Nvidia dropped on Tuesday after Intel said it had completed a $5 billion

private share sale to the chip designer. Nvidia became the world's first $5

trillion company in October.

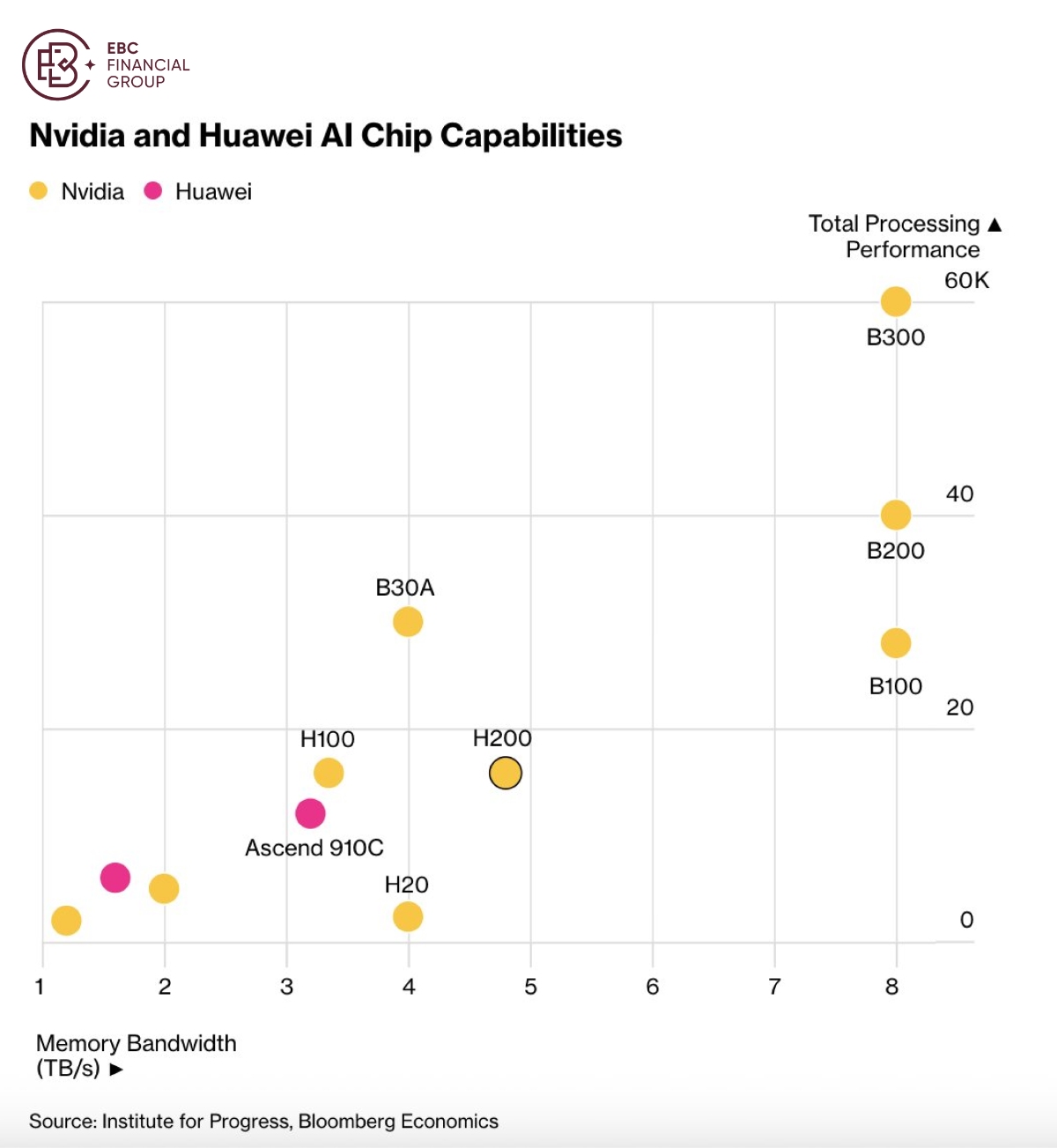

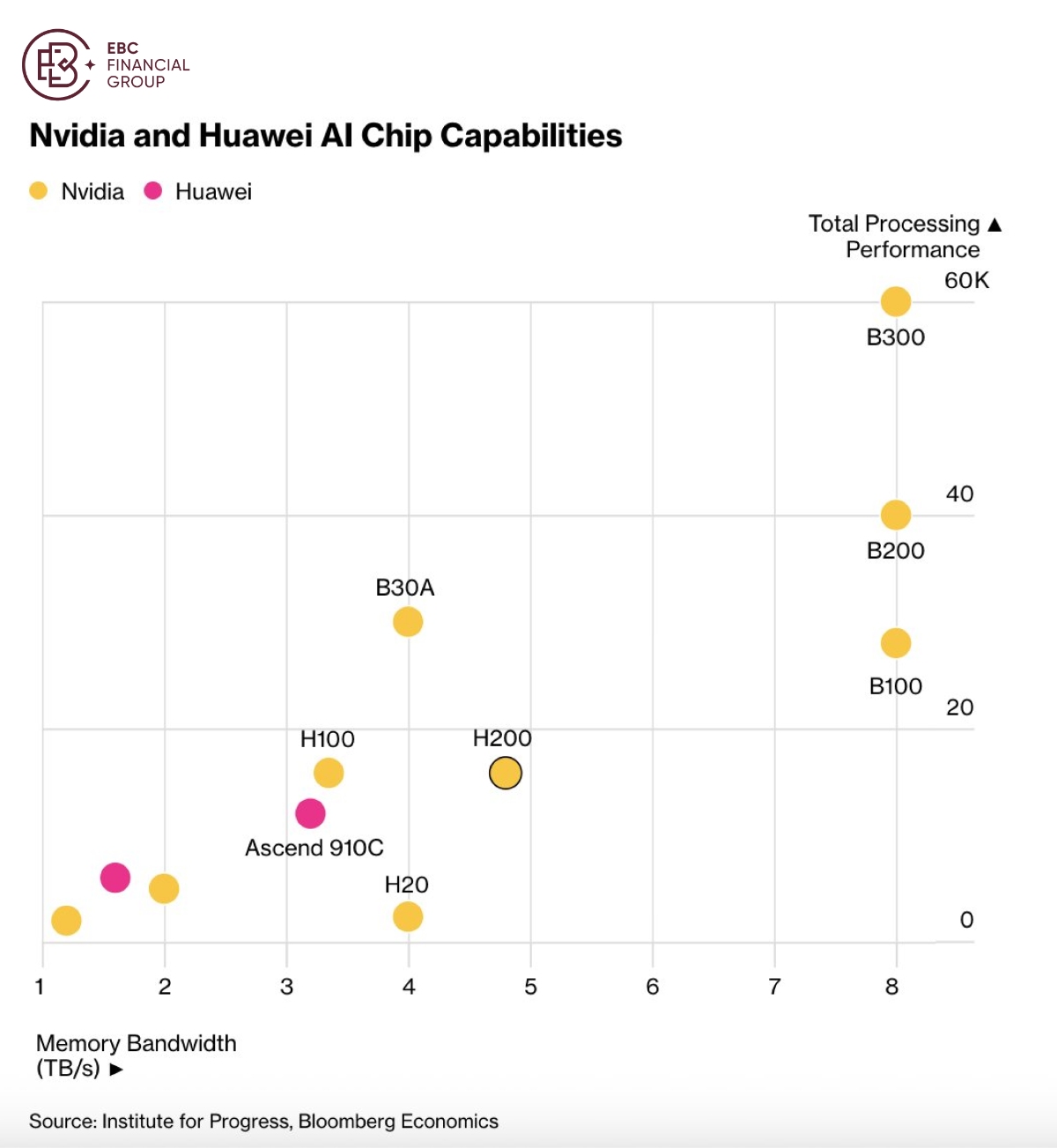

Trump said earlier this month that Nvidia would be allowed to ship its H200

AI chips to "approved customers" in China and elsewhere, on the condition that

the US gets a 25% cut.

His permission came after concluding the move carried a lower security risk

because Huawei already offers AI systems with comparable performance, according

to a person familiar with the deliberations.

Now the question for CEO Jensen Huang is whether Beijing wants it or will let

companies buy it. After the ban was lifted, the Financial Times reported China

would "limit access" to the H200, citing unidentified sources.

The H200 is far more advanced than the H20, which could be tempting for

China, while domestic alternatives to the product remain behind in performance.

