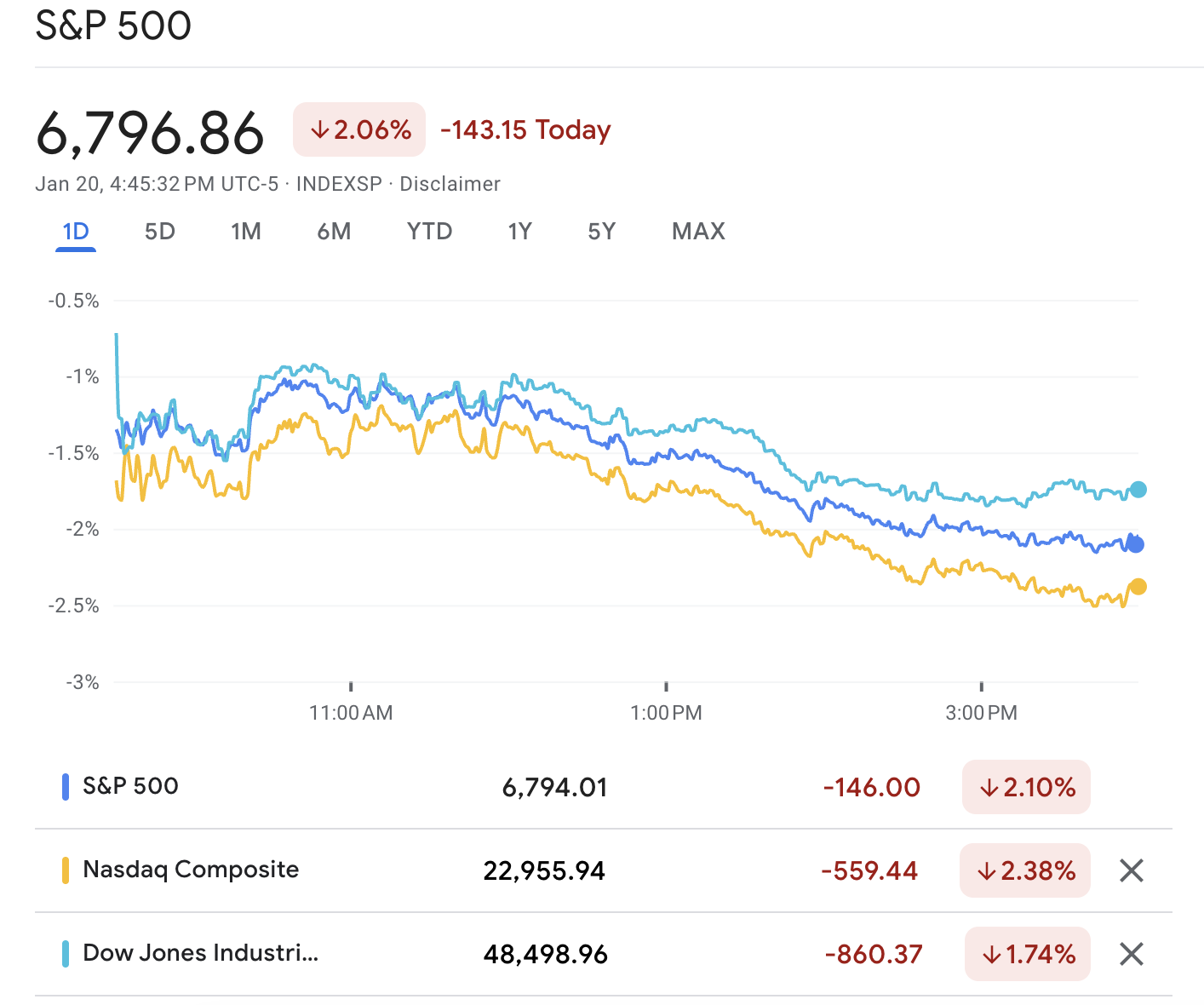

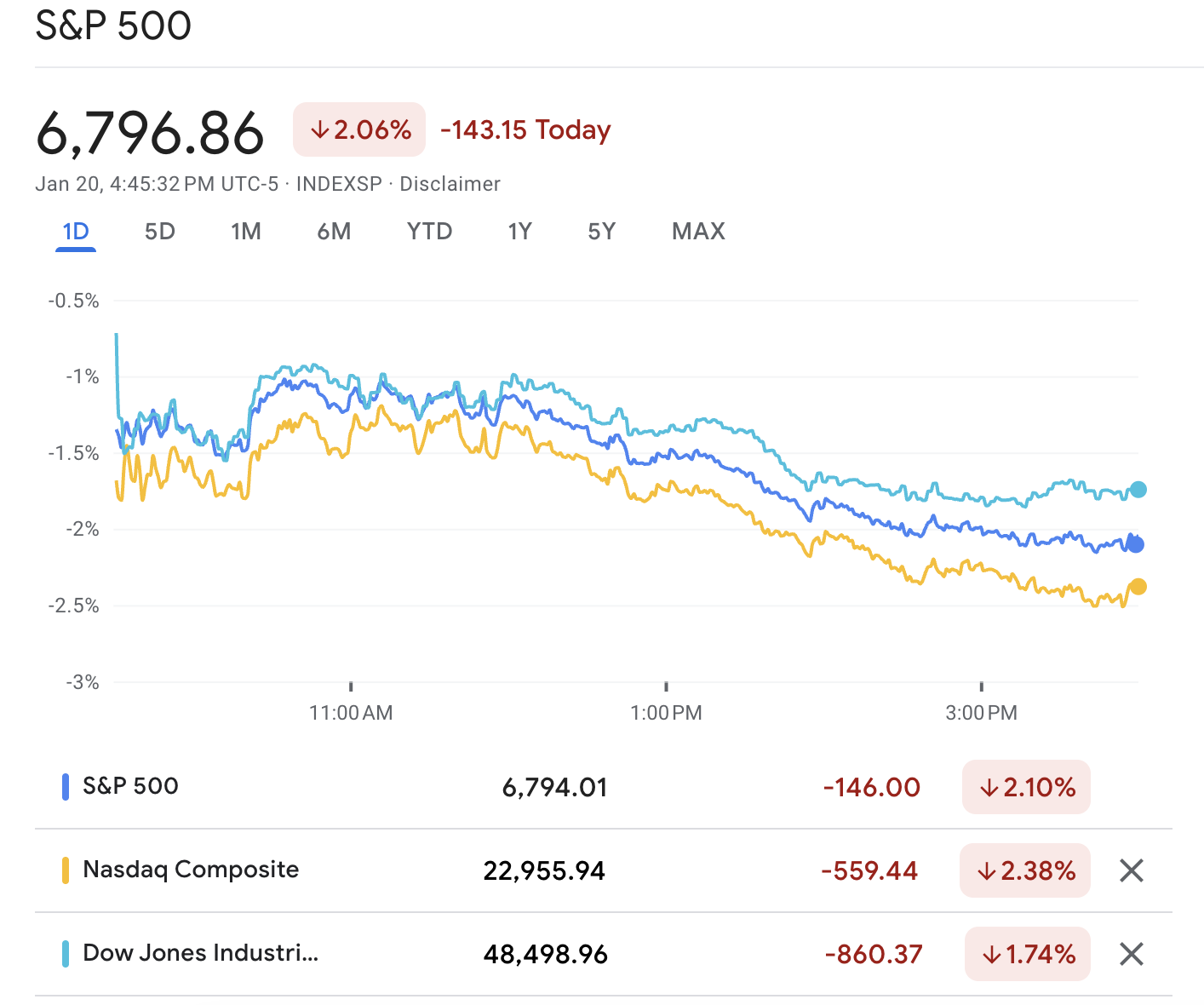

US stocks fell sharply on Tuesday, January 20, 2026, as traders returned from the Martin Luther King Jr. Day holiday to a fresh wave of tariff headlines from President Donald Trump.

By the close:

The S&P 500 fell 2.06% to 6,796.86.

The Nasdaq Composite fell 2.39% to 22,954.32.

The Dow Jones Industrial Average fell 1.76% to 48,488.59.

The movement felt larger than the percentages as it impacted multiple asset classes simultaneously. Gold skyrocketed to record highs, the dollar declined, and volatility increased.

