Global markets are seeing a broad risk-off move, with major stock indices in the U.S. and Europe sliding and volatility rising.

Commodities like oil and gold are under pressure, while Bitcoin has given back recent gains amid lower risk appetite.

Market Snapshot

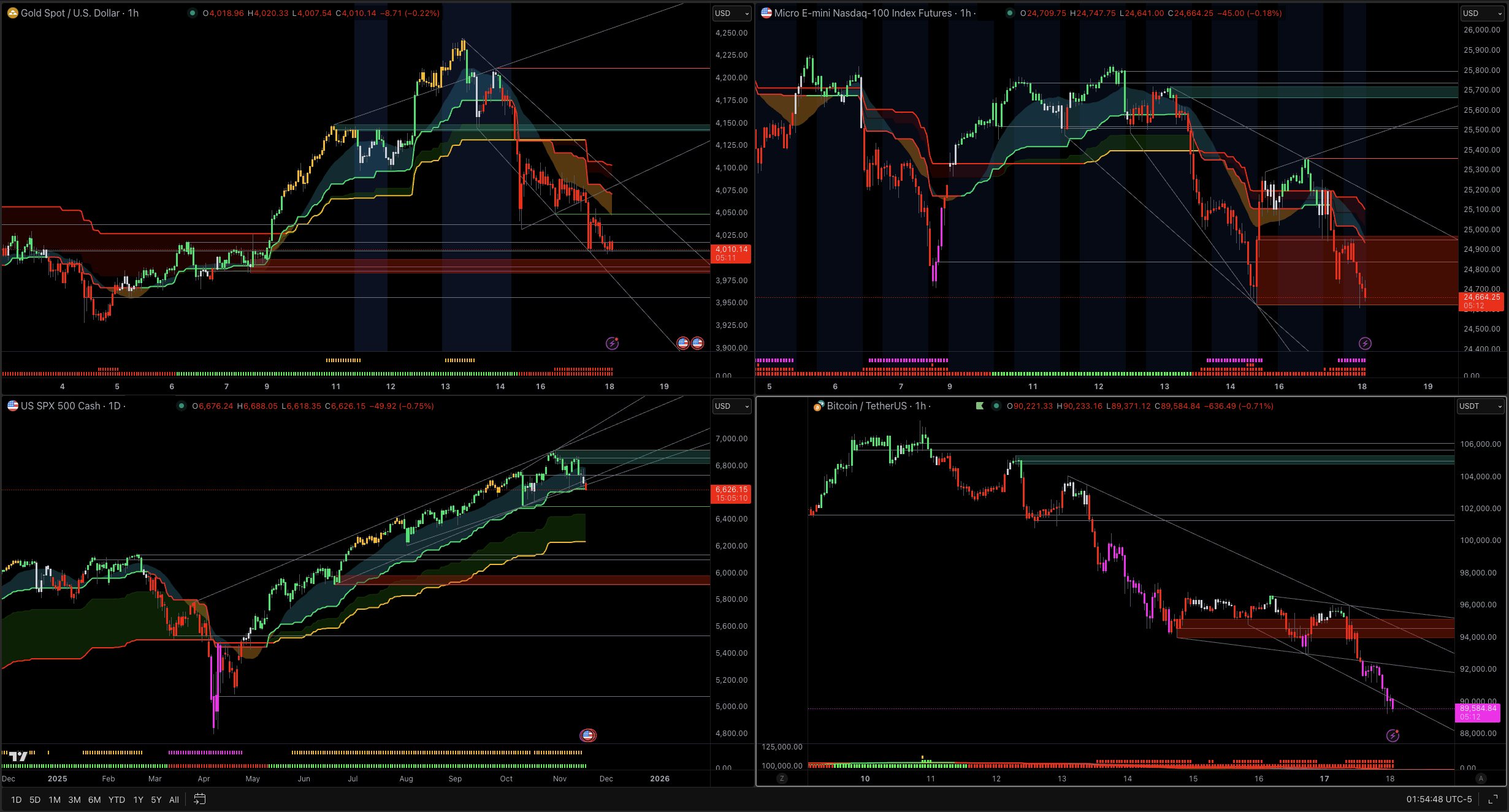

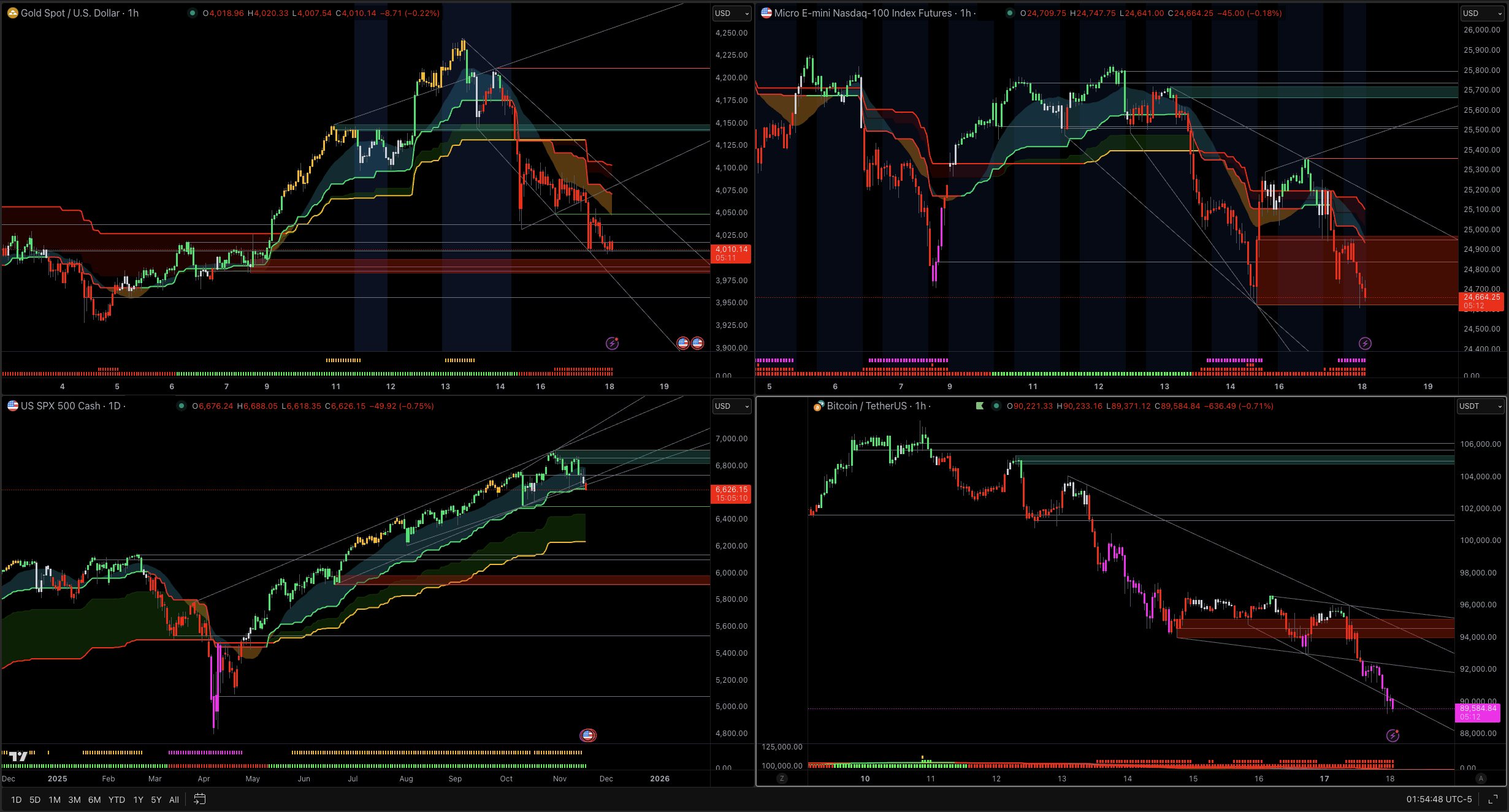

In the U.S., the S&P 500 fell about 0.9% to 6,610, closing below its 50-day moving average (~6,708) for the first time in weeks, signaling a loss of short-term momentum. The Nasdaq and Dow also dropped 0.8 - 1.2%.

