Markets move in headlines and big candles, but the quiet line that really taxes traders is the spread. Every time you hit buy or sell, you cross the bid-ask spread, handing a few market ticks before your trade idea even has a chance to play out.

Most new traders obsess over strategy and ignore this friction. Yet regulators and academics treat the bid–ask spread as one of the core measures of trading cost and liquidity, right alongside commissions.

If you trade often, getting sloppy with spreads is like running a business and never checking your margins.

Bid vs Ask: The Foundations

What Is Bid in Trading?

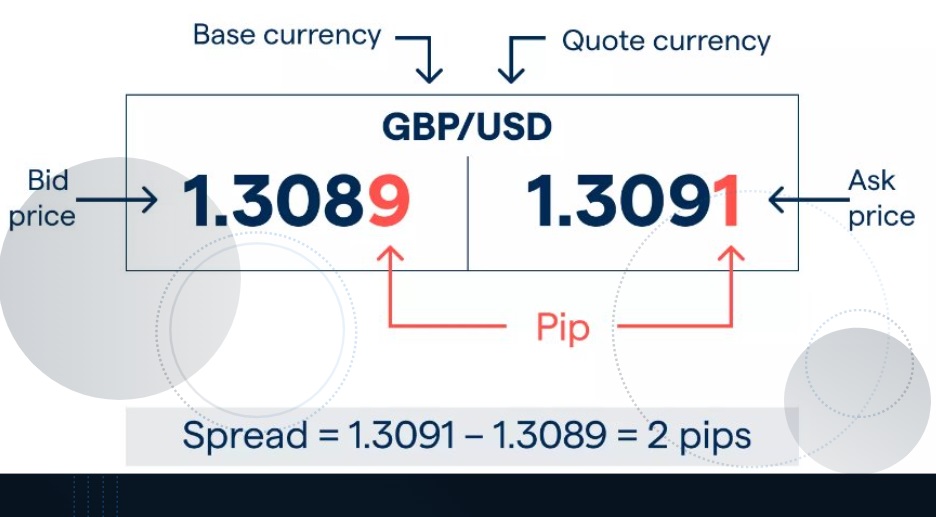

Regulators define the bid as the highest price a buyer is currently willing to pay for a given size at that moment.

If you sell at the market, you hit the bid.

The top of the bid stack in the order book shows the best "demand" for that instrument.

What Is Ask in Trading?

The ask (or offer) is the lowest price a seller is willing to accept.

If you buy at the market, you pay the ask.

The best ask shows the cheapest available "supply" right now.

Market makers and liquidity providers sit in the middle, quoting both sides. They buy at the bid and sell at the ask, earning the difference (the spread), as compensation for taking risk and providing liquidity.

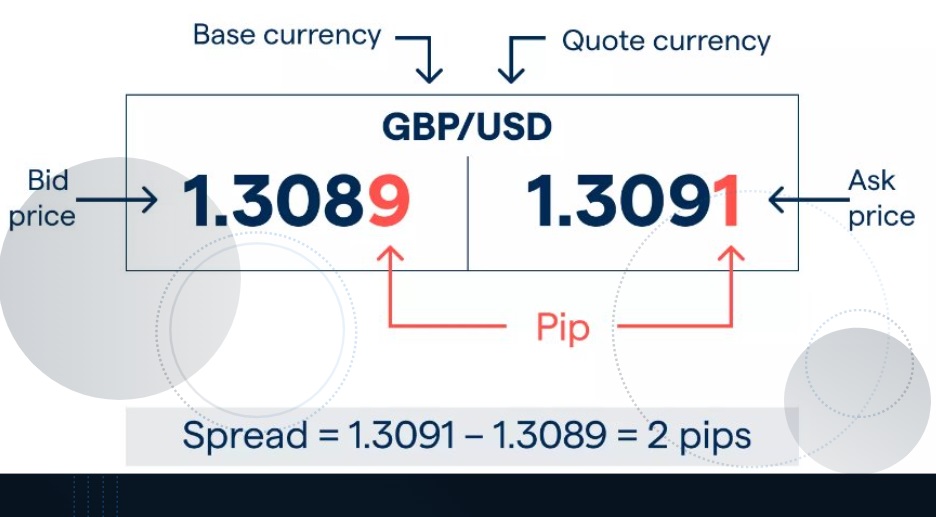

What Is Spread in Trading and How to Calculate It

The bid–ask spread is: Spread = Ask price − Bid price

Common ways to look at it:

Absolute spread: In currency units (e.g. $0.02, or 1 pip).

Percentage spread: Spread divided by price, useful for comparing across assets.

If a stock shows $24.90 bid / $25.00 ask, the spread is $0.10; in percentage terms, that's $0.10 ÷ $25.00 = 0.4%.

