Global equity markets remained volatile on 9 July 2025, with major US indices edging lower as investors digested renewed tariff threats from Washington and persistent global trade tensions.

The Dow Jones Industrial Average and S&P 500 both posted modest declines, while the Nasdaq Composite managed a slight gain. The cautious sentiment reflected broader uncertainty across world markets, with commodity prices swinging and central banks in focus.

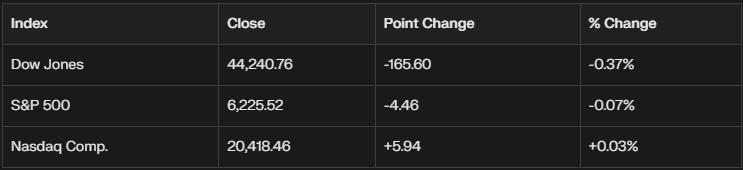

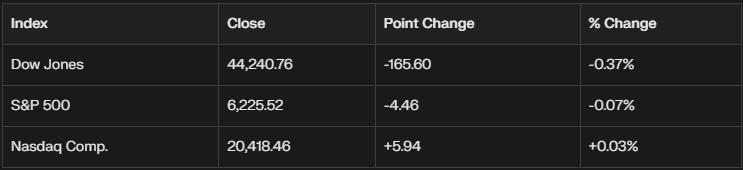

Global Market Indices: Dow, S&P 500 Edge Lower

US Markets: Modest Losses Amid Tariff Jitters

The Dow Jones Industrial Average fell by 165.60 points, or 0.37%, closing at 44,240.76. The S&P 500 slipped 4.46 points, or 0.07%, to end at 6,225.52. The Nasdaq Composite was the exception, rising 5.94 points, or 0.03%, to 20,418.46.

US markets faced a second day of declines after President Trump confirmed that new tariffs—ranging from 25% to 40% on imports from 14 countries—would take effect from 1 August, with no further extensions. The announcement also included a 50% levy on copper imports and the possibility of a 200% tariff on pharmaceuticals, though with an 18-month grace period. These moves heightened investor caution, especially in sectors exposed to global trade.

Sector Performance and Market Drivers

-

Copper Producers: US copper prices surged 10% after the tariff announcement, lifting shares of major producers.

-

Pharmaceuticals: Pharma stocks were volatile, initially rising on speculation of tariff exemptions before paring gains as the threat of steep tariffs loomed.

Technology: The Nasdaq's resilience was supported by continued strength in large-cap tech names, offsetting broader market weakness.

European and Asian Market Moves

European indices showed resilience despite the US tariff news. Germany's DAX rose 0.55% to 24,206.91, the UK's FTSE 100 gained 0.54% to 8,854.18, and France's CAC 40 added 0.56% to 7,766.71. European defence stocks hit record highs as investors sought safety amid geopolitical uncertainty.

In Asia, market performance was mixed:

-

Nikkei 225: Opened at 39,942.80, up 0.64%.

-

Hang Seng: Opened at 24,061.08, down 0.36%.

-

Shanghai Composite: Opened at 3,498.72, up 0.04%.

KOSPI: Opened at 3,123.22, up 0.27%.

Australian shares edged lower, with the S&P/ASX 200 opening at 8,565.30, down 0.30% as the Reserve Bank of Australia's rate hold and global trade risks weighed on sentiment.

Central Bank Actions and Macro Data

-

Malaysia: Bank Negara Malaysia cut its key rate to 2.75%, the first reduction in five years, citing weaker growth and global trade risks.

-

Australia: The RBA held rates steady at 3.85%, surprising some analysts and supporting the Australian dollar.

US: Investors awaited the release of the Federal Open Market Committee (FOMC) minutes and the start of the Q2 earnings season, with Delta Air Lines set to report first.

Commodities and Currencies

-

Copper: US copper futures surged over 10% on the 50% tariff news.

-

Oil: Prices remained volatile, with traders eyeing upcoming OPEC+ output decisions.

US Dollar: The dollar index hovered near 3.5-year lows, supporting some risk appetite but adding to volatility in emerging market currencies.

Market Sentiment and Outlook

The global market mood remains fragile as investors weigh the impact of US trade policy shifts, central bank actions, and key economic data releases. The confirmation of the August 1 tariff deadline and the breadth of new levies have injected fresh uncertainty, prompting defensive positioning in sectors like defence and commodities.

Looking ahead, markets will focus on:

-

The outcome of ongoing trade negotiations and any further policy shifts from Washington.

-

Corporate earnings reports, particularly in sectors exposed to tariffs and global supply chains.

Central bank communications, especially from the US Federal Reserve and European Central Bank, as inflation and growth risks evolve.

Conclusion

The Dow and S&P 500 edged lower on 9 July 2025, mirroring a cautious tone across global markets as new US tariffs and persistent trade tensions weighed on sentiment. While some indices managed modest gains, the broader outlook remains clouded by policy uncertainty and macroeconomic headwinds. Investors are likely to remain vigilant as the second half of the year unfolds, with trade, earnings, and central bank policy all in sharp focus.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.