August 2025 U.S. Non-Farm Payrolls forecast predicts 75.000 new jobs and a slight rise in unemployment, signalling a cooling labour market.

As the U.S. economy navigates through 2025. the upcoming August Non-Farm Payrolls (NFP) report is poised to offer critical insights into the nation's labour market dynamics. Scheduled for release on Friday, September 5. 2025. at 8:30 a.m. ET, this report will be closely scrutinised by policymakers, economists, and investors alike.

Key Forecast Metrics

1)Non-Farm Payrolls (NFP): Projected Growth of 75.000 Jobs

Economists anticipate that the U.S. economy added approximately 75.000 non-farm jobs in August.

The figure marks a slight increase from July's revised figure of 73.000 and represents a significant deceleration from the average monthly gains of 123.000 observed during the same period in the previous year.

Such a deceleration suggests a cooling labour market, potentially influenced by various economic factors.

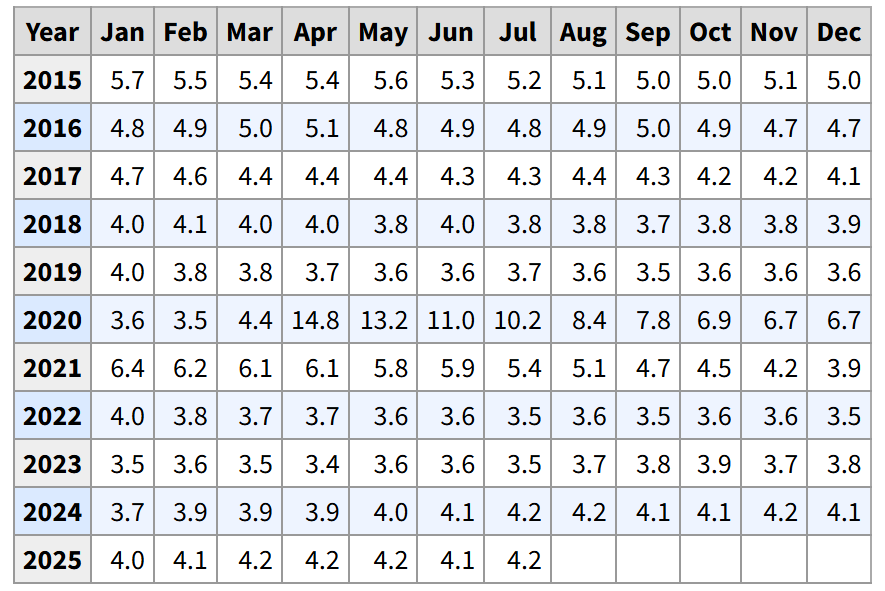

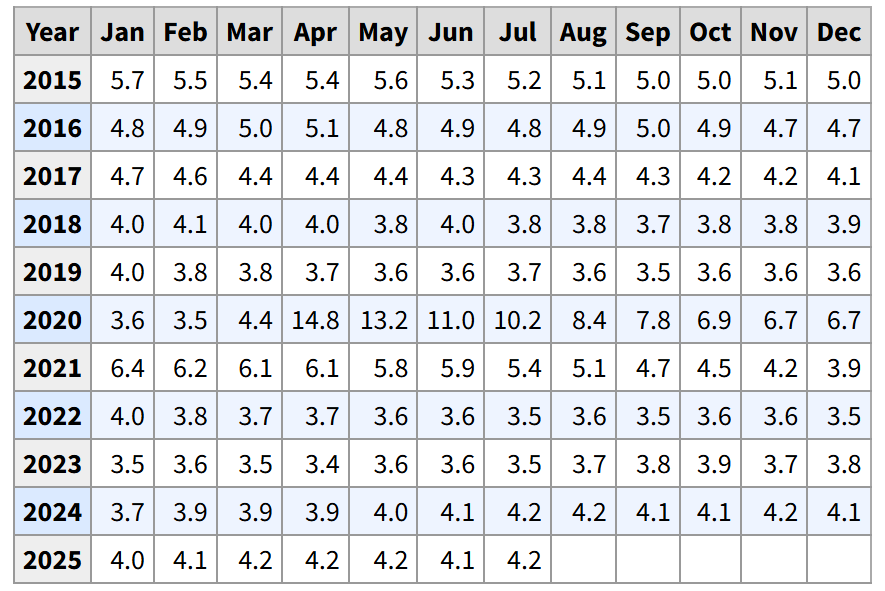

2)Unemployment Rate: Expected Uptick to 4.3%

The unemployment rate is projected to edge up to 4.3%, reflecting a combination of factors including a decrease in job openings and a slight increase in the labour force participation rate.

Such an uptick indicates a shift in the labour market, where the number of unemployed individuals is beginning to outpace available job opportunities.

