Markets started 2026 with a clear message: investors are still willing to pay up for growth, especially when the story involves lower interest rates, stronger chip demand, and improving sentiment. On Monday, January 5, 2026, global stocks reached fresh highs as traders digested major geopolitical news.

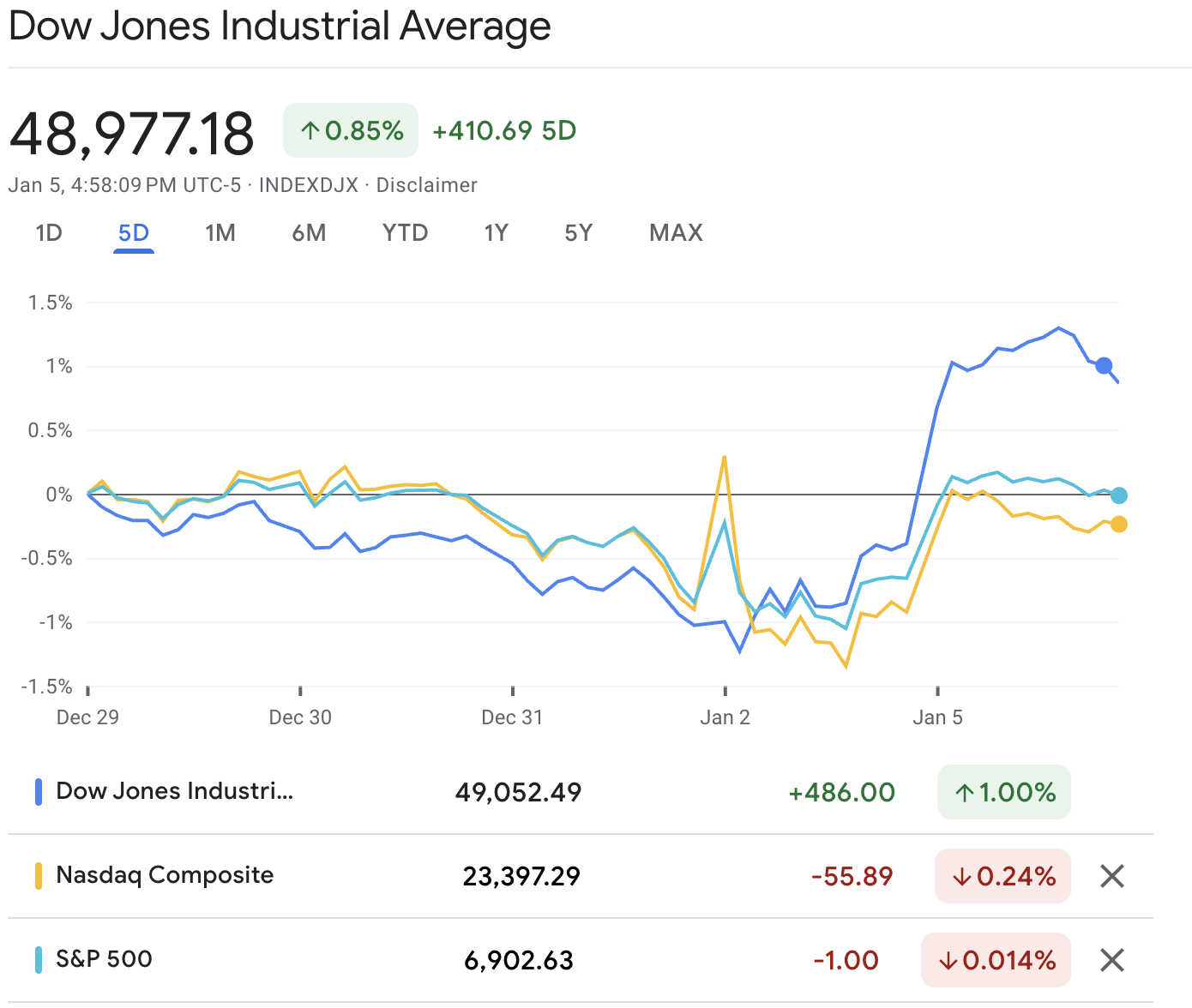