This article explains what happened, why it matters, which market segments are most exposed, and what signals to watch next.

What Trump Said: The Tariff Trigger That Shocked Investors

Over the weekend, President Donald Trump threatened new tariffs on several European allies as part of his push to secure control of Greenland.

For context, Trump announced that an additional 10% import tariff would take effect on February 1, 2026, on goods from Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland, and Great Britain.

He also stated that the tariff would increase to 25% on June 1, 2026, and remain in place until an agreement was reached for the US to purchase Greenland.

Those countries are not minor trade partners; they sit at the center of major global supply chains. That is why investors did not treat this as symbolic talk. They treated it as a real risk to earnings and international growth.

Us Market Snapshot: How Bad Was the Sell-off?

| Market measure |

Move today |

Why it matters |

| S&P 500 |

-2.06% to 6,796.86 |

Broad "risk-off" move in US stocks. |

| Nasdaq Composite |

-2.39% to 22,954.32 |

Growth stocks were hit hardest. |

| Dow |

-1.76% to 48,488.59 |

Cyclicals and industrials joined the slide. |

| VIX (fear gauge) |

Closed 20.09; highest close since 24 Nov |

Risk hedging became more expensive. |

| VIX intraday |

Reached 20.69 (eight-week high) |

Traders demanded protection quickly. |

US stocks posted their most significant one-day drop in about three months on Tuesday, January 20, 2026, after a tariff threat hit sentiment.

Both the S&P 500 and Nasdaq fell below their 50-day moving averages, which is significant because many systematic strategies utilize that level as a risk indicator.

Cross-Asset Reaction: Dollar, Bonds, and Safe Havens

| Asset class |

What moved |

What it is signalling |

| US dollar |

Dollar index fell to 98.841 |

Some investors treated this as a "Sell America" risk premium story. |

| US Treasuries |

10-year yield rose to about 4.287% |

Long-end yields rose as bonds sold off, partly from global spillovers. |

| Gold |

Spot rose to about $4,737 and hit $4,750 intraday |

Classic flight to safety as trade risk jumped. |

The key takeaway is that this was not a neat rotation from stocks into bonds. Bonds were also under pressure, which made the equity selloff feel heavier.

Why Is the Stock Market Down Today? 4 Transmission Channels

1) Tariffs Hit Profits Through Costs, Pricing, and Demand

A tariff is a tax on imports. That tax is divided between businesses and consumers, influenced by pricing ability and competition.

For equities, the first-order fear is simple:

Input costs rise for companies that import parts, materials, or finished goods.

If companies pass on price increases, demand can cool, and volumes can fall.

If companies cannot pass prices on, margins shrink.

This is why tariff headlines often hit stocks before any tariff is actually implemented. Markets price future cash flow risk immediately.

2) Tariffs Raise Uncertainty, and Uncertainty Raises the Discount Rate

Even if a company is not directly affected by tariffs, it can still suffer from uncertainty, as businesses tend to delay spending when regulations appear unstable.

In the past, tariff uncertainty has been linked to weaker business investment because firms hold back on hiring and capital plans until they can see the policy path more clearly.

Markets do the same thing. When uncertainty rises, investors usually demand a higher return to hold risky assets. That pushes valuations down.

3) Retaliation Risk Makes the Shock Feel Larger Than the Starting Tariff Rate

Additionally, the central EU states condemned the threats, and France proposed a broader range of countermeasures.

For example, the European Union discussed countermeasures, including preparing possible retaliatory measures and a tariff package worth about €93 billion.

US Treasury Secretary Scott Bessent also downplayed "hysteria" and dismissed the idea that the EU would use its Anti-Coercion Instrument. Still, that comment itself shows how serious the policy conversation has become.

Retaliation serves as the connection between "policy headline" and "economic damage," which is why the market closely monitors it.

A helpful example came from Sweden's Board of Trade, which warned that Swedish exports to the US could drop sharply if the tariff threat is carried out, with a much larger hit at the higher tariff rate.

4) Global Bond Stress

Japanese government bonds experienced a significant sell-off following the announcement of a snap election, which influenced yields in other markets, including the US.

