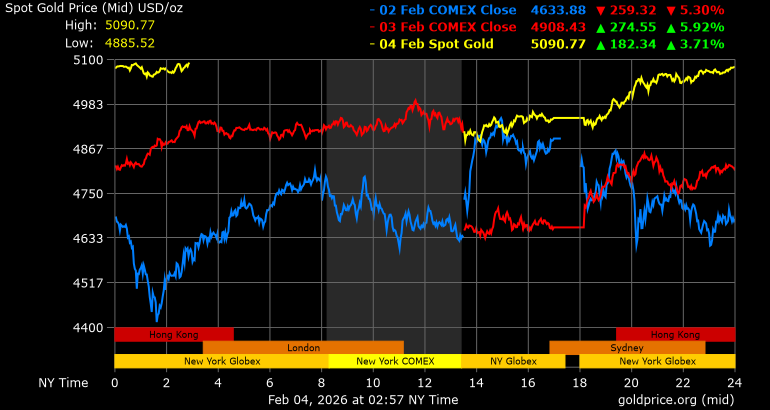

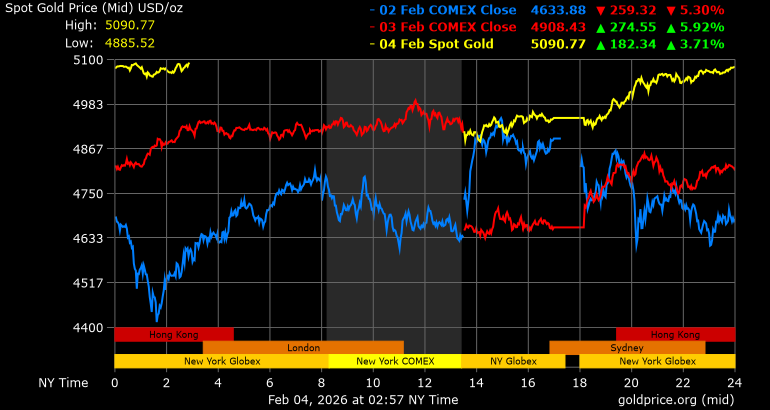

Gold has rebounded sharply after experiencing one of its most significant sell-offs in decades. Spot prices climbed back above $5,000 per ounce, with spot gold trading around $5,090 in the latest rebound.

The bounce followed a sharp decline from a record high above $5,500, prompting many short-term traders to exit their positions.

That rebound feels comforting if you believe the selloff was an overreaction. However, it can also be dangerous because the first bounce after forced liquidation often looks "obvious" right before volatility returns.

The question many traders are asking now is simple: Is it wise to buy gold after a rebound, or are late buyers getting trapped? There is no one definitive answer. It depends on your time frame, risk limits, and what you believe is driving gold in 2026.

Is Now a Good Time to Buy Gold After the Latest Rebound?

Gold can still be a good buy after a rebound if you are not chasing a one-day move and if the bigger drivers remain supportive.

The rebound appears genuine, following forced selling, margin pressure, and a rapid change in rate expectations that drove gold too far, too quickly in both directions.

Main Factors to Weigh Before Buying Gold Now

Gold's selloff was amplified by leverage and margin changes, which often create overshoots that later bounce.

Real yields remain positive, which may restrict gold's upward potential.

Long-term demand drivers remain strong, especially investment flows and central bank buying trends.

Volatility is high, so timing and position size matter more than usual.

What Caused the Rebound in Gold Prices?

The recent rebound has a straightforward narrative centered on positioning and the dollar.

Gold fell hard after the market reacted to a more hawkish perceived shift in the Fed outlook following President Trump's nomination of Kevin Warsh as the next Fed chair, which lifted the dollar and triggered technical selling.

The bounce followed as the dollar's surge paused, dip buyers stepped in, and leveraged selling pressure eased.

Margin-related mechanics were also part of the flush, which amplifies moves in both directions when positioning is crowded.

This matters for your "buy-after-rebound" decision because rebounds driven by stabilization in funding and positioning can extend. Still, they can also fail quickly if a steady fundamental bid does not back them.

Is It Better to Buy Now, or Wait?

This is where most traders get stuck. The rebound makes it feel like you either buy immediately or miss the move. That is usually the wrong mindset.

A better approach is to decide which "type" of buyer you are.

1) Long-Term Allocator (6 to 24 Months)

If you want gold as insurance, you usually care more about building a position than about picking the perfect day.

Common long-term approach:

Buy in smaller pieces over time.

Add more on pullbacks instead of chasing spikes.

Hold enough cash to act if volatility returns.

What can go wrong:

2) Medium-Term Investor (4 to 12 Weeks)

If you trade over weeks to months, your entry is more crucial because you need the move to work within your time frame.

Common approach:

Wait for the rebound to cool, then buy a higher low.

Use clear invalidation levels so one bad day does not become a big loss.

Avoid adding if the price breaks below key support.

