Boston Scientific's stock is in a clear pullback phase after its multi-year climb. As of the latest close, BSX trades around $92.53 a share. The price has fallen for seven trading sessions in a row and now sits about 15.5% below its 52-week high of $109.50, set in early September 2025.

The current 52-week range is $85.98 to $109.50, so the share price is still above its recent low but well off the top of the range.

Over the last five years, however, Boston Scientific has delivered a total return of roughly 175–180%, meaning that $1,000 invested five years ago would now be worth around $2,700–$2,800, even after this drop.

Many traders are therefore asking a simple question: why is Boston Scientific stock dropping now if the long-term story still looks strong? The answer lies in the mix of sentiment, valuation, interest rates, and technical levels, not in a collapse of the business itself.

Boston Scientific Stock Drop: Where BSX Stands Now?

On the latest trading day, BSX moved between about $92.26 and $94.84, with closing volume near 12.5–12.7 million shares, well above a recent average of just under 10 million shares.

Recent performance looks like this:

Over the past week, the stock has fallen about 8%.

Over the past month, it has been down roughly 5–6%.

Over the past year, the gain has been modest, in the low single digits.

Over five years, total return is around 176%, placing BSX near the top of its industry group on a multi-year view.

This pattern is typical of a strong growth stock that has pushed very high, then started a controlled sell-off rather than a crash. Long-term holders remain in profit, but short-term traders are feeling the pain of Boston Scientific's recent stock drop.

4 Main Reasons Boston Scientific's Stock Is Dropping

1. Profit-Taking After a Powerful Five-Year Rally

Boston Scientific has been a big winner for years. Depending on the data set, the five-year total return sits around 170–180%, far ahead of broad market benchmarks over the same period.

After that kind of run:

Many institutions gradually trim positions to lock in gains.

Short-term funds often reduce exposure when momentum cools.

Any negative headline or shaky macro day becomes an excuse to hit the sell button.

The recent pattern of seven straight down sessions on rising volume fits that behaviour very well. It looks like a "position clean-up" phase rather than a sudden loss of confidence in the company's products.

2. A Premium Valuation Is Being Reset

Even after the sell-off, Boston Scientific still trades on a premium valuation:

Trailing price-to-earnings (P/E) is around 49–50.

Forward P/E sits in the 27–28 area, based on consensus earnings forecasts.

The price-to-sales ratio is above 7, and the price-to-book is close to 6.

These are the valuation multiples markets assign to companies with robust, steady growth. They also leave very little room for disappointment.

When a stock with nearly 50 times trailing earnings breaks below key technical levels, even without bad company-specific news, the market often reprices the risk. That is exactly what this BSX sell-off looks like.

3. Higher Interest Rates Are Squeezing Growth Names

The background macro picture also matters. The U.S. 10-year Treasury yield is trading around 4.2%, near the top of its 2025 range.

Higher long-term yields usually hurt stocks that:

As discount rates rise, the present value of future cash flows declines. Boston Scientific falls into this category, making the sector less appealing to investors amid recent yield increases, even when companies meet their targets.