In the US Treasury market,

The 10-year yield reached levels not seen since late August, and later traded around 4.287%.

The 30-year yield rose to about 4.918%.

When yields rise at the same time that stocks fall, it removes one of the usual cushions for equities. It also tightens financial conditions for companies that rely on borrowing.

What Got Hit the Hardest, and Why Tech Led the Fall?

When markets go risk-off, the most expensive and most popular areas often fall first. Technology stocks carried outsized weight in the decline. For example, Nvidia fell 4.4%, and Apple fell 3.5% on the day.

That is not only about tariffs. It is also about positioning.

Tech is heavily owned, so it gets sold to raise cash quickly.

High-growth stocks are more affected by uncertainty because their valuations heavily depend on future earnings.

Any fear of slower global growth tends to pressure chip demand and consumer electronics.

Retail, banking, and industrial companies all experienced a significant decline, highlighting the widespread nature of the selling pressure.

US Stocks Technical Read: What Traders Should Watch After the Drop

Key Levels to Watch (Practical, Not Predictive)

| Index |

Today's close |

First support area |

Next support area |

First resistance area |

| S&P 500 |

6,796.86 |

6,750 (round-number zone) |

6,700 |

6,850 |

| Nasdaq Composite |

22,954.32 |

22,800 |

22,500 |

23,250 |

| Dow |

48,488.59 |

48,000 |

47,500 |

49,000 |

These levels are crucial because they correspond to the points where many traders set their stop-loss orders and profit targets. Round numbers often act like magnets during volatile weeks.

Could This Turn Into Something Worse?

A one-day drop is not a crash. The market will decide whether this becomes a deeper trend based on follow-through.

Three Questions That Will Shape the Next Move

1. Do these tariff threats become law on schedule?

Markets can recover from threats if they fade, but they tend to stay weak if policy actions harden.

2. Does Europe retaliate, and how broad is it?

Retaliation increases the likelihood that corporate guidance will span multiple sectors.

3. Do tariffs raise inflation pressure and complicate rate cuts?

Tariffs can push prices higher, making central banks more cautious. If the market starts pricing fewer cuts, equities often struggle.

What to Watch Next?

1) The Calendar Risk

If markets believe the policy will be negotiated away before those dates, today can look like a shock and fade. If markets believe implementation is likely, the risk premium can persist.

2) The Macro Data and Fed Pricing Risk

Investors face several key US releases this week, including GDP updates, PMI readings, and the PCE inflation report.

In rates, futures were pricing less than two 25 bp cuts for 2026, and the markets expect the Fed to hold steady at its next meeting.

That combination matters because tariffs can push inflation up while pulling growth down. When that occurs, the Federal Reserve has less ability to support the stock market.

3) The Market Stress Signals

Volatility: Does the VIX hold above 20, or does it cool quickly?

Breadth: Do most sectors keep falling, or does selling narrow?

Rates: Do long yields keep rising, which would add pressure to valuations?

Safe havens: Does gold remain in demand near record levels, indicating that fear is persistent?

Frequently Asked Questions

1. Why Is the Stock Market Down Today?

US stocks fell after Trump threatened new tariffs on several European countries, reviving trade-war fears and prompting a risk-off stance among investors.

2. How Big Was the Drop?

The S&P 500 fell about 2.06%, the Nasdaq fell about 2.39%, and the Dow fell about 1.76% on January 20, 2026.

3. Why Did the Nasdaq Fall More Than the Dow?

Growth-heavy indexes tend to fall more when uncertainty rises and when yields climb, because valuations are more sensitive to the discount rate.

4. Are Tariffs Enough to Cause a Stock Market Crash?

Tariffs can trigger sharp selloffs, but history suggests crashes usually require broader stressors, such as weakening growth or tighter financial conditions.

Conclusion

In conclusion, the stock market was down today because tariff risk returned, with precise dates and an escalation path.

The bigger message is that markets were repricing more than tariffs. Traders were also reacting to a broader political risk premium on the dollar and a rise in long-term yields, with the 10-year yield around 4.287%.

The next phase will hinge on whether these threats materialize into actions and if retaliation shifts a policy shock into a wider economic effect.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.