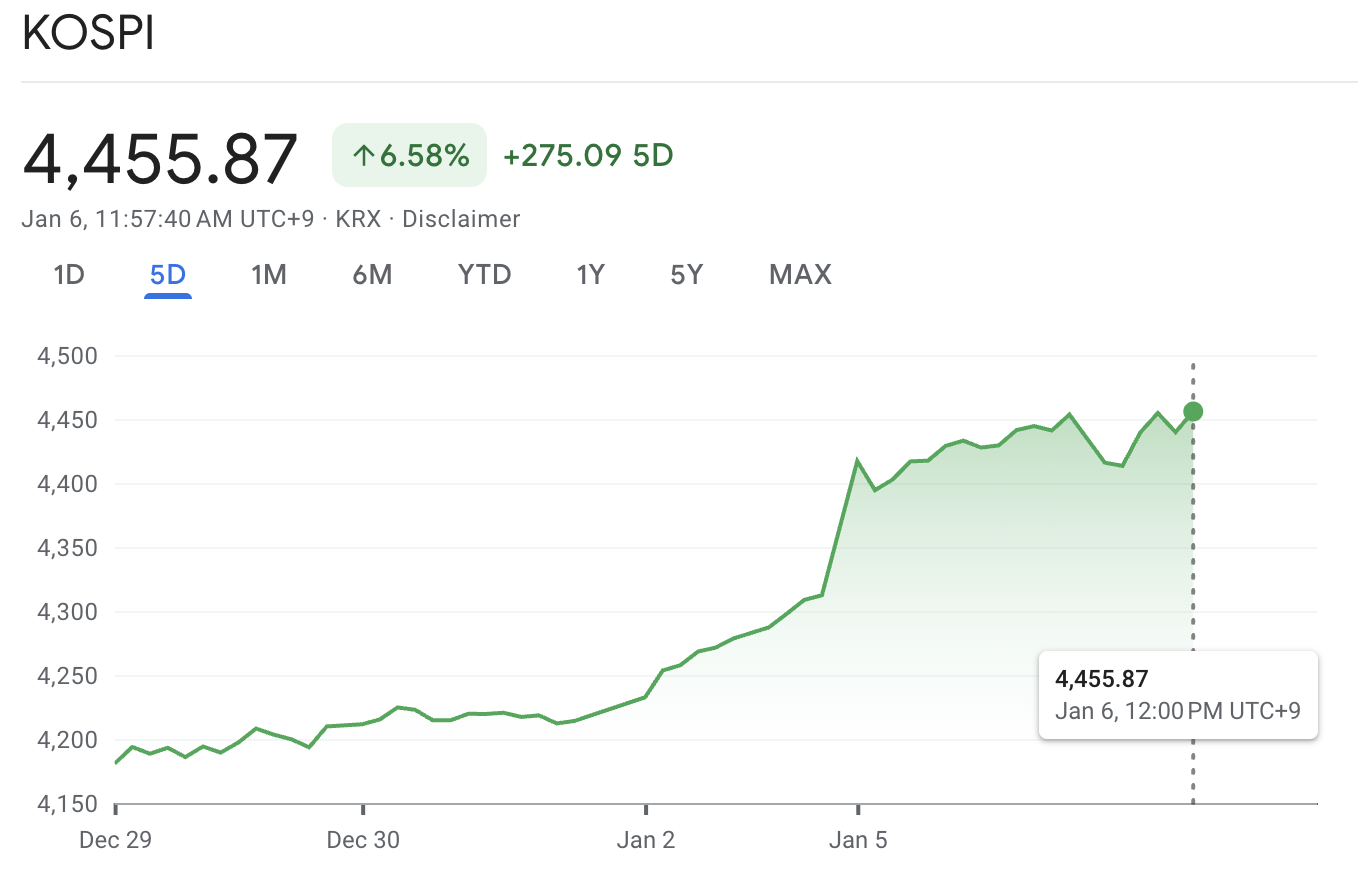

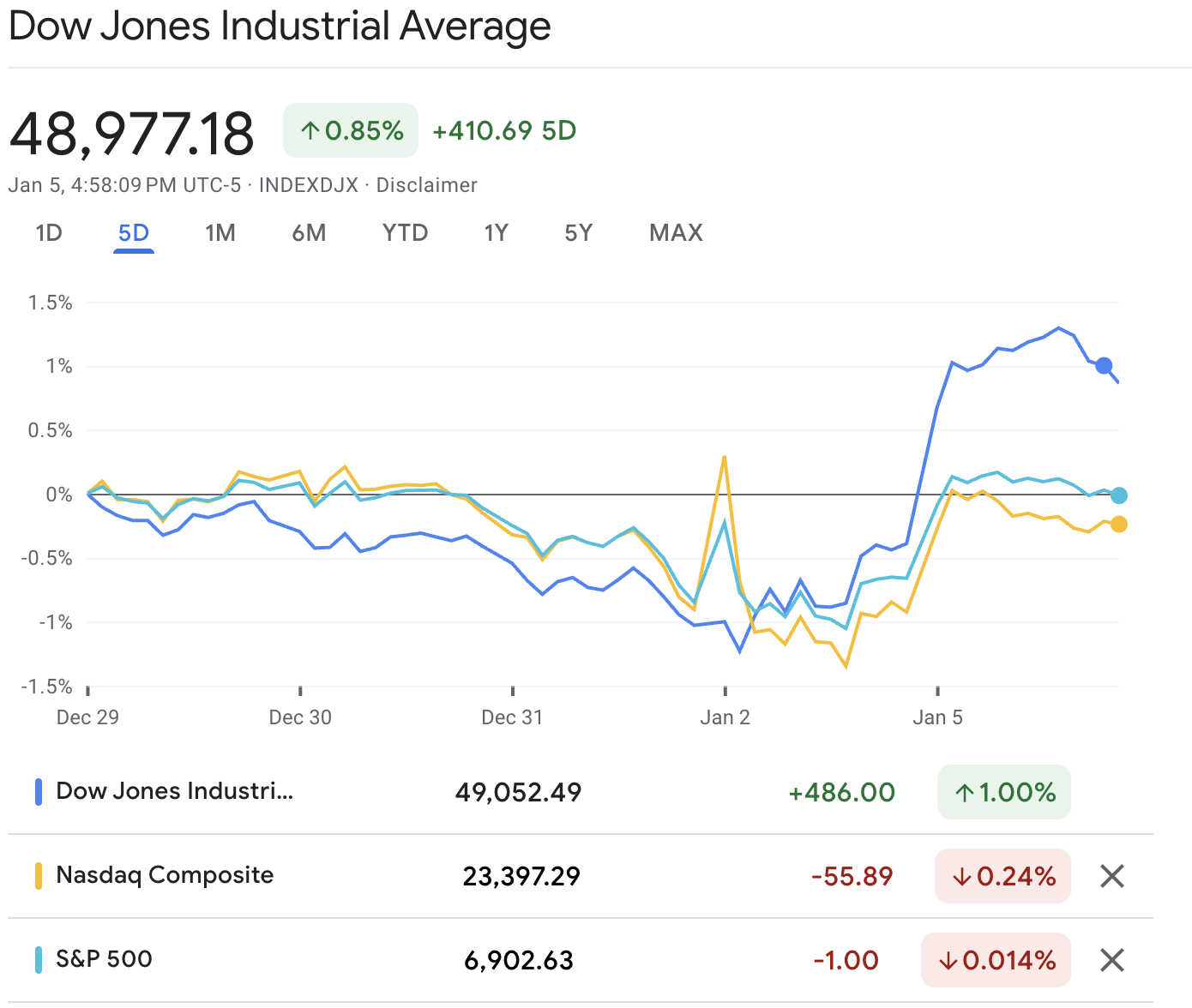

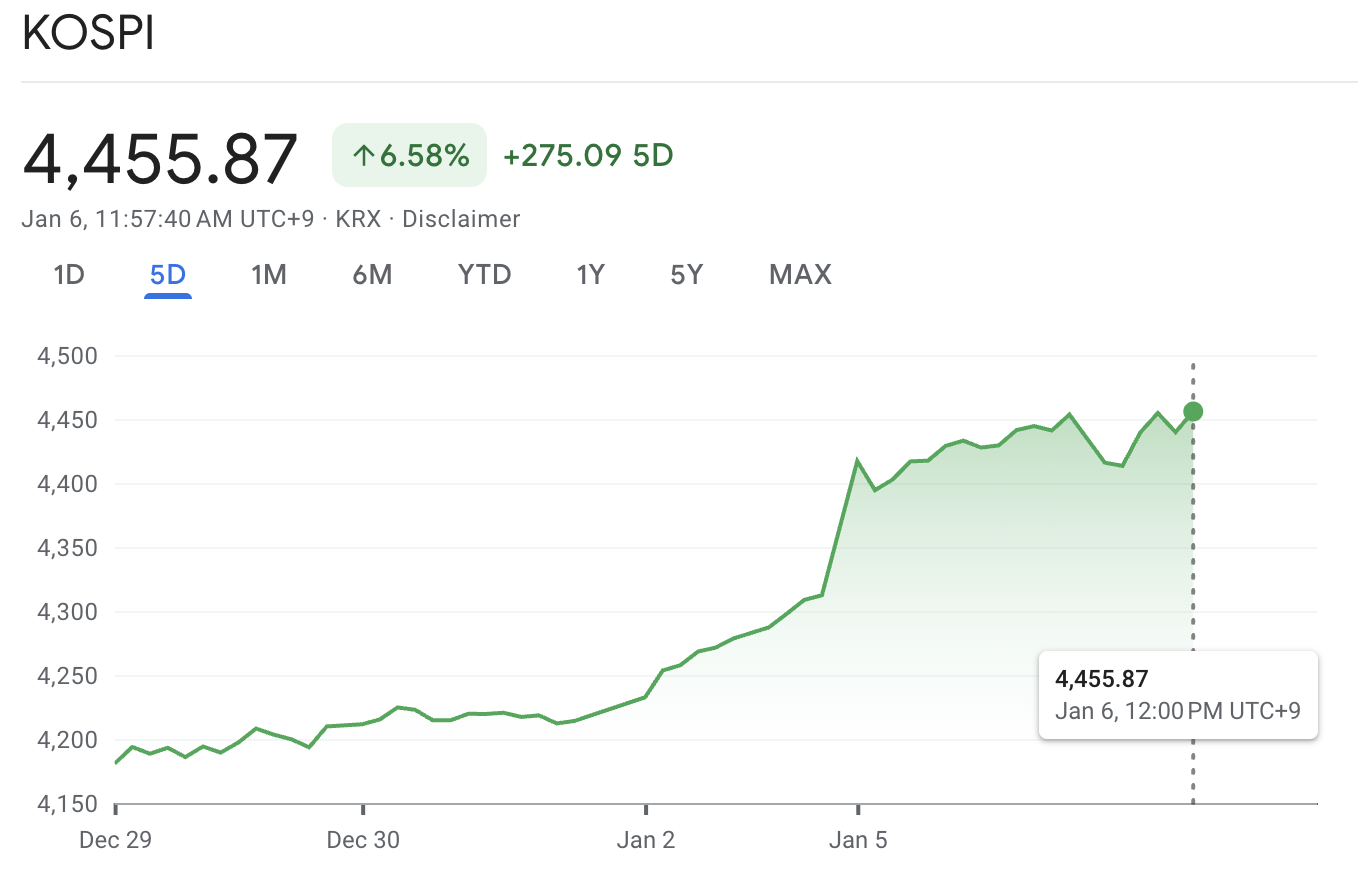

The headline records were most visible in the United States and South Korea. The Dow Jones Industrial Average closed at a new all-time high, and South Korea's KOSPI set another record as foreign buyers piled in.

