What Truly Defines the Best Forex Broker in South Africa?

Finding the best forex broker in South Africa is not about chasing marketing slogans or focusing solely on spreads. As the trading landscape matures and retail participation expands, traders increasingly look for brokers who demonstrate integrity, consistent performance, transparent pricing, reliable execution, robust education, and meaningful innovation.

In 2025, the South African market is shaped by clearer regulatory expectations, growing technological sophistication, and an influx of globally regulated brokers securing FSCA approval.

This guide examines the core pillars that define a leading broker and outlines the standards traders should expect when choosing a trustworthy partner.

Regulation and Compliance Standards That Define a Top Broker

1. Why Strong Regulation Matters

Regulation remains the single most important indicator of a broker's credibility. In South Africa, the Financial Sector Conduct Authority (FSCA) enforces strict conduct standards to protect traders. FSCA-authorised brokers must:

Keep client funds in segregated accounts

Maintain audited operational books

Meet capital and reporting obligations

Follow strict disclosure and communications rules

Provide complaint-handling and dispute-resolution frameworks

This regulatory architecture safeguards traders against misconduct and ensures that trading services are delivered with transparency and accountability.

2. The Role of Global Regulatory Frameworks

Many top brokers operating in South Africa also hold licences from reputable global regulators such as:

FCA – United Kingdom

ASIC – Australia

CIMA – Cayman Islands

FSC – Mauritius

This multilayered oversight signals deeper operational discipline, multi-jurisdictional compliance, and more advanced internal controls. For South African traders, a broker with both FSCA authorisation and global regulatory credentials often provides stronger stability and institutional-grade governance.

3. EBC's Regulatory Position

EBC Financial Group has long operated under FCA, ASIC, CIMA, and FSC licensing.

The new development is that EBC Financial Group SA (Pty) Ltd, its South African subsidiary, recently received FSCA approval as an Authorised Financial Service Provider. This demonstrates a broader industry trend: global brokers aligning their international standards with local regulatory expectations.

