Brent crude is more than just a type of oil-it's the world's most important oil market benchmark. If you've ever checked global oil prices or followed energy news, you've likely seen Brent quoted alongside West Texas Intermediate (WTI) and Dubai Crude.

But what exactly is Brent crude, why is it so influential, and how does its price impact the global economy? Here's a simple explanation for beginners and market watchers alike.

What Is Brent Crude?

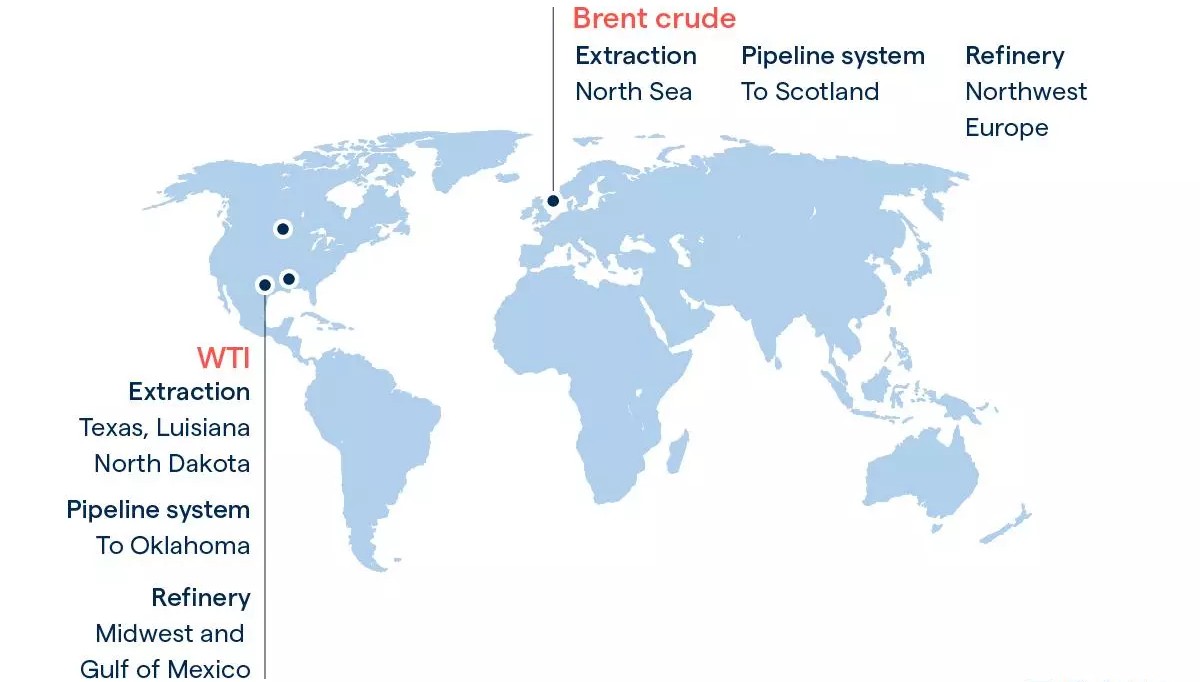

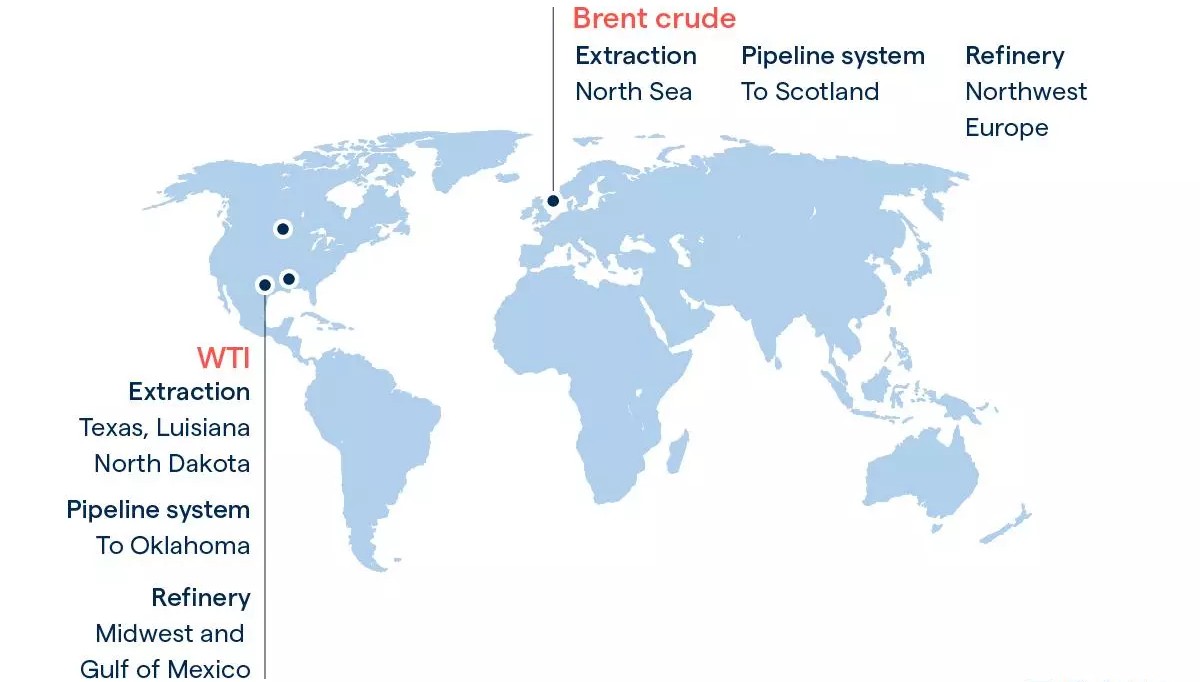

Brent crude refers to a blend of light, sweet crude oils extracted from four major oil fields in the North Sea: Brent, Forties, Oseberg, and Ekofisk. Originally, it was named after the Brent oil field, located northeast of the Shetland Islands in the UK. Over time, as production from the Brent field peaked and declined, the benchmark expanded to include oil from the other three fields, forming what is now known as Brent Blend.

Brent is classified as a “light” crude because of its relatively low density and as “sweet” because of its low sulphur content. These qualities make Brent ideal for refining into petrol and middle distillates, such as diesel and jet fuel, especially in European refineries.

Why Is Brent Crude a Benchmark?

Brent crude is the leading price benchmark for Atlantic basin crude oils and is used to price about two-thirds of internationally traded crude oil supplies. Its significance comes from:

Location and Accessibility: The North Sea is a politically stable region with well-established infrastructure, making Brent a reliable reference point.

Quality: Brent's light, sweet characteristics are highly sought after by refiners.

Liquidity: The Brent market is deep and liquid, with active trading on futures exchanges, making it a trusted indicator for global oil prices.

Other major benchmarks include West Texas Intermediate (WTI) in the US and Dubai Crude in the Middle East. Each serves as a reference for different regions and grades of oil, but Brent remains the most widely used for global pricing.

How Is Brent Crude Priced?

Brent crude prices are determined by supply and demand in the global oil market, geopolitical events, OPEC+ production decisions, and economic forecasts. Prices are quoted in US dollars per barrel and are tracked closely by traders, governments, and businesses worldwide.

In May 2025, Brent crude futures were trading around $61–$68 per barrel, reflecting a recent period of price declines due to expectations of lower global oil demand, new tariffs from the US and its trading partners, and increased OPEC+ production. The US Energy Information Administration (EIA) forecasts the average Brent price to be about $65.85 per barrel in 2025, with further declines expected in 2026 as inventories grow and demand slows.

