Gold price today and current XAU/USD levels

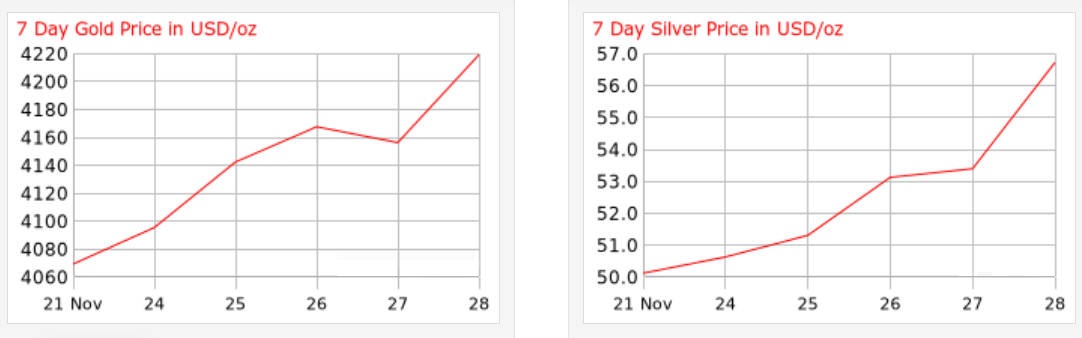

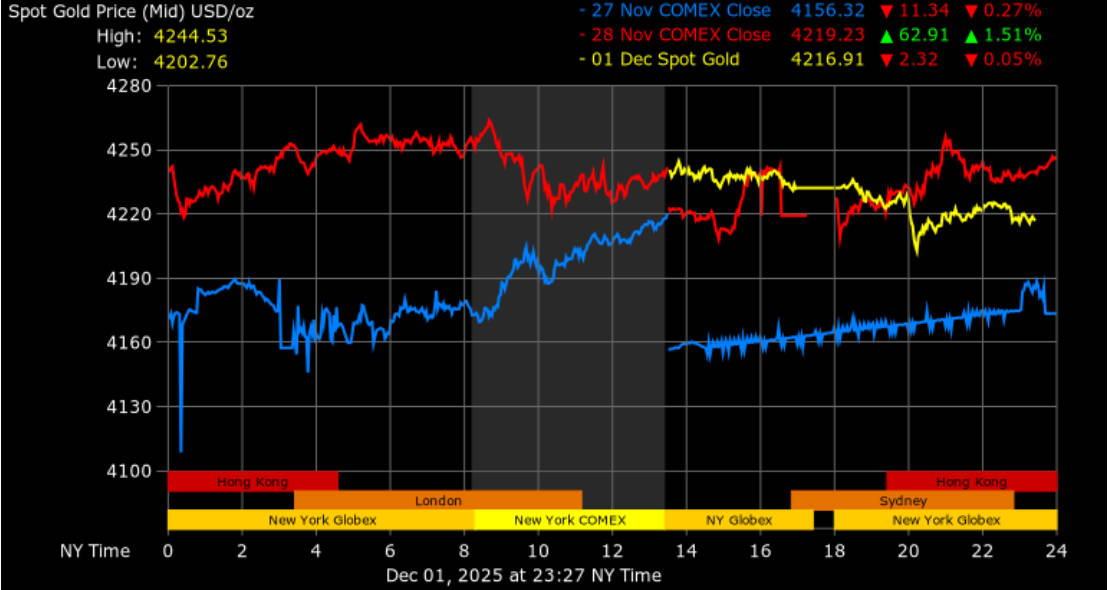

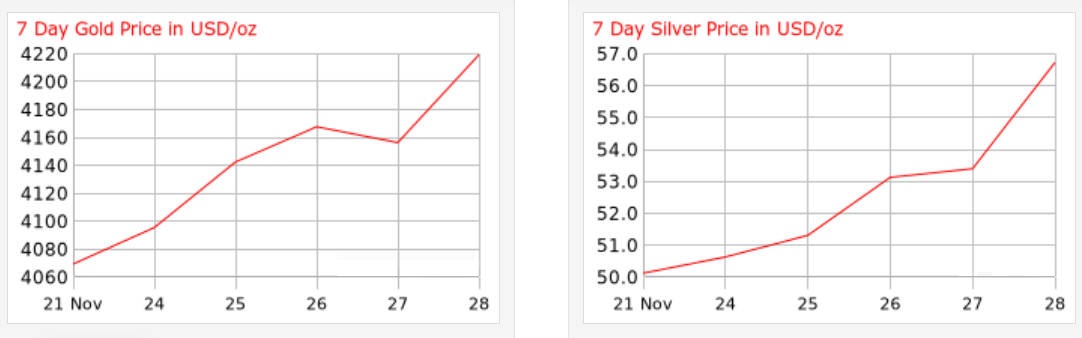

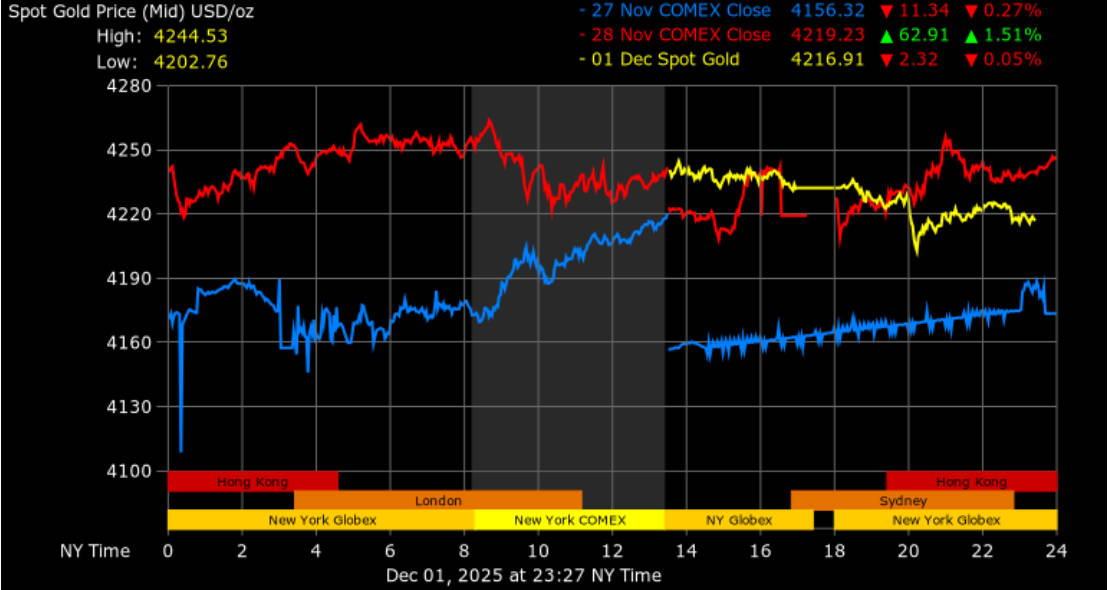

Spot gold (XAU/USD) is trading around USD 4,216 per ounce. The metal has held a strong upward trajectory over the past few weeks, gaining nearly 3% since late November. [1]

Silver has also experienced a notable surge, reaching a recent high of approximately USD 57 per ounce, signalling increasing interest in safe-haven and industrial metals alike. While silver remains secondary in focus, its gains reinforce the overall bullish sentiment in the precious metals sector.