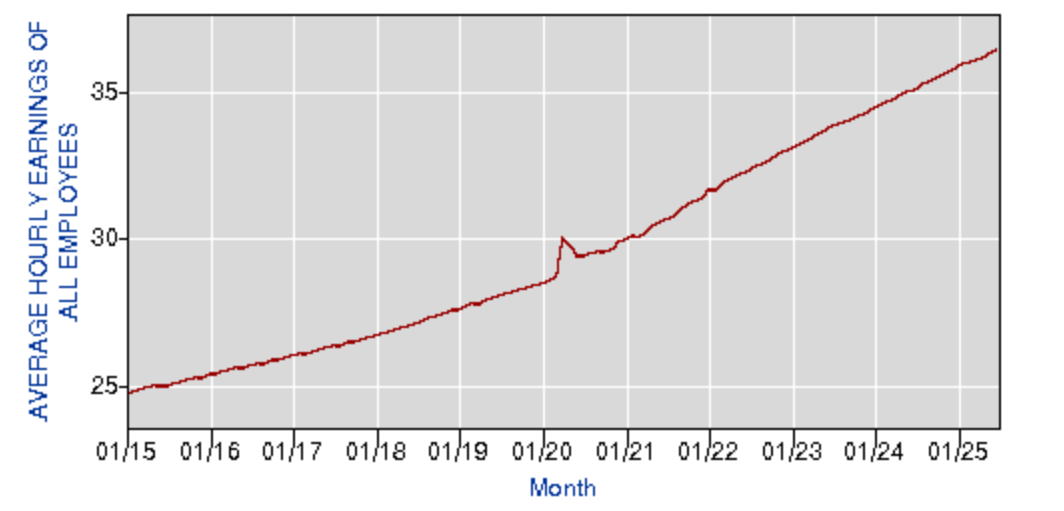

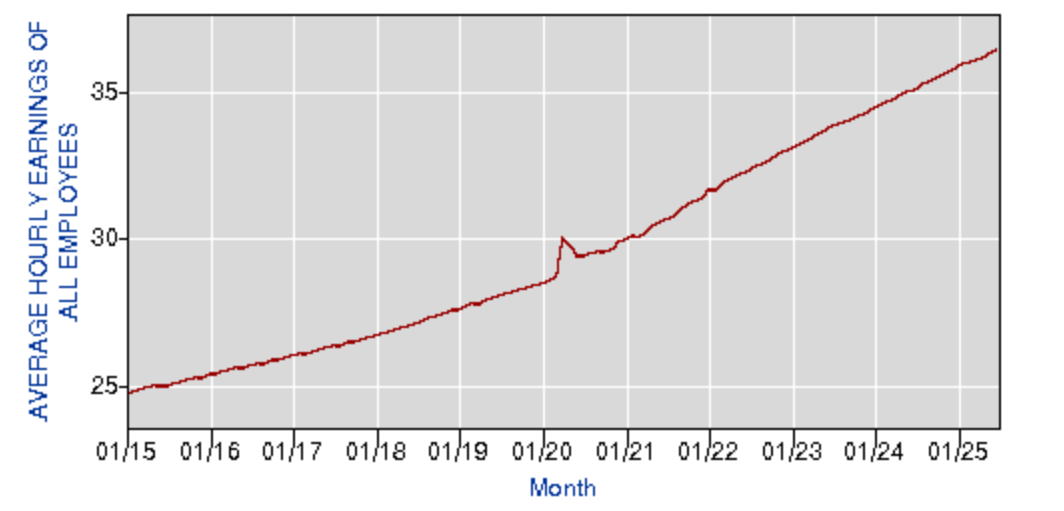

3)Average Hourly Earnings: Anticipated Increase of 0.3%

Wage growth is expected to remain steady, with average hourly earnings projected to rise by 0.3% month-over-month, bringing the annual wage growth to approximately 3.7%.

This consistent wage pressure suggests that while job growth may be slowing, demand for labour persists, particularly in certain sectors.

Labour Market Trends and Influencing Factors

1)Trade Policies and Immigration Restrictions

President Trump's import tariffs, along with tighter immigration policies, have made it harder for sectors such as construction and hospitality to hire workers, reducing labour supply and raising hiring costs.

As a result, employers face increased difficulty filling positions, which has contributed to the broader slowdown in job growth.

2)Sectoral Variations

While certain industries continue to grow, others are struggling. For example, the service sector is beginning to pick up pace, yet employment remains sluggish, especially in manufacturing and government sectors.

Such differences underscore the uneven nature of the economic recovery across various sectors.

3)Benchmark Revisions

The Bureau of Labor Statistics is expected to implement a benchmark revision, potentially lowering employment figures by up to 800.000 jobs for the year ending March.

Such an adjustment underscores the complexities in accurately assessing labour market conditions and may influence perceptions of economic strength.

Market Implications

1)Federal Reserve Policy

A disappointing jobs report could strengthen the case for a 25 basis point rate cut by the Federal Reserve at its September meeting.

Fed Chair Jerome Powell has acknowledged rising labour market risks, though inflation concerns remain a balancing factor. The Fed's current interest rate stands at 4.25%-4.50%, and any adjustments will depend on the evolving economic data.

2)Investor Sentiment

