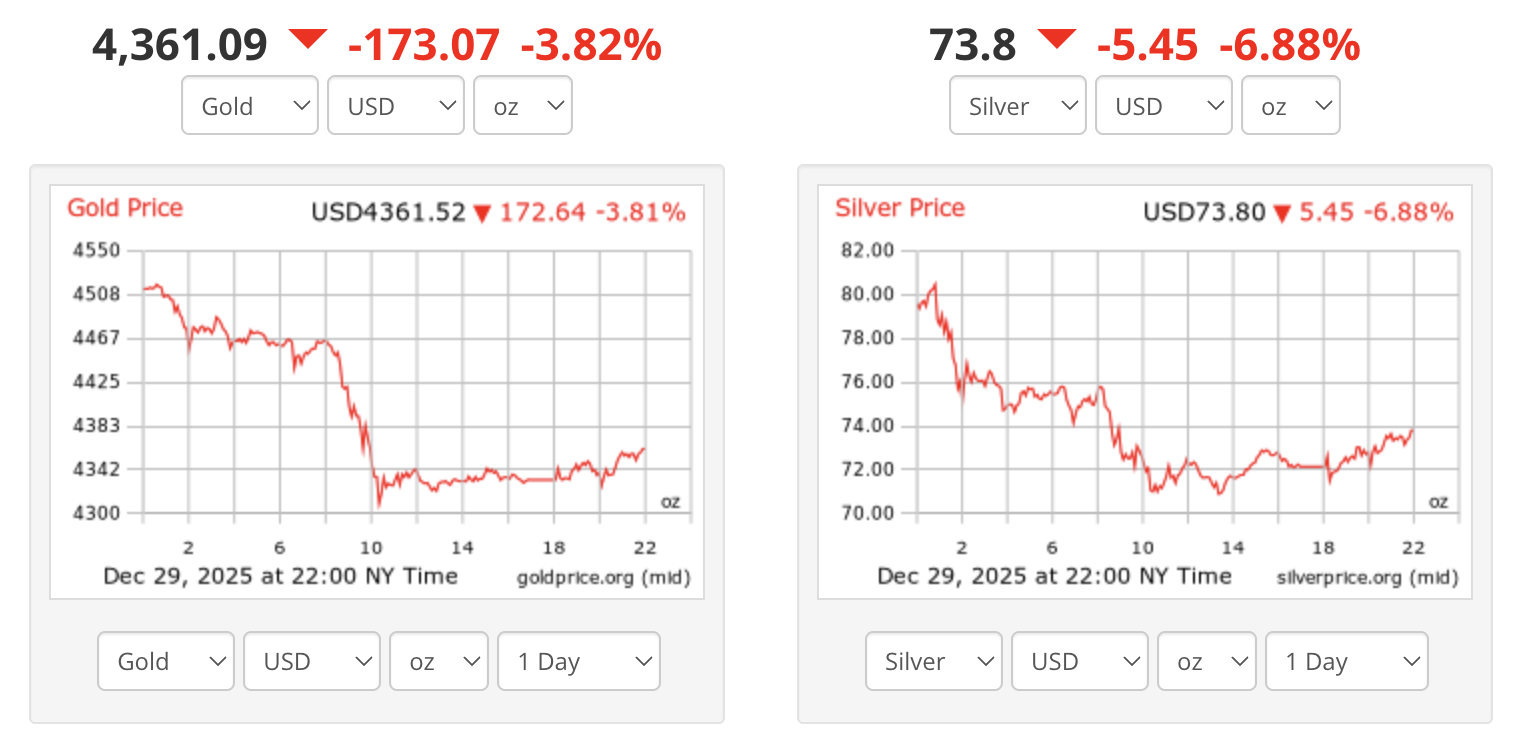

On Monday, December 29, 2025, both metals reversed hard after printing record highs. Spot gold slipped to around $4,330 per ounce, down roughly 4.5% on the day, after hitting a record near $4,549.71 the previous Friday. Spot silver dropped to around $71.66, down about 9.5%, after touching a record near $83.62 earlier in the session.

This sell-off was a classic mix of profit-taking, thin year-end trading, and a forced reduction in leveraged positions.

Gold and Silver Prices Sell-Off Numbers

| Market snapshot (Dec 29, 2025) |

Gold |

Silver |

| Record high referenced in the pullback |

~$4,549.71 |

~$83.62 |

| Price during the drop (late-session) |

~$4,330.79 |

~$71.66 |

| Approx. one-day move |

-4.5% |

-9.5% |

Silver's drop was large enough to feel like a crash even though it followed a parabolic surge.

Gold declined as well, but it seemed more like a profit-taking adjustment rather than a complete reversal.

This is important context. When a market is already up that much, it does not need a "bad" headline to fall. It often just needs a reason for traders to lock in gains.

What Is Driving the Sell-off in Gold and Silver?

1) Margin Requirements Rose, and Leverage Had to Come Out

The key spark was a sharp increase in margin requirements for major precious metals futures contracts, effective after the close on December 29, 2025.

From the official margin advisory text:

| Contract |

Old initial margin |

New initial margin |

Immediate effect |

| Silver (5,000 oz) |

$22,000 |

$25,000 |

Less leverage, forced trimming |

| Gold (100 oz) |

$20,000 |

$22,000 |

Less leverage, risk reduction |

That is not a small change in a market that had already become crowded and jumpy. That is a direct increase in the amount of cash traders must post to hold the same position size.

Why Margin Hikes Hit Price So Fast?

A margin hike does not change the "fair value" of metal. It changes the cost of holding risk.

