The January disclosure of Nancy Pelosi's stock trades in 2026 is not a simple "buy" or "sell" headline. It reads like a deliberate portfolio reset that locks in gains, funds philanthropy, and then re-establishes upside exposure with options that run into 2027.

The latest Periodic Transaction Report, digitally signed on January 23, 2026, covers activity from late December 2025 through mid-January 2026 and lists multiple seven-figure transactions across Apple, Nvidia, Amazon, and Alphabet, as well as a new multi-million-dollar position in AllianceBernstein.

The report also confirms several option exercises first initiated in January 2025, converting long-held calls into common shares at pre-set strike prices.

Key Takeaways

Massive reductions in mega-cap equity exposure (notably AAPL, NVDA, AMZN).

Fresh long-dated call option purchases dated December 30, 2025, with January 2027 expirations in multiple mega-cap names (AAPL, AMZN, GOOGL, NVDA).

Exercises of expiring January 2026 call options dated January 16, 2026, which converted options into shares for several tickers.

A new purchase of 25,000 AllianceBernstein units.

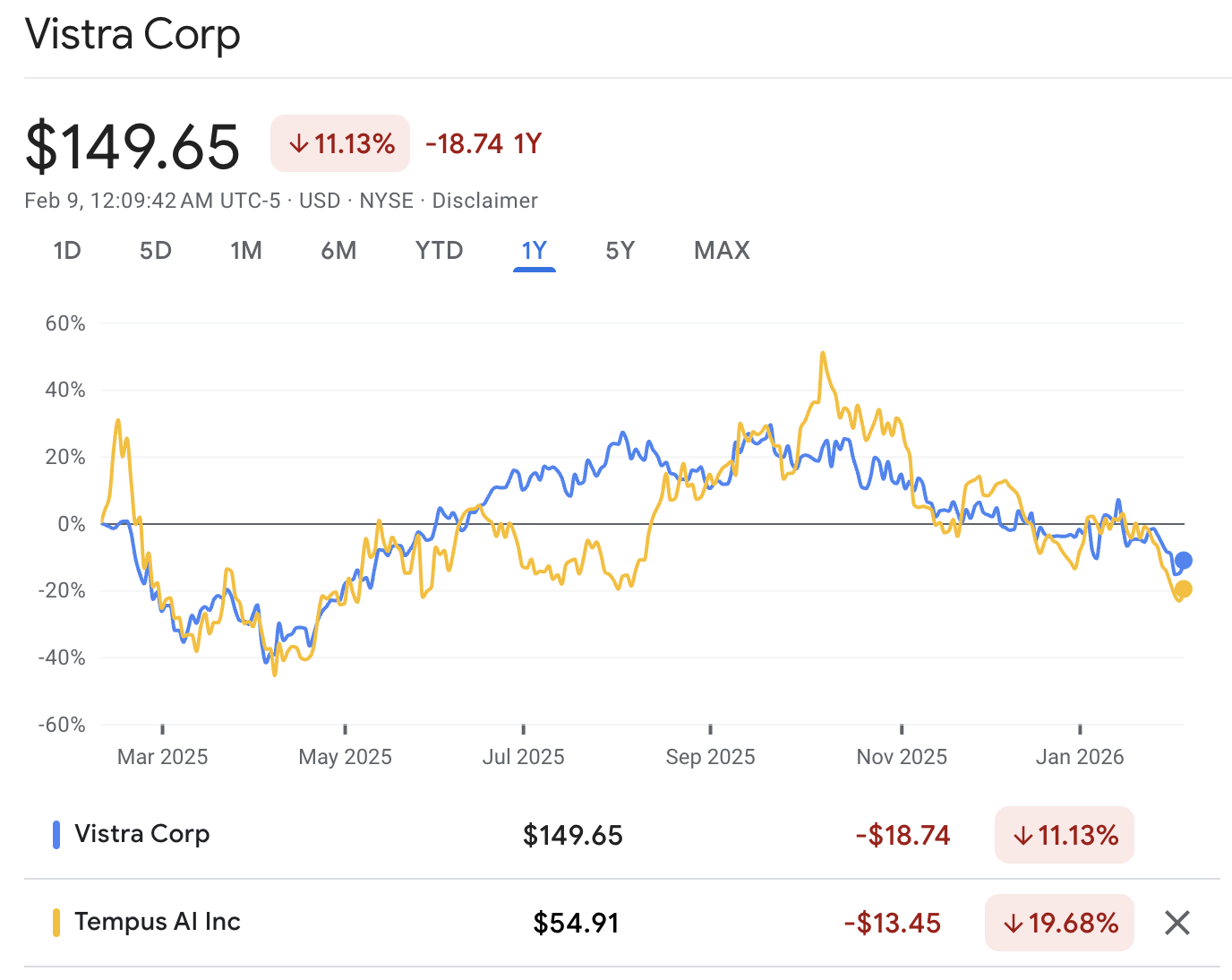

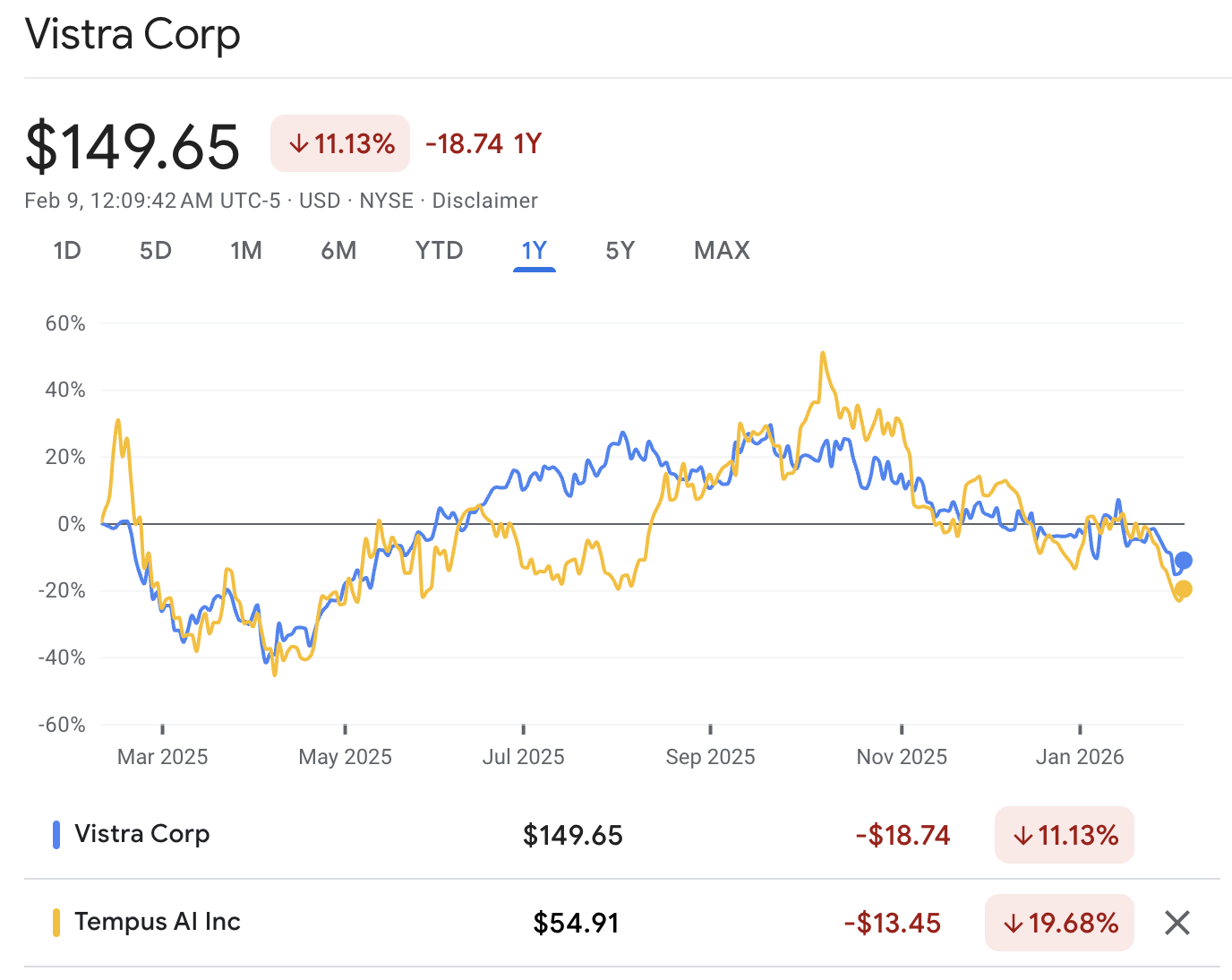

Two satellite positions in Vistra and Tempus AI.

