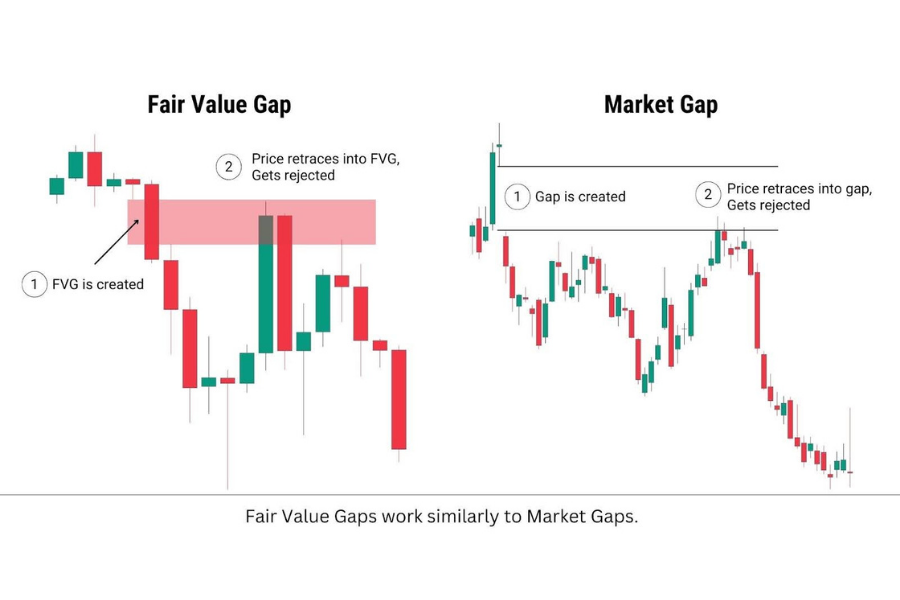

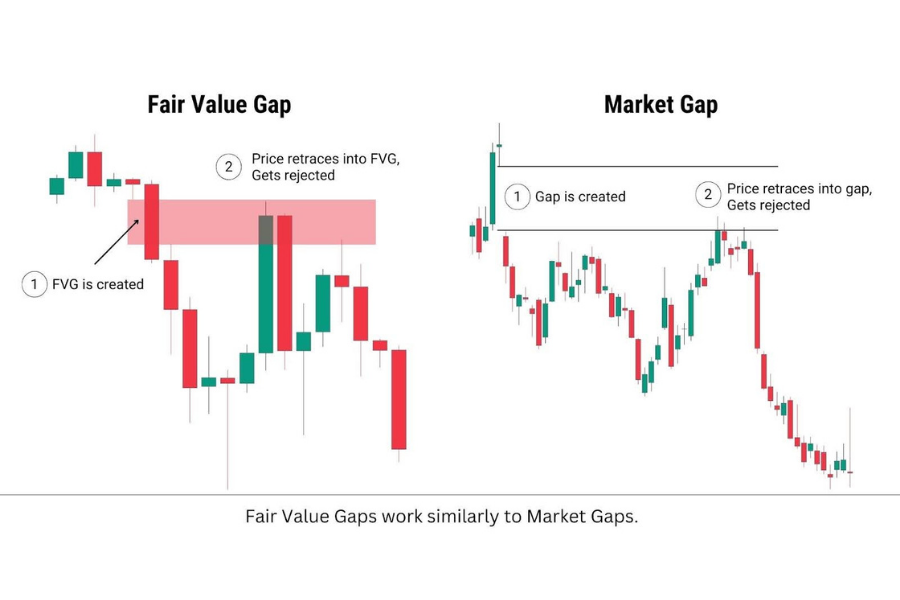

In recent years, fast repricing has become routine around policy signals, data shocks, and thin liquidity windows. Fair value gaps (FVGs) in forex are three-candle price imbalances created by displacement, leaving a thinly traded zone on the chart.

