Divergence is a signal that appears when price moves in one direction but an indicator, often a momentum indicator, moves in another. Price may make a new high, while the indicator makes a lower high, or the other way round.

This split can warn that a trend is getting tired or that a move is not as strong as it looks. For traders using technical analysis, divergence is a useful early warning tool to avoid chasing weak moves and to prepare for possible trend reversals.

Traders care deeply about classic divergence because it can reveal an early loss of trend strength before the chart shows any clear reversal, giving them time to adjust risk or prepare for a change in direction.

Definition

In trading, classic divergence is a disagreement between price structure and indicator structure.

This signals a weakening trend and increases the probability of reversal or a deeper correction. It is not a trigger by itself but a diagnostic tool showing momentum decay.

Traders see divergence on charts containing oscillators. Swing traders monitor it around major levels to anticipate reversals. Intraday traders watch it during extended moves to detect pullbacks.

It is especially valuable when combined with structure, support and resistance, and volume context.

What Changes Classic Divergence Day To Day: The Forces Behind The Mismatch

Several forces produce divergence:

Momentum exhaustion. A trend pushes to new extremes but cannot maintain indicator strength.

Indecision in the market. When traders hesitate, indicators flatten even if price still moves.

Low liquidity. Thin conditions stretch price without real conviction.

Event anticipation. Ahead of news, traders reduce exposure, weakening indicator drive.

Whenever these forces appear, price may still push forward, but internal strength shrinks, creating divergence.

How Classic Divergence Affects Your Trades

Classic divergence helps refine entries by warning traders not to chase stretched moves. Instead, it encourages waiting for confirmation, pullbacks, or a break in structure. It also improves exit timing because weakening momentum often precedes sharp reversals.

Many traders tighten stops or scale out when divergence appears near important levels.

From a risk perspective, divergence signals potential volatility. A trend that has lost internal strength can reverse abruptly.

Good situation: Clear divergence aligned with strong levels, in orderly market conditions.

Bad situation: Divergence inside choppy ranges, against higher timeframe trend, or during high-impact news.

Quick Example

Suppose GBP/USD trends upward. Price makes a new high at 1.2850 with RSI reaching 68. Price moves slightly higher to 1.2860, but RSI falls to 60. Price continues to 1.2870, but RSI now drops to 56.

Price rises, indicator falls: a classic bearish divergence. A trader planning a long may now wait or reduce size. A trader already long may move the stop higher.

When the pair later dropped to 1.2820, the divergence correctly warned that buying strength was fading.

How To Check Before You Buy Or Sell

Load an oscillator such as RSI, MACD, or stochastics.

Identify clear swing highs and lows on price.

Compare them to the indicator’s swing points.

Confirm whether divergence aligns with strong support or resistance.

Review the higher timeframe trend.

Avoid judging divergence during news or highly volatile conditions.

Check divergence whenever a new swing forms or at each session start.

Common Mistakes

Relying on divergence alone. Without structure, it produces false signals.

Forcing patterns. Traders connect random points that are not true swings.

Ignoring strong trends. Powerful trends often override divergence.

Using short timeframes only. Lower timeframes produce noise.

Confusing classic with hidden divergence. Each signals different behaviour.