Nancy Pelosi Stock Trades 2026: Full List of Buys, Sells, and Exercises

| Trade date |

Ticker / Asset |

Action |

Amount range disclosed |

Notes from filing |

| 01/16/2026 |

AB |

Buy |

$1,000,001–$5,000,000 |

Purchased 25,000 shares. |

| 01/16/2026 |

GOOGL (stock) |

Buy |

$500,001–$1,000,000 |

Exercised 50 calls (5,000 shares) at $150, exp 01/16/26. |

| 12/30/2025 |

GOOGL (calls) |

Buy |

$250,001–$500,000 |

Purchased 20 calls, strike $150, exp 01/15/27. |

| 12/30/2025 |

GOOGL (stock) |

Disposition (partial) |

$1,000,001–$5,000,000 |

Contribution of 7,704 shares to donor-advised fund. |

| 12/30/2025 |

AMZN (calls) |

Buy |

$100,001–$250,000 |

Purchased 20 calls, strike $120, exp 01/15/27. |

| 12/24/2025 |

AMZN (stock) |

Sell (partial) |

$1,000,001–$5,000,000 |

Sold 20,000 shares. |

| 01/16/2026 |

AMZN (stock) |

Buy |

$500,001–$1,000,000 |

Exercised 50 calls (5,000 shares) at $150, exp 01/16/26. |

| 12/24/2025 |

AAPL (stock) |

Sell (partial) |

$5,000,001–$25,000,000 |

Sold 45,000 shares. |

| 12/30/2025 |

AAPL (calls) |

Buy |

$250,001–$500,000 |

Purchased 20 calls, strike $100, exp 01/15/27. |

| 12/30/2025 |

AAPL (stock) |

Disposition (partial) |

$5,000,001–$25,000,000 |

Contribution of 28,200 shares to donor-advised fund. |

| 12/30/2025 |

NVDA (calls) |

Buy |

$100,001–$250,000 |

Purchased 20 calls, strike $100, exp 01/15/27. |

| 12/24/2025 |

NVDA (stock) |

Sell (partial) |

$1,000,001–$5,000,000 |

Sold 20,000 shares. |

| 01/16/2026 |

NVDA (stock) |

Buy |

$250,001–$500,000 |

Exercised 50 calls (5,000 shares) at $80, exp 01/16/26. |

| 12/30/2025 |

PYPL (stock) |

Sell |

$250,001–$500,000 |

Sold 5,000 shares. |

| 01/16/2026 |

TEM (stock) |

Buy |

$50,001–$100,000 |

Exercised 50 calls (5,000 shares) at $20, exp 01/16/26. |

| 01/02/2026 |

VSNT (stock) |

Other event |

$15.00 |

776 shares and cash in lieu from spinoff from CMCSA; no CMCSA surrendered. |

| 01/16/2026 |

VST (stock) |

Buy |

$100,001–$250,000 |

Exercised 50 calls (5,000 shares) at $50, exp 01/16/26. |

| 12/30/2025 |

DIS (stock) |

Sell |

$1,000,001–$5,000,000 |

Sold 10,000 shares. |

Important note: The January 23, 2026, Periodic Transaction Report includes the transactions below. Amounts reflect the filing's required disclosure ranges, not exact trade values.

The Part Most Headlines Miss: Donations Show Up as "Sales" in the PTR

Two line items are described as contributions to a donor-advised fund:

GOOGL: contribution of 7,704 shares, recorded as S (partial).

AAPL: contribution of 28,200 shares, recorded as S (partial).

A donor-advised contribution is not the same thing as a discretionary market sale for risk reduction, even though it reduces direct share ownership. The PTR format can still classify it as a disposition because of ownership changes.

Core Message From Nancy Pelosi Stock Trades: Sell the Shares, Keep the Upside

The key takeaway from the filing is its structural implications rather than any sensational aspects. Near the end of the year, Nancy's direct equity decreased exposure to Apple, Nvidia, and Amazon.