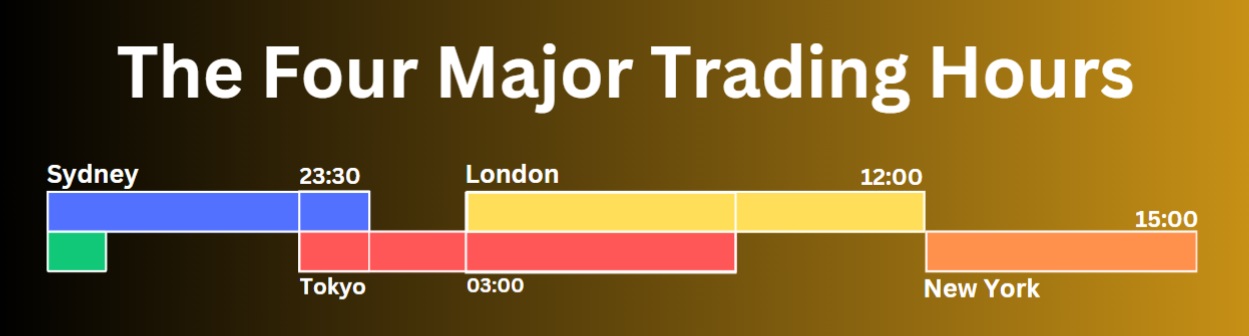

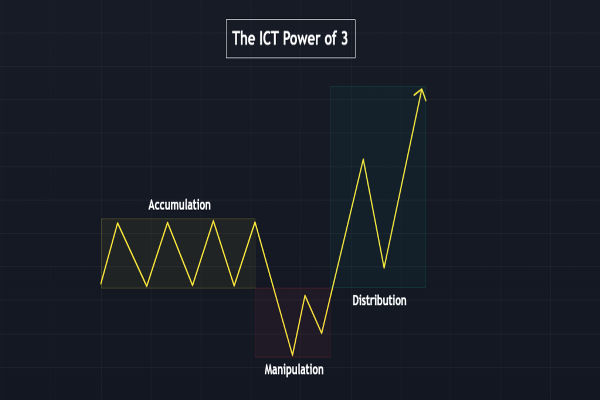

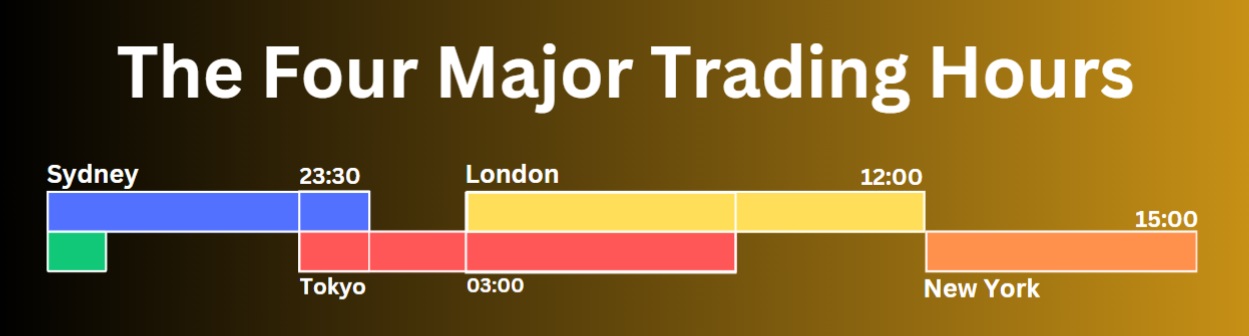

They are most often used as pullback entry and risk-mapping zones in SMC (Smart Money Concepts) and ICT-style(Inner Circle Trader) frameworks, particularly around the London open and the London-to-New York overlap, where participation is often higher and reactions can be clearer. As volatility compresses and then bursts, FVGs can serve as practical retest areas that separate continuation from failure.

Because FX trades roughly 24 hours a day, five days a week, prices can accelerate without a formal exchange open or close, which makes inefficiencies show up inside continuous trading rather than as classic gaps.

What Is A Fair Value Gap (FGV)

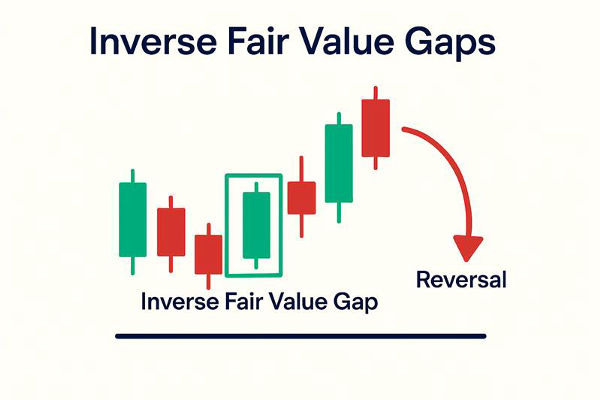

A Fair Value Gap (FVG) is a candlestick-defined zone that indicates inefficient price delivery. It typically occurs when a strong impulse candle drives the price to move rapidly, leaving minimal overlap with adjacent candles. Visually, this creates a 'pocket' on the chart where trading activity is sparse, suggesting dominance by one side and an incomplete auction process.