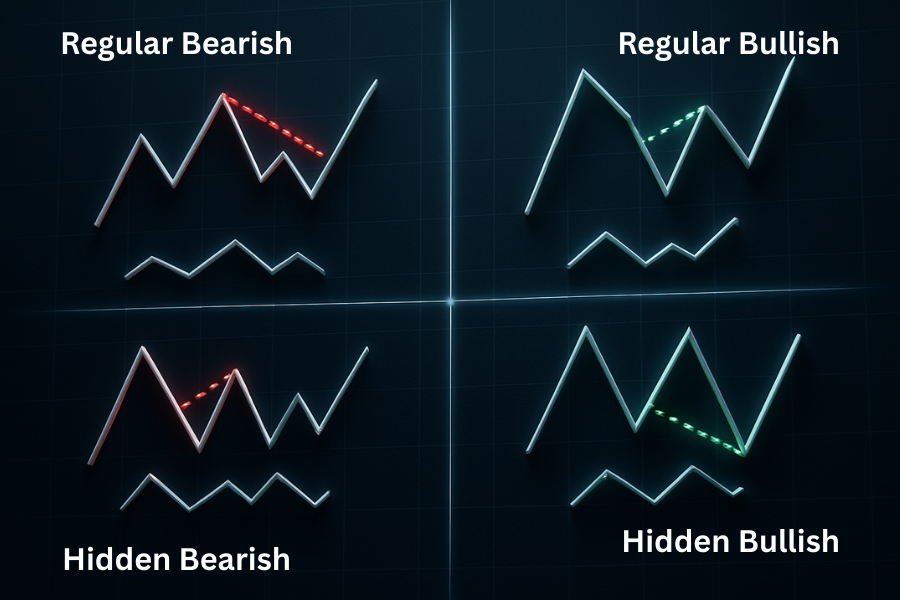

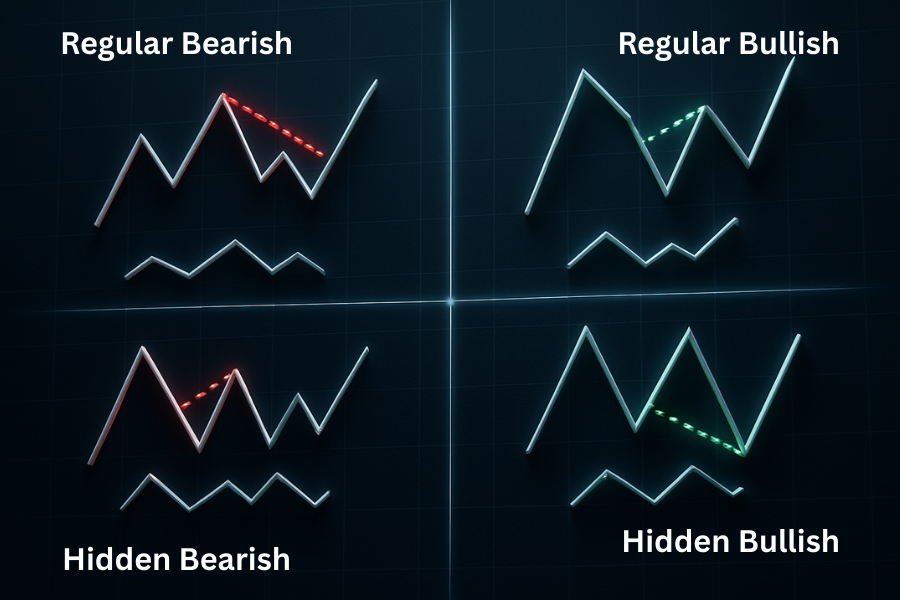

Classic vs Hidden Divergence: How the Signals Differ and When Traders Use Each

Although they both compare price to indicator swings, classic and hidden divergence send opposite messages about trend behaviour.

| Type of Divergence |

Bullish Pattern |

Bearish Pattern |

Core Meaning |

Best Use Case |

| Classic Divergence (Reversal Bias) |

Price makes lower lows, indicator makes higher lows |

Price makes higher highs, indicator makes lower highs |

Trend momentum is weakening, and a reversal or deeper pullback becomes more likely |

At key highs or lows, supply or demand zones, or after long directional moves |

| Hidden Divergence (Continuation Bias) |

Price makes higher lows, indicator makes lower lows |

Price makes lower highs, indicator makes higher highs |

Pullback pressure is weak, and the trend is likely to continue |

In trending markets to time continuation entries |

Summary of difference:

Classic divergence warns “the trend may end,” while hidden divergence suggests “the pullback may end.” One points to reversal, the other to continuation.

Related Terms

Hidden divergence: A continuation signal opposite of classic divergence.

Momentum: Divergence measures how momentum compares with price.

Overbought and oversold: Often assessed together with divergence.

Support and resistance: Divergence strengthens at key levels.

Frequently Asked Questions (FAQ)

1. Is divergence enough to enter a trade on its own?

No. Divergence is a warning sign, not a complete trading signal. Many traders wait for extra confirmation, such as a break of a trendline, a candlestick pattern, or a move through support or resistance before entering a trade based on divergence.

2. Which indicators are best for finding divergence?

The most common tools are RSI, MACD, and the stochastic oscillator. Many traders start with RSI because it is simple to read and is available on almost every platform. The key is to pick one indicator and learn its behaviour well instead of changing indicators every week.

3. What timeframe works best for divergence?

Higher timeframes such as 1 hour, 4 hour, and daily charts usually give cleaner divergence signals. Very short timeframes can show many small divergences that do not lead to meaningful moves. Newer traders often begin on the 4 hour or daily chart, then refine entries on a lower timeframe.

4. Does divergence work in forex only?

No. Divergence appears in any market that uses charts and indicators, including stocks, indices, commodities, and crypto. The logic is the same. Price pushes to a new extreme, while momentum fails to confirm. However, you should still adapt your risk management to the volatility of each market.

5. How often does divergence “work”?

There is no fixed success rate. Divergence can mark major turning points, but it also appears during normal pullbacks inside a trend. Its value comes from helping you think about the balance between price action and momentum, not from predicting every top or bottom. Testing your rules on past charts is the best way to see how it behaves for your style.

Summary

Classic divergence is the mismatch between price and momentum, signalling that a trend may weaken or reverse. Used with structure, levels, and confirmation, it helps traders improve entries and exits and avoid chasing tired moves.

Used alone or against strong trends, it can mislead, but as part of a complete process it becomes a powerful early-warning tool.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.