This makes purchase an attractive proposition.

Nvidia is scrambling to meet strong demand for its H200 chips from Chinese

technology companies and has approached contract manufacturer TSMC to ramp up

production, sources said this week.

The company is not baking in huge China sales into its forecasts as a result,

which leaves rooms for result to surprise on the upside. However, Beijing's

longer-term trajectory of self-sufficiency will continue.

Tech self-reliance

China on Friday launched three venture capital funds to invest in "hard

technology" areas, CCTV reported. The capital contribution plans for the funds

have been finalised, each with more than 50 billion yuan.

Huawei can compete far more closely with Nvidia than the US has acknowledged.

White House officials focused on a Huawei AI platform known as CloudMatrix 384

that relies on the company's newer Ascend chips.

While previous Ascend models are not considered competitive with Nvidia's on

a chip-by-chip basis, Huawei has been able to build high-performance "clusters"

by linking more of its processors.

Alibaba was developing a new AI chip in August, CNBC reported, specifically

designed for inference rather than training; Baidu has increasingly funnelled

more resources into its in-house chip designer Kunlunxin.

Also China is reportedly requiring chipmakers to use at least 50%

domestically made equipment for adding new capacity. Analysts estimate that it

has reached roughly 50% self-sufficiency in photoresist-removal and cleaning

equipment.