The most common definition uses a three-candle sequence:

The most common definition uses a three-candle sequence:

Bullish FVG: Candle 1 high is below Candle 3 low. The gap zone is drawn from Candle 1 high to Candle 3 low.

Bearish FVG: Candle 1 low is above Candle 3 high. The gap zone is drawn from Candle 3 high to Candle 1 low.

This is widely taught as a three-candle non-overlap pattern in FVG trading literature and toolkits.

Why “fair value” is a misnomer, but the gap is useful

The phrase “fair value” suggests equilibrium. In practice, an FVG marks the opposite: a moment when price outran participation. The value is in what the imbalance implies:

Displacement: aggressive repricing, often aligned with a catalyst or liquidity event.

Unfinished auction: counterparties did not transact evenly through the zone.

Future interaction: the market often revisits thin zones to test whether the move was properly accepted.

None of this guarantees a fill. It provides a probabilistic map for where reactions often occur, especially when the revisit aligns with a higher-timeframe structure.

Why Fair Value Gaps Form in FX Markets

Spot foreign exchange (FX) trades nearly continuously throughout the workweek due to its decentralized nature and adherence to global dealing hours across multiple time zones. This structure renders traditional exchange 'gaps' uncommon, but it increases the prevalence of micro-inefficiencies, which are often caused by:

1) Liquidity vacuum around key levels

When price approaches a widely watched high or low, resting orders can thin out as participants wait for confirmation. A stop run or breakout can then trigger rapid repricing. The result is a displacement candle that prints a clean FVG.

2) News-driven repricing

CPI releases, central bank surprises, and geopolitical headlines can force dealers to re-quote quickly. When the market jumps through a zone, the chart often records an imbalance. The latter revisits the question of whether the move was accepted or simply the market scrambling for liquidity.

3) Session transitions

Liquidity is not uniform across the day. Overlaps compress spreads and deepen order books, while quiet periods can exaggerate moves. The London-to-New York overlap is frequently cited as the most liquid window, capturing a large share of daily activity. More liquidity can create cleaner displacement. A lack of liquidity can cause messy spikes that quickly invalidate FVGs.

How To Grade an FVG: Quality Filters That Matter

Not all FVGs warrant consideration, as they occur frequently in the market. Professional traders apply rigorous filters to identify higher-quality assets.

High-quality FVG traits

Displacement is obvious: a strong candle that expands range and closes with intent.

Structure changes: the impulse breaks a prior swing, great or low, or shifts intraday structure.

Location is logical: near higher-timeframe supply or demand, or after a liquidity sweep.

Clean edges: the gap boundaries are clear and not already chopped through.

Low-quality FVG traits

Inside a range: overlapping candles on both sides, no directional acceptance.

Created by thin liquidity noise: single spikes during illiquid hours.

Immediately traded through: the market shows no respect for the zone on revisit.

A Practical Framework For Trading FVG in Forex

A fair value gap is most effectively utilized as an entry timing mechanism within a comprehensive trading plan. Such a plan addresses three key considerations: direction, location, and trigger.

Step 1: Set directional bias from a higher timeframe

Use a daily or 4-hour structure: trend, range extremes, and where liquidity is likely to be. If the market is compressing under a major high, bullish FVGs formed after a break can become pullback zones. If price is rejected from higher-timeframe supply, bearish FVGs can become retracement zones.

Step 2: Mark the displacement FVG and the “reaction line”

Many traders monitor the midpoint of the gap, commonly referred to as the 'consequent encroachment.' Regardless of its theoretical validity, this midpoint serves as a consistent internal reference point for partial fills.

Step 3: Wait for a revisit, then demand a trigger

A trigger converts the zone into a trade. Examples:

Lower-timeframe break of the structure in the intended direction

Rejection wick plus momentum candle back out of the gap

Failure swing that shows absorption inside the zone

Step 4: Use structure-based invalidation, not a “must fill” rule

If the trading premise is that the gap represents a pullback within a trend, the invalidation level should be set beyond the trend's swing point, rather than just a few pips beyond the FVG boundary.

