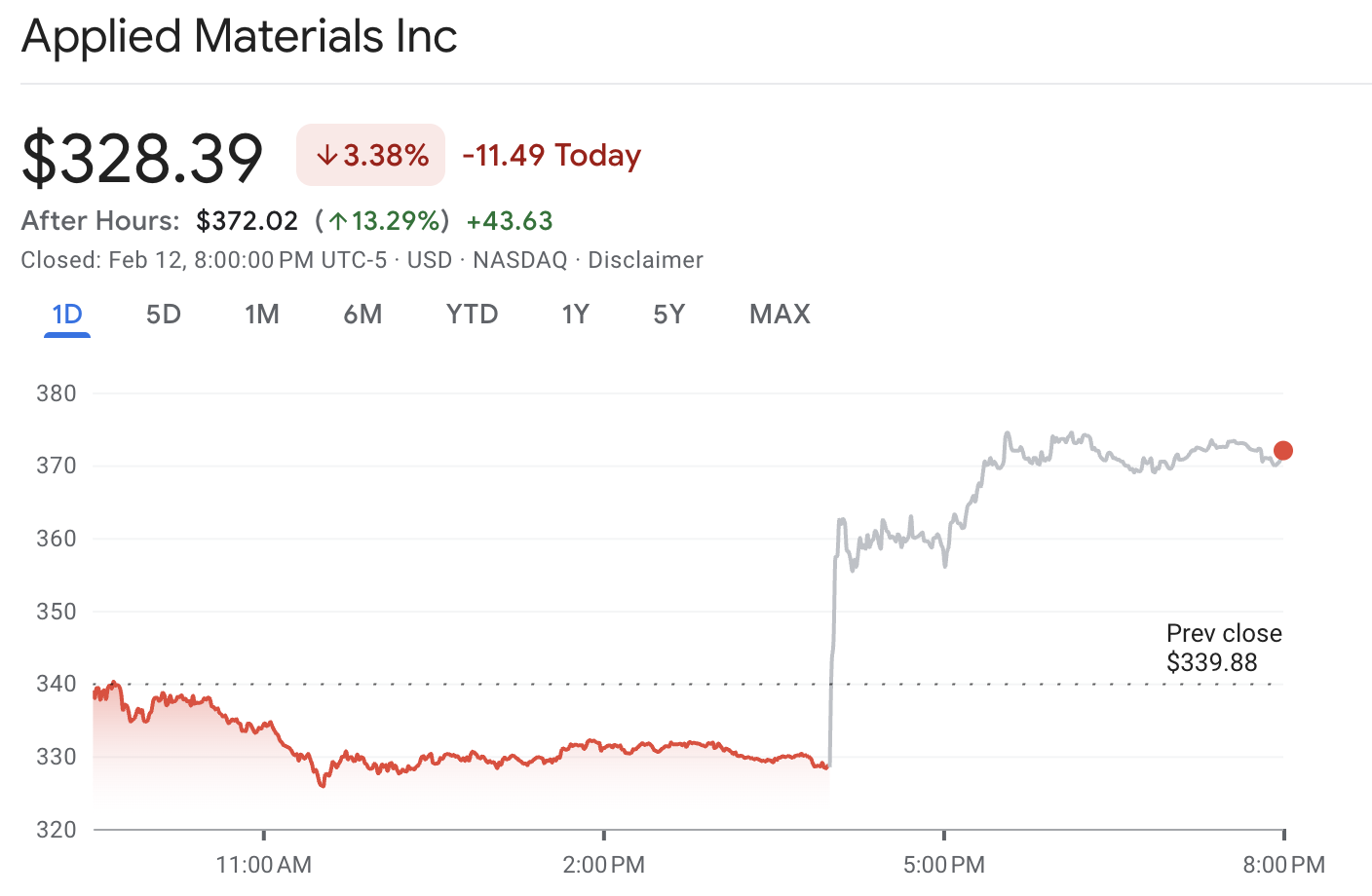

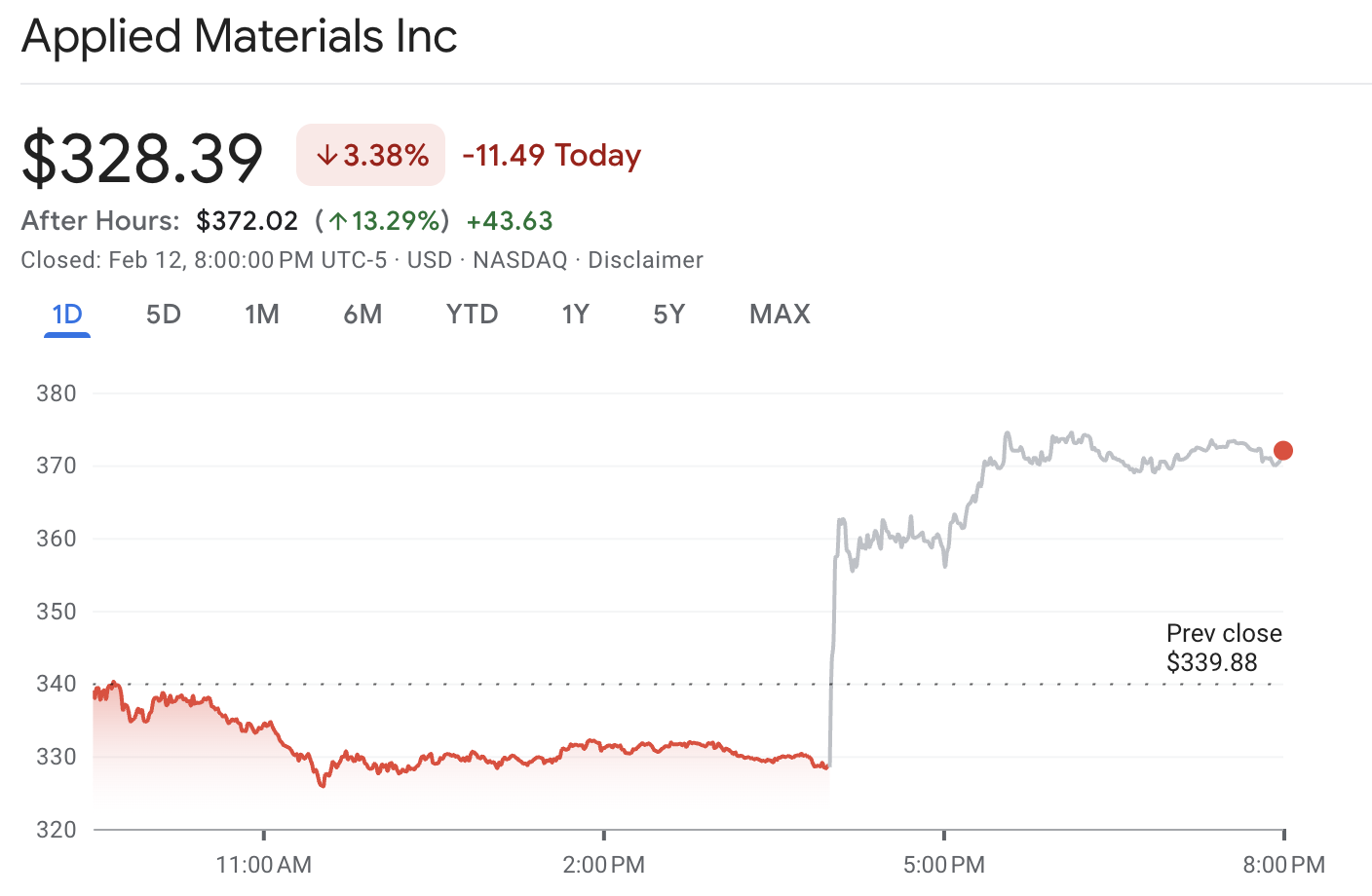

AMAT stock surged about 13% after hours after the company delivered a clear earnings beat and followed it with guidance that landed well above what the market had been bracing for. Extended trading charts indicated a move of approximately 12% to 13% shortly after the release.

The setup going into the print helps explain the size of the move. The stock had already risen before earnings, expectations were strong, and investors sought confirmation that demand for advanced chipmaking tools and high-value services continues to grow. The company delivered proof of strong profitability, a higher-than-expected outlook, and a confident message about 2026 growth.

However, the quarter itself was not a simple "everything is up" headline. Revenue came in at $7.01 billion, down 2 percent from a year ago, while adjusted earnings per share held at $2.38. What made the print feel stronger was the mix and the bridge to the next quarter: revenue guidance centered on $7.65 billion, with adjusted earnings per share centered on $2.64, implying a clear step up into the spring.

AMAT Earnings Beat: What Actually Improved

| Metric |

Q1 FY2026 |

Q1 FY2025 |

YoY change |

| Revenue |

$7.012B |

$7.166B |

-2% |

| GAAP gross margin |

49.0% |

48.8% |

+0.2 pts |

| Non-GAAP gross margin |

49.1% |

48.9% |

+0.2 pts |

| GAAP EPS (diluted) |

$2.54 |

$1.45 |

+75% |

| Non-GAAP EPS (diluted) |

$2.38 |

$2.38 |

Flat |

| Cash from operations |

$1.69B |

— |

— |

| Returned to shareholders (buybacks + dividends) |

$702M |

— |

— |

The company's headline results were solid, but the quality of the numbers mattered most. Margins stayed high, cash generation was strong, and shareholder returns continued.

The positive surprise in the results becomes more evident when compared to expectations. Analysts anticipated revenue of around $6.87 billion and an adjusted earnings per share (EPS) of approximately $2.21. It means revenue exceeded expectations by nearly 2 percent, while adjusted EPS exceeded expectations by about 8 percent. It is the kind of beat that signals execution, not a one-off accounting lift.

The key takeaway is that the quarter itself was a clean beat, but the guide suggests the near-term demand picture is improving faster than the market had penciled in.

The Main Catalysts for AMAT Stock Post-Earnings Jump

1. Guidance Points to a Sharper Upcycle

1. Guidance Points to a Sharper Upcycle

The market rarely pays up for "we did fine." It pays up for "next quarter is better than you think."

Management guided next-quarter revenue to $7.65 billion plus or minus $500 million and adjusted EPS to $2.64 plus or minus $0.20. On a midpoint basis, this suggests approximately 9.1 percent sequential revenue growth from $7.01 billion and about 10.9 percent sequential EPS growth from $2.38.

When guidance implies acceleration, investors immediately start reworking their full-year assumptions. Even if the market ends up dialing back the initial excitement, guidance like this tends to reset the conversation toward "how high can the run-rate go" rather than "how bad is the next downshift."

It also matters that the company's own framing is about a broader spending wave rather than a single product cycle. Management pointed directly to rising investment tied to AI computing, with particular strength in leading-edge logic, advanced memory, and advanced packaging.

That matters because those areas tend to require more complex steps, which typically involve more tools and more service work over time.

2. The Segment Story: Why Services Is a Quiet Stabilizer

The quarter's segment mix helps explain both resilience and upside.

| Segment |

Revenue |

Share of total |

Year-over-year |

Gross margin |

Operating margin |

| Systems |

$5.14B |

73.3% |

-8.1% |

54.3% |

27.8% |

| Services |

$1.56B |

22.2% |

+15.2% |

34.4% |

28.1% |

| Other |

$0.31B |

4.4% |

+44% |

— |

— |

Two Points Stand Out:

This mix shift matters for investors because it reduces the odds that the story depends on a single pocket of demand. When both core systems and services are in motion, the earnings base appears more stable.

3. Cash Flow and Shareholder Returns

Cash flow is where "good quarter" becomes "good business."

The company reported $1.69 billion in operating cash flow and $1.04 billion in free cash flow for the quarter. That free cash flow equals about 14.8 percent of revenue, which is strong for a period that was not a year-over-year peak growth quarter.

It also returned $702 million to shareholders through buybacks and dividends. That represents approximately 42 percent of the quarterly operating cash flow, indicating confidence while still allowing for support of capacity and inventory needs if demand continues to rise.

Risks That Can Still Move AMAT Stock in the Opposite Direction

A significant increase in guidance does not eliminate the typical risks associated with a cycle-driven business.

1. Guidance Bands Are Wide

A revenue range of ±$500 million is significant. If customers delay installs or push out orders, results can still land closer to the low end even with healthy long-term demand.

2. Regional and Policy Uncertainty Can Still Distort Demand

Export rules and customer mix can cause lumpy quarters. Even when the end demand is fine, delivery timing can vary.