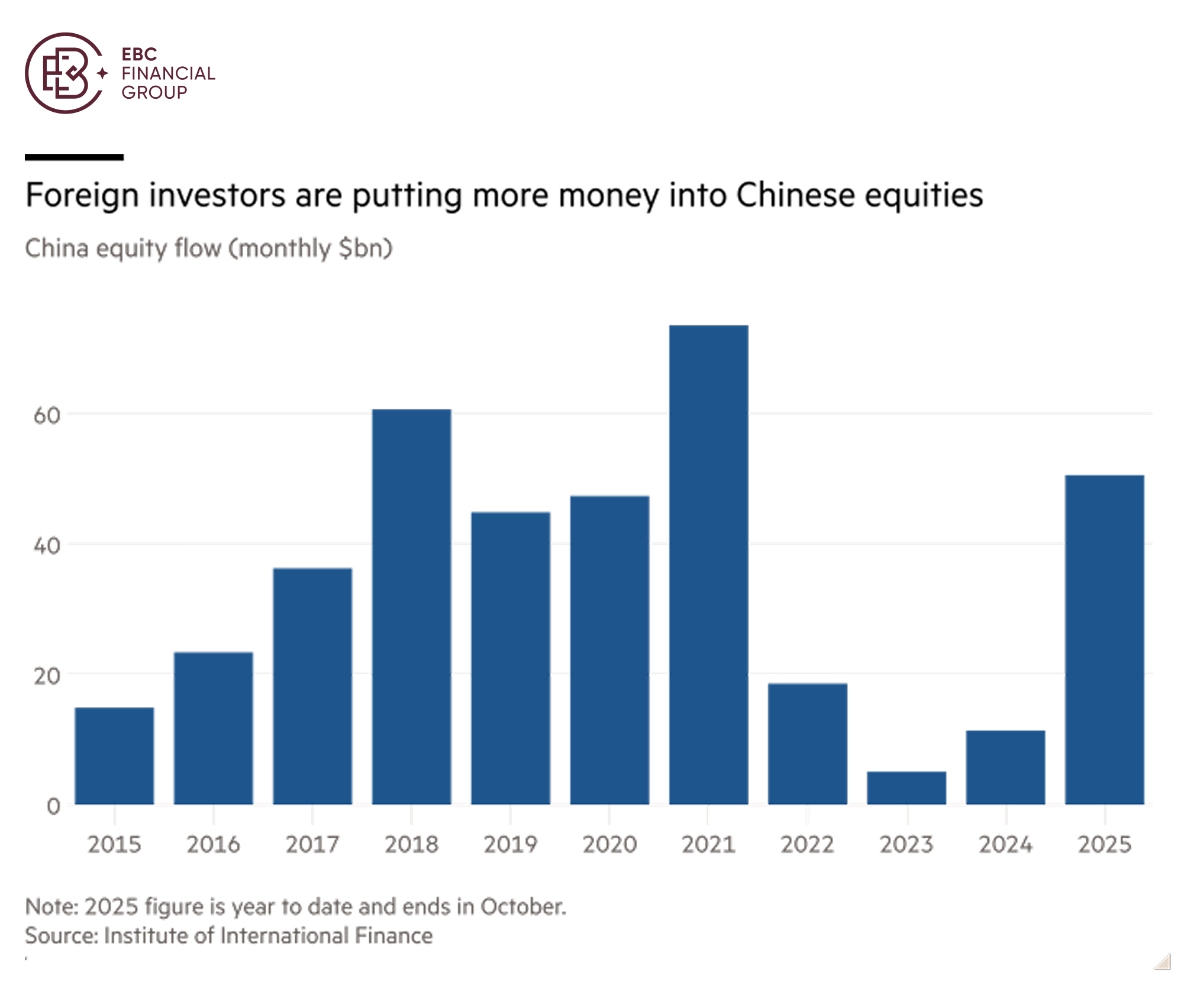

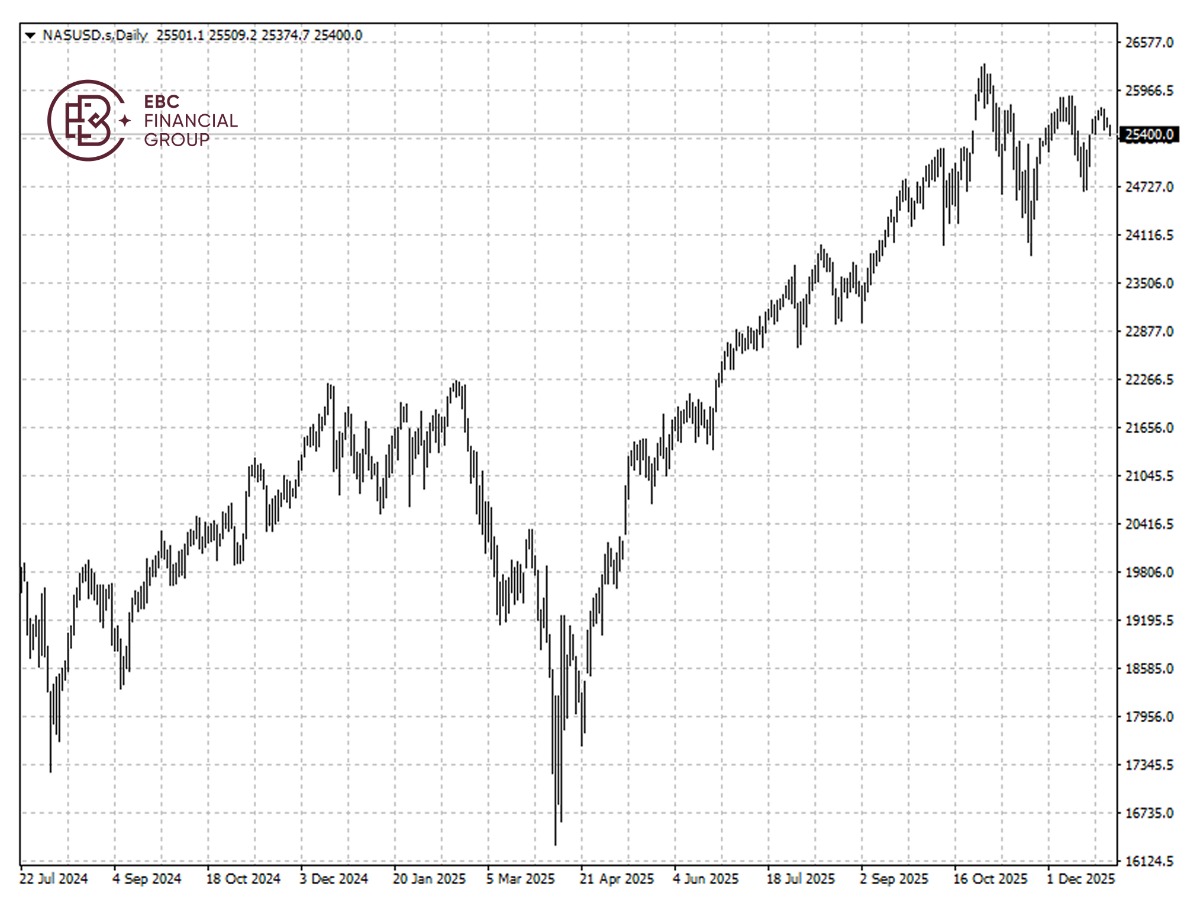

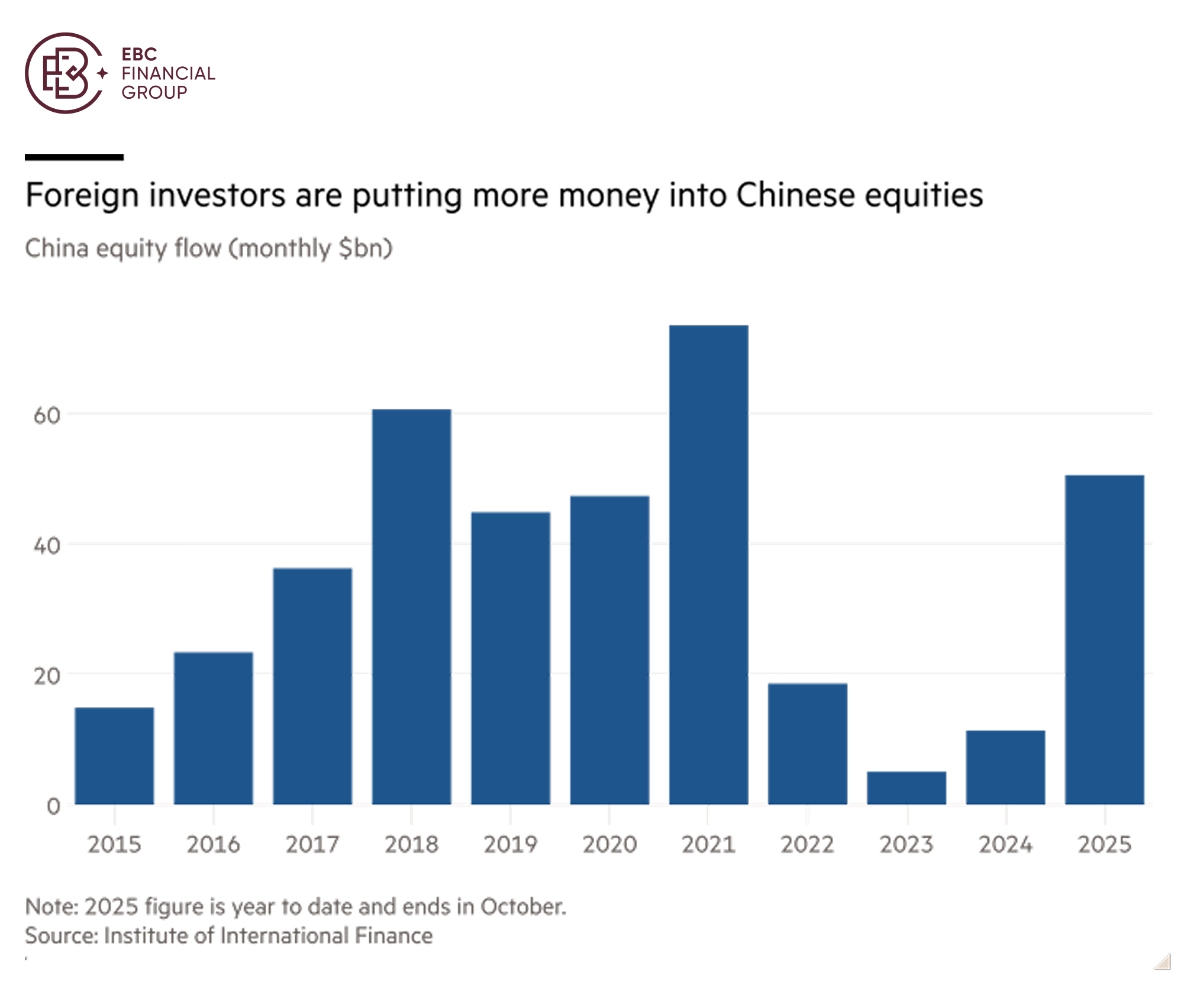

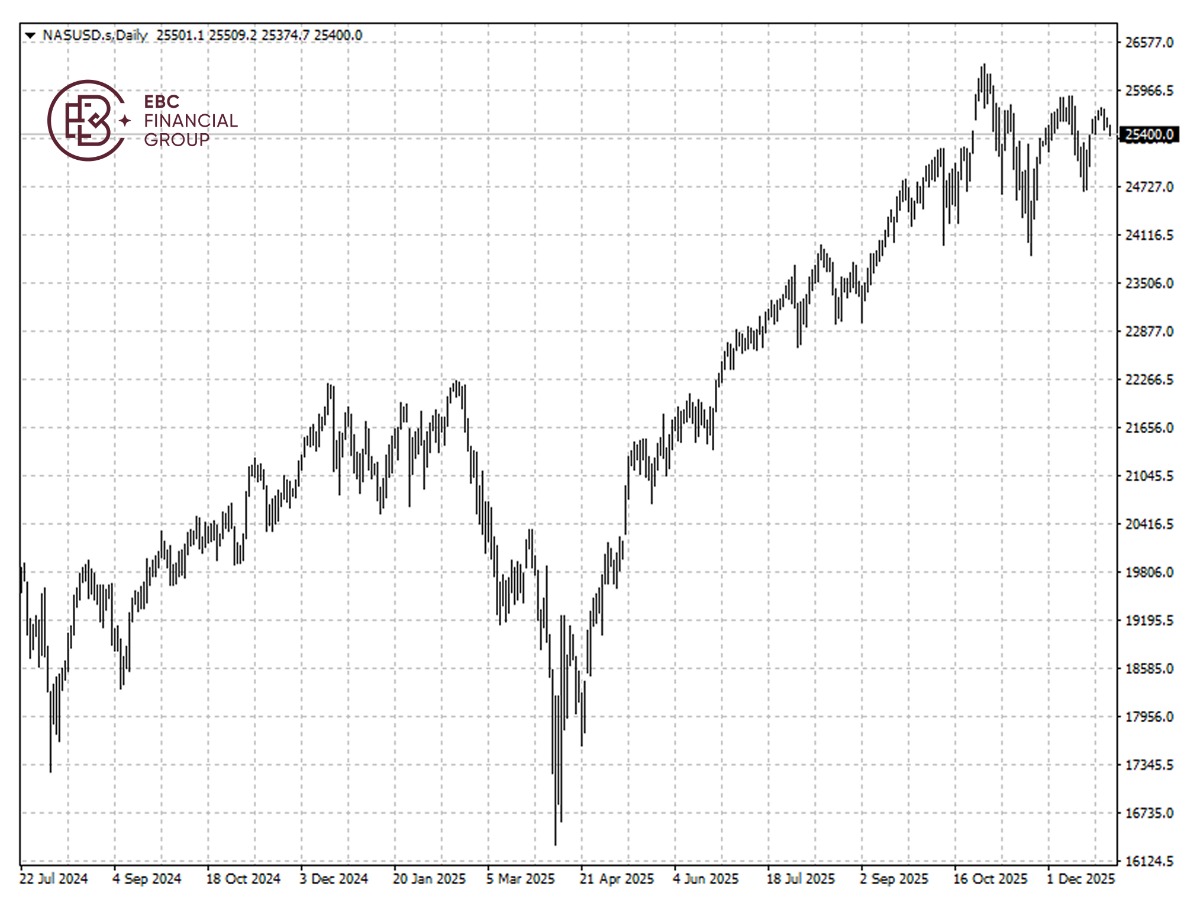

Some global asset managers to rebalance portfolios away from exposure to

"Magnificent 7". While the Nasdaq 100 trades at elevated earnings multiples, the

Hang Seng Tech Index offers cheaper access to Chinese AI leaders.

Despite that, the explosive debut performances of newly listed Chinese AI

chipmakers have raised concerns that parts of the sector are being driven more

by hype than by fundamentals.

Polarity effect

Global asset managers' cash holdings have fallen to 3.3% in December,

according to a closely watched survey of fund managers by BofA — the lowest

level since the survey began in 1999.

The measure of optimism exceeds even the heights of the "Trump trade" at the

end of 2024, as investors piled into US stocks and the dollar in anticipation of

a market-friendly presidency.

The survey also showed that a growing proportion of investors expect

long-term interest rates to be higher in 12 months' time, and 75% of managers

expect yield curves to steepen over that period.