Step 5: Target liquidity, not arbitrary R multiples

Common targets include:

Prior session high or low

Recent swing points

Equal highs or equal lows

Opposing liquidity pools are visible on the higher timeframe

Reference Table: Identifying and Using an FVG

| Element |

Bullish FVG |

Bearish FVG |

What it often implies |

| 3-candle condition |

Candle 1 high < Candle 3 low |

Candle 1 low > Candle 3 high |

Price displaced too quickly for balanced trade |

| Zone to draw |

Candle 1 high → Candle 3 low |

Candle 3 high → Candle 1 low |

Potential retracement area |

| Best context |

After a downside liquidity sweep then sharp rally |

After an upside liquidity sweep then sharp selloff |

Repricing after stops clear |

| Typical entry |

Revisit into zone + bullish trigger |

Revisit into zone + bearish trigger |

Timing improvement vs chasing |

| Invalidation |

Below the structure low |

Above the structure high |

Premise fails if structure breaks |

Forex Session Timing: When FVG Reactions Tend to Be Cleaner

Liquidity tends to concentrate during session overlaps, underscoring the importance of displacement and enhancing the tradability of revisits. The London-to-New York overlap is widely regarded as the most active period, with a substantial portion of daily volume occurring during this window.

Key Trading Times (London & New York Overlap)

| Session window |

Typical behaviour |

FVG implication |

| Asia |

Range building, selective breakouts |

More “noise” FVGs, require stronger HTF confluence |

| London open |

Volatility expansion, structure formation |

Frequent displacement FVGs that define the day’s bias |

| London–NY overlap |

Highest activity, liquidity and follow-through |

Cleaner reactions, better execution, fewer random spikes |

| NY afternoon |

Mean reversion and position management |

Late-day revisits can either complete mitigation or fail quickly |

Common Failure Modes and How to Avoid Them

1) Trading every FVG

Markets frequently generate imbalances. Without the application of directional bias and location filters, trading approaches become effectively random.

Fix: limit to FVGs that form with displacement and align with higher-timeframe narrative.

2) Ignoring where the stops are

A revisit into a gap may function as a trap if the market seeks liquidity beyond a proximate high or low.

Fix: treat liquidity pools as the destination. Use FVGs as the path.

3) Confusing partial fills with failure

Many significant price movements only reach the upper third or midpoint of a gap before continuing in the prevailing direction.

Fix: define what “mitigation” means in the plan: full fill, midpoint touch, or reaction at first entry.

4) Stops too tightly to survive normal probing

An FVG should be regarded as a price zone rather than a single price level.

Fix: place the invalidation beyond the structure and size the position so the stop can breathe.

Frequently Asked Questions (FAQ)

1) What does FVG mean in forex trading?

FVG means Fair Value Gap, which is a three-candle imbalance where price moves so quickly that Candle 1 and Candle 3 show little or no overlap around a displacement candle. Traders mark the resulting zone as a potential area for future retracement and reaction.

2) Do fair value gaps always get filled?

No. Many FVGs are partially filled, and some are never revisited. The probability improves when the gap forms with strong displacement, changes structure, and aligns with a higher-timeframe context. A rules-based invalidation level matters more than expecting a guaranteed fill.

3) What timeframe works best for FVG in forex?

Higher timeframes, such as 4-hour and daily, help identify the most meaningful displacement zones. Lower timeframes, such as 15-minute and 5-minute, help refine entries and manage risk. The combination reduces noise while preserving execution precision.

4) Is an FVG the same as an order block?

No. An order block is typically framed as the last opposing candle before a displacement, and is often used as a supply or demand proxy. An FVG is the inefficiency created by the displacement itself. They often overlap, but they answer different questions: “Where did price leave fast?” versus “Where might orders have been positioned?”

5) Why do FVGs seem to work better in London and New York?

Liquidity and participation are often higher during overlaps, and the market is more likely to build a clean structure. The London-to-New York overlap is commonly watched by traders because spreads can tighten and follow-through can be cleaner than in quieter hours.

6) Which forex currency pair is best to trade when utilizing FVG?

No single pair is “best,” but FVG works most consistently on high-liquidity majors with tight spreads and clean structure. EUR/USD and USD/JPY are common choices, especially during London and New York hours. Avoid thin, erratic crosses in off-hours, where noise creates unreliable gaps.

Conclusion

FVG in forex is most accurately conceptualized as a visual representation of inefficient price delivery. It identifies areas where market urgency outpaced two-way participation, resulting in zones that are frequently retested.

The advantage does not arise solely from the gap itself, but from its integration within a disciplined framework: employing higher timeframe bias for directional context, targeting liquidity as the destination, and utilizing structure-based triggers for execution. In a market that processes trillions of US dollars in notional value each day, effective strategies often involve recognizing where the auction process was incomplete and awaiting subsequent market reactions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The most common definition uses a three-candle sequence:

The most common definition uses a three-candle sequence: