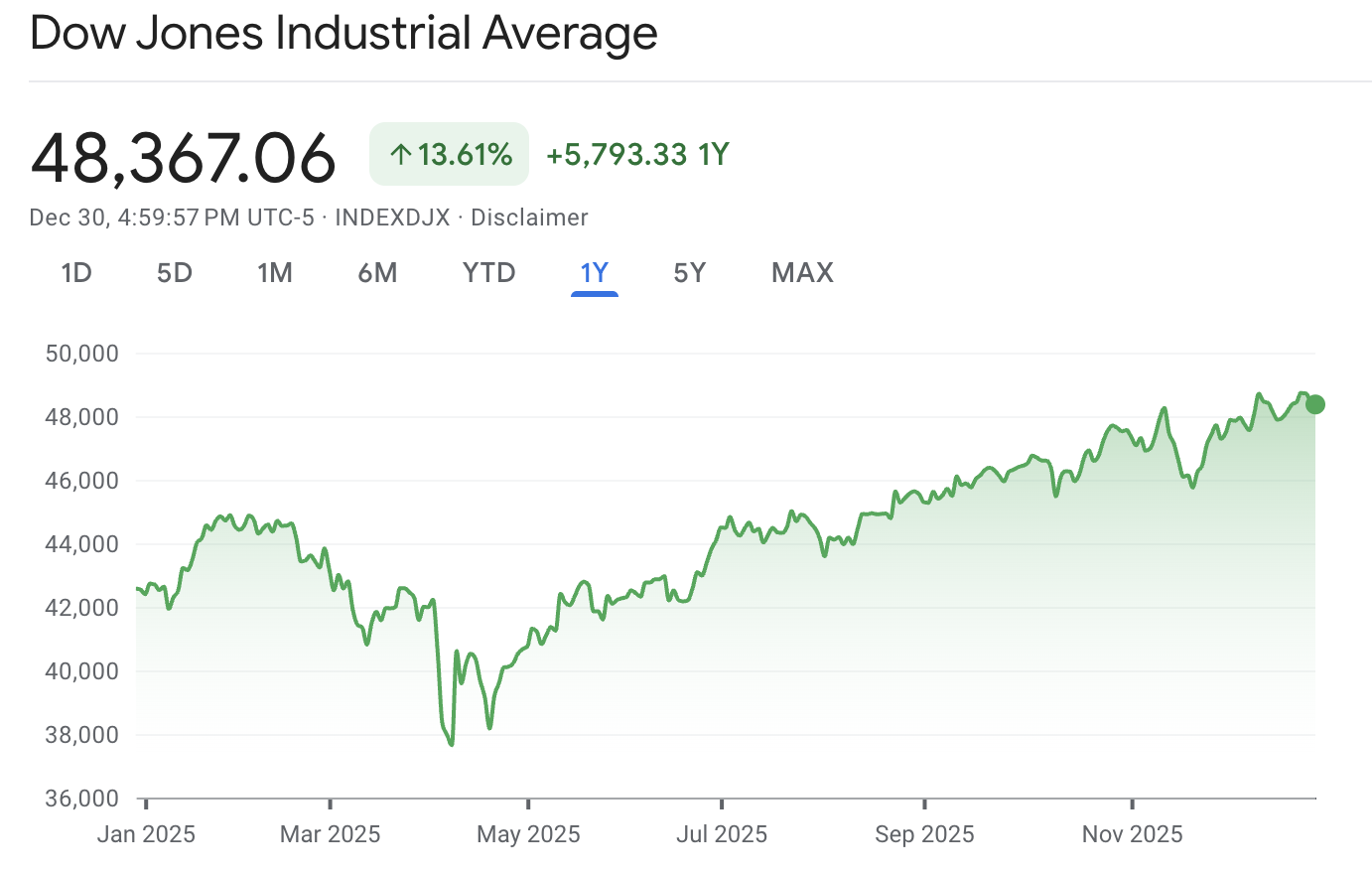

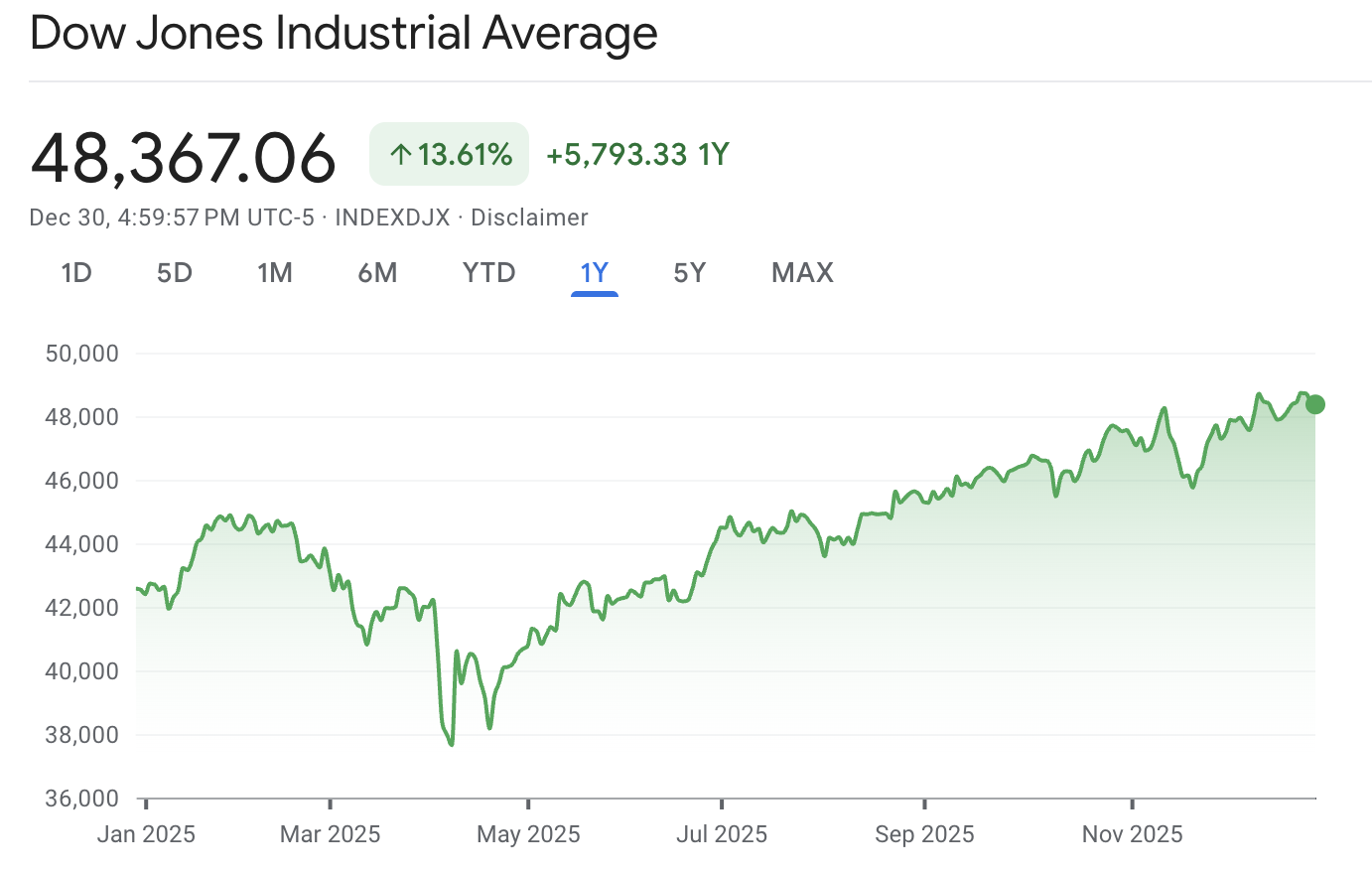

The Dow is doing something that usually feels bullish on its own. It is on pace for an eighth straight month of gains, which puts it close to the longest monthly winning run since early 2018.

At the same time, the market is not delivering the year-end "Santa Claus rally" that traders hoped for during the final stretch of December and the first sessions of January.

This mix looks odd at first glance, but it is not random. The Dow's strength is being supported by rotation and steadier earnings narratives. On the other end, the broader "Santa rally" window is being weighed down by thin liquidity, selective risk appetite, and a market that is already priced for a good 2026.

Key Takeaways

Dow Market Recap (End-December 2025)

| Date |

Dow close |

Session tone |

What it suggested |

| Dec 24, 2025 |

$48,731.16 |

Record close in a shortened session |

A strong kickoff, but with holiday-light participation. |

| Dec 26, 2025 |

$48,710.97 |

Nearly flat, snapped a five-session run |

A "catching breath" session instead of momentum. |

| Dec 29, 2025 |

$48,461.93 |

Clear pullback |

Santa hopes were discussed, but price did not cooperate. |

| Dec 30, 2025 |

$48,367.06 |

Drifted lower in thin conditions |

A market that is willing to pause near highs, not chase. |

The Dow set a record close of 48,731.16 on 24 December 2025. That looked like the start of a classic late-December push, and headlines quickly framed it as the beginning of the Santa rally window.

Then the tone changed. By 30 December 2025, the Dow closed at 48,367.06, which left it down roughly 364 points (about -0.75%) from the 24 December close.

Despite this, the Dow is still on track to notch eight straight months of gains, which would be its longest run since the 2017–2018 stretch.

The Dow also has the "strong year" backdrop behind it. It is up about 14% in 2025, which helps explain why fund managers may prefer to protect gains rather than chase a late-December breakout.

Why Is There No Santa Claus Rally Feel This Year?

The cleanest way to describe the current tape is that the Santa window started, but it did not accelerate.

For context, the Santa rally period began on the Wednesday before Christmas and runs through 5 January 2026, and investors were actively watching for signs of follow-through.

Instead of a steady climb, the market has delivered a string of muted sessions, including a flat-to-down post-Christmas day and a sharper pullback at the start of the final week.