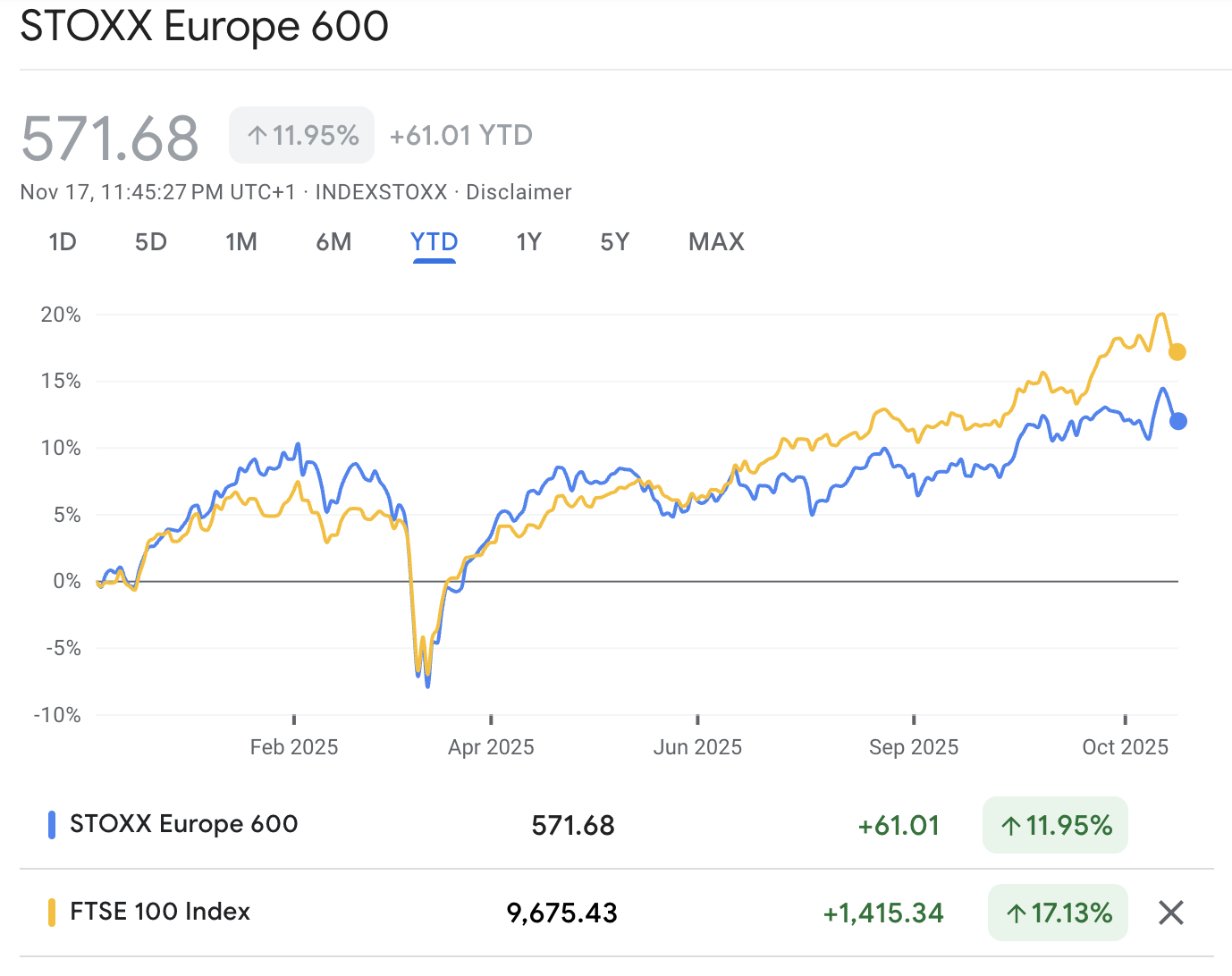

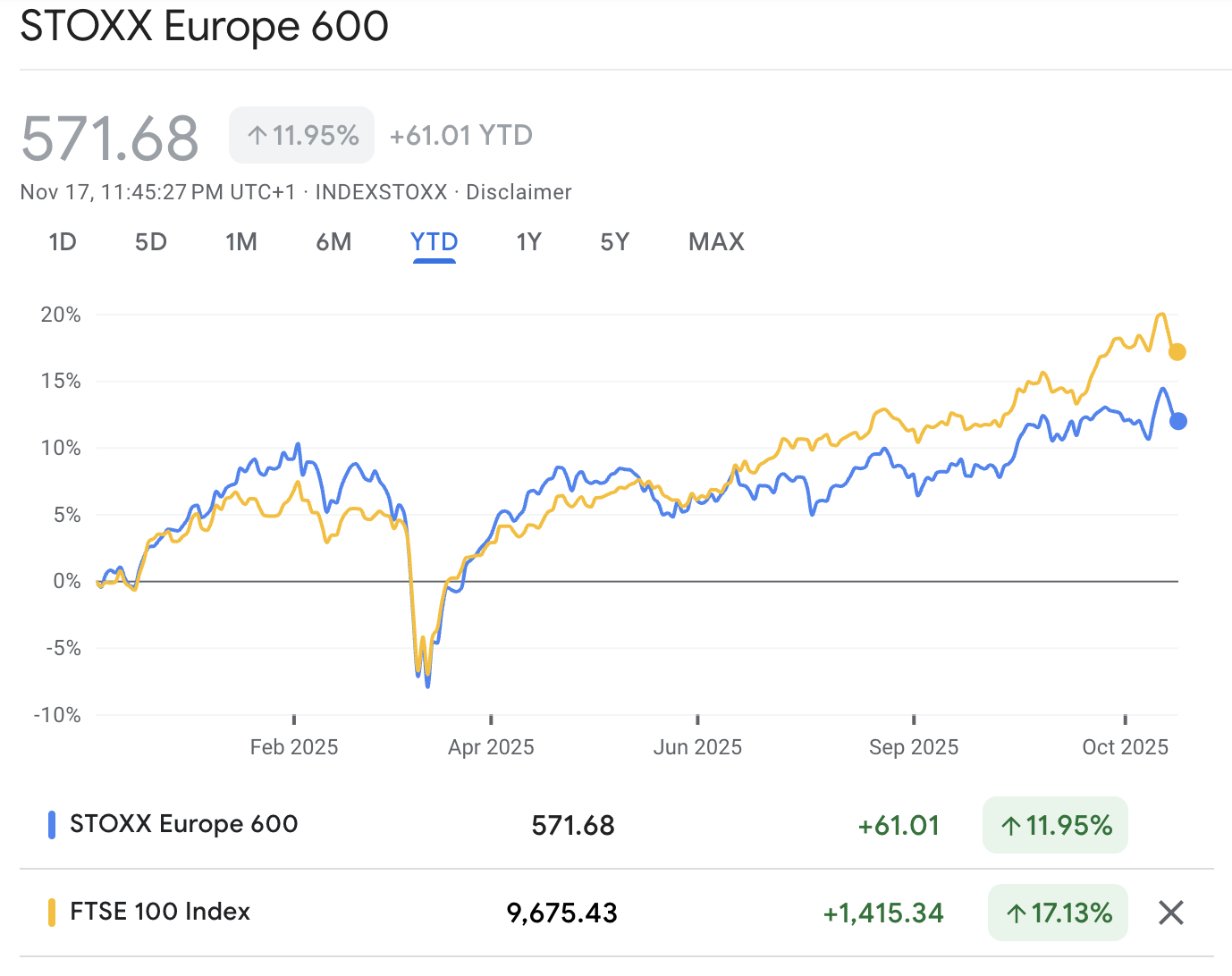

In Europe, the STOXX 600 slipped from last week’s record high of ~584 to around 572, while the FTSE 100 fell three days in a row to near 9,675 (-0.2%).

Volatility is rising but not at panic levels, with the VIX jumping from the mid-17s to above 22, a more than 20% increase over a few sessions.

Commodities are under pressure, too; Brent crude trades around $64 per barrel amid oversupply concerns, and gold hovers just above $4,000/oz, down about 7% over the past month due to a stronger dollar and fading rate-cut expectations.

Bitcoin has dropped below $87,500, wiping out 2025 gains and sitting roughly 25–27% below its October peak, as large holders take profits and risk appetite declines.

So, this isn’t just one asset class having a bad day. It’s a broad risk-off move across stocks, indices, commodities, and Bitcoin. Why is this happening?

The Big Macro Trigger: Central Banks and Interest Rates

The single biggest macro driver behind this sell-off is changing expectations for interest rates.