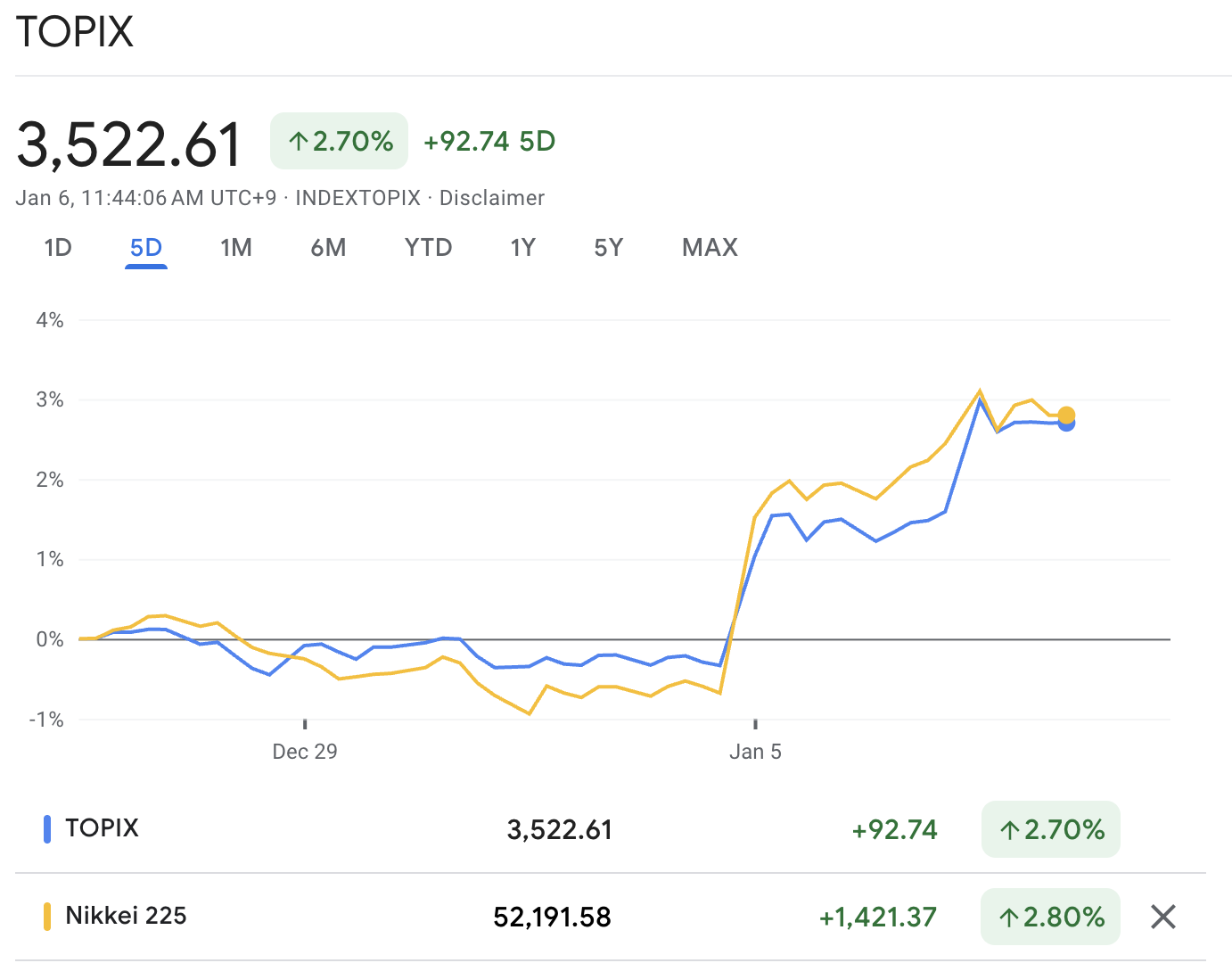

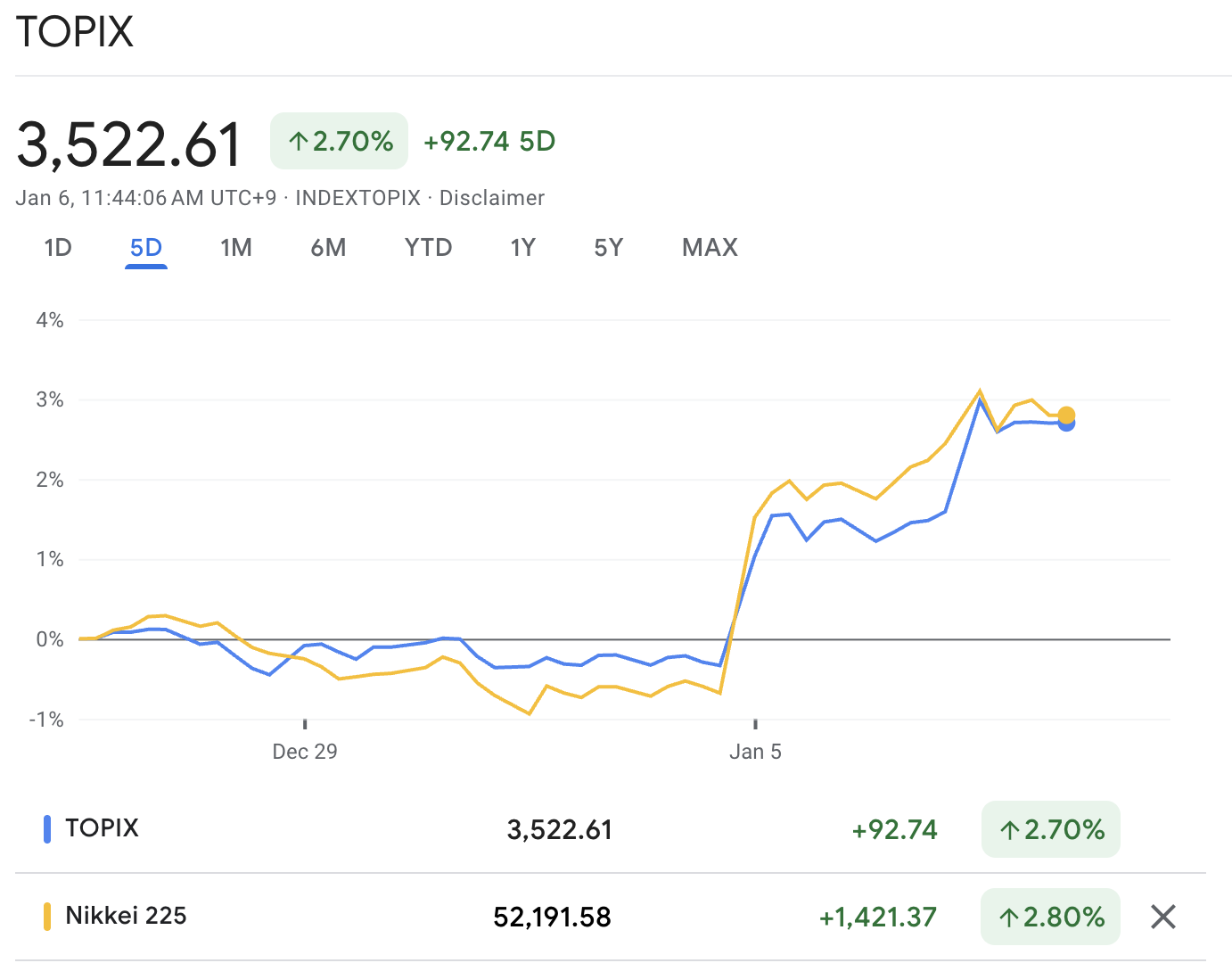

Japan's picture was slightly different but still bullish. The TOPIX printed a record close, while the Nikkei 225 jumped sharply and moved back towards its late-2025 record zone, led by chip and AI-linked names.