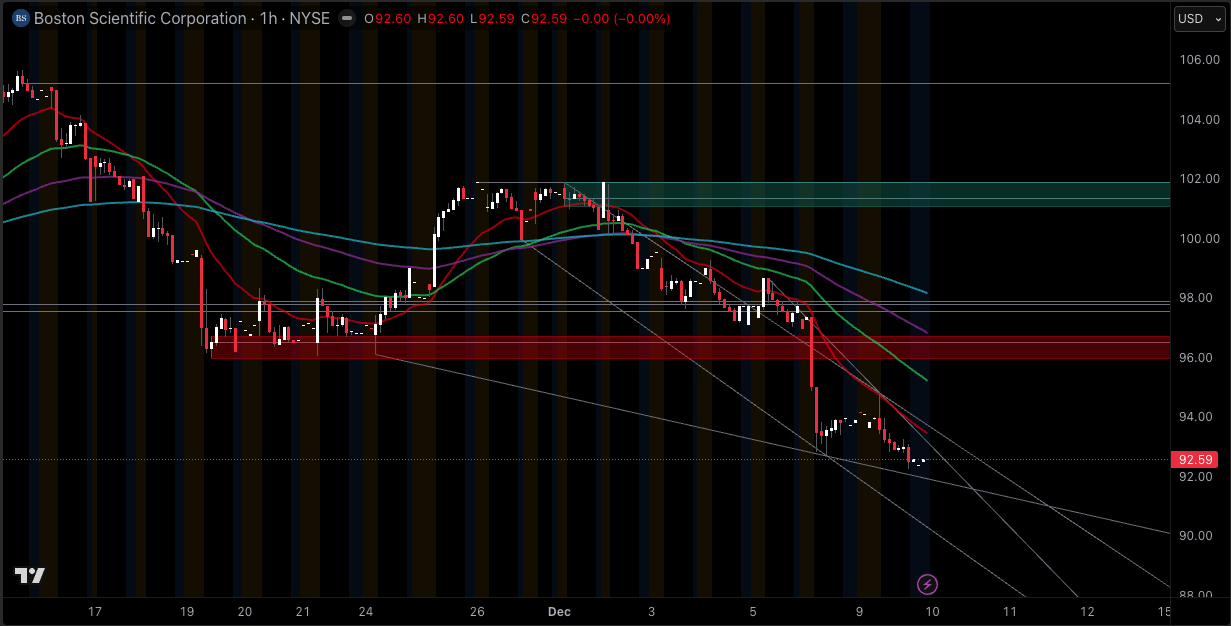

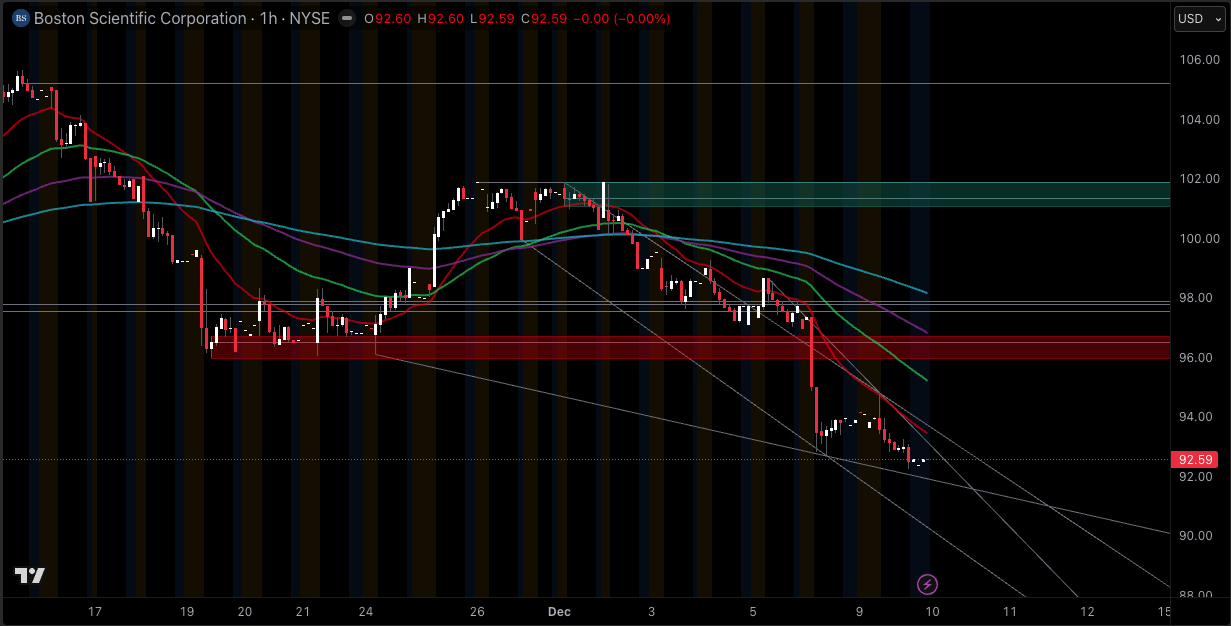

4. A Technical Breakdown Has Invited More Selling

Technical traders have also had clear reasons to sell or stay cautious.

Fresh data show:

The share price is below its 10-day, 20-day, 50-day and 200-day simple moving averages.

The 14-day RSI sits in the low 30s, signalling weak momentum and approaching oversold territory.

The MACD line is negative (around -0.8), confirming a short-term downtrend.

Bollinger Bands on a 25-day setting sit roughly in the $97–$102 range, so a price around $92–$93 is trading below the lower band, another sign of pressure.

When a stock drops below its major moving averages with low-30s RSI and heavy volume, many rule-based strategies shift from "buy dips" to "sell rallies," which can deepen the Boston Scientific stock drop even if fundamentals look fine.

Boston Scientific Fundamental Picture: Earnings Are Still Moving in the Right Direction

What stands out about the BSX sell-off is that it is happening amid very robust operating performance.

In Q3 2025, Boston Scientific reported:

Revenue of $5.07 billion, up about 20% year on year, and ahead of market forecasts.

Organic sales growth around 15%, showing broad underlying demand.

Adjusted earnings per share of $0.75, up roughly 19% from the prior year and above the company's own guidance range.

