A swift rise to fresh highs invites bubble talk, but current evidence points to stretched rather than manic conditions: rich tech valuations sit on easier policy hopes and resilient earnings, breadth is mixed, and this week's inflation data could confirm or test the move decisively.

Market And Macro Overview

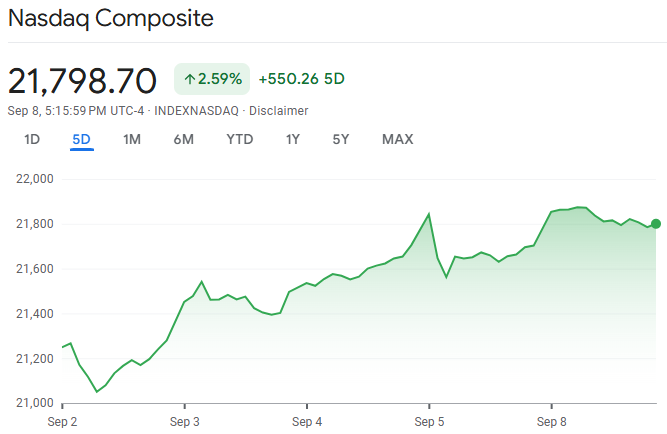

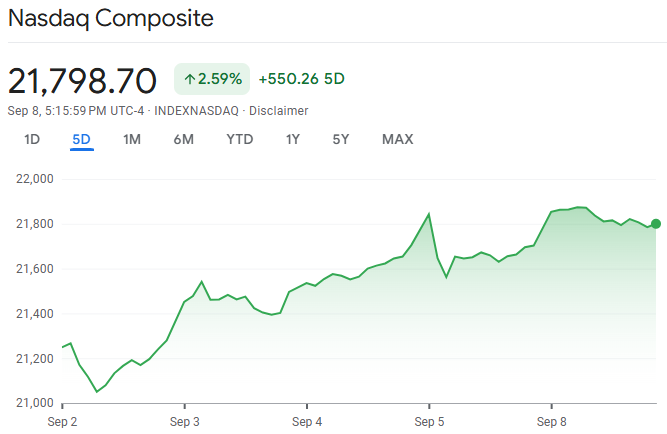

The Nasdaq Composite closed at a record 21,798.70 as lower yields and firm technology leadership lifted risk appetite into the US CPI print, while the Dow rose about 0.3 percent to 45,514.95 and the S&P 500 edged higher on the day. [1]

Investors leaned toward the view that the Federal Reserve will begin cutting rates next week after softer labour data, with several banks shifting to a steeper easing path for 2025 as traders positioned around CPI and payroll revisions later in the week.

Government bond yields eased, with the 10‑year near 4.05–4.10 percent and the 2‑year around 3.49–3.51 percent, loosening financial conditions and favouring duration‑sensitive equities ahead of CPI.

The dollar slipped toward multi‑week lows as markets priced deeper cuts, then steadied as attention turned to inflation, helping global risk assets and emerging‑market FX at the margin into the data window.

Macro Pulse

| Metric |

Latest/Direction |

Read-Through |

| US 10-Year Yield |

~4.05–4.10% (lower) |

Supports duration and growth |

| US 2-Year Yield |

~3.49–3.51% (lower) |

Reinforces cut expectations |

| US Dollar Index |

Softer into CPI |

Looser global conditions |

| Fed Cut Expectations |

September cut priced |

Risk appetite supported |

Cross‑Asset Signals: Gold, Oil, FX

Gold pushed through $3,600 per ounce for the first time as lower real‑rate expectations and hedging demand built into macro event risk, signalling caution beneath the equity rally despite new highs in indices.

Brent crude hovered near the mid‑$60s after last week's drop, with OPEC+ confirming only a modest output increase from October and physical indicators pointing to softer demand near term, which caps energy‑driven inflation pressure for now.

-

Next catalysts include US inventory data and OPEC+ compliance, both of which could sway time‑spreads and near‑term direction if draws or discipline surprise.

FX remains sensitive to CPI; a softer print would likely keep the dollar offered, while a hot print risks a rebound and tighter global conditions into quarter‑end. [2]

Market Internals And Regional Read‑Throughs

Leadership remains concentrated in mega‑cap technology, where elevated multiples are anchored by robust free cash flow and secular demand tied to cloud and AI infrastructure, while breadth is uneven and cyclicals have lagged on growth concerns, indicating a still‑selective advance.

Asia's tone improved as prospects for the US easing outweighed political noise and mixed growth signals, with follow‑through likely hinging on the CPI outcome and the ECB's tone, given their impact on the dollar and global rates.

India's pre‑open bias aligned with the global setup, with cut expectations supporting indices and a steadier currency backdrop into the data.

Internals And Regional Cues

| Indicator/Region |

Latest/Direction |

Comment |

| Nasdaq Composite (close) |

21,798.70 (record) |

Tech leadership remains firm |

| Breadth (session tone) |

Mixed; late-day participation |

Event-driven conviction more than euphoria |

| VIX (directional read) |

Subdued vs. data risk (qualitative) |

Cautious but constructive tone |

| Asia Equities (regional tone) |

Firmer on easing hopes |

CPI/USD path is key for follow-through |

| India (pre-open bias) |

Higher with Fed-cut backdrop |

Rates narrative supports sentiment |

Takeaway: Internals show confident but selective risk, with broader confirmation likely if CPI validates disinflation and the dollar stays soft enough to support non‑US flows.

Risk Check: Bubble Or Rates‑Led Pullback?

Signs of froth are visible in AI‑linked momentum pockets and narrow leadership, but cross‑asset markers remain balanced rather than euphoric: gold at records implies ongoing hedging and lower real‑rate expectations, while oil in the mid‑$60s suggests growth is steady, not overheating.

Elevated price‑to‑earnings ratios in the largest platforms are high versus history, yet continue to be supported by strong cash generation and capex cycles tied to cloud and AI, pointing to rate sensitivity as the primary risk rather than a classic speculative blow‑off. [3]

CPI Path: Validation Or Reversal

| CPI Scenario |

Likely Near-Term Impact |

| Softer Headline And Core |

Yields fall, dollar eases, quality growth and duration extend; EM FX and credit firm. |

| Sticky Headline, Soft Core |

Rotation toward services-oriented shares; energy tactically bid; overall tone mixed. |

| Hot Headline And Core |

Front-end yields rise, dollar firms, long-duration equities lag; defensives gain favour. |

Conclusion

Equity strength in the CPI release reads as a policy‑supported repricing rather than unchecked speculation, with leadership centred on large, cash‑generative technology and cross‑asset signals still balanced.

The inflation print and central bank guidance will likely decide whether the advance broadens or pauses, while gold near records and oil contained suggest markets remain alert to risk even as indices set highs.

On this footing, the record close appears less a late‑cycle climax and more a data‑dependent waypoint, with the path ahead contingent on whether disinflation can persist without undermining growth.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

[1] https://www.cnbc.com/2025/09/07/stock-market-today-live-updates.html

[2] https://www.reuters.com/world/middle-east/dollar-slips-7-week-low-jobs-gloom-bolsters-fed-cut-wagers-2025-09-09/

[3] https://www.reuters.com/business/energy/oil-settles-up-after-opec-opts-modest-output-hike-2025-09-07/