Market Snapshot: All-Time Highs Across Indices

| Index |

Latest highlighted move |

Record status |

What stood out in the tape |

| Dow Jones Industrial Average |

48,977.18 close (5 Jan) |

Record close |

Financials and energy led; defence also firm. |

| KOSPI |

4,457.52 close (5 Jan) |

Record close |

Foreign buying surged; chip cycle optimism dominated. |

| TOPIX |

3,477.52 close (5 Jan) |

Record close |

Broad Japan strength; chips and AI lifted the whole market. |

| Nikkei 225 |

51,832.80 close (5 Jan) |

Back near record zone |

About 1.1% below its 52,411.34 peak from 31 Oct 2025 (calculated from closes). |

One sentence that matters for traders: This was not a narrow rally driven by a single mega-theme alone. A wide "risk-on" movement drew in chips, banks, energy, and exporters simultaneously.

Japan

Japan's market shift on January 5 was significant as it involved more than just one stock.

The Nikkei closed at 51,832.80, up 2.96% on the day.

The TOPIX closed at 3,477.52, a historic close, indicating strong breadth.

What that means: When TOPIX makes a record, it suggests the rally is not just concentrated in the biggest names. More sectors are participating, and that often makes pullbacks shallower.

Japan-Specific Catalysts Traders Are Watching

Continued demand for chip equipment and AI supply chain names.

Evidence that Japan's manufacturing momentum is stabilising after a weak patch, which Reuters said helped sentiment.

Currency sensitivity, because exporters often react as much to FX as they do to earnings.

United States

The Dow's record close was not an accident. The tape showed investors moving into areas that benefit from a mix of policy expectations and cyclicality.

For context, the Dow closed at 48,977.18, while the S&P 500 and Nasdaq also gained.

The Drivers in the U.S. Session

The rally leaned on:

Financials, helped by earnings expectations and rotation away from crowded tech leadership.

Energy, boosted by the market's expectation of future investment opportunities tied to Venezuela headlines, even while the oil price story itself stayed complicated.

A Valuation Reality Check

The S&P 500's price-to-sales ratio stands at a historic 3.30, serving as a clear reminder that the market is expensive.

Valuations rarely end bull markets on their own, but they do make prices more sensitive to surprises in interest rates, earnings, and geopolitical risk.

South Korea

South Korea delivered one of the clearest risk-on signals of the week, with the KOSPI pushing to record territory alongside strong foreign buying.

On January 5, the KOSPI closed at 4,457.52, up 3.43% on the day, driven largely by foreign inflows.

The Korea Exchange stated that foreign investors purchased a net of 2.17 trillion won in stocks (approximately $1.5 billion), according to Korea JoongAng Daily.

Why the KOSPI Move Looked So Aggressive

The market firmly accepted the notion that a semiconductor upcycle is still in progress.

Investors were positioning ahead of major earnings signals in the sector.

Risk appetite was strong enough that traders largely brushed off geopolitical noise.

Why Markets Are Surging Now? 5 Key Drivers Explained

1) The Venezuela Shock Was Treated as an "Energy Opportunity," Not a Recession Risk

Typically, a major geopolitical shock sends investors into cash and classic safe havens; this time, equities reacted differently, with the U.S. move that captured Venezuela's leader sparking a rapid rotation into energy and defence while the broader market stayed composed, reflecting a view that the event was unlikely to escalate into a long, open-ended conflict.

This is a classic "risk checklist" reaction. Traders asked three quick questions:

Will this spike oil prices enough to hurt growth?

Will this meaningfully tighten financial conditions?

Will it drag the U.S. into a longer conflict?

The market's first answer was "no," which kept the dip-buying reflex alive and allowed the rally to spread.

2) Chips and AI Spending Keep Pulling Global Indices Higher

The rally was not only American. It travelled across time zones.

In Tokyo, increases in chip- and AI-related stocks, following the strength of U.S. chips, broadly boost Japanese shares.

