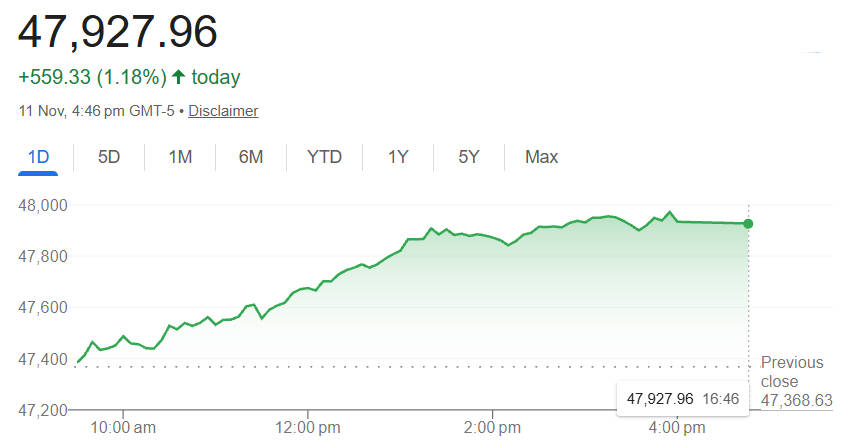

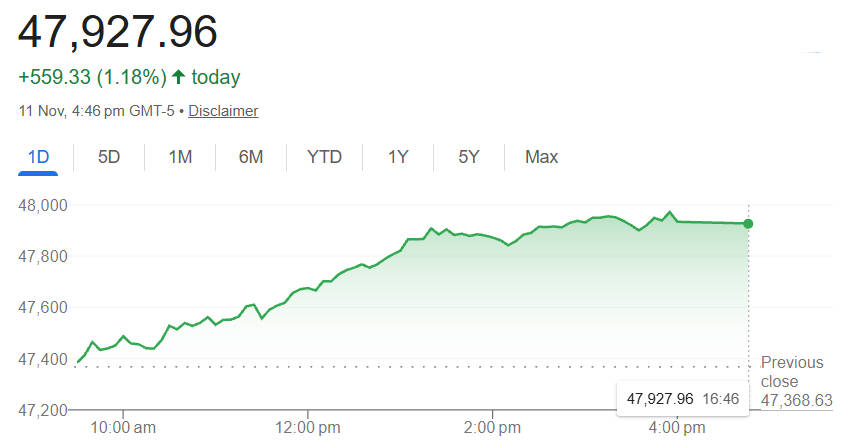

The Dow Jones Industrial Average surged to a new all-time closing high of 47.927.96. gaining 559.33 points (1.18%) on 11 November 2025. The rally came as investors welcomed improving prospects for an end to the US government shutdown and rebalanced portfolios away from over-valued technology shares into traditional blue-chip sectors.[1]

