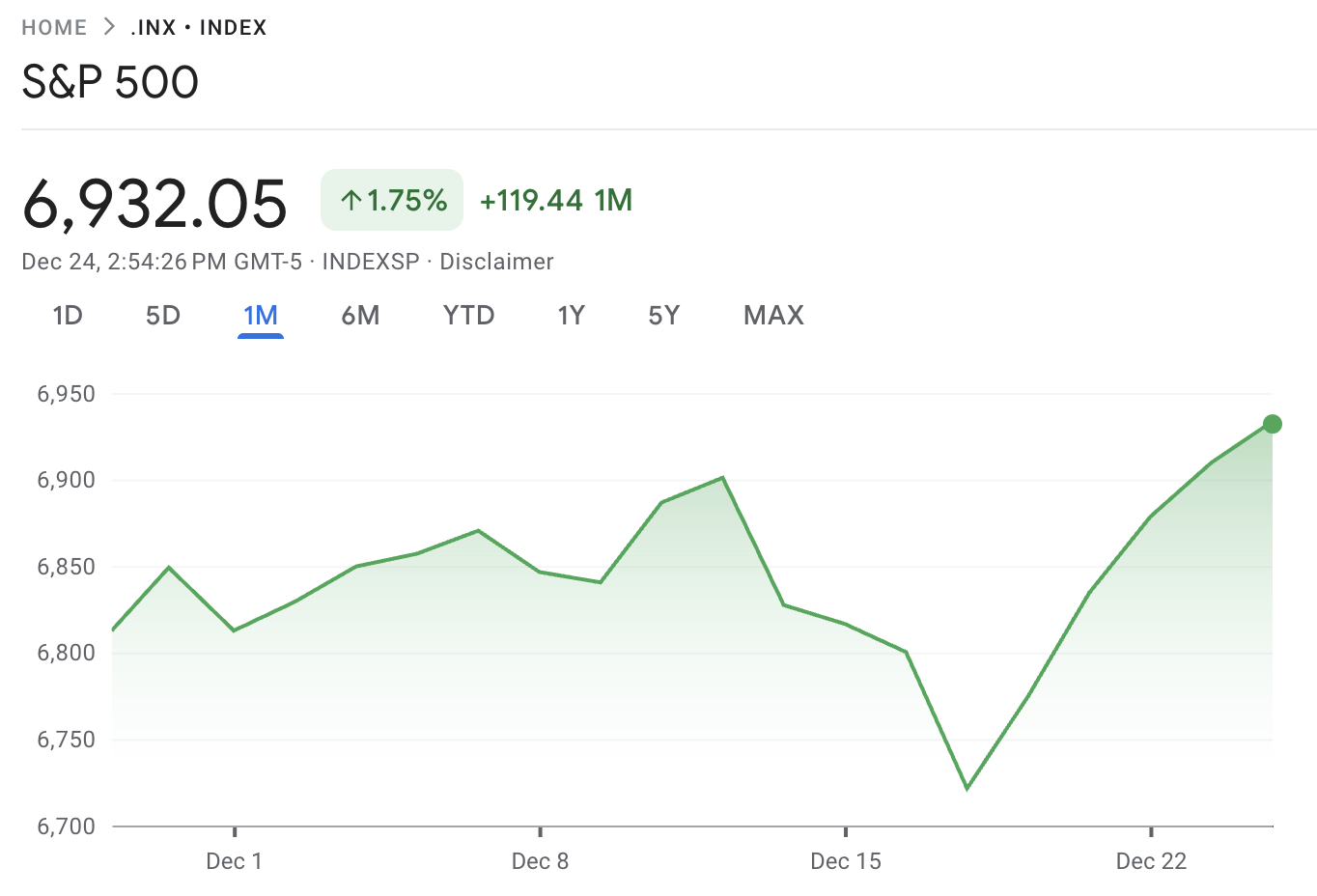

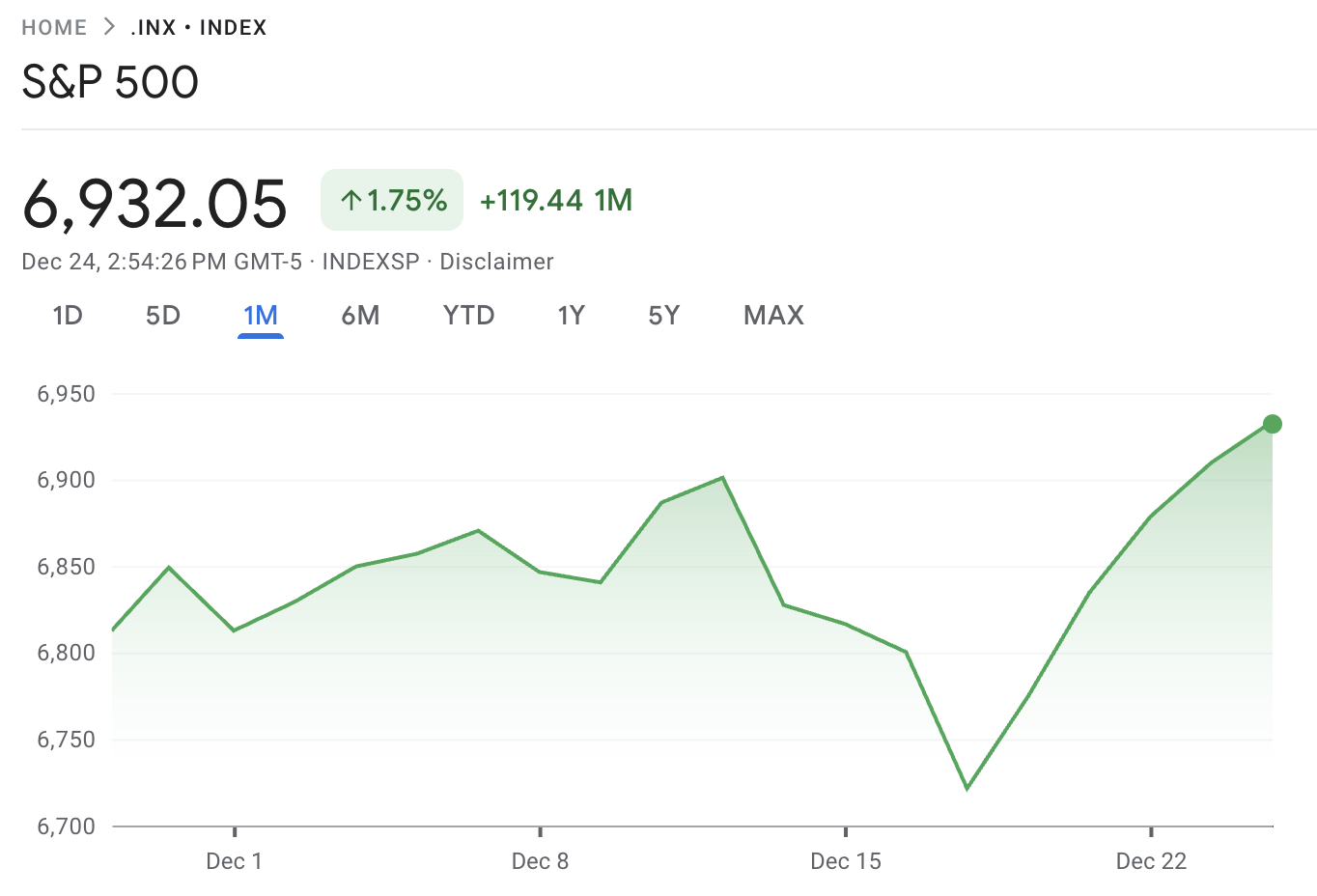

The S&P 500 and the Dow Jones Industrial Average ended the latest session at fresh record highs as year-end trading thinned and investors leaned into a 2026 outlook shaped by easier U.S. monetary policy and durable corporate earnings.