In Seoul, investors bought the market as if the semiconductor upcycle still has room to run, with optimism building ahead of major earnings updates in the sector.

This is the key change versus many past rallies: the "AI trade" is no longer just a small group of technology names. It is increasingly a capex-and-infrastructure story that touches utilities, industrials, and credit, which helps widen participation.

3) Currency Moves Are Helping Exporters in Asia

Japan's stock market has consistently displayed a similar trend: a declining yen typically benefits major exporters since international earnings convert to greater yen amounts.

For example, in late 2025, Japan's market strength was linked to a weaker yen and a tech-led push.

More recently, the yen was sold after a Bank of Japan move, showing how quickly currency pricing can reinforce equity momentum.

South Korea's market has its own currency channel. A competitive Won can be supportive for exporters, especially when the world is leaning into a new electronics and memory cycle.

4) Sector Rotation Is Real, and It Is Feeding the Upside

One reason records are being held is that leadership is rotating.

On Wall Street, the Dow's record close was driven by strength in financials and energy, and defence names also firmed after the weekend's geopolitical shock.

This matters because it reduces the market's reliance on a single crowded trade. A rally is more durable when it can shift leadership from week to week without collapsing.

In 2026, investors might engage in "value hunting," focusing more on undervalued sectors as concerns about an AI bubble increase.

5) New-Year Positioning and "FOMO" Still Shape Price Action

Most of the price movements in January are not driven by new information. It is about fresh positioning.

Fear of missing out can extend recent trends, especially when investors feel they are chasing a market that keeps refusing to break.

That is why breakouts often happen early in the year. Portfolio managers want exposure on the books, and nobody wants to explain to clients why they stayed underinvested while indices printed new highs.

Technical Levels Traders Should Monitor This Week

| Index |

Immediate resistance |

Immediate support |

Why these levels matter |

| Nikkei 225 |

52,000 then 52,411

|

50,300 then 50,000

|

52,000 is a round-number magnet; 52,411 is the Oct 2025 record close. |

| TOPIX |

3,478–3,486 zone |

3,400 |

Record closes often retest; 3,400 is a clean psychological area. |

| Dow |

49,000 area |

48,380 then 48,000

|

49,000 is the next big round number; 48,380 was the 2 Jan close before the new record push. |

| KOSPI |

4,460–4,500 zone |

4,300 |

4,300 was a major breakout area early in 2026; 4,500 becomes the next psychological target. |

These are practical levels built around recent closes, record marks, and big round numbers that often matter for positioning.

Key Signals to Monitor in the Next 7–10 Days

U.S. jobs data (January 9, 2026)

Fed leadership and tariff risks

Semiconductor earnings signals in Asia

Geopolitics feeding sector moves

Frequently Asked Questions (FAQ)

1. Did the Nikkei 225 Actually Hit a New All-Time High?

No. The Nikkei jumped sharply and moved back towards its late-2025 record zone, while the broader TOPIX index printed a fresh record close. The Nikkei's prior record close was 52,411.34 on October 31, 2025.

2. Why Did the Dow Hit a Record Close?

The Dow was lifted by strong gains in financials and energy, alongside improved risk appetite.

3. What Is Driving the KOSPI Record Highs?

Foreign buying and a strong semiconductor narrative are carrying the weight. Net foreign purchases reported on January 5 were approximately 2.17 trillion won (around $1.5 billion).

4. What Could Trigger a Pullback From These Highs?

A negative surprise in U.S. jobs data, a shift in rate expectations, an AI-related earnings disappointment, or tariff and policy shocks could all shift sentiment.

Conclusion

In conclusion, this rally stands out because record highs are being set across multiple regions simultaneously. In the U.S., financials and energy have helped lift the Dow, South Korea has been powered by foreign inflows and chip-led optimism, and Japan has shown broad strength with the TOPIX finishing at a record close.

The tailwinds are straightforward: easier-rate expectations, durable AI and semiconductor demand, and fresh New Year positioning.

The risks are just as clear: stretched valuations, tariff and policy uncertainty, and the possibility that incoming growth data disappoints.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.