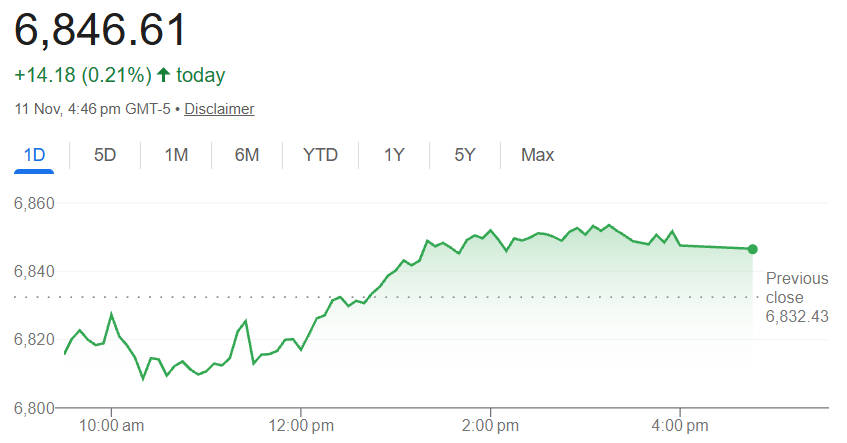

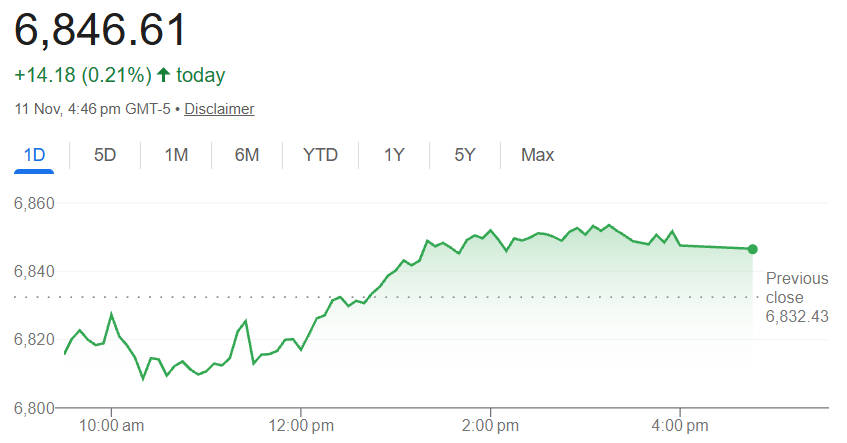

While the S&P 500 advanced modestly, the Nasdaq Composite dipped as traders took profits in artificial-intelligence and semiconductor stocks. The divergence highlighted a renewed preference for value, stability and dividend resilience over speculative growth.

Dow Jones New High Reflects Dual Market Shifts

Two simultaneous developments explain why the Dow Jones New High occurred now.

Policy clarity improved: Political negotiations in Washington increased expectations that the prolonged federal shutdown would soon end, easing uncertainty that had constrained spending and data releases.

Sector rotation intensified: Investors redirected funds from high-growth names into defensive industries such as healthcare, consumer staples and industrials. Stocks including Merck, Amgen, and Johnson & Johnson were among the session's top performers.

These dynamics produced a broadening of market leadership, transforming a previously tech-driven rally into a more balanced advance across sectors.[2]

Market Snapshot and Key Statistics

| Index |

Closing Level |

Daily Change |

Year-to-Date Change |

| Dow Jones Industrial Average |

47,927.96 |

+559.33 (+1.18%) |

+14.2% |

| S&P 500 |

6,846.62 |

+14.19 (+0.21%) |

+17.3% |

| Nasdaq Composite |

23,468.30 |

−58.87 (−0.25%) |

+21.6% |

Dow Jones New High Driven by Policy, Earnings and Macro Trends

Several inter-linked factors contributed to the fresh record close:

Government progress:

Optimism surrounding a budget agreement reduced the probability of further disruption to economic operations and consumer confidence.

Corporate resilience:

Recent quarterly earnings from large-capitalisation industrials and healthcare groups exceeded expectations, confirming underlying business strength.

Monetary expectations:

Softer employment data increased hopes that the Federal Reserve may cut interest rates later in 2025. supporting equity valuations.[3]

Global sentiment:

Stabilising energy prices and calmer geopolitics encouraged investors to re-enter risk assets selectively.

These developments reinforced the perception that the United States economy remains fundamentally solid, even as investors reassess growth-stock valuations.

Dow Jones New High and Sector Rotation Explained

| Sector |

Performance Driver |

Investor Rationale |

| Healthcare |

Broad gains led by Merck & Co., Amgen, and Johnson & Johnson |

Reliable earnings and defensive characteristics during policy uncertainty[4] |

| Consumer Staples |

Solid demand for household goods and beverages |

Steady cash flow and dividend stability attracted income investors |

| Industrials |

Optimism over resumption of federal projects |

Potential fiscal boost once shutdown ends |

| Technology |

Relative underperformance of semiconductor and AI leaders |

Profit taking and valuation adjustment after sharp earlier rallies |

Dow Jones New High: Technical and Historical Perspective

Crossing 47.900 points represents a technical breakout above prior resistance levels near 47.300. From a charting standpoint, this breakout triggers momentum buying as traders interpret the level as confirmation of strength.

Historically, each Dow Jones New High has tended to attract incremental inflows from passive index funds and exchange-traded products benchmarked to the index. This structural demand can sustain upward pressure in the short term, although overbought signals often follow if fundamentals do not keep pace.

Dow Jones New High and Its Implications for Investors

The new record offers both opportunities and cautions for investors:

1. Positive signals

Broader market participation beyond technology implies improved economic confidence.