Execution Quality, Platform Technology, and Trader-Centric Performance

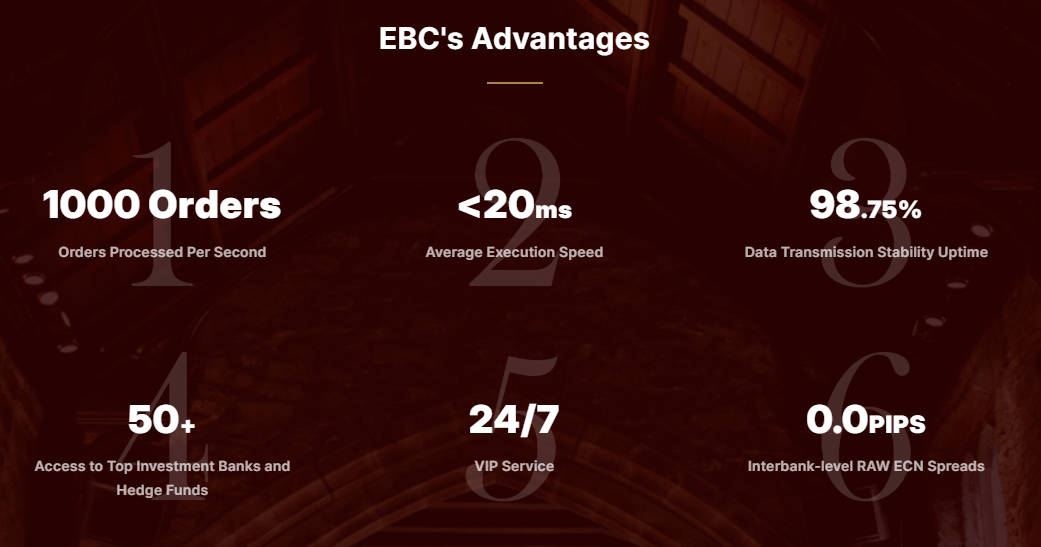

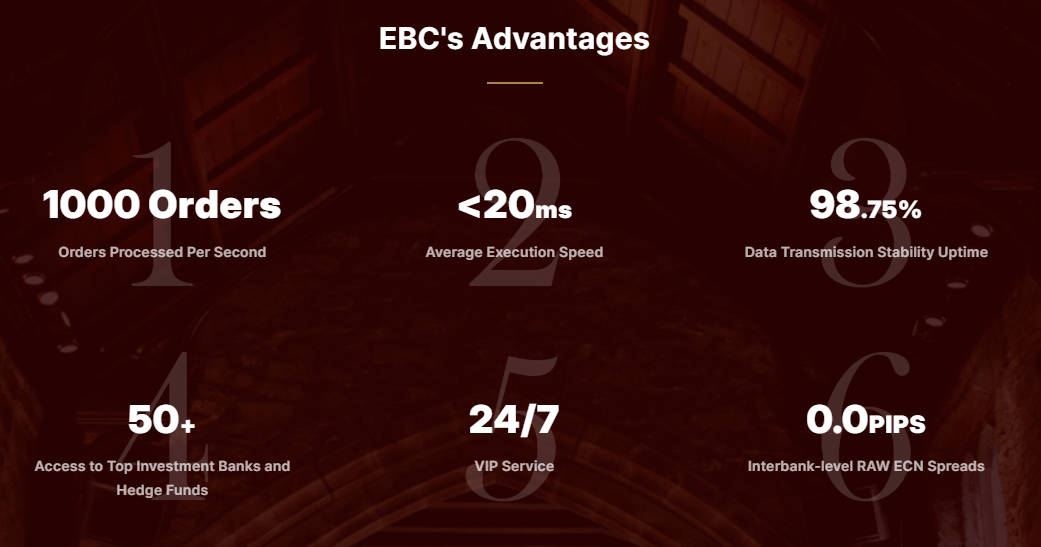

1. Execution Infrastructure: The Silent Backbone of a Good Broker

A broker's execution system is one of the most defining elements of trade quality. The best brokers invest in:

Low-latency execution engines, often supported by server colocation

Deep liquidity pools, aggregated from multiple bank and non-bank providers

Smart order routing, which reduces slippage during volatile market conditions

High uptime and platform stability during peak sessions

These elements ensure your orders are filled at intended prices and reduce unexpected slippage — a critical factor in forex trading where milliseconds matter.

2. Professional Platform Standards

A top broker provides platforms that combine speed, reliability, and analytical depth. Traders should expect:

Comprehensive charting

Advanced order types

Integrated economic calendars

Custom indicators and algorithmic trading support

Mobile and desktop synchronisation

Whether it is MT4, MT5, cTrader, or a proprietary system, a capable platform must help traders interpret market conditions, not simply execute trades.

3. A Creative Perspective: Platforms as Strategic Partners

Instead of viewing platforms as tools, think of them as strategic partners. Leading brokers now develop features that:

Reduce analytical noise

Highlight volatility pockets

Identify liquidity clusters

Summarise market sentiment in real time

This evolution shifts the platform from an execution interface to an intelligence layer that enhances decision-making.

Pricing Transparency, Fee Structures, and Account Architecture

A competitive broker demonstrates transparency in all pricing matters. Key components to evaluate include:

1. Spreads and Commissions

Tight variable spreads during liquid hours

Clear commission structures for raw-spread accounts

No hidden mark-ups embedded in pricing

2. Swap Fees and Overnight Charges

These affect long-term strategies and can influence profitability for swing or position traders.

3. Deposit and Withdrawal Policies

Top brokers eliminate unnecessary fees and process withdrawals promptly.

Leverage Parameters

While leverage offers flexibility, responsible brokers ensure traders cannot unknowingly take excessive risk. Balanced leverage options are a sign of good risk governance.

