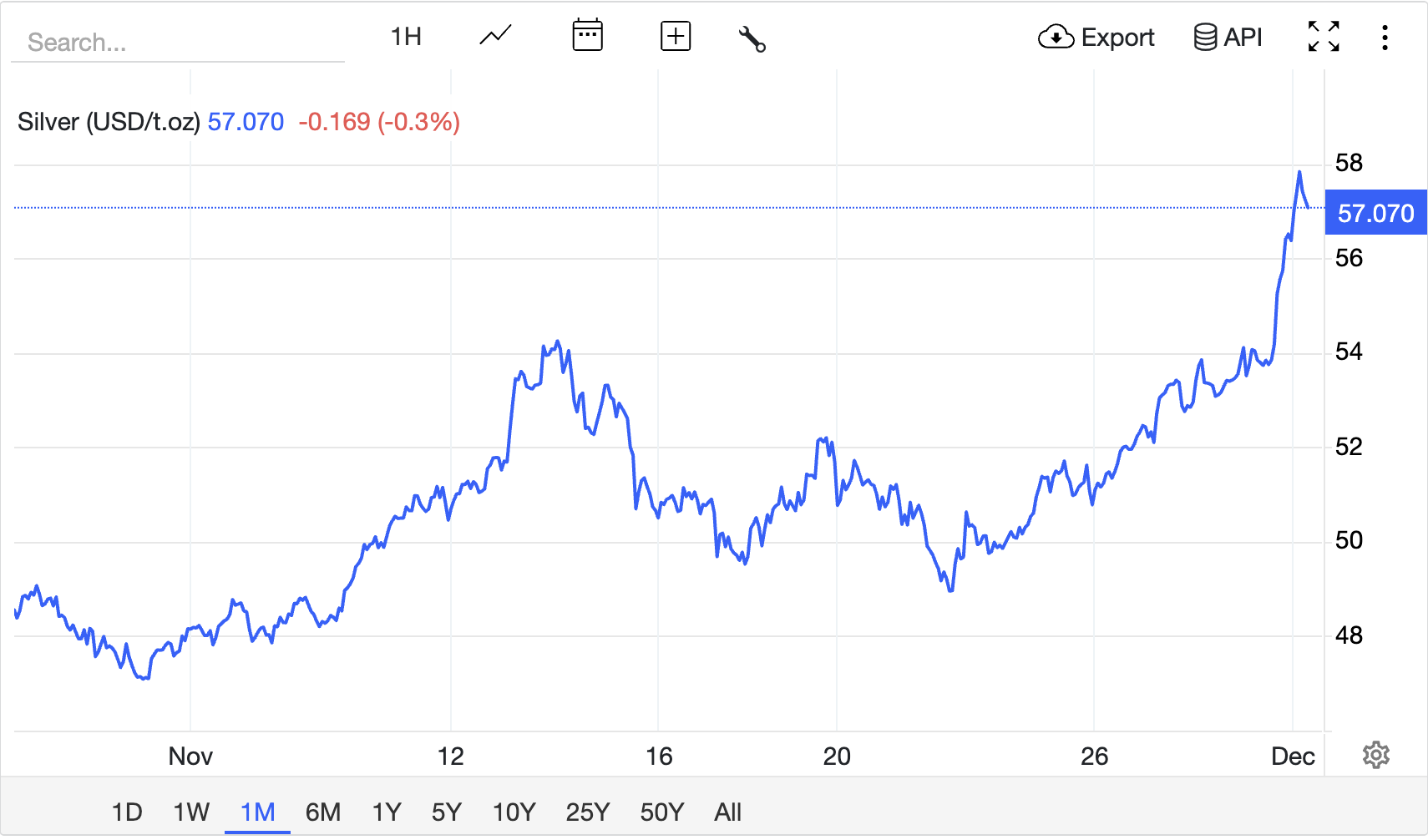

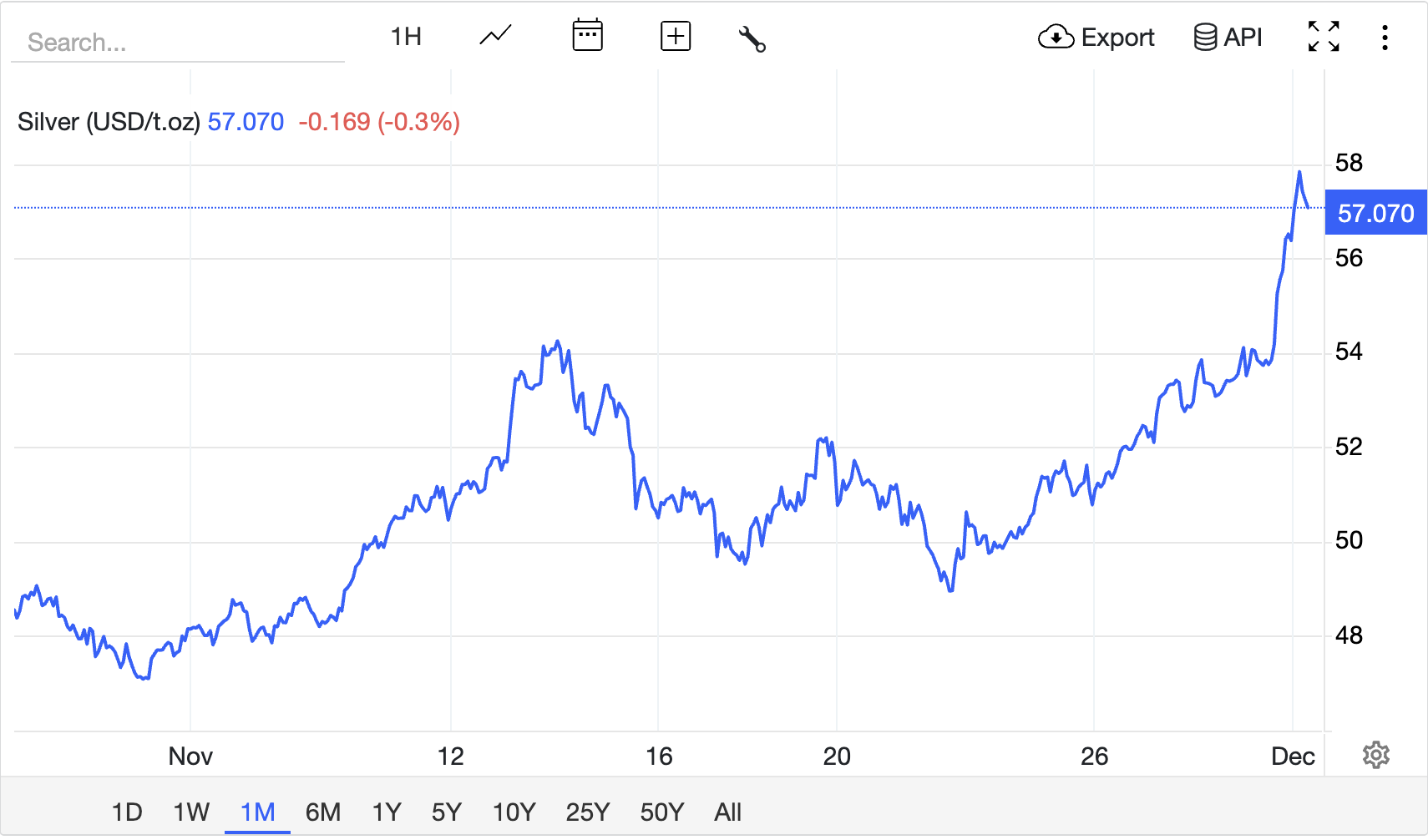

Silver's just printed new all-time highs above $57.5 an ounce and is now trading around the mid-$50s, with intraday spikes reported as high as roughly $57–58 across major venues.

That means the market has finally smashed through the old $50 area peaks from 1980 and 2011, levels that capped silver for more than four decades.

When a market breaks into new territory like this, the usual "what's the target?" The question matters less than "what's my plan?" If you're long from lower, you're sitting on serious unrealised gains. If you've been waiting on the sidelines, FOMO is probably screaming at you.

Let's break down what's actually driving the move, lay out the key technical levels, and then build a clear framework for buy, hold or take profit depending on your timeframe.

Where Silver Stands Now? Key Recent Data

In late November 2025, spot silver surged to fresh records above $57.5 per ounce, peaking around $57.6 after a CME outage, and reaching intraday highs in the $56-57 zone.

In late November 2025, spot silver surged to fresh records above $57.5 per ounce, peaking around $57.6 after a CME outage, and reaching intraday highs in the $56-57 zone.

Recent data show spot silver around $57–58 on 1 December 2025, up more than 20% over the past month and nearly 90% over the past year.

Against that, the historical reference points now look small:

January 1980: London fix near $49.45, and COMEX futures spiked a little above $50 during the Hunt Brothers squeeze.

April 2011: Spot silver briefly traded above $49.50 intraday before rolling over hard later that year.

Nominally, we're comfortably through both of those ceilings. Adjusted for inflation, there's still an argument that silver isn't at its "real" high, but from a trading and psychology standpoint, the chart is in unexplored territory.

How Big Is the 2025 Silver Rally?

Since October 2023, spot silver has run from a low near $20.67 to a peak around $54.38 in mid-November, a gain of roughly 163% in just over two years.

Overlay that with the last few weeks, where price has accelerated from the mid-$40s to the high-$50s, and you're looking at a market that's:

Trending strongly higher on weekly and monthly charts.

Short-term extended on the daily chart, with a typical 2–4% of intraday ranges.

Vulnerable to sharp shakeouts simply because positioning and sentiment are stretched.

What's Driving Another Record Surge in Silver?

1. Fed Policy, Real Yields and the Dollar

The macro backdrop has flipped from "higher for longer" to "cuts are coming":

The Fed has already cut rates twice in 2025, bringing the funds rate to the 3.75 to 4.00% range.

Futures pricing and FedWatch data show markets expecting another 25 bp cut in December, with some estimates putting that probability around 80%.

Lower policy rates and softer real yields tend to help non-yielding assets like gold and silver. That support is amplified by:

Ongoing concerns about fiscal deficits and U.S. debt sustainability.

A weaker dollar tone on rate-cut expectations, which mechanically lifts dollar-denominated commodities.

2. Industrial Demand: Solar, Electronics and AI

Unlike gold, silver is deeply embedded in industry. The data here are critical:

The Silver Institute reports industrial demand hit a record 680.5 million ounces in 2024, up 4% year-on-year and marking a fourth straight record high.

Overall demand exceeded supply for the fourth consecutive year, leaving a structural deficit of 148.9 million ounces in 2024 and a cumulative shortfall of 678 million ounces between 2021 and 24.

LSEG data shows industrial demand at 689.1 million ounces in 2024, with 243.7 million going into solar panels alone, up 158% versus 2020, and projects solar alone could add roughly 150 million ounces of annual demand by 2030.

That mix of solar, electrification, grid upgrades, electronics and AI-driven data centres gives silver a dual identity: part monetary metal, part growth-linked industrial input.

3. Supply Constraints and Physical Tightness

On the supply side, the picture is tight and getting tighter:

The Silver Institute shows mine production only creeping higher and largely constrained as most silver is a by-product of copper, lead, zinc and gold operations.

Data estimates the market deficit in 2024 at over 500 million ounces on a broader definition of physical balance, significantly larger than in earlier years.

Recent commentary suggests global silver output could slip from around 944 million ounces in 2025 to about 901 million by 2030 as some mines close.

On top of that structural tightness, you've had near-term squeezes:

London saw a sharp supply squeeze in October, forcing metal to be flown in from other hubs; roughly 54 million ounces reportedly arrived to relieve that pressure.

Inventories at the Shanghai Futures Exchange have dropped to their lowest since 2015, with Shanghai Gold Exchange volumes around a nine-year low, a sign that visible stock is being drawn down.

When you line that up with Fed easing and industrial growth, you get a market that doesn't need much of a spark to gap higher.

4. Tariffs, "Critical Mineral" Status and COMEX Drama

There's also a geopolitical and regulatory layer:

Silver was added to the U.S. Geological Survey's list of critical minerals in November 2025, raising the risk of tariffs or export-related distortions.

Around 75 million ounces have left COMEX vaults since early October as traders reposition metal globally, wary of potential U.S. premia or policy shifts.

A high-profile CME/COMEX outage halted trading in FX, Treasuries, commodities and equity futures for hours on 28 November, forcing some dealers to hedge by phone. When trading reopened, silver ripped through prior highs, briefly above $55 and then into the mid-$50s.

Those kinds of events create forced positioning and amplify moves, particularly when the underlying supply/demand picture is already tight.

Technical Analysis: Key Levels After the Breakout

1. Trend and Momentum (Daily/Weekly)

The latest technical work has silver (XAG/USD) trading above $56, comfortably above all major moving averages, with a 21-day SMA around $50.7 and momentum indicators firmly bullish. R

SI on the daily chart has pushed into the overbought 70+ band, while MACD stays positive with a widening histogram.

Translated into trader language:

Monthly/weekly trend: Up and clean breakout through prior all-time highs.

Daily trend: Strong uptrend but stretched; overbought readings warn of air pockets.

Intraday (4H/1H): Volatile breakaway move; pullbacks can be deep but are getting bought quickly.

2. The Key Technical levels (Summary Table)

Below is a compact technical map for XAG/USD based on current price action, historical peaks and widely-watched indicators:

| Timeframe |

Price area (USD) |

Role now |

| Daily / 4H |

57.50–58.00 |

Immediate resistance / new highs |

| Daily |

56.00–56.50 |

Reference breakout band |

| Daily |

55.00–54.00 |

First strong support |

| Daily / Weekly |

50.70–50.00 |

Major support / breakout base |

| Weekly |

49.50 |

Historic pivot |

| Weekly |

45.00–46.00 |

Deeper support |

| Monthly |

40.00 |

Long-term floor |

Indicators to watch:

RSI (daily): Above 70 = strong trend but prone to pullbacks; a drop back below 70 with price still elevated often marks the start of a cooling phase.