Blue-chip dividend payers are regaining investor favour, potentially stabilising portfolios.

Reduced policy uncertainty should enhance corporate planning and capital expenditure.

2. Points of caution

Rapid rotations can reverse abruptly if macro data disappoints.

High valuations in certain defensive sectors may limit further upside.

Earnings revisions could moderate enthusiasm if growth decelerates.

Investors are therefore encouraged to view the Dow Jones New High as confirmation of resilience rather than a cue for unrestrained optimism.

Risks That Could Reverse Recent Gains

Although the Dow Jones achieved a record close, several risks remain relevant:

Technology correction risk:

Renewed weakness in major AI or semiconductor stocks could weigh on overall sentiment.

Macroeconomic shocks:

Unexpected inflation data or energy price volatility may reignite monetary tightening concerns.

Political uncertainty:

A delay in implementing the budget resolution could erode confidence in government functionality.

External headwinds:

Slowing growth in China or Europe could affect multinational earnings within the index.

Preparedness through diversification and disciplined asset allocation remains crucial for investors seeking to preserve gains.

Dow Jones and Portfolio Allocation Strategies

| Objective |

Suggested Strategy |

| Capital Preservation |

Maintain exposure to high-quality blue-chips and increase cash buffers to exploit volatility. |

| Income Generation |

Focus on dividend growth stocks within the Dow such as healthcare and consumer staples leaders. |

| Growth Orientation |

Retain selected technology exposure for innovation upside but trim excessive concentration. |

| Hedging and Risk Control |

Use index ETFs or sector spreads to balance cyclical and defensive holdings. |

Dow Jones in the Context of the U.S. Economy

The latest Dow Jones milestone sends a broader message about investor sentiment toward the United States economy.

Equity markets interpret continued earnings resilience as a sign that the economy is coping with higher borrowing costs.

Confidence in established companies with pricing power and global diversification remains high.

A stable or easing Federal Reserve policy could reinforce support for large-cap equities.

Nevertheless, analysts caution that equity market records do not automatically translate into widespread economic prosperity. Sustained gains will depend on productivity, wage growth, and fiscal discipline in the months ahead.

Conclusion

The Dow Jones reaching 47.927.96 is a clear sign of market confidence, reflecting improved policy clarity and a meaningful rotation toward fundamental value. This achievement shows that investors are no longer relying solely on the technology sector to drive gains.

However, it also introduces new challenges. Elevated valuations, lingering political uncertainty, and global economic fragility all require vigilance. For disciplined investors, the Dow Jones record should serve as confirmation of resilience rather than an excuse for complacency.

Frequently Asked Questions

Q1: Why did the Dow reach a new high today?

Investor optimism about a likely end to the federal shutdown, combined with rotation into blue chip and value sectors and supportive corporate updates, lifted the Dow to a record closing level.

Q2: Why did the Nasdaq fall while the Dow rose?

The Nasdaq is heavily weighted to high growth technology names, which experienced profit taking and valuation pressure, while the Dow benefitted from flows into more defensive, dividend paying sectors that outperformed on the day.

Q3: Does a Dow record mean the market is overvalued?

A record close signals stronger sentiment but does not alone prove overvaluation. Investors must inspect valuations, earnings trends and macro indicators to determine whether prices are justified by fundamentals.

Q4: How should individual investors respond to this development?

Investors should review diversification, rebalance to match risk tolerance, consider trimming overconcentrated high valuation positions, and maintain a clear plan for volatility management and reallocation.

Q5: What are the main risks to the Dow's continued advance?

Key risks include a renewed tech sector correction, unexpected inflation or policy shifts, and any political reversal that prolongs economic uncertainty or disrupts corporate guidance.

Sources:

[1]https://www.marketwatch.com/story/dows-banner-day-points-to-investor-pivot-beyond-s-p-500s-top-winners-4bce59df

[2]https://www.reuters.com/world/africa/us-futures-retreat-tech-concerns-resurface-federal-reopening-awaited-2025-11-11/

[3]https://www.investing.com/news/stock-market-news/asian-markets-make-tepid-gains-as-us-shutdown-set-to-end-4349871

[4]https://www.thestar.com.my/business/2025/11/12/dow-surges-as-traders-bet-on-end-to-government-shutdown

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.