Contracts for Difference (CFDs) have become one of the most popular financial instruments among modern traders. They allow investors to speculate on the price movement of assets without actually owning them, making it a flexible and accessible way to participate in global financial markets.

Whether you're trading forex, stocks, commodities, indices, or cryptocurrencies, CFDs provide a unique opportunity to profit in both rising and falling markets.

But how exactly do CFDs work, and why should you learn about them before diving into trading? This guide will explain how CFDs work, their advantages and risks, strategies for beginners, and what you must know before you start trading CFDs today.

What Is a CFD?

As mentioned above, a Contract for Difference (CFD) is a derivative instrument. When you trade CFDs, you agree to pay or receive the difference in the asset's price between the opening and closing of your position.

For example, if you buy a gold CFD at $2,000 and close it at $2,050, you earn $50 per unit (multiplied by the contract size). If the price drops instead, you incur a loss of the same magnitude.

The key feature of CFDs is that you never own the asset itself; you're simply trading on the price changes.

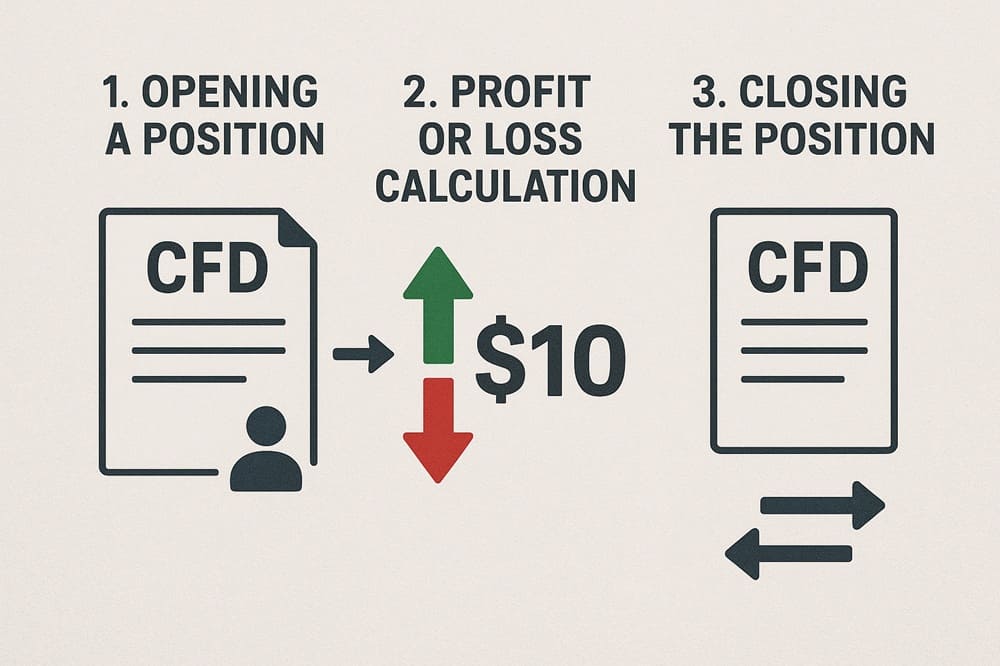

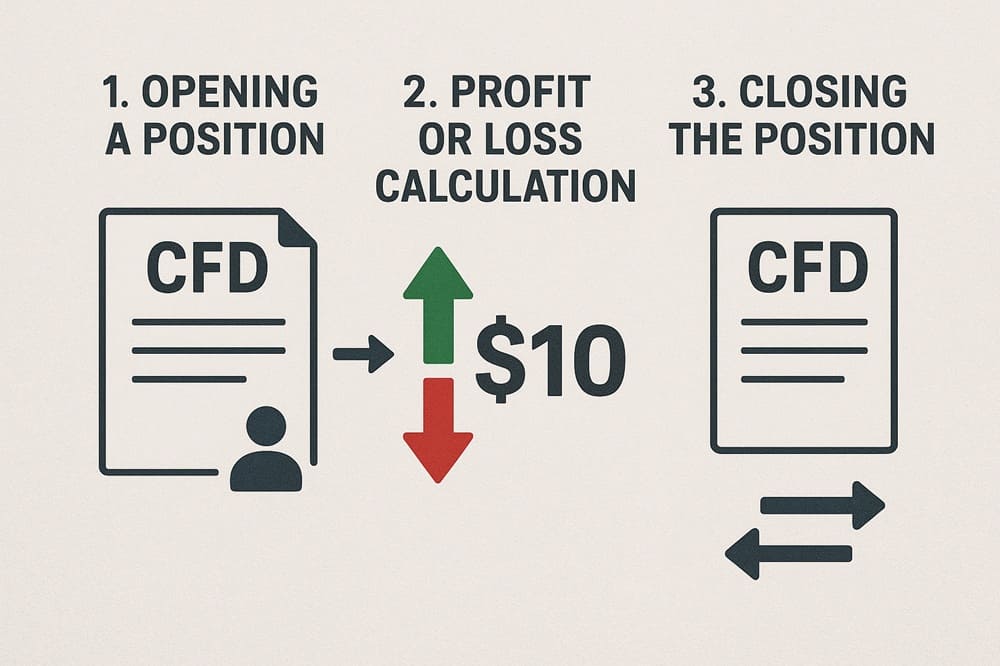

CFD How It Works: Step-by-Step Guide for Beginners

1. Choosing an Asset

CFDs can be traded on a wide range of markets, including forex pairs, stocks, commodities such as gold and oil, indices such as the S&P 500, and even cryptocurrencies.

2. Opening a Position

You can take a long position (buy) if you expect the price to rise or a short position (sell) if you expect the price to fall.

3. Leverage and Margin

CFD trading uses leverage, meaning you only need to deposit a fraction of the trade's total value (called margin). This allows traders to control larger positions with smaller capital.

4. Profit or Loss Calculation

Your profit or loss is determined by the difference between the entry and exit prices, multiplied by your position size.

5. Closing the Trade

When you close a position, the CFD broker settles the difference between the opening and closing prices in cash.

Example of a CFD Trade

Let's say you want to trade a stock CFD:

With 10:1 leverage, you only need to deposit a margin of $1,000.

If the price rises to $105, your profit is ($105 – $100) × 100 = $500.

If the price falls to $95, your loss is ($95 – $100) × 100 = $500.

What Are the CFD Markets You Can Trade?

A significant advantage of CFD trading is the ability to access various asset classes through a single trading account. With a broker like EBC Financial Group, traders can explore a wide variety of CFD markets, including:

Forex CFDs: Trade currency pairs like EUR/USD, GBP/USD, or USD/JPY with fast execution.

Stock CFDs: Access global companies such as Apple, Tesla, and Amazon without owning the shares.