For most of 2025, markets were priced for a neat story: inflation glides lower, growth stays okay, and the US Federal Reserve and other central banks can cut rates steadily into 2026. That story is now being questioned.

Recent US data has come in stronger than expected, hinting the economy is still running hot. Fed officials, including Vice Chair Philip Jefferson, have pushed back on the idea of a guaranteed December rate cut, telling markets they’ll move “cautiously”.

As a result, the implied probability of a December cut has dropped sharply from almost certain a few weeks ago to closer to 40% now.

When investors expect the central bank might cut interest rates soon which is also known as the so-called “rate-cut hopes”, two things happen if those hopes fade:

Bond yields rise because markets price at higher rates for longer.

Future cash flows get discounted harder which hurts the valuations of long-duration assets like growth and tech stocks.

That’s exactly what we’re seeing: global equity indices slipping while bond yields grind higher.

Bond Yields, the Dollar and Valuations

Higher yields and a firm dollar are toxic for stretched valuations:

MSCI’s global equities gauge has slipped as US Treasury yields ticked up and central bankers knocked back aggressive rate-cut bets.

The MSCI World Index is still trading on a P/E around 24x, not cheap by historical standards, which leaves very little cushion when the rate story turns less friendly.

In a simpler term, when you start from expensive, you don’t need a crisis, you just need a nudge. That nudge has come from the Fed and from stronger data, and the market is now repricing risk across the board.

Tech-Led Equity Sell-Off: When AI Hype Meets Reality

US Stocks: S&P 500, Nasdaq and Growth Names

Wall Street just saw its worst day in about a month, driven largely by a sell-off in heavyweight technology and AI names.

The S&P 500 has slipped below its 50-day moving average, and the Nasdaq has dropped about 0.8–0.9% in the latest session, with traders openly worried about an AI valuation bubble.

Remember, mega-cap tech carried the market for much of 2025. When leadership names wobble, passive flows reverse, and that pressure ripples through the whole index. This is why you’re seeing broad selling, even in sectors that don’t look obviously overvalued.

From a technical perspective:

The S&P 500 is now testing support in the 6670 area, a zone defined by recent swing lows and the 50-day average.

Below that, eyes go to the 6,500 handle which is a round number and prior breakout region.

As long as price holds above that 6,500 band, this still looks like a deep correction within an uptrend, not a confirmed long bear market.

Europe and UK Indices Under Pressure

Europe and the UK are echoing the US move, with some local twists:

The STOXX 600 hit a record close around 571 last week and has since given back over 2% as higher bond yields and Fed pushback on cuts weigh on risk appetite.

The FTSE 100 is down for three straight days, around 9,675, dragged by financials and miners, as investors brace for key UK inflation data and the upcoming budget.

Europe is dealing with its own growth worries and political noise, but the underlying driver is the same: higher global yields and less faith in easy money.

Commodities Under Pressure: Oil and Gold

Crude Oil: Supply Surge Meets Risk-Off

Crude is being hit from two sides: fundamentals and sentiment.

Goldman Sachs expects oil prices to fall in 2026 due to a large supply surge, projecting Brent around $56 and WTI near $52, with possible dips into the $40s if a recession hits.

Brent futures are trading around $63-64, down from earlier in the year, with modest daily declines recently. Technically, Brent is sitting on a medium-term support band in the low-60s, which lines up with prior consolidation from earlier in the year.

A clean break below that opens up the mid-50s, which is not far from the 2026 forecasts now circulating.

On a more sentiment side, the same risk-off move affecting equities is hitting cyclical commodities. Traders are cutting exposure to growth-sensitive assets, and crude is top of that list.

Gold: Strong Dollar Caps the Safe Haven

Gold is where many retail traders are confused: “If markets are crashing, why isn’t gold going vertical?”

Right now, gold is down, not up:

Spot gold is around $4,038-4,040/oz, down about 7% over the month, and has fallen in four straight sessions.

The driver is a stronger US dollar and those fading rate-cut expectations. Higher real yields increase the opportunity cost of holding an asset that pays no income.

Though, gold remains high compared with a few years ago, supported by central bank demand and geopolitical risk. In the short term, however, higher rates and a stronger dollar are creating headwinds, even as equities sell off.

Where Does Bitcoin Fit Into This Crash?

Bitcoin is behaving less like “digital gold” and more like a high-beta risk asset.