The S&P 500 closed at 6,932.05 on December 24, while the Dow finished at 48,731.16, both record closes, in a shortened pre-holiday session.

The rally reflects a market that is increasingly comfortable with cooling inflation, looser financial conditions, and a powerful corporate “bid” through buybacks and dividends, while keeping one eye on early-2026 data that can quickly reset rate expectations.

A calm volatility backdrop has reinforced risk-taking, with the VIX at 13.47 on December 24.

A central driver has been the Federal Reserve’s shift toward easing. In its December 10 statement, the Fed lowered the target range for the federal funds rate by 0.25 percentage point to 3.50% to 3.75%, and signaled that additional moves will depend on incoming data and the balance of risks. [1]

Inflation progress has supported that pivot. The U.S. The Bureau of Labor Statistics reported that CPI inflation for all items rose 2.7% over the 12 months ending in November, keeping alive the view that price pressures are moderating enough to allow further cuts if the trend holds.

Growth has also stayed firm, which helps justify record index levels. The Bureau of Economic Analysis estimated real GDP rose at a 4.3% annual rate in Q3 2025, led by increases in consumer spending, exports, and government spending that were partly offset by a decline in investment. [2]

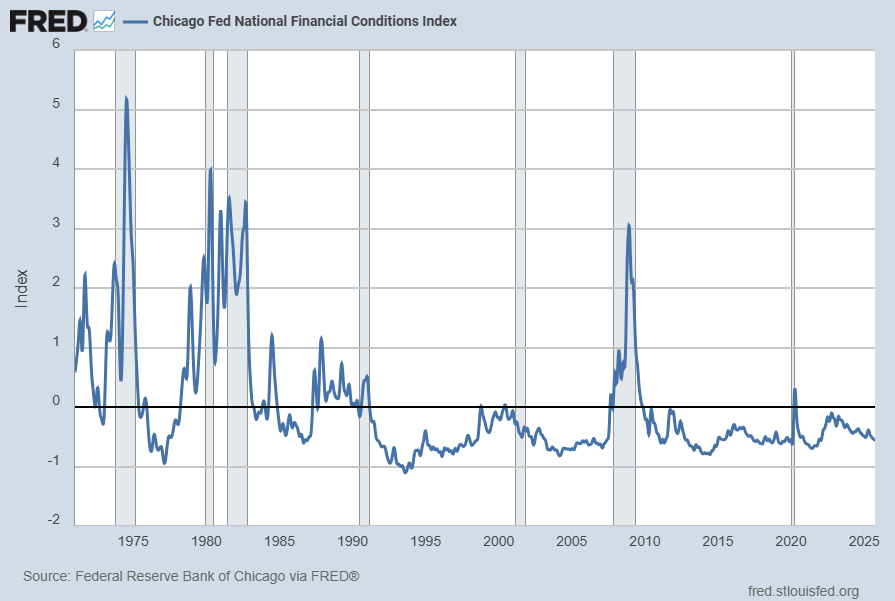

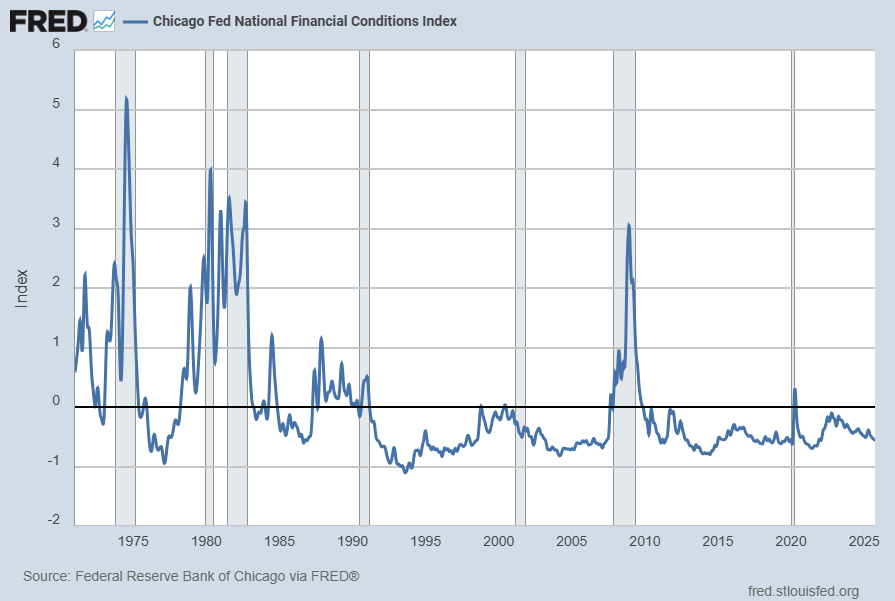

Easier financial conditions have reinforced the rally by lowering funding stress and supporting higher equity valuations.

The Chicago Fed’s National Financial Conditions Index remained meaningfully negative in mid-December, with the NFCI at -0.54299 for the week ending December 12 and -0.54911 for the week ending December 19, levels associated with looser-than-average conditions.

Corporate shareholder returns are another major pillar, especially when headline liquidity is thin. S&P Dow Jones Indices reported S&P 500 Q3 2025 buybacks of $249.0 billion, and a record $1.020 trillion in repurchases over the 12 months ending September 2025, alongside record dividends over the same 12-month period.

The same report noted an initial 2026 outlook in which companies planned to increase buyback spending, supported by expected cash flow.