3) Short-Term Trader (Hours to Days)

If you trade hours or days, you are not "investing in gold." You are engaging in volatility trading.

Common short-term approach:

Fundamental Picture: What Is Still Supporting Gold in 2026?

To help you make a more informed choice, let's look into the key factors that continue to favor gold in early 2026.

1. Central Banks Are Still Buying, Even at Record Prices

One of the most durable pillars under gold has been central bank demand. The World Gold Council reported that central banks purchased a net total of 863.3 tonnes of gold in 2025, with net purchases in the fourth quarter rising to 230 tonnes.

While this amount is less than the roughly 1,000 tonnes seen in the last three years, it is still considerably higher than the yearly average documented from 2010 to 2021 as reported by the WGC.

The critical point is not perfection. The important point is that official-sector demand has remained persistent despite higher prices, which is not how gold typically behaves late in a cycle.

2. Real Yields Are Not Collapsing, but They Are No Longer Rising Relentlessly

Gold often struggles when real yields are rising fast, because investors can earn inflation-adjusted returns in government bonds. The U.S. 10-year TIPS yield recently sat around 1.88%.

At present, gold is in an unfavorable position compared to earlier, due to negative real yields. However, it's noteworthy that gold is rallying even with real yields still positive, indicating that factors beyond interest rates alone influence demand.

3. ETF Flows Show Demand Is Broadening, but the Crowding Risk Is Rising

According to reports, precious metals ETFs listed in Asia drew $7.1 billion in net inflows in January, with some China-listed products taking in record amounts.

While these inflows can support prices, they also raise valid concerns: rapid retail-led inflows may coincide with late-stage enthusiasm, increasing the risk of sudden declines when volatility returns.

Gold Technical Analysis

| Item |

Level |

Why it matters |

| Spot reference (XAU/USD) |

$5,075 |

The rebound anchor after the selloff. |

| RSI (14) |

71.757 |

Momentum is strong, but pullback risk rises from here. |

| MA20 (simple) |

$4,974 |

A first "trend support" zone in a normal dip. |

| MA50 (simple) |

$4,827 |

A deeper support zone if volatility returns. |

| Classic pivot |

$5,079.73 |

A near-term decision level around current price. |

| Classic R1 / S1 |

$5,089.84 / $5,069.38 |

First resistance and first support for short-term price discovery. |

Technically, gold has regained trend strength fast.

On the daily technical dashboard for XAU/USD, the signal indicates a Strong Buy, and the 14-day RSI is at 71.757, nearing overbought territory. Additionally, several oscillators are also showing an "Overbought" condition.

It does not mean gold must fall tomorrow. It means the next entry becomes more sensitive to timing and pullbacks.

How to Interpret the Table:

If gold stays above the pivot area and buyers emerge on shallow dips, momentum can continue to build.

However, if the price fluctuates and consistently struggles to remain above resistance while the RSI stays elevated, the market may quickly shift from "rebound" to "distribution."

Gold Scenario Map for the Next Few Weeks

| Scenario |

What would likely be true |

What gold might do next |

| Continuation rally |

Dollar stays soft, real yields stable, and dip buying persists |

Tests resistance above $5,100 and tries to rebuild toward prior highs |

| Range and digestion |

Volatility fades, but buyers and sellers stay evenly matched |

Trades sideways between roughly $4,950 and $5,100 |

| Rebound fails |

Dollar strengthens again and positioning unwinds |

Slides back toward the $4,800s MA50 zone and forces a reset |

This is not a prediction. It is a way to avoid emotional decision-making when the market is moving quickly.

Frequently Asked Questions

1. Is Gold Still a Good Buy After It Bounced Back Above $5,000?

Gold can still be attractive, but the risk is higher after a sharp rebound. Spot gold traded around $5,090 during the bounce, so buyers should avoid overly large positions and consider buying in smaller steps.

2. Do Central Banks Still Support Gold at These Prices?

Yes. The World Gold Council reported total central bank net purchases of 863.3 tonnes in 2025, with Q4 buying rising to 230 tonnes.

3. Is It Too Risky to Trade Gold Right Now?

Gold is in a high-volatility phase after a historic selloff and a fast rebound. Margin changes and leveraged unwinds can keep swings large, so smaller position sizes and clear risk limits matter.

4. What Should I Watch Next if I Want to Buy Gold?

Keep an eye on real yields, the U.S. dollar trend, and whether gold can maintain key levels such as $5,000 during pullbacks. On February 2, 2026, real yields stood at approximately 1.94%, a significant factor in gold pricing.

Conclusion

In conclusion, whether now is a good time to buy depends on how you plan to manage risk. A disciplined way to approach gold after a rebound is to treat it as a volatility regime.

Traders typically monitor whether the price stays above the daily pivot and the rising short-term moving averages, then they adjust their positions, assuming that sharp swings can revert quickly. That process helps separate trend participation from emotional chasing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.