Subsequently, she rebuilt upside exposure by purchasing long-dated call options that are set to expire in January 2027, focusing on the same major companies.

This strategy of shifting from equities to options can effectively achieve three objectives for institutional investors.

It can crystallise gains for tax management. It can free capital for charitable contributions, which are explicitly recorded in the filing as transfers to donor-advised funds. It can also maintain a bullish directional profile with less cash tied up, because call options can control the same underlying exposure with a smaller upfront outlay.

The implication for the market is that the Pelosi household, at least as shown in this disclosure, is not signaling a bearish view on mega-cap technology. It is communicating a preference for capital efficiency and a longer runway, with contracts set to run well beyond the 2026 calendar year.

Options Strategy Breakdown: What the Strikes and Expiries Imply

| Underlying |

Action |

Contracts |

Implied shares |

Strike |

Expiry |

Interpretation |

| Apple (AAPL) |

Bought calls |

20 |

2,000 |

$100 |

01/15/2027 |

Long-dated upside exposure, low-capital stock control. |

| Nvidia (NVDA) |

Bought calls |

20 |

2,000 |

$100 |

01/15/2027 |

Continued AI exposure despite equity trimming. |

| Amazon (AMZN) |

Bought calls |

20 |

2,000 |

$120 |

01/15/2027 |

Cloud and consumer platform exposure into 2027. |

| Alphabet (GOOGL) |

Bought calls |

20 |

2,000 |

$150 |

01/15/2027 |

Search, AI, and platform exposure into 2027. |

| Alphabet (GOOGL) |

Exercised calls |

50 |

5,000 |

$150 |

01/16/2026 |

Converted prior-year calls into shares, signalling a hold decision at expiry. |

| Amazon (AMZN) |

Exercised calls |

50 |

5,000 |

$150 |

01/16/2026 |

Converted prior-year calls into shares, preserving exposure at the strike. |

| Nvidia (NVDA) |

Exercised calls |

50 |

5,000 |

$80 |

01/16/2026 |

Converted prior-year calls into shares, strengthening long exposure. |

| Vistra (VST) |

Exercised calls |

50 |

5,000 |

$50 |

01/16/2026 |

Converted power theme options into shares. |

| Tempus AI (TEM) |

Exercised calls |

50 |

5,000 |

$20 |

01/16/2026 |

Converted healthcare AI options into shares. |

Options are often treated as short-term speculation, but these contracts are not short-term instruments.

The January 2027 expiries extend the market bet across a complete earnings cycle and into a period where AI capital expenditure, cloud competition, and platform monetisation will be judged on cash flow, not narratives.

Why These Stocks Stand Out Among Nancy Pelosi's Stock Trades in 2026?

AllianceBernstein

The new purchase of 25,000 AllianceBernstein units is the most obvious diversification move in the report.

At a portfolio level, AllianceBernstein changes the risk texture. It is linked to market levels and asset flows, but it also tends to appeal to income profiles because asset managers can distribute significant cash when earnings and fee streams are healthy.

In a year where mega-cap multiples can compress even if earnings grow, an income sleeve can stabilise a portfolio's cash generation.

The tactical logic is simple. If 2026 rewards a narrower set of growth winners, the options maintain convexity. If 2026 becomes more volatile, a yield-focused strategy can ease the pressure to sell growth investments during downturns.

Vistra and Tempus AI

Two of the most analytically interesting entries in the filing are the exercised calls in Vistra and Tempus AI.

Vistra reflects the infrastructure constraint behind the AI buildout. Training and inference workloads are increasingly energy-intensive, and data-centre investment has made power availability, grid interconnection, and generation mix strategically relevant to equity markets. A power generator with scalable capacity can benefit indirectly from AI demand, even though it is not a "tech" company.

Tempus AI demonstrates the application of artificial intelligence in healthcare, focusing on generating commercial value through clinical workflows, diagnostics, and decision support rather than through consumer-facing applications.

The disclosed position size is smaller than the mega-cap complex. Still, the message is consistent: AI exposure is being expressed across both the computing stack and real-economy use cases.

Should You Copy Nancy Pelosi's Stock Trades for 2026?