Account Types That Support Trader Growth

A strong broker offers account structures for different experience levels and trading styles:

Micro/Cent accounts for beginners or strategy testing

Standard accounts for day-to-day trading

ECN/Razor-style accounts for professional-grade spreads

High-volume or VIP tiers for active traders

This flexibility ensures traders can scale intelligently without operational barriers.

Research Quality, Market Intelligence, and Trader Development Programmes

1. Why Education Matters in 2025

Given the complexity of global markets, trader education is no longer a bonus — it is essential. Brokers that invest in education demonstrate a commitment to long-term client success, not short-term transactions.

High-quality educational ecosystems include:

Live and on-demand webinars

Analyst commentary and daily market briefings

Economic breakdowns and event roadmaps

Trading psychology guidance

Data-driven case studies

Podcasts, Q&A sessions, and thematic research

2. A Creative Perspective: Brokers as Thinking Partners

The modern trader does not only ask "how do I trade?" but also "why does the market behave this way?"

Leading brokers help traders understand:

3. EBC's global educational initiatives

EBC's global educational initiatives, including webinars, podcasts, and academic partnerships, reflect a wider industry trend where brokers act as intelligence partners rather than simple service providers.

Technological Innovation and Meaningful Industry Differentiators

Top brokers in 2025 differentiate themselves with innovations that enhance clarity, discipline, and trader control.

1) Market Awareness Tools

Real-time dashboards showing sentiment, volatility conditions, liquidity zones, and economic catalysts.

2) Behavioural and Psychological Support

Tools that monitor trading patterns, identify risky behaviour, and detect emotional decision-making.

3) Multi-Asset Flexibility

Access to forex, indices, commodities, and global markets ensures traders can adapt strategies across cycles.

4) Advanced Risk Controls

Features like execution throttling, guaranteed stop-loss, and smart order routing reduce operational risk during volatility spikes.

5) Community and Collaborative Learning

Trading rooms, analyst discussions, and active communities reduce the isolation often felt in retail trading.

This new wave of innovation represents a more holistic approach to trader support — one that empowers both technical and behavioural performance.

South Africa's Regulatory Landscape and the Entry of Globally Supervised Brokers

As South Africa continues to strengthen regulatory expectations under the FSCA, global brokers increasingly pursue local authorisation to serve clients more transparently. For traders, this trend brings:

Stronger safeguards

Higher operational standards

Better technology and execution

More structured education

Multi-jurisdictional protection

The recent FSCA approval of EBC Financial Group SA (Pty) Ltd is one example among many. What matters is the broader shift: South African traders are gaining access to internationally recognised brokers that align global governance with local compliance, raising the overall quality of the trading landscape.

Frequently Asked Questions

1. What makes a forex broker the best in South Africa?

A top broker combines strong regulation, advanced platforms, transparent pricing, reliable execution, and meaningful education. The best brokers support informed decision-making and long-term development rather than focusing solely on transactions.

2. Is FSCA regulation necessary when choosing a broker?

Yes. FSCA regulation offers local protection, ensures compliant conduct, and creates a structured environment for fair trading. While global licences add credibility, FSCA authorisation remains the primary safeguard for South African traders.

3. Do international brokers provide better tools?

Often they do, thanks to larger investments in technology, liquidity networks, and research. The ideal choice is a broker that combines global standards with FSCA oversight for both innovation and protection.

4. Are tight spreads more important than execution speed?

Both matter. Tight spreads reduce cost, while fast execution ensures your orders fill accurately — especially during volatility. The best brokers provide competitive spreads without sacrificing execution quality.

5. What education should a top broker offer?

Look for structured programmes including webinars, insights, tutorials, psychological guidance, and practical case studies. Quality education enhances consistency and strengthens risk management.

Conclusion

The best forex broker in South Africa in 2025 demonstrates excellence across multiple dimensions: strong regulation, robust technology, transparent pricing, comprehensive education, and thoughtful innovation. As more global brokers secure FSCA approval and bring multi-jurisdictional expertise to the region, traders benefit from higher standards, richer insights, and platforms designed to support long-term success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.