Commodity CFDs: Popular choices include gold, silver, and crude oil.

Index CFDs: Speculate on the performance of global indices like NASDAQ, S&P 500, FTSE 100, or DAX.

Crypto CFDs: Trade leading digital currencies like Bitcoin.

What Are Some Key Tips Before Starting CFD Trading?

CFD trading can be rewarding, but only if approached with preparation and discipline. Here are some essential tips, including how EBC Financial Group supports beginners:

Understand Leverage: Use leverage carefully. With EBC, traders can choose flexible leverage settings tailored to their risk tolerance.

Use a Demo Account: EBC provides free demo accounts, allowing traders to practice strategies without financial risk.

Set Stop-Loss Orders: Always protect your trades with stop-loss levels, something EBC's platforms provide automatically.

Stay Informed: EBC provides daily market insights and research to inform traders about global financial events.

Start Small: Trade with smaller lot sizes until you gain confidence. EBC supports micro and mini contracts, perfect for beginners.

What Are the Advantages and Risks of CFD Trading?

| Advantages |

Risks |

| Ability to trade both rising and falling markets |

Leverage amplifies losses |

| Access to global markets from one account |

Market volatility increases risk |

| Lower capital requirement due to margin trading |

Overnight financing fees can add up |

| No need to own physical assets |

You don’t gain ownership rights |

| Flexible lot sizes suitable for all levels |

Counterparty risk with brokers |

Frequently Asked Questions

1. What Does CFD Mean in Trading?

CFD stands for Contract for Difference. It is a financial agreement between a trader and a broker to exchange the difference in an asset's price from when the position is opened to when it is closed, without owning the underlying asset.

2. How Does CFD Trading Actually Work?

If you believe the price will rise, you go long (buy); if you think it will fall, you go short (sell). Your profit or loss is based on the difference between the entry and exit prices, multiplied by your position size.

3. Can Beginners Trade CFDs?

Yes, beginners can trade CFDs, but we recommend starting with demo accounts, low leverage, and small positions.

Conclusion

In conclusion, CFD trading offers a flexible and powerful way for traders to access global financial markets. By allowing you to profit in both rising and falling markets, CFDs create opportunities that traditional investing doesn't always provide.

However, the use of leverage, market volatility, and overnight costs means that CFDs are not risk-free. Before you start your CFD trading journey, it's crucial to learn how they work, practice with demo accounts, understand the risks, and apply strict risk management strategies.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.