MACD (daily): Still widening; a flattening or bearish cross with price failing to make new highs would be an early warning of buyer fatigue.

21-day SMA (~$50.7): First dynamic support. As long as the price holds above, bulls are in control.

Should You Buy, Hold or Take Profit?

1. Short-Term Traders (Days to a Few Weeks)

If you're trading CFDs, futures or leveraged products, your main enemy now is volatility, not valuation.

Pros for staying long or buying dips:

Strong upside momentum and clear uptrend on higher timeframes.

Fed easing bias and still-tight physical market.

A breakout above a multi-decade cap often leads to follow-through.

Reasons to be cautious / take partial profit:

Daily RSI is in overbought territory.

Fresh record highs after a parabolic leg are exactly where violent mean-reversion moves tend to start.

COMEX outages and thin liquidity spikes show the market can move several dollars in minutes.

A pragmatic short-term approach now. If already long:

Consider banking some profit into the $56–58 zone, and trail stops on the remainder just below $54–55.

Avoid adding leverage at new highs; look to reload closer to support.

If flat and bullish:

Map $55–54 as your first preferred buy zone, with a hard stop somewhere below $53–52, depending on your risk tolerance.

Only chase a fresh breakout above $58 if there's a clear catalyst and you can define risk very tightly (e.g., back inside the prior day's range).

2. Swing Traders (Weeks to Months)

You're less sensitive to intraday noise but still care about drawdowns.

Why holding still makes sense:

The macro story of Fed easing, industrial growth and structural deficits is a multi-year theme, not a one-week narrative.

Supply response is slow because silver is mostly a by-product, and capex decisions are being made for copper/gold, not for silver itself.

Even after the run, the gold/silver ratio says silver is stronger but not yet in total "melt-up" territory.

Swing-oriented positioning idea:

Core position: Keep a core long as long as weekly closes stay above $50.

Trading overlay: Use pullbacks toward $55–54 and, if offered, $51–50 to add tactically with tighter stops.

Consider scaling out into $60+ if price overshoots quickly with no new fundamental news; that's often where blow-off behaviour lives.

3. Long-Term Investors (Multi-Year Horizon)

If your thesis is about the energy transition, deficits and monetary debasement, the question is less "is this the top?" and more "how do I average in sensibly?".

Why you might still hold or even add over time:

According to present forecasts, ongoing deficits and high industrial demand (notably in solar) are anticipated to persist in 2026–27.

If forecasts of solar-driven demand adding ~150 Moz/year by 2030 are broadly correct, the market will need either higher prices to ration demand or a delayed supply response.

Inflation and policy risk still favour holding some hard-asset insurance in a portfolio.

Sensible investor playbook:

Vary your investments: combine physical assets, reputable ETFs, and, if you're comfortable with equity risk, high-quality silver mining firms or streaming companies.

What Could Go Wrong? Key Risks to Track

1) Fed Path Surprise:

If inflation proves sticky and the Fed signals slower or fewer cuts, real yields could push higher again, weighing on all precious metals.

2) Demand Destruction/Substitution:

At very high prices, manufacturers may accelerate thrifting or substituting away from silver in some applications, especially electronics and jewellery.

3) ETF Outflows:

A risk-on shift in broader markets could cause investors to rotate out of silver ETFs, removing a vital demand pillar.

4) Policy Shocks:

Tariffs or export restrictions might lead to short-term local premiums but could also severely reduce demand in important end-markets if enforced too stringently.

5) Regulatory or Exchange Changes:

Higher margin requirements or position limits, especially after a period of extreme volatility, can force de-leveraging, just like in 1980.

Frequently Asked Questions

1. Is Silver in a Bubble Now?

Silver is clearly hot and overbought in the short-term. However, multi-year deficits, rising industrial use and easier Fed policy are grounded in real data.

2. How Much Could Silver Realistically Correct From Here?

A pullback to the $55–54 support zone would be a normal reset after such a fast spike.

3. What Does the Current Gold–Silver Ratio Imply?

The ratio has dropped into the high-70s, its lowest area in around 18 months, showing silver outperforming gold but not yet at some historic extreme where silver is wildly rich.

Conclusion

In conclusion, silver has finally done what it's threatened to do for years: break cleanly above the $50 wall and hold in the mid-$50s. The move isn't just a speculative front, it sits on top of multi-year supply deficits, record industrial use and a Fed that's moving steadily toward easier policy. That gives the bull market real depth.

For short-term traders, this is a market to respect rather than chase. For swing traders, the key battleground is $50. And for long-term investors, silver's breakout is less a finish line than the start of a new regime in which the metal's industrial role matters as much as its monetary one.

Whatever your approach, the critical thing now is not predicting a precise top, but aligning your position size, timeframe and stop-loss with the reality of a volatile market in uncharted territory. Silver has earned your respect; make sure your risk management shows it.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.