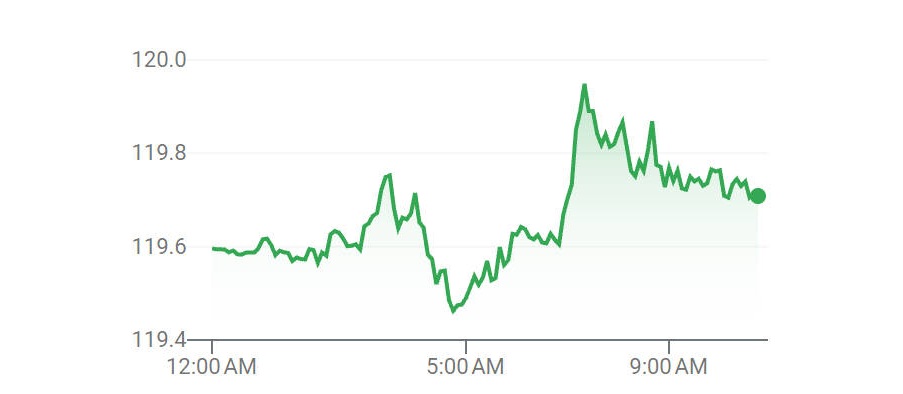

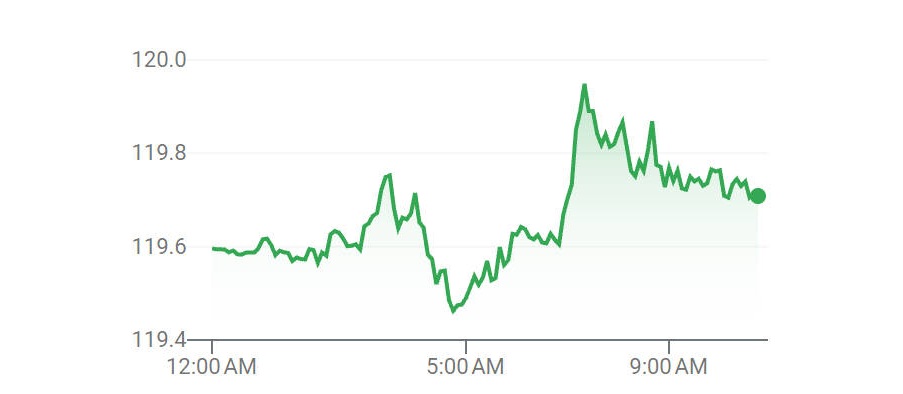

As of 10 December 2025, GBP/INR trades around ₹119.87 per British Pound, following sterling strength and rupee volatility after monetary-policy shifts and global capital flows.

This article examines the macroeconomic drivers, central-bank policies, technical levels and hedging strategies to outline a realistic 2026 forecast for GBP to INR.

GBP to INR Rate Today

Currently, the pound-to-rupee rate rests near ₹119.87. Over 2025, GBP/INR fluctuated between roughly ₹104.70 and ₹120.63, reflecting bouts of rupee depreciation, sterling resilience, and market volatility.

Looking ahead, we forecast a base case range of ₹115–₹125 for much of 2026, with potential for spikes beyond ₹125 under a "bullish sterling / weak rupee" scenario.

