Market Recap

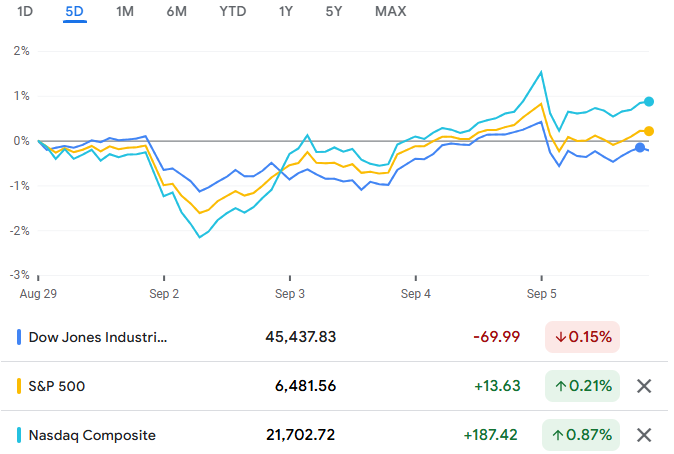

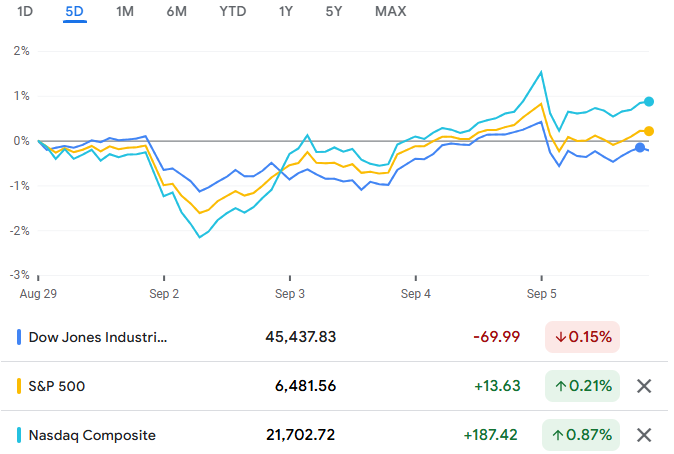

US equities finished the week mixed as technology outperformed on easing yields after a soft August payrolls report, with weekly moves of Dow −0.3 per cent, S&P 500 +0.3 per cent, and Nasdaq +1.1 per cent. (Reuters)

European shares lagged, with the STOXX 600 ending a volatile week marginally lower as energy and financials weighed into Friday’s close. Asia was uneven into the new week, with sentiment supported by rate‑cut hopes yet still sensitive to growth signals and political developments in Japan.

Treasury yields eased, with the 10‑year falling about 13 bps week on week to 4.10 per cent and the 2‑year down roughly 8 bps to 3.51 per cent, favouring duration and rate‑sensitive equities. The dollar retreated after payrolls, trimming its weekly gain as the DXY slipped on Friday alongside lower yields.

Brent crude posted a weekly loss and settled down more than 2 per cent on Friday, hovering in the mid‑$60s amid supply expectations, while gold neared $3,600 per ounce on haven demand and policy hopes, marking its strongest week in three months.

Macro Data

US nonfarm payrolls rose by about 22,000 in August, with unemployment up to roughly 4.3 per cent, reinforcing a cooling‑labour narrative ahead of CPI and PPI.

Equities tagged record levels earlier in the week as softer labour indicators failed to dislodge easing expectations, though seasonality and valuation concerns capped follow‑through.

Week‑ahead Highlights

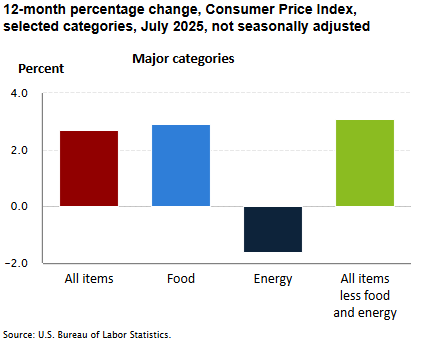

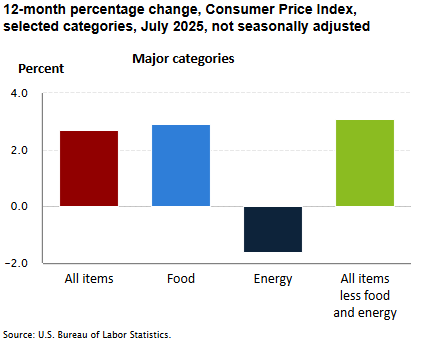

United States: US CPI (Thu, 11 Sep) is the main event, with focus on headline versus core and shelter dynamics into the 16–17 Sep FOMC window.

United States: PPI final demand (Wed, 10 Sep) offers upstream context ahead of CPI and subsequent spending data later in the month.

Eurozone: ECB decision and press conference (Thu, 11 Sep) will steer the deposit‑rate path and tone on growth and tariffs. (European Central Bank)

China: August CPI and PPI (Wed, 10 Sep) and credit aggregates provide a read on domestic demand, disinflation, and policy traction.

United Kingdom: Monthly GDP (Fri, 12 Sep) follows signs of improving summer momentum for the UK economy.

Earnings: Oracle Q1 FY26 (Tue, 9 Sep after the close) and Adobe (Thu, 11 Sep after the close) are key for enterprise IT spend and AI‑driven demand signals.

Sentiment and Sectors

Risk appetite improved mid‑week as front‑end yields fell and futures priced higher odds of a September Fed cut, though elevated multiples and a seasonally weak September argue for selective exposure.

Leadership remained with mega‑cap technology and quality growth, while Europe underperformed on energy and financials weakness following oil’s slide.

Policy and Geopolitics

Futures markets lean toward at least a 25 bp Fed cut at the September meeting after the jobs miss, with curve bull‑steepening anchoring cross‑asset sensitivity into CPI day.

The ECB tone skews steady into 11 Sep as growth holds, but tariff and energy risks complicate the inflation path and forward guidance.

OPEC+ signalled a slower pace of output increases from October, helping to stabilise crude after last week’s drop as inventories and compliance come into focus.

Escalation risk persists after Russia’s largest air assault of the war struck central Kyiv, while Gaza ceasefire and hostage talks continue to influence the regional risk premium for energy and haven flows.

Risks and Catalysts

CPI upside surprise could lift US yields and the dollar, tighten financial conditions, and pressure long‑duration equities.

Softer China CPI/PPI and credit could reinforce global disinflation, weigh on industrial commodities, and test cyclical FX.

Oracle and Adobe guidance on cloud and AI workloads may swing mega‑cap leadership and factor breadth into quarter‑end. (Adobe)

OPEC+ implementation and inventory trends could add two‑way volatility to crude and energy equities after the weekly sell‑off.

Geopolitics in Ukraine and the Middle East may widen the risk premium, supporting gold and dampening pro‑cyclical assets.

Conclusion

The set‑up into CPI favours a measured risk‑on stance if disinflation persists and labour cools, but thin September liquidity and policy‑sensitive tech leadership argue for discipline and selective exposure.

Anchor positioning around CPI and ECB communication, keep energy tactical pending OPEC+ execution, and let Oracle and Adobe guide conviction on the durability of the growth trade.