Barclays Private Bank and Wealth Management chief market strategist Julien

Lafargue said valuations are "not cheap" but companies are delivering on growth,

calling for differentiation across specific sectors.

The bigger risk lies with companies benefitting from an increased share price

when they have not yet generated earnings, he added, pointing to quantum

computing-related companies.

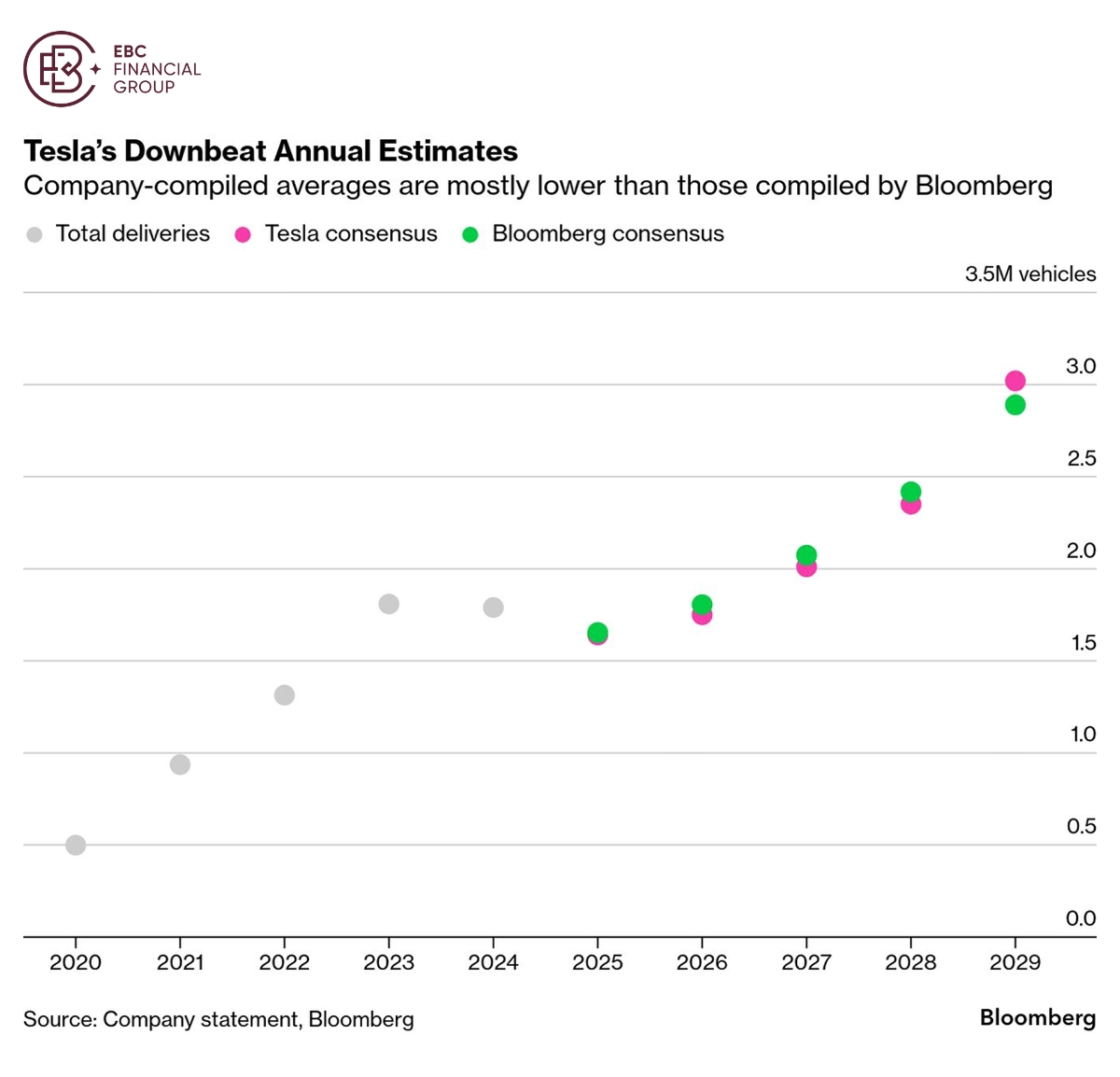

Michael Field, chief equity strategist at Morningstar, sees an upside in most

of "Magnificent 7" despite crowded trades. However, he warns Tesla is "more than

50% overvalued."

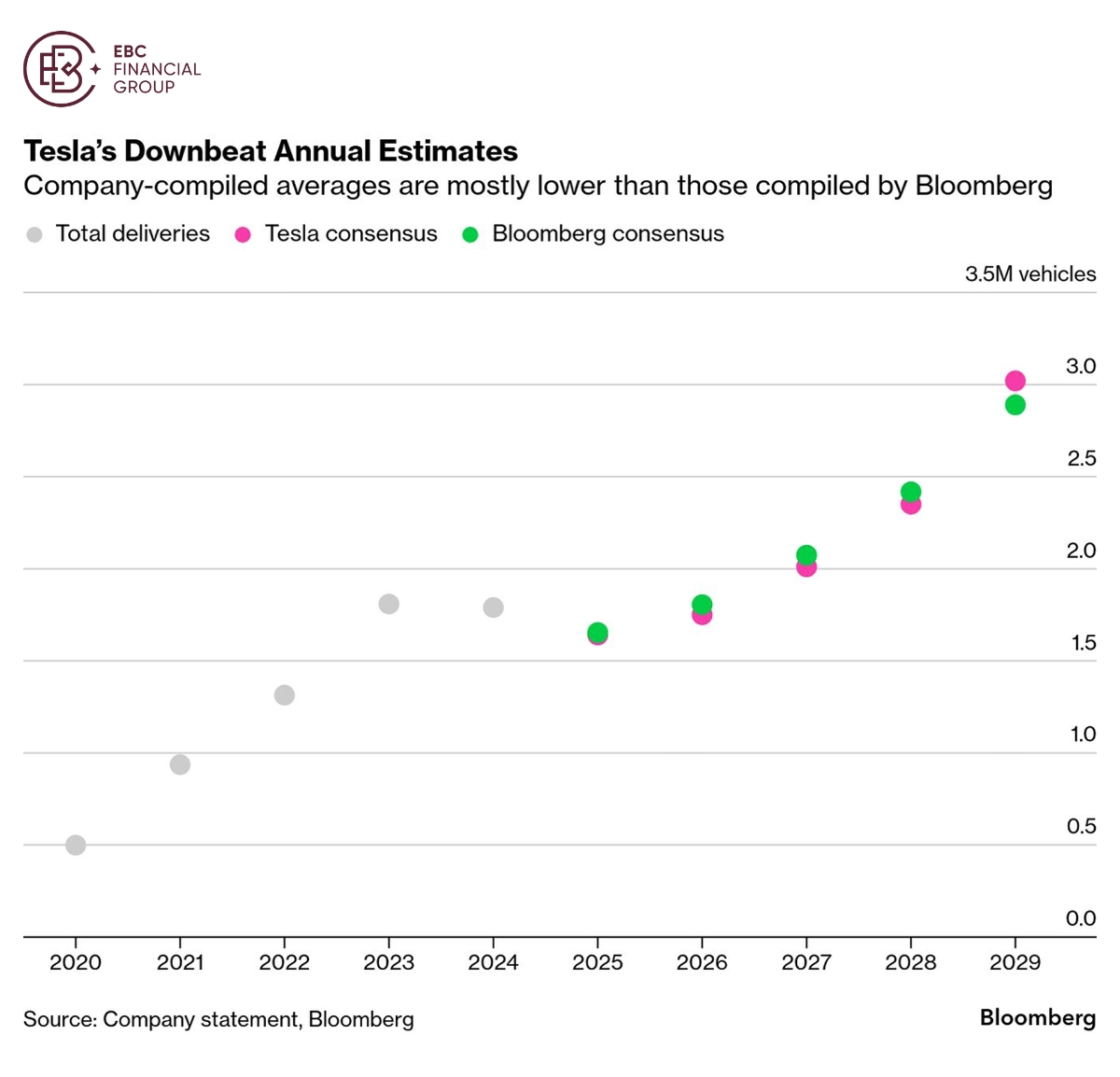

Tesla has taken the unusual step of publishing a series of sales estimates

indicating the outlook for its vehicle deliveries may be lower than many

investors were expecting.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.