Copying the Pelosi household's disclosed trades can look like an investor shortcut, but the evidence is mixed, and the mechanics are stacked against real-time imitation.

The filings are most useful as a theme and risk-positioning signal rather than as a repeatable trade entry system, especially when the activity involves options and when the public disclosure arrives weeks after execution.

The Main Problem: You Cannot Copy the Trade You Think You Are Copying

| Friction |

What it means in practice |

Why it matters for returns |

| Disclosure lag (up to 45 days) |

You learn about the trade long after the price has moved. |

Any "edge" can be arbitraged away before you can act. |

| Dollar values are ranges |

Filings use broad ranges instead of exact position sizing. |

You cannot infer conviction or portfolio weight precisely. |

| Options are incomplete |

Filings show strike and expiry, but not the premium paid, implied volatility, or whether the position was spread-hedged. |

Two investors can hold the "same" call and have radically different risk and breakeven levels. |

| Tax and liquidity context is invisible |

A trade may be tax management, philanthropic transfer, or rebalancing, not a directional view. |

You risk copying the headline while missing the true objective. |

| Execution and timing |

The household may stage entries, use limit orders, or transact around liquidity. |

Slippage can erase the small expected advantage of copying. |

Even if a filing is accurate, you rarely know enough to replicate the risk profile.

Why Does Pelosi's Trade Move Markets Even With a Disclosure Lag

The Pelosi household sits at the intersection of three forces.

The first is scale. Even with range-based reporting, the filing shows multiple transactions in the seven-figure bands, which is large enough to invite inference about conviction and intent.

The second is instrument choice. The consistent use of long-dated calls is not how many retail investors express exposure, so the disclosure becomes a behavioural signal about leverage, duration, and risk appetite.

The third is narrative power. Pelosi-related filings are now tracked, packaged, and distributed within hours by a growing ecosystem of transparency platforms and market media, which can amplify a single report into a broader sector rotation story.

This is also why misunderstandings are common. A headline that says "sold Apple" is incomplete if the same report shows a simultaneous rebuild via calls, plus a separate block moved into a donor-advised fund.

3 Ways Investors Can Use Nancy Pelosi's Stock Trades Without Blind Copying

Use them for idea generation, not as trade signals.

Use them as a policy-sensitivity map.

Use them as a sentiment indicator for crowded themes.

If You Insist on Copying, Follow These Defensible "Rules"

These rules do not guarantee outperformance, but they reduce the chance of copying noise.

You should only react to a disclosed trade if you can explain the fundamental thesis and you can tolerate holding through at least one full earnings cycle.

You should treat any option disclosure as directional intent, not as a replicable structure, because you do not know premium, sizing, or hedges.

You should assume the "trade date" is already stale and requires a fresh technical and valuation check before entry, because the information delay can be material.

You should size positions as if you are wrong, because the academic record shows that broad congressional portfolios do not reliably beat passive benchmarks.

Frequently Asked Questions (FAQ)

Does Nancy Pelosi Make the Trades Personally?

The filing uses the "SP" owner designation for many entries, which indicates spouse transactions under the reporting framework.

Did Pelosi "Dump" Big Tech in 2026?

The filing shows sizeable reductions in direct equity holdings late in December, but it also shows new long-dated call options in the same mega-cap names expiring in January 2027. That combination aligns more with a reshaping of exposure than a clean exit.

Can Investors Profit by Copying Nancy Pelosi's Stock Trades?

Copying is structurally challenging because disclosures can occur weeks after execution, and option trades lack critical information, such as premiums and exact sizing beyond the specified ranges. The filings are best used for thematic insight and risk-mix analysis, not as real-time signals.

Conclusion

In conclusion, Nancy Pelosi Stock Trades 2026, as reflected in the January 23 filing, shows a portfolio behaving like an institution rather than a headline. Investors reduced direct mega-cap exposure, crystallised gains, and moved a measurable portion of equity into donor-advised vehicles.

At the same time, they deliberately rebuilt upside exposure through long-dated calls expiring in January 2027, and they exercised prior-year calls into shares across AI-linked names.

The most revealing element is not any single ticker. It is the portfolio architecture: profit-taking paired with leverage re-entry, growth exposure paired with income ballast, and core AI positions complemented by second-order infrastructure and healthcare AI themes.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.