Notable robust expansion in essential cardiovascular product categories, which are crucial to its strategy.

Following those results, the company raised its full-year 2025 adjusted EPS guidance to $3.02–$3.04 per share, up from the prior range of $2.95–$2.99.

Looking slightly further back, the 2023 annual report showed net sales of $14.2 billion, with double-digit growth across all major regions.

Current summary metrics underline the scale of the business today:

Revenue (latest twelve months): about $19.3 billion.

Earnings per share: around $1.87 on a GAAP basis.

Gross margin: roughly 68%.

Return on equity: about 12–13%.

Market capitalisation: close to $137 billion.

Analyst forecasts reflect this strength, with 12-month price targets ranging from $105 to $140 per share, implying significant upside from current levels as long as growth aligns with expectations.

Taken together, the data suggest that the Boston Scientific stock drop is mainly a valuation and sentiment reset, not a sign that the business has suddenly weakened.

BSX Technical Analysis: Key Levels Many Traders Are Watching

| Indicator / Level |

Approximate value |

What it suggests for BSX |

| Last close |

$92.53 |

Price is in a short-term downtrend after several red days. |

| Day’s range |

$92.26 – $94.84 |

Intraday swings are contained but all trading is happening below major averages. |

| 52-week high |

$109.50 |

Stock is about 15–16% below its recent peak. |

| 52-week low |

$85.98 |

First major long-term support zone sits in the high-$80s. |

| 10-day simple moving average |

≈$99.0 |

Price is well below the short-term trend line. |

| 20-day simple moving average |

≈$99.5 |

A first resistance band if the stock tries to bounce. |

| 50-day simple moving average |

$99.1 |

Medium-term trend line now acting as resistance. |

| 200-day simple moving average |

$101.3–101.4 |

Long-term trend line above current price, confirming a correction phase. |

| RSI (14) |

Low 30s (≈33) |

Momentum is weak and close to oversold, which often happens late in a down-swing. |

| MACD (12,26) |

Around −0.8 |

Confirms that the shorter-term trend is down. |

| Bollinger Bands (25-day) |

About $97–$102 |

Price around $92–$93 is trading below the lower band, which often signals stretched selling. |

| Daily volume vs 3-month average |

≈12.5M vs ≈9.8M |

Selling is happening on heavier-than-usual activity, showing real participation. |

| Beta (5-year) |

≈0.67 |

Historically less volatile than the broader market, despite recent swings. |

Listed is a snapshot of the current Boston Scientific technical picture using the latest daily data:

Simply put, this setup tells traders the following:

The short-term trend is downward, as the price sits below all key moving averages.

Momentum remains weak but near oversold levels, with RSI in the low 30s and the price below the lower Bollinger Band.

Volume is elevated, which means the Boston Scientific stock drop reflects real repositioning, not just a quiet drift lower.

For short-term traders, rallies into the $99–$101 area are likely to be treated as resistance until the chart proves otherwise. For investors with a longer horizon, the $86–$90 band stands out as a zone where many would reassess the risk-reward profile if the stock reaches it.

How Different Traders Can Trade with the BSX Stock Drop

1) Short-term Traders

May continue to respect the downtrend while BSX trades below the 20-day and 50-day moving averages. Many will only flip to a more positive stance if the price can reclaim and hold above roughly $100 with improving momentum.

2) Swing Traders

Might watch for signs that selling pressure is easing, such as RSI turning up from the low 30s or MACD flattening. A stabilisation around $90–$92, followed by a close back above the 20-day average, would often be seen as a potential "reset" entry zone.

3) Long-term Investors

Focus on the business rather than the short-term tape. May view this BSX sell-off as a normal consolidation after a big run, as long as revenue and earnings continue to grow in line with the raised guidance.

None of these views is "right" on its own. They reflect different time horizons and risk appetites.

Frequently Asked Questions

1. Why Is Boston Scientific Stock Dropping Right Now?

Boston Scientific's stock is declining primarily due to a valuation reset for a highly valued, strongly performing name.

2. Is Boston Scientific Stock Oversold?

On classic technical measures, BSX is pressured but not deeply washed out.

3. Has Something Gone Wrong With Boston Scientific's Business?

No. Current information does not point to a fundamental problem.

Conclusion

When you put the pieces together, the current Boston Scientific stock drop largely reflects positioning, valuation, and interest rates, not a collapse in fundamentals.

Technically, BSX remains in a downtrend but is approaching levels where oversold conditions and prior support often attract patient buyers.

For some traders, that mix will look like a warning sign. For others, it will look like the start of a new watchlist opportunity in a quality growth name at a better price. Your decision should always match your time frame, risk tolerance, and trade plan.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.