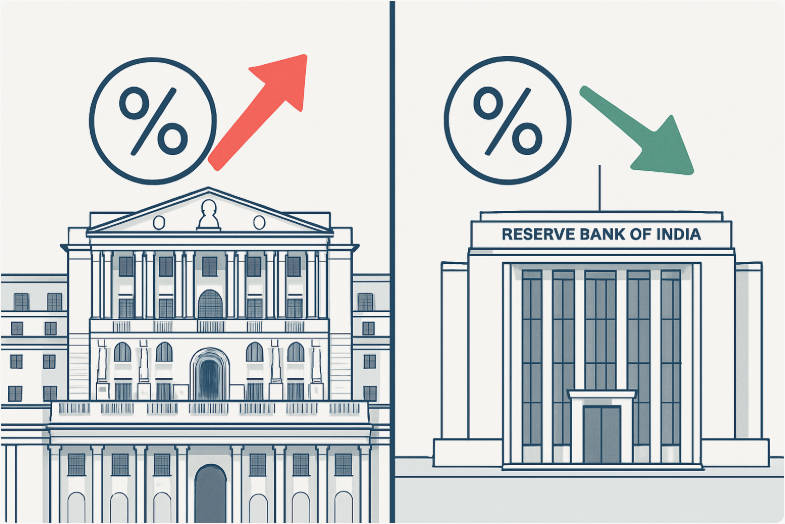

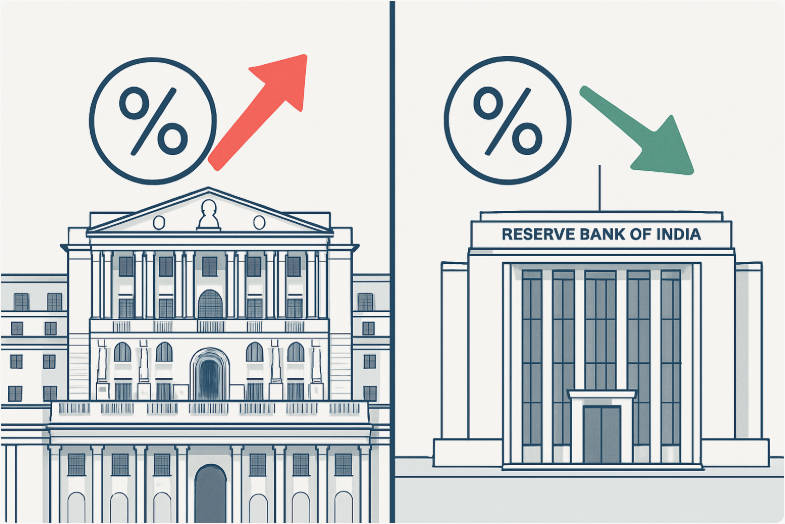

GBP to INR prediction: Why central banks matter (BoE vs RBI)

UK: Bank of England (BoE)

The BoE currently keeps its Bank Rate at 4.00%, reflecting caution amid sticky inflation and economic uncertainty.

Major global banks such as HSBC and Deutsche Bank have pushed back expectations of steep rate cuts, citing persistent inflation risks.

If BoE maintains relatively high rates longer, that tends to support sterling (GBP), which may push GBP/INR upward, especially against a weakening rupee backdrop.

India: Reserve Bank of India (RBI)

On 5 December 2025, the RBI lowered its key repo rate from 5.50% to 5.25%, citing easing inflation and a desire to support growth.

Despite the rate cut, the RBI maintained a "neutral" policy stance.

Lower interest rates typically weaken the rupee (INR) relative to foreign currencies, including GBP, all else equal, as lower yields may discourage foreign investment into INR-denominated instruments.

Combined, the divergence between relatively higher UK interest rates and softer Indian rates could favour a stronger GBP/INR rate over 2026.

GBP to INR prediction: Macro drivers, trade and capital flows

Beyond interest-rate mechanics, several macro factors influence GBP/INR:

Global capital flows and India FDI / equity flows:

Weakness in the rupee often coincides with weaker foreign inflows or capital outflows. If India attracts strong investment via bonds, equities, or foreign direct investment in 2026 that could shore up the rupee and moderate GBP/INR gains.

India economic growth vs inflation dynamics:

Lower inflation and supportive monetary policy (post-rate cut) may aid consumption and investment, which over time could stabilise INR.

UK economic and inflation outlook:

If inflation in the UK remains sticky and BoE keeps rates higher for longer, sterling strength may persist, pushing GBP/INR up.

Global risk sentiment and USD direction:

As USD/INR moves impact base-cross rates, a stronger USD (versus INR) could push INR weaker, indirectly lifting GBP/INR; conversely, if global risk appetite improves and USD weakens, INR may strengthen.

Given these crosswinds, GBP/INR is likely to remain sensitive to developments in global risk, capital flows, and central-bank policies, making a clear 12-month forecast challenging, but a range-based outlook feasible.

GBP to INR Recent Market Action and Volatility

The GBP/INR exchange rate trading near ₹119.87 places the pair close to the upper boundary of its 2025 range, which stretched roughly from ₹104.70 to ₹120.63. This top-heavy positioning reflects a combination of persistent sterling strength and renewed rupee softness as investors reacted to shifting central-bank policies and global risk sentiment.

Throughout late 2025, sterling benefited from the Bank of England's tighter stance, as policymakers resisted aggressive rate cuts despite cooling inflation. Market expectations repeatedly moved toward a "higher for longer" path in the UK, supporting the pound.

Meanwhile, India's rupee came under pressure as the Reserve Bank of India implemented a 25 bps rate cut (5.50% → 5.25%), signalling an easing cycle designed to stimulate economic growth. Lower rates tend to reduce the appeal of INR-denominated assets, contributing to modest downward pressure on the currency.

Beyond central-bank actions, the rupee's volatility has been influenced by fluctuations in foreign portfolio investment (FPI), which has moved unevenly as global investors rotate between emerging markets.

Periods of global risk-off sentiment, driven by geopolitical tensions or shifting expectations for US Federal Reserve policy, have led to short bursts of rupee weakness as capital flows out of emerging markets. Conversely, temporary improvements in risk appetite provided only brief INR relief, failing to create a sustained recovery.