What Influences Brent Crude Prices?

Several key factors influence Brent crude prices:

Global Supply and Demand: Changes in oil production, consumption, and stockpiles directly impact prices.

OPEC+ Decisions: Production targets set by OPEC and its allies can tighten or loosen supply, moving prices up or down.

Geopolitical Events: Conflicts, sanctions, and diplomatic developments in oil-producing regions can cause price spikes or drops.

Economic Growth: Slower growth or recession fears reduce oil demand, putting downward pressure on prices.

Alternative Energy and Policy: The rise of renewables and shifts in energy policy can influence long-term demand for crude oil.

Brent Crude vs. Other Oil Benchmarks

Brent vs. WTI: Brent is lighter and sweeter than many global oils but not as much as WTI. WTI is used primarily in the US, while Brent is the global standard, especially for Europe and Africa.

Brent vs. Dubai Crude: Dubai Crude is heavier and more sour, serving as the benchmark for Middle Eastern exports to Asia.

Price spreads between these benchmarks reflect differences in quality, location, and transportation costs.

Why Does Brent Crude Matter?

Brent crude's price is a key reference for:

Global Oil Contracts: Many oil-exporting countries and companies use Brent as the basis for pricing their shipments.

Energy Markets: Movements in Brent prices affect everything from petrol costs to airline ticket prices.

Economic Policy: Governments and central banks monitor Brent closely as it influences inflation and trade balances.

2025 Outlook for Brent Crude

In 2025, Brent crude prices have been lower than many expected, with the EIA and Citi Research both revising forecasts downward due to weaker demand and rising inventories. OPEC+ production increases and potential geopolitical agreements, such as a US-Iran nuclear deal, could push prices even lower, possibly to $55 per barrel or below in the short term. However, any supply disruptions or renewed demand could cause prices to rebound.

Final Thoughts

Brent crude is the world's most important oil market benchmark, setting the price for much of the oil traded globally. Its value is shaped by a mix of supply, demand, geopolitics, and economic trends.

Whether you're an investor, business owner, or consumer, understanding Brent crude helps you make sense of energy prices and their impact on the broader economy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.