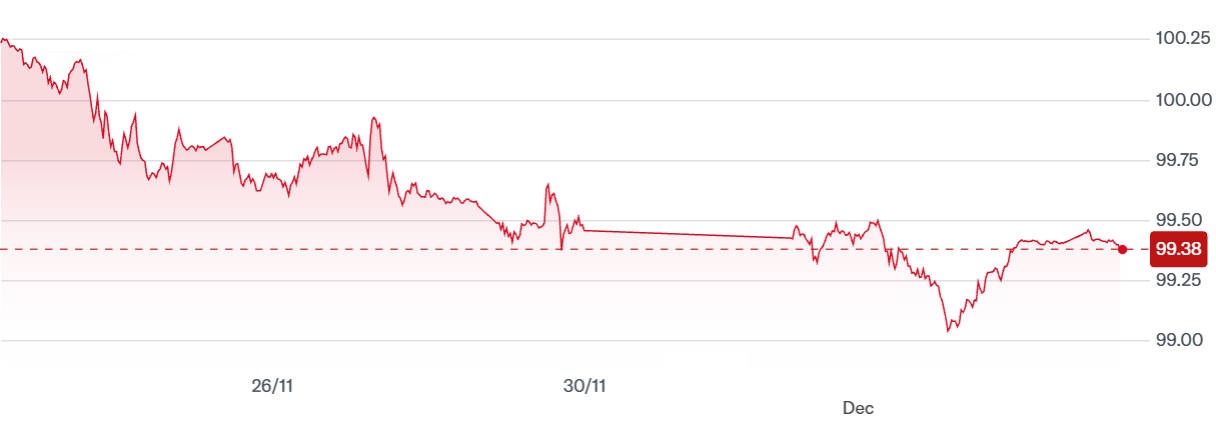

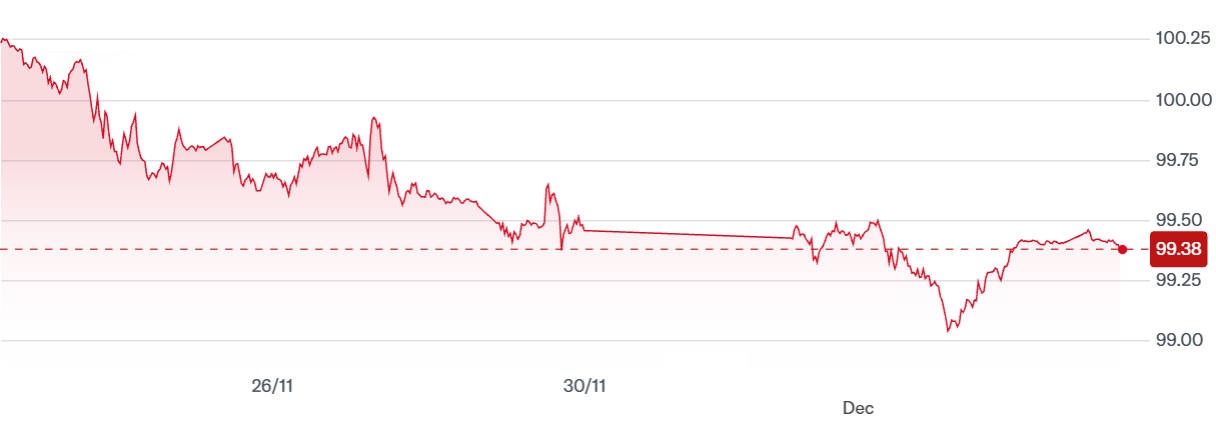

Meanwhile, the US dollar index (DXY) has softened to around 99.4. reducing pressure on dollar-priced metals and making gold more attractive for international buyers. Gold's resilience amid a softer dollar highlights the combined effect of Fed expectations and macroeconomic uncertainty.

Fed rate cut signals and US dollar weakness

Markets are increasingly pricing in a December 2025 rate cut from the Federal Reserve, with futures indicating roughly a 70% probability of a 25-basis point reduction. Lower interest rates reduce the opportunity cost of holding non-yielding assets such as gold, creating a fertile environment for short-term gains.

US dollar weakness further reinforces this dynamic. A softer DXY not only encourages foreign demand for XAU/USD but also supports gold ETFs and physical buying globally. Analysts note that Fed hawkishness in the past has often caused volatility, but current expectations of easing appear to be the key driver behind the current bullish gold price forecast.

Technical analysis gold and XAU/USD forecast

1. XAU/USDTrend and price structure

XAU/USD is currently in a clear uptrend on the daily chart, forming a series of higher highs since late October. This trend indicates that buyers remain in control, and the current momentum aligns with a constructive medium-term outlook.

2. Key support and resistance

Immediate resistance lies in the USD 4,300 to USD 4,350 range. A decisive daily close above this zone would confirm a potential breakout.

Support floors are around USD 4,140 to USD 4,180. a level that has previously absorbed pullbacks and held the trend intact.

These zones are crucial for both traders and longer-term investors, offering clear entry and exit points.