Financial markets are closely monitoring the NFP data, with expectations that a soft labour market may lead to accommodative monetary policies. U.S. Treasury yields have eased, and Asian stocks have risen in anticipation of potential rate cuts.

These market movements reflect investor optimism regarding the possibility of supportive monetary actions.

Frequently Asked Questions (FAQ)

Q1: What exactly does the Non-Farm Payrolls report measure?

A1: The NFP report measures the number of jobs added or lost in the U.S. economy, excluding farm workers, government employees, and non-profit organisation employees. It provides a comprehensive snapshot of the labour market's performance.

Q2: Why does the NFP move markets so dramatically?

A2: The NFP is a key economic indicator that influences investor expectations regarding economic growth and Federal Reserve policy. Strong job growth can signal a robust economy, potentially leading to higher interest rates, while weak job growth may prompt rate cuts to stimulate the economy.

Q3: How do revisions to past reports change the outlook?

A3: Revisions to previous NFP reports can significantly alter the understanding of economic trends. Large downward revisions, as seen in recent months, suggest that the labour market may be weaker than initially reported, influencing policy decisions and market expectations.

Q4: Which other economic indicators should we watch alongside NFP?

A4: Other important indicators include the unemployment rate, average hourly earnings, labour force participation rate, and weekly jobless claims. These metrics provide additional context to the NFP data and offer a more comprehensive view of labour market conditions.

Conclusion

The August 2025 Non-Farm Payrolls report is poised to offer critical insights into the U.S. labour market's trajectory.

With expectations of modest job growth and a potential rise in the unemployment rate, the data may reinforce concerns about a cooling economy. Investors and policymakers alike will be closely analysing the report to gauge the need for future monetary policy adjustments.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.