Inflation expectations also played a role in near-term volatility. Though India's inflation trend is improving, traders remained sensitive to commodity-price movements and supply-chain indicators, especially in energy. Import-heavy economies like India often see the rupee weaken when oil prices rise, adding another layer of uncertainty in GBP/INR price action.

For forex traders and corporates, this backdrop reinforces the importance of active risk management. Many firms with GBP-INR exposure adopted layered forward hedges, spreading contracts across different tenors to manage timing risk. Others preferred options-based strategies, such as buying GBP call/INR put options, to protect against sharp INR depreciation while retaining upside flexibility.

The elevated volatility also increased the relevance of short-term technical levels, as intraday swings became more pronounced, particularly around BoE and RBI policy announcements, inflation releases, and global risk events.

In summary, GBP/INR continues to trade with a bullish bias, powered by policy divergence and global capital-flow sensitivity. Traders should expect volatility to remain elevated as both currencies respond to macro data, interest-rate signals, and shifting global sentiment.

GBP to INR prediction: Technical Levels & Short-Term Targets

Technical analysis provides a critical lens for understanding short-term GBP/INR movements. Based on recent price action, chart patterns, and support/resistance zones, traders can identify likely floors, ceilings, and potential breakout points.

Support Levels (~₹116)

The ₹116 mark has historically acted as a robust support level. In scenarios where the rupee strengthens, possibly due to stronger-than-expected FDI inflows, foreign portfolio investment, or a temporary dip in global risk aversion, the pound may struggle to sustain gains above this floor. Similarly, any sterling weakness caused by dovish BoE signals, disappointing UK economic data, or risk-off sentiment could see GBP/INR test this support level.

Short-term traders often use 50-day moving averages and recent swing lows to confirm support. A sustained break below ₹116 could signal a deeper retracement toward ₹114–₹115, particularly if macro fundamentals simultaneously favour the rupee.

Resistance / Upside Zones (~₹122–₹124)

The ₹122–₹124 range serves as the near-term upside zone for GBP/INR. This level is reinforced by the combination of historical highs and intraday resistance points observed over the past two months. Should the BoE maintain relatively higher interest rates while the RBI continues easing, sterling may gain momentum, and the pound could challenge this resistance band.

Traders often watch weekly pivot points, Fibonacci retracements, and trendline intersections to anticipate potential breakout points. A successful breach of ₹124 with solid volume may indicate a continuation toward extended bullish targets.

Extended Bullish Scenario (~₹125–₹126)

In a more aggressive bullish scenario, GBP/INR could push toward ₹125–₹126, particularly if:

Sterling rallies sharply due to hawkish BoE announcements or unexpected UK macro strength.

INR faces sustained pressure from capital outflows, global risk-off sentiment, or elevated import costs.

Cross-currency effects, such as a weaker USD/INR, further amplify pound strength relative to the rupee.

This scenario would be characterised by increased volatility, making intraday swings more pronounced. Traders often complement their technical analysis with momentum indicators like RSI or MACD to time entries and exits effectively.

Trading Considerations

Short-term traders should monitor both daily and weekly charts for momentum, trend strength, and volatility signals. Key strategies include:

Layered entry/exit points near support and resistance levels to reduce risk.

Trailing stops to lock in profits in a volatile market.

Monitoring BoE and RBI announcements, as central-bank signals can trigger immediate technical reactions.

Overall, technical analysis suggests GBP/INR remains bullish with caution, bounded by the ₹116 support and ₹124 resistance range in the near term, with potential for spikes to ₹125–₹126 if market conditions favour sterling strength and rupee pressure persists.

GBP to INR prediction: Scenario Analysis (Bull / Base / Bear)

Understanding GBP/INR movements requires a clear scenario-based framework that incorporates central bank policies, macroeconomic developments, capital flows, and global risk sentiment. The following scenarios outline plausible outcomes for 2026, along with triggers and implications for traders and businesses.

| Scenario |

Trigger / Conditions |

GBP/INR Outlook (2026) |

| Bull |

BoE maintains higher rates; INR weakens (capital outflows, trade deficit, inflation) |

₹124–₹126+ |

| Base |

BoE rate stable; RBI keeps gradual easing; moderate capital flows to India |

₹115–₹125 range |

| Bear |

INR strengthens (capital inflows, trade improvement); sterling weakens |

₹112–₹115 |

Key Considerations Across Scenarios

Central Bank Signals – Both the BoE and RBI are primary drivers. Even small policy hints can cause short-term volatility.

Capital Flows – Foreign portfolio inflows/outflows into India significantly impact the rupee, affecting GBP/INR indirectly.