3. Momentum indicators

The 14-day RSI sits in the mid-40s to high-40s, signalling neutral momentum and leaving room for further upward movement without immediate overbought risk.

MACD indicators are bullish, with the histogram supporting continued upward pressure.

Short and medium moving averages act as dynamic support, providing a safety net during minor pullbacks.

4. Breakout probability and trading ideas

A daily close above USD 4,300 on strong volume would signal a high probability of continued upside. Failure to break resistance could trigger a pullback toward support near USD 4,140, offering potential re-entry opportunities. Traders should monitor RSI divergence and MACD crossovers for early warning signals.

Macro drivers beyond the Fed supporting gold price forecast

1. Geopolitical risk and safe-haven flows

Heightened geopolitical uncertainty elevates demand for safe-haven assets and physical gold. Recent risk-off episodes have benefited precious metals.

2. Central bank buying and reserve diversification

Central bank purchases remain a structural tailwind as many nations diversify reserves away from the US dollar, supporting the medium-term gold price forecast.

3. Fiscal pressures and long-term real yields

Ongoing fiscal deficits and potential future monetary easing put downward pressure on real yields, which is typically positive for gold.

4. Silver dynamics and investment flows

Strong silver performance and a narrow gold-silver ratio draw attention to precious metals broadly, encouraging ETF and physical buying that can lift gold prices. Reuters and goldprice data show silver gains alongside gold.

Gold price forecast: can XAU/USD break higher?

1. Bull case

If the Fed confirms a December 2025 cut and DXY remains weak, XAU/USD could push through USD 4,300 to target USD 4,500 in the medium term. Technical momentum would likely accelerate a sustained breakout.

2.Base case

A tested consolidation between USD 4,140 and USD 4,300, with gradual upside as macro catalysts reassert themselves. Monitoring CPI, NFP and Fed minutes is essential.

3. Bear case

Strong US data or hawkish Fed remarks lift the dollar and yields, prompting a pullback toward USD 4,000 or lower into the key support area. Traders should watch for RSI divergence as an early warning.

Trading insights and practical gold price strategies

Investors can stagger buys between USD 4,180–4,220.

Traders should watch for daily close above USD 4,300.

Stop-loss placement below USD 4,140 support is recommended.

Frequently asked questions

Q1. Why is the gold price rising right now?

Gold is climbing because markets anticipate a December 2025 Fed rate cut, which lowers opportunity costs. A softer US dollar and increased demand for safe-haven assets further support XAU/USD upside and the gold price forecast.

Q2. What is the gold price forecast for the coming months?

The outlook is bullish if Fed easing occurs and the dollar remains weak. XAU/USD could test higher resistance zones, while stronger US data could temporarily slow momentum. Monitoring macro data is essential.

Q3. How does US dollar weakness affect gold?

A weaker dollar makes gold cheaper for international buyers, increasing demand. Alongside lower yields from expected Fed cuts, this dynamic supports XAU/USD strength and reinforces short-term and medium-term gold price forecasts.

Q4. Do geopolitical risks influence safe-haven assets like gold?

Yes. Rising geopolitical tensions encourage investment in safe-haven assets, boosting demand for gold and silver. This effect often strengthens even when other economic drivers are neutral.

Q5. Which technical levels should traders watch in XAU/USD?

Resistance lies around USD 4,300–4,350 and support near USD 4,140–4,180. Traders should observe RSI, MACD signals, and daily close confirmations to identify breakouts or anticipate pullbacks.

Conclusion

Gold has continued its upward trajectory, supported by Fed rate cut signals, US dollar weakness, and broad macroeconomic uncertainty. Technical analysis shows XAU/USD in a bullish trend, with key resistance around USD 4,300–4,350 and support near USD 4,140–4,180.

Silver's recent high adds further confirmation that precious metals are benefiting from safe-haven demand and investor interest. While the outlook remains generally positive, traders and investors should remain vigilant for potential reversals triggered by stronger US economic data or shifts in Fed policy.

Overall, the gold price forecast suggests continued opportunities for those tracking XAU/USD and precious metals, but careful risk management and attention to technical and macro drivers remain essential.

Sources:

[1] https://goldprice.org/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.