What Is Driving the "Dow Jones Win Streak but No Santa Claus Rally" Setup?

1) The Dow's "Win Streak" Is Real, but It Is Mainly a Monthly Story

The Dow and the broader market have been extending a steady string of monthly gains into year-end, which is why the "since 2018" comparison keeps resurfacing.

For example, with equities tracking toward an eighth straight monthly advance on rate-cut optimism and a resilient economy, the pattern started to echo the long streak that ended in early 2018.

This remains relevant now as a strong multi-month uptrend can still coexist with a weak final-week tape, particularly around quarter- and year-end when rebalancing and positioning flows can distort short-term price action.

2) Thin Liquidity Is Turning Small Selling Into Bigger Moves

Trading in late December typically sees reduced volume as many institutional investors scale back risk, limit their activity, and concentrate on safeguarding year-end results instead of initiating new positions.

In reality, the recent sessions may experience "holiday-thin" liquidity, causing sector-level buying and selling to balance each other out, resulting in the major indexes moving sideways or drifting aimlessly.

In simple terms, it does not take much selling to knock the Dow down 100–200 points when the market is quiet.

3) Rotation Is Beating Momentum, and the Dow Is Very Sensitive to It

The Dow is price-weighted and made up of only 30 stocks, so moves in a handful of the highest-priced constituents can disproportionately swing the whole index, even if breadth is mixed or the rest of the market is rotating normally.

Because of that construction, a rotation out of (or into) just a few high-priced Dow names can make the index look stronger or weaker than traders might expect from the broader tape.

Its recent weakness is in parts of the market that looked more like rotation and reallocation than panic selling.

That is exactly the kind of market that can keep a monthly streak alive while still failing to deliver a clean Santa rally.

4) Investors Are Still Digesting the New Interest-Rate Path

The Federal Reserve has been reducing rates, and market players are attempting to determine how much that easing will extend in 2026.

To recap, the Fed had cut rates by 75 basis points over its last three meetings, taking the policy range to 3.50%–3.75%, and traders were looking to the December minutes for more guidance.

When rates become a two-way debate again, stocks often lose their smooth seasonal climb, as each new data point can alter the "cuts" narrative.

5) Record Highs Are Triggering Sensible Profit-Taking

A market can be bullish and tired at the same time. The Dow finished the latest session down, but it was still up 13.7% for 2025.

That is a strong year, and it gives funds a reason to lock in gains, especially when the calendar is about to flip.

What to Watch in the Remaining Santa Window?

| Indicator |

Value |

What it means |

| Last |

$48,367.06 |

Price is consolidating below recent highs. |

| RSI (14) |

39.336 |

Momentum has cooled, which fits a pause in the Santa window. |

| MACD (12,26) |

-30.780 |

Short-term momentum has flipped negative. |

| ADX (14) |

40.854 |

Trend strength is high, which can mean moves extend once they start. |

| ATR (14) |

88.382 |

Daily ranges remain meaningful, even in holiday conditions. |

| MA5 (simple) |

48,385.15 |

Price is just below the near-term mean. |

| MA20 (simple) |

48,496.60 |

This is the first area bulls usually want to reclaim. |

| MA200 (simple) |

47,948.88 |

This is the medium-term trend line that matters if a deeper pullback begins. |

The Santa window is still live, so it is too early to call it "failed" with confidence. It is more accurate to say the market has not confirmed it yet.

Signs the Santa Rally Is Arriving Late

The Dow reclaims the pivot area near $48,394 and holds above it into the close.

Broader indexes stop slipping and start printing higher lows in the final sessions of the year.

Signs the Market Is Choosing Consolidation Instead

The Dow remains capped below the MA20 region near $48,497.

Holiday-thin trading continues to produce flat sessions with quick reversals.

Frequently Asked Questions

1) What Is the Santa Claus Rally Window?

It is the last five trading days of December and the first two trading days of January.

2) Why Is the Dow Strong Even Without a Santa Rally?

The Dow can hold up when investors rotate into steadier areas safeguard year-end profits.

3) Is There No Santa Rally in 2025?

So far, the Dow sits below the 24 December close through 30 December, indicating that the rally has yet to be reflected in the price. The window is not finished until the first two trading sessions of January.

4) Does a Weak Santa Rally Predict a Weak January?

It can be a warning sign, but it is not a reliable prediction on its own.

5) Which Levels Matter Most for Traders Right Now?

The record-close zone near 48,731 is key resistance, while the 48,300–48,350 area is near-term support. The larger support line is the 200-day average at 47,949.

Conclusion

In conclusion, the Dow is close to its longest monthly winning run since the 2017–2018 period, but the Santa rally has not delivered clean follow-through so far.

The market looks more like a rotation and year-end positioning story than a fresh risk-on surge, and thin liquidity is amplifying every small push and pull.

Technically, the Dow is soft below the 50-day area, but it is still holding above the 200-day line, helping to maintain the larger uptrend as we approach 2026.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.