If you're leveraged and margin requirements rise, you must either add capital quickly or scale down the position.

In a fast market, many traders reduce positions simultaneously.

That wave of selling can push the price down quickly, which then triggers more risk reductions.

This is one reason silver fell harder than gold. Silver futures are often traded with higher leverage and higher volatility, so margin pressure tends to hit silver first and hit it harder.

A Simple Leverage Estimate (New Data, Derived):

At about $75/oz, a 5,000‑oz silver contract has roughly $375,000 of notional value; against a $25,000 margin, that's about 15x notional-to-margin.

At about $4,470/oz, a 100‑oz gold contract has roughly $447,000 of notional value; against a $22,000 margin, that's about 20x notional-to-margin.

These are simplified estimates, but they explain why a margin hike can behave like a sudden tightening of financial conditions for leveraged traders.

2) Profit-Taking Hit After a Parabolic Run

To no one's surprise, this drop resulted from a profit-taking pullback after "spectacularly high levels," following record highs in multiple metals.

It is the most common pattern in late-December markets:

Large year-to-date gains

Thin liquidity around the holidays

A final push higher that attracts late buyers

A sharp reversal when early buyers sell into strength

Gold has also been coming off a historic year. The World Gold Council noted that by late November 2025, gold had set more than 50 all-time highs and returned over 60%, supported by uncertainty, a weaker US dollar, and positive momentum.

3) Liquidity Was Thin, Which Makes Moves Sharper

When liquidity is thinner, it takes less volume to push the price. Liquidity constraints and holiday-thinned trading were also factors that worsened the drop.

This is why traders often treat late-December price action with caution. The same order size can move the market further than it would in a normal week.

4) Safe-Haven Demand Cooled as the Tone Improved

Gold tends to benefit when fear is rising. It often provides a "risk premium" when anxiety decreases.

Reduced safe-haven demand played a role, with shifting headlines around geopolitical tensions affecting the bid for precious metals.

This does not mean geopolitics no longer matters. It means the market temporarily felt less urgency to hold the most crowded safety trades at record prices.

5) Rates Expectations Shifted From "Easy Money Soon" to "Not So Fast"

Gold and silver love falling yields because neither metal pays interest. When yields rise or rate cuts get pushed out, the opportunity cost of holding metal increases.

Investors also headed into the week watching the Federal Reserve's December meeting minutes for clues on how soon and how far rate cuts might continue in 2026.

When traders feel less confident about a quick easing, metals can lose momentum, especially after an extended rally.

6) Silver's "High-Beta" Nature Turned a Pullback Into a Plunge

Silver is not just a monetary metal. It is also an industrial metal. That makes it more sensitive to positioning, manufacturing demand expectations, and supply pinch stories.

It also means silver often behaves like a leveraged version of gold. When traders seek risk, silver can outperform gold. When investors aim to reduce risk, silver may decline more rapidly than gold.

That is exactly what played out as silver surged above $80 and then reversed sharply.

Gold and Silver Technical Levels Traders Are Watching Next

| Metal |

Support 1 |

Support 2 |

Resistance 1 |

Resistance 2 |

| Gold |

$4,300 to $4,330 |

$4,240 area |

$4,430 to $4,470 |

$4,500 to $4,550 |

| Silver |

$71 to $73 |

$68 to $70 |

$75 to $76 |

$80 to $84 |

After a sharp reversal, traders should concentrate on support levels, resistance levels, and, if volatility remains elevated.

Gold: Key Zones After the Drop

Resistance zone: $4,500 to $4,550 (the breakout and record-high area)

Near-term resistance: $4,430 to $4,470 (the post-drop consolidation region)

Support zone: $4,300 to $4,330 (where price printed during the sell-off)

Silver: Key Zones After the Drop

Resistance zone: $80 to $84 (the spike zone that failed)

Near-term resistance: $75 to $76 (the area silver fell back into during the reversal)

Support zone: $71 to $73 (the post-crash base area)

These are zones, not single numbers. In markets this volatile, the "exact level" matters less than whether the price holds the area for more than a few hours.

What to Watch Next?

Traders should watch these signals over the upcoming few sessions:

Whether margin-driven selling fades: If forced selling was the main driver, volatility often cools after a day or two.

Whether gold holds the $4,300 to $4,330 area: The shift may appear as a quick reset instead of a trend disruption.

Whether silver can rebuild above $75: If it cannot, traders often treat rallies as corrective bounces rather than fresh breakouts.

Any shift in rate expectations: Gold is sensitive to real yields and the policy path, so central bank communication still matters.

Frequently Asked Questions (FAQ)

1. Why Did Gold and Silver Prices Drop Today?

Gold and silver dropped mainly due to profit-taking after record highs and forced deleveraging following higher margin requirements.

2. Why Did Silver Fall More Than Gold?

Silver is typically more volatile and more sensitive to speculative positioning. When leverage comes out, silver often drops harder than gold.

3. Is This Sell-off Bearish for 2026?

A one-day crash is not, by itself, a long-term signal. It is a warning that the market was crowded and stretched.

4. Can the Upcoming Fed Minutes Move Gold and Silver?

Yes. If the minutes shift rate-cut expectations, they can move yields and the dollar, which often drives quick moves in gold and silver.

Conclusion

In conclusion, gold and silver prices dropped because a crowded year-end rally met a margin shock, profit-taking, and thinner liquidity simultaneously.

The long-term bull case may still be intact, but the short-term message is clear: when leverage accumulates, metals can fall fast even in an uptrend.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.