For a trader who crosses the spread, half of that gap (from mid-price to bid or ask) is your instant cost the moment you get filled.

Spread as a Hidden Trading Cost

Regulators are blunt: the spread is an inherent cost of trading. The wider it is, the more it costs you to get in and out, even before broker fees.

Imagine this quote in a stock:

Bid: $10.00

Ask: $10.02

Spread: $0.02

You buy 1,000 shares at the ask and, one second later, sell them at the bid with no price move:

Buy cost: 1,000 × $10.02 = $10,020

Sell proceeds: 1,000 × $10.00 = $10,000

Loss from spread alone: $20

No chart pattern failed, no headline hit. You just paid $20 in spread for a round trip.

Why Spread Hurts Active Traders Most

For long-term investors, spread is a small, one-off drag. For scalpers or high-frequency intraday traders, it's a recurring tax:

Trade 20 round-trips a day in a product with a $0.02 spread on 1,000 shares: that's $400/day in spread cost alone if you always cross the market.

In FX, a day trader hitting a 1-pip spread on EUR/USD with a standard lot (100,000 units) will pay $10 per round trip in spread costs.

Academic work on execution cost treats bid–ask spreads as a core driver of realised trading performance, alongside commissions and price impact.

Bid-Ask Spread Cost Comparison Table

Here's a quick feel for how spread scales with size:

| Instrument |

Quote (Bid / Ask) |

Spread |

Position size |

Round-trip spread cost* |

Spread as % of price |

| US stock |

10.00 / 10.02 |

$0.02 |

100 shares |

$2 |

0.20% |

| US stock |

10.00 / 10.05 |

$0.05 |

1,000 shares |

$50 |

0.50% |

| EUR/USD |

1.1000 / 1.1001 |

1 pip |

100,000 |

~$10 |

~0.009% |

| EUR/USD |

1.1000 / 1.1003 |

3 pips |

100,000 |

~$30 |

~0.027% |

*Assumes you buy at the ask and sell at the bid once.

For strategies targeting small intraday moves (a few cents or a handful of pips), this cost can make or break the edge.

What Makes Spreads Tight or Wide?

A spread isn't random. It reflects liquidity, volatility and market structure.

1) Liquidity and Trading Activity

More liquidity usually means tighter spreads:

Highly traded stocks and FX majors have heavy order flow on both sides of the book; thus, market makers can quote narrow spreads with confidence.

Thinly traded small caps, exotic FX pairs or tiny crypto tokens have fewer resting orders, so makers need a wider cushion to take risk.

For example:

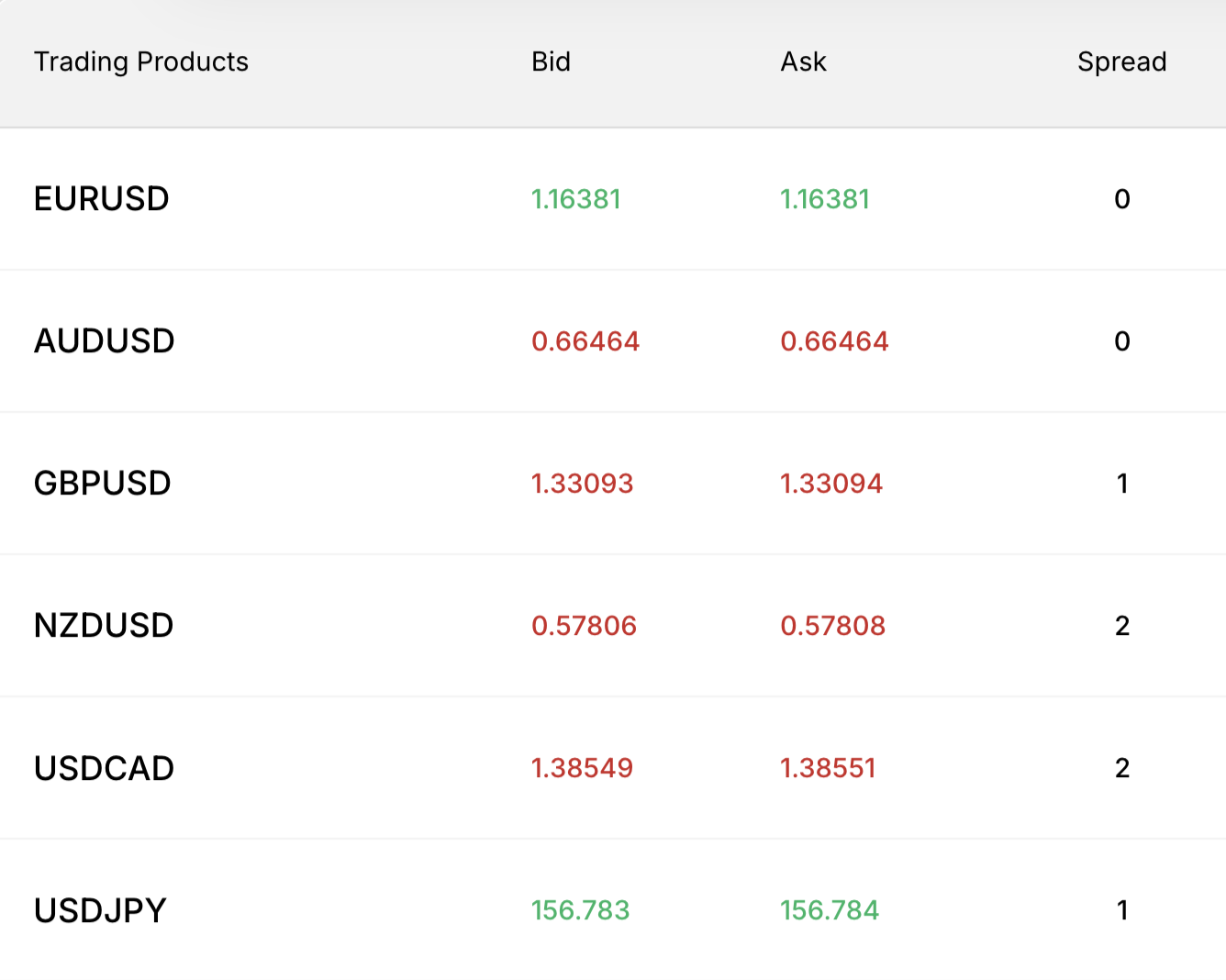

EUR/USD average spreads at top-tier brokers are often below 1 pip (some raw accounts quote 0–0.3 pips, plus a small commission), while the broader industry average is closer to 0.6–1.5 pips.

2) Volatility and Stress

When volatility explodes, spreads widen, and depth thins out:

During the March 2020 COVID shock, the New York Fed and others documented much wider bid–ask spreads and lower depth in US Treasuries and equities.

Research on multiple markets finds the same pattern: higher volatility is associated with wider spreads and worse liquidity.

You'll also see spreads routinely blow out:

Around major news releases (NFP, CPI, rate decisions).

When markets open, before the order book settles.

In extended-hours trading, the SEC warns that lower volume often means wider spreads and worse execution for retail traders.

3) Market Structure and Product Type

Different products naturally carry different spreads:

FX majors: very tight in normal hours; exotics much wider.

Large-cap stocks & big ETFs: often just a cent or a few basis points in calm markets, but spreads spiked to ~20 bps in the S&P 500 during the March 2020 turmoil.

Small caps, options, thin credit, minor coins: typically wider spreads to compensate for higher risk and lower turnover.