Seasonality and market mechanics amplified the late-December move. The December 24 session was an early close at 1:00 p.m. Eastern time, and trading volume was unusually light, conditions that can intensify index moves when positioning is one-directional.

Heading into 2026, the market’s “price of admission” is higher: record indices mean disappointments on inflation, rates, or earnings can produce sharper pullbacks than investors saw during the climb.

The calm VIX environment supports risk-taking, but it can also indicate under-hedging, making markets more sensitive to surprises once liquidity normalizes in January.

The first quarter’s calendar is built to test the soft-landing narrative quickly. The BLS says December 2025 CPI data will be released on January 13, 2026, a report that can immediately reprice the path of rate cuts through bond yields and equity valuations.

Monetary policy checkpoints arrive fast as well. The Fed’s published schedule shows the next FOMC meeting on January 27 to 28, 2026, followed by March 17 to 18, with additional meetings throughout the year, giving markets regular opportunities to validate or challenge expectations for further easing. [3]

Three forces are likely to define whether record highs can extend in 2026. The first is inflation persistence: a renewed uptick in key categories would limit cuts and pressure valuations.

The second is earnings durability: if margins compress or demand softens, equity leadership can narrow and become more fragile. The third is the corporate bid: continued buybacks and dividend growth can stabilize pullbacks, but that support is ultimately tied to cash flow and confidence.

A reasonable base case for 2026 is a slower, choppier market where returns depend more on earnings growth than on higher valuation multiples, because a large portion of the “good news” about rates and disinflation is already reflected in prices.

The upside case requires cleaner disinflation alongside productivity-driven profit growth that broadens leadership beyond the largest stocks. The downside case is a double hit of sticky inflation and fading growth, forcing a harsher pricing across both bonds and equities.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.federalreserve.gov/newsevents/pressreleases/monetary20251210a.htm

[2] https://www.bea.gov/news/2025/gross-domestic-product-3rd-quarter-2025-initial-estimate-and-corporate-profits

[3] https://www.federalreserve.gov/monetarypolicy/fomccalendars.htm