Global Risk Appetite – Risk-off conditions tend to strengthen GBP relative to INR, while risk-on sentiment supports INR.

Macro Data – Inflation, trade balance, and GDP growth in both the UK and India influence medium-term trend formation.

Summary Insight

Bull Scenario: GBP/INR breaks above ₹124–₹126, favourable for traders seeking gains but risky for importers.

Base Scenario: Range-bound ₹115–₹125, suitable for range-trading and moderate hedging.

Bear Scenario: GBP/INR falls below ₹115, offering opportunities for importers, but caution for exporters and speculators.

By using a scenario-based approach, traders and corporates can make risk-aware decisions, combining macro insight with technical levels and hedging strategies to navigate GBP/INR volatility throughout 2026.

GBP to INR Prediction: Practical Hedging & Trade Ideas

For corporates, importers/exporters, and remitters with GBP/INR exposure, managing currency risk is crucial to protect profit margins and cash flow. The GBP/INR pair can be volatile due to central-bank divergence, global capital flows, and macroeconomic events, so a structured hedging strategy is essential.

1. Forward Contracts – Locking in Rates

A forward contract allows you to lock in a GBP/INR rate for a future date, eliminating uncertainty in cash flows.

Example:

An Indian importer expects to pay £500,000 in six months. By entering a forward contract at ₹120/GBP today, the importer ensures that the payment will cost ₹60 million, regardless of GBP/INR movements.

When to use:

2. Options (Puts/Calls) – Protecting While Retaining Upside

Currency options provide flexibility to limit losses while preserving potential gains. A GBP call/INR put option gives the right, but not the obligation, to buy pounds at a predetermined strike rate.

Example:

When to use:

3. Staggered Hedges – Spreading Risk

Rather than hedging an entire exposure at once, layering forward contracts or options across multiple maturities can reduce timing risk and cost.

Example:

Benefits:

4. Natural Hedges – Offsetting Exposures

A natural hedge involves matching GBP revenues with GBP liabilities to offset exposure without entering into financial contracts.

Example:

Benefits:

Cost-efficient since it avoids transaction fees associated with forward contracts or options.

Simplifies treasury management, especially for corporates with balanced GBP cash flows.

5. Combining Strategies – Tailored Risk Management

A combination of forwards, options, staggered hedges, and natural hedges allows corporates to adapt to different market scenarios:

Bullish GBP/INR outlook: Use staggered forwards or options to benefit from potential appreciation.

Bearish GBP/INR outlook: Lock rates using forwards to avoid higher costs.

Uncertain market conditions: Blend forwards and options to cap risk while keeping upside potential.

Practical Tips

Monitor macro triggers: BoE and RBI decisions, USD/INR trends, and capital flow data.

Set internal thresholds: Decide in advance when to enter or adjust hedges.

Consult treasury professionals: Complex hedging may require customised instruments like exotic options or structured products.

Regularly review exposure: Currency exposure can change rapidly; adapt strategies quarterly or monthly as needed.

Frequently Asked Questions

1. What is the current GBP to INR rate?

As of 10 December 2025, GBP/INR trades around ₹119.87 per pound. Since daily ranges and actual transaction rates vary, investors should always check a live feed for accurate, real-time pricing.

2. Will GBP appreciate against INR in 2026?

GBP may appreciate modestly if the BoE holds higher rates and the rupee remains under pressure. Under base assumptions, expect a range-bound GBP/INR around ₹115–₹125; bullish divergence could push it higher.

3. How do interest rates affect GBP/INR?

Interest rate differentials drive capital flows: higher UK rates tend to support GBP, while lower Indian rates can weaken INR. As a result, GBP/INR tends to rise when UK remains relatively hawkish and Indian monetary policy eases.

4. What is a realistic short-term target for GBP to INR?

For 1–3 months, traders may target ₹122–₹124 if momentum from sterling strength continues and rupee remains under pressure. Use technical levels and volatility indicators for entry/exit planning.

5. How can businesses hedge GBP/INR exposure?

Businesses can hedge via forwards, options, or natural hedges. A staggered forward-contract approach, or call/put options, can help manage currency risk effectively while preserving flexibility.

Conclusion

Over 2026, expect GBP/INR to trade broadly in the ₹115–₹125 range under a neutral base case. However, divergence in monetary policy (BoE vs RBI), rupee stress from capital flows, and global risk sentiment may push occasional spikes beyond ₹125.

If you or your business has GBP/INR exposure such as imports, exports, remittances, it's wise to hedge proactively, monitor central-bank signals (BoE minutes, RBI policy), watch INR-USD dynamics, and stay alert to macroeconomic developments.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.