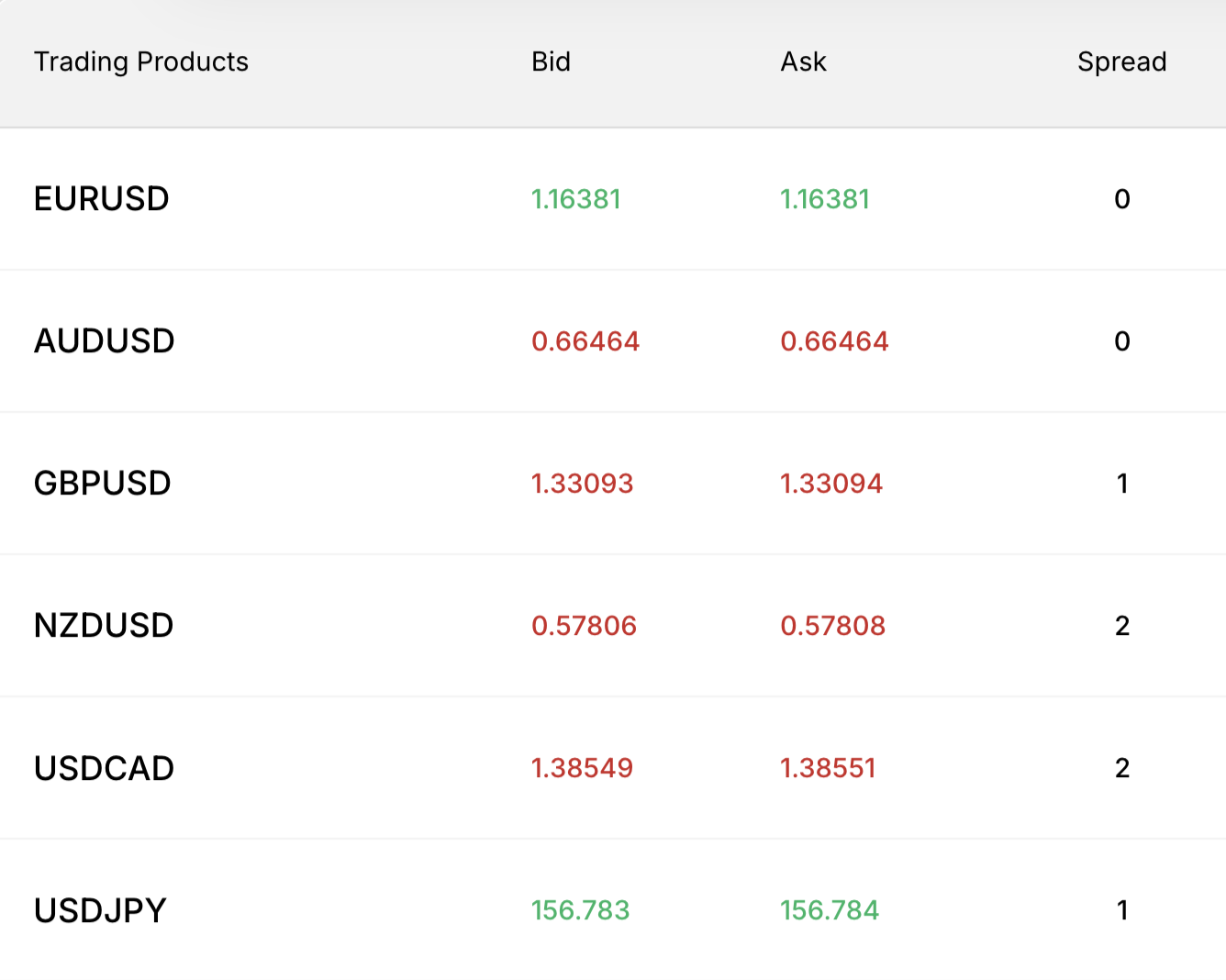

What Are the Typical Spreads Across Markets?

| Market / Instrument |

Typical spread in calm conditions |

Notes |

| FX major (EUR/USD) |

Often < 1 pip at competitive brokers; broader industry averages around 0.6–1.5 pips. |

Very deep market; tightest spreads in London/NY overlap. |

| FX exotic (e.g. USD/TRY) |

Several pips to tens of pips |

Higher risk, lower liquidity, bigger overnight gaps. |

| Liquid US large-cap stock |

1–2 cents (a few bps) in normal hours; much wider in stress. |

Tightest during main session; wider at open/close and after-hours. |

| Small-cap stock |

Several cents to >5% in extreme illiquidity |

Spreads balloon when volume is thin or order book is shallow. |

| Large ETF (e.g. S&P 500 ETF) |

Often < 5 bps in normal markets; widened sharply in March 2020. |

Often more liquid than underlying basket in stress. |

For any instrument you trade, it's worth watching the live spread over several sessions to build your own mental benchmark.

Why Spread Matters for Every Trader

1. Execution Quality and Realised P&L

Trading performance isn't just about where the chart goes; it's also about how cleanly you get in and out.

Studies on bid–ask spreads and execution costs show:

Wider spreads mean higher cost per trade.

Higher costs reduce net returns, especially for active strategies.

Measured performance can look poor even if the signal had an edge, simply because the spread and impact ate it.

If your average target is 0.5% per trade and your all-in cost is 0.3% (spread + commission + slippage), your margin for error is tiny.

2. Risk in Illiquid Names

A wide spread is also a warning flag on liquidity risk:

When you need to exit fast, you might have to cross a big spread and push the price further.

Stops can fill worse than expected if the nearest liquidity is several ticks away.

Treat the spread as a real-time liquidity gauge for markets, not just a trading nuisance.

3. Microstructure Noise in Charts

On very short timeframes, the "bid–ask bounce" (price jumping back and forth across the spread) can create fake noise in your chart:

Without understanding spread behaviour, it's easy to overfit intraday strategies to this noise.

Frequently Asked Questions

1. Is a Smaller Spread Always Better?

A tighter spread is usually good because it means lower cost and better liquidity.

2. How Can I See the Bid–Ask Spread on My Platform?

Most platforms, such as EBC Financial Group, show bid and ask directly on the order ticket or the quote window.

3. Why Did My Stop-Loss Fill So Much Worse Than My Level?

In fast markets, the price can gap through your stop, and the next available bid might be far away, especially in illiquid names with wide spreads.

4. Can Limit Orders Let Me "Earn" the Spread?

Yes. When you post a limit order, and someone else crosses it, you effectively sell at the ask or buy at the bid.

Conclusion

In conclusion, bid, ask, and the spread between them are not small print. They're the microstructure of every trade you place, the toll you pay to get into and out of the market.

Therefore, if you treat spreads with respect, you keep more of your edge. That's the difference between a decent idea that bleeds out in friction and a strategy that actually shows up in your P&L.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.