The coin has dropped to a six-month low below $87,500, erasing all its 2025 gains and sitting roughly 27% below its October record high.

Analysts point to “whale” selling, general de-risking, and the same macro forces hitting growth stocks: higher yields and a stronger dollar.

From a cross-asset point of view, Bitcoin is moving with tech, not against it. When the Nasdaq sells off, Bitcoin often amplifies that move. That’s exactly what we’re seeing now: correlated risk-off, not a safe-haven hedge.

What Traders and Investors Are Really Asking Right Now

Is This 2008 All Over Again?

Short answer, no, at least based on current available data.

Markets are seeing pullbacks from record or near-record highs in U.S. and European indices, while volatility has risen to the low-20s, well below the 50-80 range typical of full-blown crises.

Credit and funding markets are still functioning normally, showing no signs of systemic stress. While markets could move lower, the current action appears to reflect a sharp repricing of rates and valuations rather than a banking-system shock.

How to Think in Probabilities, Not Headlines

In a market like this, professionals don’t ask “Will it crash or not?” Instead, they focus on probabilities.

Probabilities such as how far could the repricing run if rate-cut hopes fade, where the major support levels lie (S&P 500 around 6,500; STOXX 600 near 560–550; FTSE 100 around 9,500), and whether positioning suggests forced selling or early-stage de-risking.

This approach shifts attention from headlines to levels, data, and timeframes, where the factors that really matter can be considered.

Practical Playbook: How to Navigate a Broad Market Sell-Off

1. Anchor on levels, not emotions

On the S&P 500, the 6,650–6,600 band is your first test. Below that, 6,500 is the big line in the sand.

A similar structure exists in Europe and the UK, with the STOXX 600 holding around 584 and the FTSE 100 watching the 9,500-9,600 zone.

2. Separate what’s broken from what’s just repriced

High-multiple AI and tech names that were priced for perfection can easily fall 20-30% without anything “breaking” in the real economy.

Solid cash-flow businesses often just get pulled down mechanically as ETFs and index funds de-risk.

3. Respect the cross-asset message

Higher yields + strong dollar + weaker oil + heavy Bitcoin = tightening financial conditions.

As long as that combination holds, dips in risk assets are less likely to see instant V-shaped recoveries.

4. Think in tiers, not all-in/all-out

Professionals rarely slam from 0% to 100% risk. They scale: trim into strength when valuations are stretched, add selectively into support when the risk/reward improves.

Retail traders get hurt most when they trade emotionally at the extremes by selling everything at the lows or chasing at the highs.

Frequently Asked Questions (FAQs)

1.Is this a crash or just a correction?

It looks like a sharp correction from elevated levels, not a 2008-style crash. Volatility is higher, but there’s no systemic stress in banking or credit markets.

2. Why are tech stocks falling more?

Tech, especially AI-related names, had very high valuations. Rising yields and fading rate-cut hopes hit these long-duration growth stocks hardest.

3. How do higher interest rates hurt markets?

Higher rates raise the discount on future earnings, lowering stock values, especially growth names. They also make bonds and cash more attractive, pulling money out of equities.

4. Why is gold dropping even though markets are nervous?

A stronger dollar and higher real yields increase the opportunity cost of holding gold, so it can fall even in risk-off periods.

5. Is Bitcoin a hedge against crashes?

Not currently. It’s trading like a high-beta tech asset, moving with other risk assets rather than providing protection.

6. Should I sell everything during a market drop?

No. Professionals adjust position sizes and manage risk gradually. Selling everything is usually an emotional decision.

7. What should I watch to see if markets fall further?

Key signals: S&P 500 around 6,500, widening credit spreads, VIX moving toward 30+, and central bank guidance on rates.

Conclusion

Today’s market crash isn’t random, its a logical repricing after a year of strong gains, high valuations, and overly optimistic assumptions about rapid rate cuts and endless AI-driven growth.

The main drivers are fading central-bank support, rising yields, stretched tech valuations, softer oil on supply concerns, and synchronized de-risking across equities, commodities, and Bitcoin.

It feels painful, but this is the market adjusting to tighter money and more realistic earnings expectations.

Zooming out, this is the phase that separates emotional trading from disciplined risk management: focus on levels, liquidity, and your time horizon, rather than headlines, to navigate a market that’s remembering gravity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.