3. Valuation Is Not Cheap

With a market value of approximately $200 billion and a P/E ratio in the high 30s, the stock is sensitive to any indication that growth is slowing.

AMAT Stock Technical Analysis

The earnings reaction matters, but price action around key levels often decides whether a post-earnings rally lasts.

Latest Price Context

The stock was last quoted around $328.39 at the close before the full after-hours reaction played out, and the next session showed a very wide range, reflecting the post-earnings volatility.

A 13% after-hours jump from the $328 area implies an after-hours price near $371, which matches the type of upside traders were seeing in extended trading.

Daily Indicators (Most Recent Read February 13)

| Indicator |

Value |

Signal |

| RSI (14) |

46.641 |

Neutral |

| MACD (12,26) |

2.62 |

Buy |

| Stoch (9,6) |

27.4 |

Sell |

| Stoch RSI (14) |

0 |

Oversold |

| ADX (14) |

21.812 |

Neutral |

| ATR (14) |

5.5618 |

High volatility |

How to Read This Mix:

RSI near the middle does not scream "overbought," but the oversold readings on some momentum tools show how choppy trading had been into the close. After earnings, the focus typically shifts to whether the price can remain above key moving averages.

Moving Averages (Daily)

| Moving average |

Simple |

Signal |

Exponential |

Signal |

| MA5 |

329.73 |

Sell |

331.01 |

Sell |

| MA10 |

333.99 |

Sell |

332.12 |

Sell |

| MA20 |

334.03 |

Sell |

331.46 |

Sell |

| MA50 |

321.19 |

Buy |

327.76 |

Buy |

| MA100 |

325.08 |

Buy |

322.96 |

Buy |

| MA200 |

315.13 |

Buy |

312.18 |

Buy |

Practical Takeaway: The longer-term trend remained constructive because the 50-day, 100-day, and 200-day moving averages were still pointing up. The near-term averages were tighter and had started to flash caution signals, a common occurrence just before a major event.

Support and Resistance (Pivot Levels)

| Level set |

S1 |

Pivot |

R1 |

| Classic |

330.20 |

331.14 |

332.20 |

| Fibonacci |

330.38 |

331.14 |

331.90 |

Pivot levels are from the same daily technical snapshot.

Short-term levels are particularly beneficial for intraday traders seeking areas where the price might pause or reverse after a significant overnight move.

How Traders Can Approach AMAT Stock After a Big After-Hours Move

After an earnings gap, the biggest risk is chasing price without a plan.

Thus, you should focus on clear rules instead:

Determine in advance the point at which your trade idea becomes invalid.

Use position sizing that matches the bigger post-earnings volatility.

Watch liquidity and spreads in the first hour of regular trading, because the market is still digesting new information.

Trading carries risks, and losses can exceed deposits when using leverage. Ensure you fully understand these risks before engaging in trading.

Frequently Asked Questions (FAQ)

Why Did AMAT Stock Surge After Hours?

The stock jumped because the company beat Q1 expectations and issued Q2 guidance that came in well above the consensus levels cited by market coverage.

What Were the Key AMAT Earnings Numbers?

Revenue was $7.01B and non-GAAP EPS was $2.38 for the quarter ended January 25, 2026.

What Did AMAT Guide for the Next Quarter?

The company guided Q2 revenue to $7.65B ± $0.50B and non-GAAP EPS to $2.64 ± $0.20

What Levels Traders Should Watch Now?

Many traders focus on the 50-day area near 321 and the 200-day area near 315 as trend support, while watching how the price behaves around the post-earnings spike zone for near-term resistance.

Conclusion

In conclusion, AMAT stock surged about 13% after hours, as this was not merely a modest beat. It was a report that paired solid execution with guidance that raised expectations, especially for next quarter's profit.

The company demonstrated that growth in services can help stabilize the cycle when equipment demand fluctuates quarter to quarter, supported by strong cash generation and consistent returns to shareholders.

Now, the market will determine whether the rally can sustain during regular trading and whether the company can deliver on its strong Q2 outlook. The technical trend remains constructive on longer-term measures, but earnings-driven moves can stay volatile for several sessions, so risk control matters as much as direction.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

1. Guidance Points to a Sharper Upcycle

1. Guidance Points to a Sharper Upcycle